Financial Management and Markets BADM 3501 Fall

advertisement

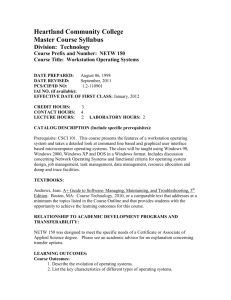

Financial Management and Markets BADM 3501 Fall 2012 Wednesday 7:10-9:40 PM in Room 207 of Funger Hall Instructor: Dr. T.G. Geurts, FRICS Phone: +1 (202) 994-7542 E-mail: TGG@gwu.edu Room: Funger Hall 510 Teaching Assistant responsible for Grading: Steven Majich E-mail: smmajich@gmail.com Please deal with Steven directly regarding the submission of assignments and/or any grading issues. Do not send anything to me, since I will ignore it. Office Hours: Tuesday = 5:00pm – 6:00pm Wednesday = 2:00pm – 5:00pm Thursday = 1:00pm – 2:00pm Course Overview: This is a survey course in Finance. It sets the stage for other finance courses you may take, or if you don’t, shows the crucial role of the finance function in a business. Building on your knowledge of financial statements from basic accounting, and a little from basic statistics, you will learn what financial managers do to keep their firms healthy. The topics covered include: Financial markets, financial statements and cash flows; time value of money; measurement of risks and rates of return; sources and uses of debt and equity; bond and stock valuation; cost of capital; capital budgeting and investment and capital structure decisions for the firm. Course Prerequisites: Principles of Economics (ECON 1012); Introductory Financial Accounting (ACCY 2001); Business and Economic Statistics (STAT 1051 or 1053); Mathematics and Calculus (MATH 1051 and 1252). Course Objectives: By the end of the semester, students are expected to be able to: 1. make informed decisions regarding the analysis of cash flows by reading financial statements. This requires that they have at least some minimal knowledge of business finance. 2. understand basic financial concepts such as the time value of money, asset valuation, risk and return, and capital market equilibrium. 3. have a basic understanding of the financial evaluation of a business idea through capital budgeting techniques. You will demonstrate these capabilities through class discussions, assignments, and exams. Required Textbooks: 1. Fundamentals of Financial Management: Concise Edition by Brigham and Houston. 7th Edition (2012): South-Western. ISBN # 978-0538477116. Book website: http://www.cengage.com/search/productOverview.do?N=+16&Ntk=P_Isbn13&Ntt=978053847 7116 2. Financial Calculator (if you do not have any yet, you should buy the Texas Instruments BA II Plus). The ability to use a financial calculator is critical to your success in the class. You are responsible for learning how to operate your financial calculator—and it is crucial that you are familiar with your calculator by the time we begin Chapter 5. Make sure that you bring your calculator to class. Students may not share calculators on exams. Please be sure to check your batteries before quizzes and exams. 3. Use of Blackboard for all class material including homework problems, solutions, and grades. Recommended Textbooks or Readings: The Wall Street Journal. Course Requirements: Class attendance and participation are strongly suggested. Attendance at exams is mandatory. Failure to complete an exam will result in a failure for the final grade. There are no make-up exams, unless the student has contacted the instructor before the scheduled exam and has a valid reason. Note that the exam dates and assignment submission dates are tentative, hence it is possible that they change. Any changes will be announced in class. It is the responsibility of the student to know about any announcements made by the professor! Final Grades: Final grades will be determined using the following weights: Mid Term Exam 30% Final Exam 30% Assignments 40% ==== + 100% The material to be learned for al exams will be non-comprehensive and will encompass the lecture material, the course textbook, and class discussions. The format of the exams will be multiple choice and true/false problems. A total of 8 assignments will be assigned throughout the course, each problem set is worth 5% of your final grade. You have to do the assignments alone. No credit will be given for assignments handed-in late, regardless of reason!! In order to receive full credit one has to show the work leading to the answer. Assignments with just the answers will NOT get full credit. Assignments need to be typed, hence I will ignore handwritten assignments. Academic Integrity: The School of Business at GW strives to promote an ethical learning environment and want to ensure that all students understand the concepts of academic integrity. We see this as an extremely important issue for the students' time at GW, but also for after graduation. Hence we require that all students familiarize themselves with the Code of Academic Integrity as found on the following link: http://www.gwu.edu/~ntegrity/code.html Please read the Code of Academic Integrity carefully and make sure that you follow it whenever you submit any work for this course. Sessions: 08/29/2012 = Course Overview and Introduction to Financial Management. LITERATURE : * Book: Chapter 1. 09/05/2012 = Financial Markets and Institutions. LITERATURE : * Book: Chapter 2. 09/12/2012 = Analysis of Financial Statements, Cash Flow, and Taxes. LITERATURE : * Book: Chapters 3 and 4. ASSIGNMENT ONE is due on 9/12/2012. 09/19/2012 = Time Value of Money. LITERATURE : * Book: Chapter 5. ASSIGNMENT TWO is due on 9/19/2012. 09/26/2012 = The Basics of Capital Budgeting. LITERATURE : * Book: Chapter 11. ASSIGNMENT THREE is due on 9/26/2012: See for instructions the document titled “Assignment Three Instructions”. 10/03/2012 = Interest Rates. LITERATURE : * Book: Chapter 6. 10/10/2012 = Bonds and Their Valuation. LITERATURE : * Book: Chapter 7. ASSIGNMENT FOUR is due on 10/10/2012. ASSIGNMENT FIVE is due on 10/13/2012. 10/17/2012 = Mid Term Exam (30% of Final Grade). 10/24/2012= Risk and Rates of Return. LITERATURE : * Book: Chapter 8. 10/31/2012 = Stocks and Their Valuation. LITERATURE : * Book: Chapter 9. 11/07/2012 = The Cost of Capital. LITERATURE : * Book: Chapter 10. ASSIGNMENT SIX is due on 11/07/2012. 11/14/2012 = Distribution to Shareholders: Dividends and Share Repurchases. LITERATURE : * Book: Chapter 14. ASSIGNMENT SEVEN is due on 11/14/2012. 11/28/2012 = Financial Planning and Forecasting. LITERATURE : * Book: Chapter 16. ASSIGNMENT EIGHT is due on 11/28/2012. 12/05/2012 = Summary, Review, and Conclusions. Final Exam (30% of Final Grade) during Final Examinations Period.