Transfer Pricing, Vertical Integration and Production Externalities

advertisement

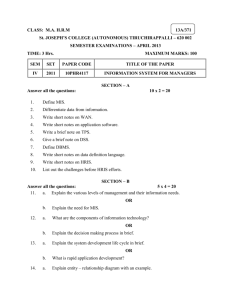

Transfer Pricing, Vertical Integration and Production Externalities: Implications on Profits and the Arm’s Length Principle* Yaron Lahav† ABSTRACT According to transfer pricing regulations, multinational enterprises should price their intercompany transactions as if they are dealing with unrelated companies (i.e., at arm’s length). This paper shows that when externalities exist in the production processes of related parties, arm’s length pricing may result in profit shifting, which contradicts transfer pricing regulations. This paper presents a model of production with externalities that shows how externalities affect transfer prices and in what way they are detrimental to the arm’s length principle. The paper then analyzes the effects of externality and the sensitivity of profit shifting to differences in taxes across jurisdictions. JEL Classification: F15, F23, H83, K34, L23, M41 Keywords: Arm’s Length, Externalities, Multinaltional Enterprises, Profit Shifting, Transfer Pricing, Vertical Integration. I wish to thank Reuven Avi-Yonah, Zvika Afik, Kimberly Clausing and Michael Durst for their helpful comments. All errors and misinterpretations are solely mine. † Department of Business Administration, Guilford Glazer Faculty of Management, Ben-Gurion University of the Negev, P.O. Box 653 Beer Sheva 84105 Israel. Phone: 972-8-6479738. email: ylahav@som.bgu.ac.il. * 1 1. Introduction Transfer pricing is the practice of setting a price that multinational enterprises (MNEs) use for their intercompany transactions. When two (or more) related companies are involved in the buying and selling of goods or services, it is important to accurately price these transactions for several reasons: first, transfer pricing determines the profits of each entity. Second, improper pricing may interfere with the proper evaluation of managers and decision makers in the MNE. Finally, every MNE should address certain tax issues related to transfer pricing. For instance, when a MNE owns two subsidiaries located in different countries with different tax rates, it has an incentive to determine its transfer pricing with the goal of shifting its profits to the subsidiary residing in the country with the lower tax rate. In many countries, however, this practice is constrained by regulations. With the exception of a few outliers, transfer pricing regulations are similar across tax jurisdictions and are based on the arm’s length principle. Accordingly, related parties should price their intercompany transactions as if they were dealing with unrelated companies. When two related parties trade in a generic product, it is sufficient for the MNE to show that the intercompany price determined for their trade is the price that the MNE would have used in its dealings with an unrelated company. If the tax authority is convinced by the MNE’s explanation, the latter is thus considered to be in compliance with transfer pricing regulations. Alternatively, if the product is not generic and the two parties to the trade represent the sole buyer or seller of that product (e.g., permission to use intangible assets or trading an intermediate product that is unique to the production process of the MNE’s final products), the MNE should show that the transfer price is determined such that each entity earns a normal profit compared to similar, unrelated entities that engage in the same transactions and operate in the same business environment. 2 Externalities exist when economic decisions (either to manufacture or consume) are affected by some activity that is not priced by the market. An example of a production externality is pollution. A plant spewing pollutants into its surrounding environment may harm the manufacturing abilities of neighboring plants, thereby reducing their profits. Although the polluting plant is responsible for an environmental cost (i.e., reduction of overall production), it does not bear the actual costs of its activity. The neighboring plants, meanwhile, do not perceive this externality, instead taking the pollution as a given. In economic theory, externalities prevent markets from achieving efficiency. Researchers address several ways to correct the inefficiency, which include imposing taxes, controlling the quantities produced and consumed or controlling the externality itself, allowing ownership on the source of externality, integrating the market, etc.1 Production externalities are common by-products of the business integration of two or more companies, which is usually accompanied by a change in the production process or the use of technology. These changes are part of attempts by managers to increase overall efficiency. In such a case, it is reasonable that the profitability level of one company (or more) increases at the expense of the other(s). In this paper, I show that while the profitability of two companies may be affected by production externalities, the effect may also have consequences for profit shifting for tax purposes when applying the arm’s length principle if the companies are related. In fact, I show that if production externalities exist between two related parties that do not reside in the same country, then the companies may not be in compliance with transfer pricing regulations. When externalities are present, it is possible that if the company were using a profit-based method to document its transfer pricing, it would, in fact, 1 These cases and more are discussed in the classic literature and can be found in textbooks on resource economics. See for example hartwick and Olewiler (1997), P. 194. 3 generate a profit shift that contradicts the essence of the arm’s length principle. I present a fairly simple model to show this process and analyze the effects externalities have on MNE compliance with transfer pricing regulations. This paper is not the first to tackle the objectivity of the arm’s length approach. Halperin and Srinidhi (1987, 1991, 1996) show that the transfer pricing methods specified under U.S. regulations can affect the MNE’s resource allocation. Smith (2002) shows that the arm’s length principle can affect the investment choices of the MNE. Stevenson and Cabell (2002) argue that subsidiaries have different cost structures than third parties because of the unique way the MNE allocates costs among its subsidiaries. Comparing a subsidiary to a third party, therefore, often produces biased results.2 The five papers cited above illustrate how MNEs can manipulate their cost allocations or even their levels of investment for tax purposes. However, this paper shows that the transfer price can become distorted despite MNE wishes to comply with transfer pricing regulations and to avoid “legal” manipulations. The profit shift occurs because of an economic environment that the MNE cannot control and in most cases is not even aware of. Section 2 presents some of the relevant features of transfer pricing rules together with analysis. In section 3 I present a simple model of externalities in production to emphasize their effects on profit shifting. Section 4 discusses externalities caused by vertical integration in the absence of taxes, section 5 introduces taxes, and Section 6 is a summary. 2 This opinion regarding the inability to compare related to unrelated parties is also stated by tax experts. See for example Langbein (1986), Avi-Yonah (1995, 2010, 2011), Clausing et al (2009) and Avi-Yonah and Benshalom (2012). However, thus far, to the best of my knowledge, there in no theoretical model that explains this inability. 4 2. Transfer Pricing Regulations (in a nutshell) As mentioned, countries determine their own regulations, but in general these regulations comprise the same principles and specify essentially the same methods around the world. The Internal Revenue Services (IRS) implements the Treasury regulation section 1.482 (Treas. Reg. 482). The Organisation for Economic Co-operation and Development (OECD) publishes its own transfer pricing guidelines for MNEs and tax administrations (OECD Guidelines) that are adopted by its member countries, who can add modest modifications. Each MNE is required to document its transfer pricing transactions annually. Highly factual, this documentation should include a detailed description of the MNE, its business structure, risk analysis and economic analysis, which together determine whether the MNE’s intercompany transactions are conducted at arm’s length. Transfer pricing regulations specify several methods that MNEs can use to document intercompany transactions. These methods can be divided into two categories: price-based and profit-based. The former can be used if a market price exists for the same (or similar) product or service and that product or service is being traded by unrelated companies. Included among the price-based methods are the comparable uncontrolled price (CUP) and the comparable uncontrolled transaction (CUT) methods. According to the first, a MNE should show that the product it sells to related parties (the tested transaction) is priced similarly to a comparable product sold to unrelated parties. The CUT effectively applies the same procedure to services.3 In the absence of a similar transaction with unrelated parties, profit-based methods are used. An economic analysis from a profit-based approach compares the profitability level of the transaction or (at least) of one party to the transaction (the tested party) to 3 The CUT is specified in the Treas. Regs. 482 only and not in the OECD Guidelines. 5 the profitability level of similar unrelated transactions or companies. To obtain a favorable comparison, the tested party should engage in routine activities only and should not own any valuable intangibles. According to the cost plus method, a mark-up on direct costs associated with producing the product should be similar to the mark-up on direct costs of similar products produced and sold to unrelated parties. Using the resale price method (RPM), the profit margin on a product sold to related parties should be similar to that earned on the same product sold to unrelated parties. 4 The most common method is the comparable profit method5 (CPM), in which the profitability level of the tested party is compared to a range of profitability levels of similar, unrelated companies involved in the same activities and operating in the same business environment as the tested party. To compare profitability levels, profit level indicators (PLIs) have been defined by regulators. The first PLI is the operating margin (OM), measured by dividing the revenue into the operating profit. The second, the net cost plus (NCP) ratio, is the quotient of profit divided by total cost (cost of goods sold and operating expenses). The third, the return on assets, is calculated by dividing operating profit by operating assets (total assets, net of intangible assets and depreciation). The last indicator for comparing profitability levels is the return on operating expenses (also known as the Berry Ratio, or BR), calculated by dividing gross profit by operating expenses. 4 Naturally, the cost plus method is used when the tested party is a manufacturer, and the RPM is used when the tested party is a distributor. 5 The CPM is essentially the transactional net margin method (TNMM) specified in the OECD Guidelines with several differences that are negligible in terms of the analysis provided in this paper. Throughout this paper (unless otherwise mentioned) the use of CPM also implies the TNMM if the tax authority implements the OECD Guidelines. 6 The last profit-based method – the profit split method (PSM) – is used mainly when the two companies to the transaction own valuable intangibles or for some other reason they cannot be compared to other, unrelated companies. In addition, transfer pricing regulations permit the use of any other unspecified method, provided it is shown to have more credible results. 3. A Model of Externalities in Production In this section I use a simple model of externalities in production to illustrate the effect of externalities on methods of transfer pricing analysis. It consists of two companies, M and D, which are (for now) unrelated. Company M produces an intermediate good m, used as input in the production of d, the final good produced by company D. To manufacture m, the company uses one input, x. For simplicity, m is the only input used to produce the product d. Companies M and D reside in different tax jurisdictions. The production functions of both m and d exhibit diminishing return to scale and implement the Inada conditions,6 but they cannot be observed by each other. Also, the use of x in the production process of m generates externality in the production of d (e.g. as a negative externality, x is a pollutant that adversely affect the production of d). Nevertheless, company D cannot control the level of x, and therefore, takes it as given:7 𝑚 = 𝑚(𝑥) 𝑑 = 𝑑(𝑚, 𝑥) = 𝑑(𝑚|𝑥) The marginal production of both x and m is positive and decreasing and the marginal effect of x on d is constant: 6 7 See Inada, 1963. Company D’s inability to influence the externality level is because it is unaware of the production process used by company M. 7 𝜕𝑚 𝜕𝑑 , 𝜕𝑥 𝜕𝑚 𝜕2 𝑚 𝜕2 𝑑 , 𝜕𝑥 2 𝜕𝑚2 > 0, < 0, 𝜕𝑑 𝜕𝑥 = 𝑒̅ (1) The value 𝑒̅ determines the type of externality (i.e., positive if 𝑒̅ > 0 or negative if 𝑒̅ < 0). The prices of x, m and d (𝑃𝑥 , 𝑃𝑚 , 𝑃𝑑 ) are determined competitively (𝑃𝑚 is determined via negotiations between the companies). In this benchmark case (referred to as the “no relation” condition), the pre-tax profit of each company is:8 𝜋𝑀 = 𝑃𝑚 ∙ 𝑚(𝑥) − 𝑃𝑥 ∙ 𝑥 (2) 𝜋𝐷 = 𝑃𝑑 ∙ 𝑑(𝑚|𝑥) − 𝑃𝑚 ∙ 𝑚 (3) Note that the price 𝑃𝑚 is the arm’s length price. As unrelated entities, the two companies determine the level of inputs that maximize their profits given market prices. The first order conditions are: 𝑃𝑚∗ ∙ 𝜕𝑚(𝑥 ∗ ) 𝜕𝑥 𝑃𝑑 ∙ 𝜕𝑑(𝑚∗ |𝑥 ∗ ) 𝜕𝑚 (4) = 𝑃𝑥 (5) = 𝑃𝑚∗ where 𝑥 ∗ and 𝑚∗ are the equilibrium quantities of x and m, respectively, and 𝑃𝑚∗ is the negotiated price of the intermediate good. Combining equations 4 and 5 provides the equilibrium path of the “no relation” condition: 𝜕𝑑 𝑃𝑑 ∙ 𝜕𝑚 ∙ 𝜕𝑚 𝜕𝑥 (6) = 𝑃𝑥 The derived quantities and prices determine the profitability levels ( 𝛽 𝑀 and 𝛽 𝐷 , henceforth “operating margin”) of both companies as follows: 𝛽𝑀 = 8 ∗ ∙𝑚(𝑥 ∗ )−𝑃 ∙𝑥 ∗ 𝑃𝑚 𝑥 ∗ ∙𝑚(𝑥 ∗ ) 𝑃𝑚 (7) When the two companies are unrelated, it is sufficient to maximize pre-tax profit to determine the value of the choice variables. 8 𝛽𝐷 = ∗ ∙𝑚∗ 𝑃𝑑 ∙𝑑(𝑚∗ |𝑥 ∗ )−𝑃𝑚 𝑃𝑑 ∙𝑑(𝑚∗ |𝑥 ∗ ) (8) Assume now that these two, previously unrelated companies become part of an MNE. The owner of this new MNE is interested in complying with transfer pricing regulations. This can be done either by using the arm’s length price 𝑃𝑚∗ as the transfer price (using the CUP method) or by maintaining the arm’s length operating margin of one of the entities (using the CPM). In both cases, the profit function of the new MNE is: (9) 𝜋𝑀𝑁𝐸 = (1 − 𝑡 𝐷 )[𝑃𝑑 ∙ 𝑑 − 𝑃𝑚 ∙ 𝑚] + (1 − 𝑡 𝑀 )[𝑃𝑚 ∙ 𝑚 − 𝑃𝑥 ∙ 𝑥] where 𝑡 𝑀 and 𝑡 𝐷 are the corporate tax rates of jurisdictions M and D, respectively. The MNE then maximizes equation 9, incorporating at least one constraint determined by the chosen transfer pricing method. For simplicity, assume first that taxes in both jurisdictions are equal (an assumption that will be relaxed later on), a condition referred to as the “relation, equal taxes” condition. In this case, the MNE maximizes: 𝜋𝑀𝑁𝐸 = (1 − 𝑡)(𝑃𝑑 ∙ 𝑑 − 𝑃𝑥 ∙ 𝑥) (10) where t is the corporate tax rate. As the two companies are now related, the owner of the MNE can now observe the two production functions and no longer regards the level of x as given in the production process of d. Furthermore, the transfer price (the price of m) does not affect the MNE’s profit. To illustrate, I first examine the effect of externalities on the level of input without incorporating compliance with transfer pricing regulations. In this case, the first-order condition with respect to the input x is: 𝜕𝑑 𝑃𝑑 ∙ 𝜕𝑚 ∙ 𝜕𝑚 𝜕𝑥 + 𝑃𝑑 ∙ 𝑒̅ = 𝑃𝑥 (11) Intuitively, equation 11 states that the marginal cost of one unit of x equals the marginal contribution of the same unit to revenues. However, the contribution of x to MNE revenues is entered twice. First, it directly increases the revenues (first term on 9 the left side), and second, it indirectly decreases (increases) the revenues of the MNE by increasing the negative (positive) externality (second term on the left side). To compare the equilibrium quantities under the “relation, no taxes” and “no relation” conditions, I compare equations 6 and 11. If the externality is negative, the second term on the left side of equation 11 is negative. This means that the first term on the left side of equation 11 is now larger relative to the left term of equation 6 (“no relation”), implying that the marginal productions of both x and m are higher. The higher marginal productions of x and m mean (according to equation 1) that the MNE chooses levels of x and m lower than would have been chosen by the two unrelated entities M and D. The specific level of x chosen by the MNE is defined as 𝑥̂ where 𝑥̂ < 𝑥 ∗. If, on the other hand, the externality was positive, then we would obtain 𝑥̂ > 𝑥 ∗. A graphic description of a negative externality is depicted in Fig. 1. The left-hand side of equation 6 (the “no relation” condition) is defined as Ψ(x), and the left-hand side of ̂ (x) . The difference equation 11 (the “relation, equal taxes” condition) is defined as Ψ between the two functions stems from the existence of a negative externality. As both equations 11 and 6 show, the equilibrium level of input x is determined by the interception of each function with the input price, 𝑃𝑥 . A positive externality, therefore, will imply that 𝑥̂ > 𝑥 ∗ . Lemma 1 describes the connection between externalities and transfer pricing. Lemma 1. When two related entities trade an intermediate product, if the seller’s production process generates an externality affecting the production process of the buyer and taxes are identical across jurisdictions, then profit maximization shifts the profit as follows: (i) If the externality is negative, the pre-tax profit of the seller (buyer) decreases (increases). 10 (ii) If the externality is positive, the pre-tax profit of the seller (buyer) will increase (decrease). (iii) In any case, the pre-tax profit of the MNE will be higher after the merger. Proving lemma 1,9 notice that because the MNE has chosen to change the level of input compared to the allocations by the unrelated companies M and D, its profit is now higher because the production level 𝑥 ∗ is still within the production set of the MNE. It can still choose the level of input 𝑥 ∗ and stay on the same profit level. Using the same logic, related entity M chooses a different input level than the unrelated company M, although there is no change in the production technology or in the market prices of inputs and output. The input level of related entity M as imposed by the MNE is possible for the unrelated company M, which has decided (as unrelated) to purchase different amounts to maximize its profits. It implies that the profit of the related entity M is lower than that of the unrelated company M. Combining the two explanations, the related company D must earn a higher profit than the unrelated company D. The difference between companies D and M (both change levels of production) is that company D faces a change in the production process via a reduction in x. In this model, the companies do not own any fixed assets or bear any operating expenses. This means that if the MNE wishes to use the CPM, it can only use the operating margin as the PLI. To comply with transfer pricing regulations, the MNE should therefore either use the market price of the intermediate good or preserve the pre-merger operating margins of the two entities. In either case, the MNE’s only instrument is the transfer price. Proposition 1 states that if the MNE wishes (or is 9 The proof is for part i, where the externality is negative. The same proof can be used for the case of positive externality in part ii. In both cases, total profit is higher, as stated in part iii. 11 required) to use a profitability method, then there is no transfer price that can equalize the profit margins of the related entities with that of their unrelated counterparts. Proposition 1. When two entities in a profit-maximizing MNE trade an intermediate product, if taxes are equal across jurisdictions and externalities exist, then there is no transfer price that the parties can adopt that will ensure both parties achieve profit margins equal to those of comparable, unrelated entities. The proof is in appendix A. The importance of proposition 1 is emphasized by an explanation about the nature of most related transactions, especially those that involve tangible goods, documented under transfer pricing regulations. In such cases, when the analytical method used is the CPM, the tested party to the transaction is usually the entity responsible for routine activities and that does not own valuable intangibles. The rationale behind this is that only such companies earn normal returns on their expenses and therefore, only they can be compared to other benchmark companies. Following the same rationale, the second party to the transaction, i.e., the one that owns valuable intangibles (and that probably also engages in other activities that cannot be segmented out from the financial reports) should earn, in addition to its normal profit, some extra mark-up for the risks it bears (e.g., research and development or other services such as central management, information technology, marketing, patenting and other activities) as the owner of the intangibles. Because the extra mark-up cannot be accurately measured, it is assumed to be residual profit, after the normal profit of the tested party was allocated based on economic analysis. Moreover, proposition 1 shows that part of this residual profit should not be attributed to intangible assets, as it is a result of externalities (if they exist). The failure to account for this portion of the residual profit is in fact profit shifting, which contradicts the essence of transfer pricing regulations. But there is more to it than that. As the proof in appendix A shows, when the externalities are negative and the production level is reduced as a result of the merger, 12 the profit margin of entity M increases, but according to Lemma 1, its operating profit decreases. If company M is the tested party to the transaction, the tax authority (or even the MNE itself, when seeking compliance) would require that the transfer price 𝑃𝑚 be reduced to lower the operating margin to its arm’s length level, 𝛽 𝑀 , a move that would further increase the profit shift. 4. Production Externalities and Vertical Integration It may be difficult for the readers to understand the importance of such initial findings. After all, how many such cases—two related companies that are situated side by side (or at least close enough for the pollution of one to affect the other) and trading with one another are separated by a border—could there be? In fact, this scenario is more common than one would think, and it exists when in vertical integrated MNEs. In this section I begin by defining vertical integration and then provide two examples in which vertical integration generates the transfer pricing issues discussed above. A firm is vertically integrated if it owns (at least) two production processes, where part or all of the output from one production process serves as input in the production of a product from another production process. 10 In other words, a vertically integrated enterprise produces part or all of the intermediate goods for the production of its own final product. Vertical integration is the result of three major factors: market imperfection, transactional economies and technological economies. Market imperfection occurs, for instance, when there is imperfect competition between two unrelated firms involved in trade or when there is information asymmetry. But it can also exist when externalities are present. Consider the model presented in section 3, but this time 10 See Perry (1989). The textbook definition of vertical integration excludes the case where part of the intermediate goods function as partial input for the final product. This situation is defined as “partial vertical integration.” However, this restriction has no relevance in the analysis of this paper. 13 assume that the production of d is increasing in x. If company M increases its production level, company D’s profits will increase as would the aggregate profit. Company M, however, does not increase its level of production because it only maximizes its own profit. But if the two companies integrate, the production levels of both will be higher, resulting in a higher total profit for the MNE. Suppose now that companies M and D are unrelated and reside in different tax jurisdictions. Company M is a manufacturer of some good, and company D, the distributor of that good, also provides post-sale services such as installation and maintenance.11 It is reasonable to assume that a higher quality of post-sale service on behalf of company D will increase demand for the product manufactured by company M. However, company D determines the quality of services in terms of maximizing only its own profit. Although company M’s profit is also determined by the performance (level of input) of company D, it has no control over company D performance levels. Should these two companies undergo integration, the owner of the new MNE increases the level of effort invested by entity D in the quality of its services, which would shift profit from company D to company M, resulting in the transfer pricing issues discussed in section 3. Profit shifting from vertical integration can occur when production technologies between the two companies are not matched, a scenario that generates inefficiencies in transaction. Consider the case in which company M is a manufacturer of a durable product and company D is the distributor of that product. The two companies are unrelated and reside in different countries. When company M ships the product m to company D, it packages the product in large, cardboard boxes. Company D, however, prefers plastic packaging because it reduces storage costs, but for company M, plastic wrap is more expensive than cardboard boxes. So cardboard boxes it is. When the two companies vertically integrate, the owner of the new MNE realizes that although 11 This example is inspired by Pfaffermayr (1997). 14 packaging m in plastic reduces the profits of company M, it increases the overall profit of the new MNE. As a result of this business integration, therefore, profit shifts from company M to company D, but the overall profit of the MNE is higher than the aggregated profits of the unrelated entities M and D. Since MNEs consist of more than one entity, the effect of such integration on transfer prices, and therefore on total profitability (for tax purposes), is crucial. As mentioned, the tax regulations of MNEs consist of the arm’s length principle, according to which all entities within a MNE should trade with each other as if they are unrelated. But as described above, this stipulation is virtually impossible to enact when externalities are present. The MNE prepares its transfer pricing analysis based on comparable companies that operate in the same environment and are involved in the same activities as the tested party but that do not have intercompany transactions. As these comparable companies will not use the same technology (e.g., they will still use boxes to package intermediate good m), by definition, they cannot be considered comparable companies. In the next section I examine the effect of corporate taxes on the profit shifting caused by externalities. 5. Production Externalities with Taxes I now extend the model presented in section 3 and assume that taxes are present and different across jurisdictions. The profit function of the MNE is given in equation 9, and the first order conditions of the benchmark (when the companies are unrelated) are presented in equations 4-6. Taxes and operating margins in both jurisdictions are assumed to be positive and less than 50%. The MNE (still interested in complying with transfer pricing regulations) can either use 𝑃𝑚∗ as the transfer price (CUP method) or keep the pre-merger operating margin of at least one entity (CPM). 15 5.1. Finding production level with CUP When using the CUP method, the MNE should maximize equation 9 with x as the control variable, fixing the transfer price as 𝑃𝑚∗ . The first order condition is: 𝜕𝑑 𝑃𝑑 ∙ 𝜕𝑚 ∙ 𝜕𝑚 𝜕𝑥 + 𝑃𝑑 ∙ 𝑒̅ = 𝜑𝑀𝐷 ∙ 𝑃𝑥 + (1 − 𝜑𝑀𝐷 ) ∙ 𝑃𝑚∗ ∙ 𝜕𝑚 𝜕𝑥 (12) where 𝜑𝑀𝐷 = (1 − 𝑡 𝑀 )⁄(1 − 𝑡 𝐷 ) . Equation 12 implies that the after-tax (direct and indirect12) marginal contribution of x to the revenues of the MNE (left side) equals the tax-exempt marginal cost of x (first term on the right side) plus the net tax loss from the intercompany transaction (second term on the right side). This loss is actually a profit if 𝑡𝐷 > 𝑡𝑀. Notice first that when taxes are equal across jurisdictions, equation 12 becomes equation 10 (the “relation, equal taxes” condition). But when taxes are different, the production level can either increase or decrease, depending on production functions, market prices and the externality. Fig. 2 describes the conditions for which production level decreases when the externality is negative. Panels 2a-2c represent the case of 𝑡 𝑀 > 𝑡 𝐷 , and panels 2d-2f represent the case of 𝑡 𝑀 < 𝑡 𝐷 . In all panels the right-hand side of ̃ (x), and the new production level is equation 12 is represented by the dashed curve Ψ represented by 𝑥̃. As can be seen from the different panels, thus production level can either be lower or higher than 𝑥̂ and 𝑥 ∗ , or somewhere between them. Using comparative statics, we can characterize the effect of taxes on profit shifting. Proposition 2 determines how changes in tax rates affect the level of production (via the amount of x purchased by the MNE). To do this, we first assume that 𝑥̃ is the equilibrium level of x prior to the change in the tax rate. 12 Referred to the intuitive explanation of equation 10. 16 Proposition 2. When two entities in a profit-maximizing MNE trade an intermediate product, if tax rates vary across jurisdictions, negative externalities exist, and the MNE uses the CUP method for transfer pricing documentation, then an increase in 𝑡 𝑀 or a decrease in 𝑡 𝐷 changes the level of production as follows: a) The level of x decreases if 𝑥̃ < 𝑥 ∗ . b) The level of x increases if 𝑥̃ > 𝑥 ∗ . The presence of positive externalities, a decrease in 𝑡 𝑀 or, equivalently, an increase in 𝑡 𝐷 changes the level of production in the opposite direction. Fig. 3 graphically describes the tax effect on production level. The four panels of the figure represent the four different scenarios covered by equation 12. Panels a and b of Fig. 3 represent two cases in which 𝑡 𝐷 < 𝑡 𝑀 . The dashed curve represents the right side ̃ (x)], and the dotted curve [defined as Υ(x)] describes the of equation 12 [defined as Ψ ̃ (x) as 𝑡 𝑀 increases or 𝑡 𝑑 decreases. The nature of x’s response to changes in change in Ψ tax rates is due to the nature of the function Υ(x). When 𝑡 𝑀 (𝑡 𝐷 ) increases (decreases), the function Υ(x) increases on the domain 𝑥 < 𝑥 ∗ and decreases on the domain 𝑥 > 𝑥 ∗ . This distinction is important, because if 𝑥̃ is initially lower than in the “no relation” condition, the MNE will reduce its production when 𝑡 𝑀 (𝑡 𝐷 ) increases (decreases), as shown in Fig. 3a; otherwise, it will increase its production (Fig. 3b). Panels c and d of Fig. 3 graphically represent the situation 𝑡 𝐷 > 𝑡 𝑀 . Although the graphs are slightly different, their descriptions are the same. Proposition 2 has two important implications. First, the difference in tax rates does not necessarily distance production further from the arm’s length level. In fact, it can increase production back to that level. Second, even if different tax rates contribute to a profit shift compared to the “no relation” condition, an increase in 𝑡 𝐷 or a decrease in 𝑡 𝑀 can, in fact, diminish the profit shift caused by externalities. This result seems counter 17 intuitive, because it is usually an increase in 𝑡 𝐷 that drives profits to jurisdiction m. However, it is the negative externality that shifts profit back, and the profit shift caused by the externality (and not the difference in tax rates) is the one that is balanced by an increase in 𝑡 𝐷 or a decrease in 𝑡 𝑀 . In summary, tax rates affect profit shifting, but the direction of the shift is determined by the initial level of production. So when using a CUP method in the presence of externalities, changes in tax rates can shift profits either way, depending on the direction of the change. 5.2. Finding production level with CPM The MNE’s second alternative is to set the operating margin of one of its entities to the arm’s length operating margin. In so doing, the MNE maximizes equation 9 with either equation 7 or 8 as a constraint and both x and 𝑃𝑚 as control variables. If the MNE chooses company M as the tested party, the constraint is equation 7, which tells us the relationship between the two choice variables: 𝑃 ∙𝑥 (13) 𝑥 𝑃𝑚 = 𝑚(1−𝛽 𝑀) The objective function is therefore: 𝑃 ∙𝑥 𝑃 ∙𝑥 𝑥 (1 − 𝑡 𝑀 ) (𝛽 𝑀 ∙ 𝑥 𝑀 ) 𝜋𝑀𝑁𝐸 = (1 − 𝑡 𝐷 ) (𝑃𝑑 ∙ 𝑑 − 1−𝛽 𝑀) + 1−𝛽 (14) The first order condition with respect to x is: 𝑃𝑑 ∙ 𝜕𝑑 𝜕𝑚 ∙ 𝜕𝑚 𝜕𝑥 + 𝑃𝑑 ∙ 𝑒̅ = 𝑃𝑥 1−𝜑𝑀𝐷 ∙𝛽 𝑀 1−𝛽 𝑀 (15) Assuming that taxes and the operating margin do not exceed 50%, the right-hand side of equation 15 is positive. Far less intuitive than equation 12, because the requirement under the CPM is to keep the operating margin of entity M constant. Equation 15 also tells us that the production level would be similar to the “relation, equal taxes” condition 18 only if 𝑡 𝑀 = 𝑡 𝐷 . The level of production is therefore determined by the difference between taxes. Particularly, when 𝑡 𝑀 < 𝑡 𝐷 , the right-hand side of equation 15 is lower than 𝑃𝑥 , which means that production is higher. If the externality is negative, then the profit shift is lower than under the “relation, equal taxes” condition. This can be captured by looking at fig. 1 and assuming that the 𝑃𝑥 line is now lower. When 𝑡 𝑀 > 𝑡 𝐷 , the opposite occurs. Proposition 3 tells us how the MNE determines its level of production when the CPM is used for transfer pricing documentation and entity M is the tested party. In addition, Proposition 3 also determines how changes in tax rates affect the profit shifting caused by externalities. Proposition 3. When two entities in a profit-maximizing MNE trade an intermediate product, if tax rates are different across jurisdictions, negative (positive) externalities are present, and the MNE uses the CPM for transfer pricing documentation with company M designated the tested party, then: a) Production is further reduced and profit is further shifted if 𝑡 𝑀 > 𝑡 𝐷 (𝑡 𝑀 < 𝑡 𝐷 ). b) Production is increased and profit shifting is lowered if 𝑡 𝑀 < 𝑡 𝐷 (𝑡 𝑀 > 𝑡 𝐷 ). c) An increase in 𝑡 𝑀 or a decrease in 𝑡 𝐷 reduces (increases) production and increases (decreases) profit shifting. If entity D is the tested party, then equation 9 is maximized with equation 8 as the constraint. The first order condition with respect to x in this case is: 𝜕𝑑 𝑃𝑑 ∙ 𝜕𝑚 ∙ 𝜕𝑚 𝜕𝑥 𝜑𝑀𝐷 + 𝑃𝑑 ∙ 𝑒̅ = 𝑃𝑥 𝛽𝐷 +𝜑𝑀𝐷 (1−𝛽𝐷 ) (16) Interestingly, when entity D is the tested party, the relationship between the difference in taxes and the profit shift is the opposite of the case in which entity M is the tested party, as stated in proposition 4: 19 Proposition 4. When two entities in a profit-maximizing MNE trade an intermediate product, if tax rates are different across jurisdictions, negative (positive) externalities are present, and the MNE uses the CPM for transfer pricing documentation with company M designated the tested party, then: a) Production is further reduced and profit is further shifted if 𝑡 𝑀 < 𝑡 𝐷 (𝑡 𝑀 > 𝑡 𝐷 ). b) Production is increased and profit shifting is lowered if 𝑡 𝑀 > 𝑡 𝐷 (𝑡 𝑀 < 𝑡 𝐷 ). c) An increase in 𝑡 𝑀 or a decrease in 𝑡 𝐷 increases (decreases) production and decreases (increases) profit shifting For graphic depictions of the determination of x when the MNE uses the CPM we can use Fig. 1 and shift the 𝑃𝑥 line up or down, depending on the values of the tax rates. In summary, externalities in production may contribute to a profit shift that, if not incorporated in proper transfer pricing documentation, will result in improper use of the arm’s length principle. Ironically, it may be taxes that shift profit back, but even so, one cannot rely on an arbitrary difference in tax rates between two jurisdictions to solve this distortion. 6. Conclusion Transfer pricing documentation based on the arm’s length approach is currently the most widely used method to enforce transfer pricing regulations around the world. The sole objective of these regulations is twofold: to prevent companies, in their efforts to reduce their tax burden, from shifting their profits between countries and to ensure that every country receives its fair share of tax revenues. It is therefore crucial that the chosen transfer pricing method be the most accurate from among the available alternatives. The arm’s length approach has been criticized for its legal weaknesses and for the flexibility transfer pricing analysts are allowed to exercise in interpreting their clients’ business. The economic concepts at its foundation, 20 however, are generally accepted as valid by tax authorities, transfer pricing practitioners and other experts. This paper directly challenges the validity of the arm’s length approach. Relevant to contemporary international business relations and widely applicable, the analysis focuses on a flaw integral to any comparison made between entities whose business involves intercompany transactions and companies whose business does not. Business news often contains accounts of mergers or acquisitions. Typically, we expect a company that was purchased by, or merged with, another, to undergo some structural changes characterized by major layoffs, management reorganization, or changes to distribution methods or even to production processes. As a result the company, which is now part of a larger, profit maximizing organization, will no longer operate as a single, economically independent entity. Therefore, any comparison of the financial results of this entity in its new form as part of a bigger organization to those of economically independent companies should expose the differences that arise in the wake of such structural, organizational and business changes. In other words, profitability level comparisons between companies with and without intercompany transactions are invalid, as there is no basis to compare such essentially different companies (unless, of course, an economic adjustment is incorporated to overcome this difference). Some may think that this distortion can only occur when the CPM is used and that the CUP preserves the validity of the arm’s length approach because prices are determined in markets and not by companies. Under this scenario, as long as the price is competitive, then the intercompany transaction faithfully upholds the principle of arm’s length. But several other issues must be addressed here. First, the CUP is rarely used in transfer pricing analysis because most intercompany transactions involve either proprietary products or a product that is not largely traded. Second, even if the product is sold by other companies, reliable price information is often not 21 available. Third, the CUP method is based on what economists refer to as “the law of one price,” which occurs under the theoretical state of perfect competition characterized by large numbers of similar companies and consumers, all of who have all the information they need to make informed decisions. However, in most (if not all) markets, “the law of one price” does not exist. Instead, corporations usually have some level of market power. Where perfect competition has been replaced by monopolistic competition, different products are sold at different prices. We therefore expect, for instance, that the engines of two different cars sold for different prices cannot be argued to be worth or to cost the same. Ultimately this distortion caused by externalities can have, and probably has, different effects in different cases. In fact, it is reasonable to assume that the impact externalities have on transfer pricing analysis depends on the industry in which the companies to the transaction operate. This effect, however, is very difficult to measure because related entities do not publish their segmented financial statements. However, an empirical analysis that can measure this effect will not only shed light on its magnitude, it will also suggest ways to adjust for it, thereby improving the transfer pricing analysis and the accuracy and validity of the results. Such a study is therefore highly recommended as a continuation to this theoretical study. 22 Appendix A This appendix describes the proof of proposition 1. According to Lemma 1 and assuming negative externalities, the profit of company M is lower and the profit of company D is higher after the merger. I define 𝑥1 as the pre-merger quantity of x purchased by company M and 𝑥2 as the quantity purchased after the merger, so 𝑥1 > 𝑥2 , or equivalently: (A1) 𝑥2 = 𝛼 ∙ 𝑥1 where 0 < 𝛼 < 1. Assuming decreasing returns to scale in production, by definition: (A2) m(α ∙ x1 ) > α ∙ m(x1 ) This implies: (A3) 𝑚(𝑥2 ) > 𝛼 ∙ 𝑚(𝑥1 ) Combining equations A1 and A3: 𝑥1 𝑚(𝑥1 ) 𝑥 (A4) > 𝑚(𝑥2 2) Therefore: 𝑃𝑥 ∙𝑥1 𝑚 ∙𝑚(𝑥1 ) 𝛽1𝑀 = 1 − 𝑃 𝑃𝑥 ∙𝑥2 𝑚 ∙𝑚(𝑥2 ) <1−𝑃 = 𝛽2𝑀 (A5) = 𝛽2𝐷 (A6) Similarly: 𝛽1𝐷 = 1 − 𝑃𝑚 ∙𝑚(𝑥1 ) 𝑃𝑑 ∙𝑑1 <1− 𝑃𝑚 ∙𝑚(𝑥2 ) 𝑃𝑑 ∙𝑑2 where 𝛽1𝐽 and 𝛽2𝐽 represent the operating margin of company j before and after the merger respectively. The pre-merger profit margin of each entity represents its arm’s length profit margin. If the chosen transfer pricing method is the CUP, then the profit margins of the two entities are different than before the merger. If the chosen transfer 23 pricing method is the CPM, then according to equation A5, in order to regain the premerger profit margin of company M, the MNE must decrease 𝑃𝑚 . But according to equation A6, decreasing 𝑃𝑚 increases 𝛽2𝐷 even more. In the same way, increasing 𝑃𝑚 in order to decrease 𝛽2𝐷 will increase 𝛽2𝑀 even more. It remains to conclude that there is no level of 𝑃𝑚 that can regain the same profit margin to both entities. The same holds in the case of positive externalities. 24 References Avi-Yonah, R.S., 1995. Rise and Fall of Arm’s Length: A Study in the Evolution of US International Taxation. Va. Tax. Rev. 89, 89-147. Avi-Yonah, R.S., clausing, K.A. and Durst, M.C., 2009. Allocating Business Profits for Tax Puropses: A Proposal to Adopt a Formulary Profit Split. U. Fla. Tax Rev. 497, 540553. Halperin, R., Srinidhi, B., 1987. The Effect of the U.S. Income Tax Regulations’ Transfer Pricing Rules on Allocative Efficiency. Account. Rev. 62(4), 686-706. Halperin, R., Srinidhi, B., 1991. U.S. Income Tax Transfer Pricing Rules and Resource Allocation: The Case of Decentralized Multinational Firms. Account. Rev. 66(1), 141157. Halperin, R., Srinidhi, B., 1996. U.S. Income Tax Transfer Pricing Rules for Intangibles as Approximations of Arm’s length Pricing. Account. Rev. 71(1): 61-80. Hartwick, J.M., Olewiler, N. D., 1997. The Economics of Natural Resource Use, second ed. Addison-Wesley, Boston, MA. Inada, K., 1963. On a Two-Sector Model of Economic Growth: Comments and a Generalization. Rev. Econ. Stud., 30(2), 119-127. Internal Revenue Services 2006. Section 482. – Allocation of Income and Deductions Among Taxpayers. Rev. Proc. 2006-9. Langbein, S.I., 1986. The Unitary Method and the Myth of Arm’s Length. Tax Notes, 17 February, 625-681. Organisation for Economic Co-operation and Development 2010. Transfer Pricing Guidelines for Multinational Enterprises and Tax Administration. 25 Perry, M.K., 1989. Vertical Integration: Determinants and Effects, in: Schmalensee, R., Willig, R.D. (Eds.), Handbook of Industrial Organization, Vol. 1. Elsevier Science Publishers B.V. Pfaffermayr, M., 1997. Multinationals, Production Externalities, and complementarity between Domestic and Foreign Activities? Swiss J Econ and Stat, 133(4), 673-690. Smith, M. J., 2002. Ex Ante and Ex Post Discretion over Arm’s Length Transfer Prices. Account. Rev., 77(1), 161-184. Stevenson, T. H. and Cabell, D. W. E. Integrating Transfer Pricing Policy and ActivityBased Costing. J. Int. Marketing, 10(4), 77-88. 26 0.5 0.4 5 Ψ ̅(x) Ψ(x) 0.4 P(x) 0.3 5 0.3 0.2 5 0.2 0.1 5 0.1 0.0 5 0 1 2 3 4 5 6 7 8 9 10 𝑥̂ 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 𝑥 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 ∗ Figure 1: Graphic description of the determination of production level in the cases of “no relation” ̅ (x)] conditions. The graph represents negative externalities. [Ψ(x)] and “relation, equal taxes” [Ψ 27 Fig 2a: 𝜏 𝑀 > 𝜏 𝐷 and production is reduced compared to “no relation” and “relation, no taxes” conditions. Fig 2d: 𝜏 𝑀 < 𝜏 𝐷 and production is reduced compared to “no relation” and “relation, no taxes” conditions. 0.5 0.5 0.4 5 0.4 5 0.4 0.4 0.3 5 0.3 5 0.3 0.3 0.2 5 0.2 5 Ψ(x) 0.2 0.2 Ψ(x) ̃ (𝑥) 𝛹 0.1 5 0.1 5 0.1 0.1 ̂ (x) Ψ ̂ (x) Ψ 0.0 5 0.0 5 0 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 𝑥 𝑥̃ 𝑥̂ 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 1 2 3 ∗ 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 Fig 2b: 𝜏 𝑀 > 𝜏 𝐷 , production is reduced compared to “no relation” but increased compared to “relation, no taxes”. 0.5 0.4 5 0.4 5 0.4 0.4 0.3 5 0.3 5 0.3 0.3 0.2 5 0.2 5 Ψ(x) 0.2 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 Fig 2e: 𝜏 𝑀 < 𝜏 𝐷 , production is reduced compared to “no relation” but increased compared to “relation, no taxes”. 0.5 0.1 5 30 𝑥∗ 𝑥̃ 𝑥̂ ̃ (𝑥) 𝛹 Ψ(x) 0.2 0.1 5 ̃ (𝑥) 𝛹 0.1 0.1 ̂ (x) Ψ 0.0 5 ̂ (x) Ψ 0.0 5 0 0 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 1 2 3 4 5 6 𝑥∗ 𝑥̃ 𝑥̂ 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 Fig 2c: 𝜏 𝑀 > 𝜏 𝐷 and production is incerased compared to “no relation” and “relation, no taxes” conditions. 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 𝑥∗ 𝑥̂ 𝑥̃ Fig 2f: 𝜏 𝑀 < 𝜏 𝐷 and production is incerased compared to “no relation” and “relation, no taxes” conditions. 0.5 0.5 0.4 5 0.4 5 0.4 0.4 0.3 5 0.3 5 0.3 0.3 0.2 5 0.2 5 0.2 ̃ (𝑥) 𝛹 0.2 Ψ(x) 0.1 5 Ψ(x) 0.1 5 ̃ (𝑥) 𝛹 0.1 0.1 ̂ (x) Ψ ̂ (x) Ψ 0.0 5 0.0 5 0 0 1 2 3 4 5 6 7 8 9 10 𝑥̂ 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 1 𝑥 ∗ 𝑥̃ 2 3 4 5 6 7 8 9 𝑥̂ 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 𝑥∗ 33 34 35 36 37 38 39 40 41 42 43 44 45 46 47 48 49 50 51 52 53 54 55 56 57 58 59 60 61 62 63 64 65 66 67 68 69 70 71 72 73 74 75 76 77 78 79 80 81 82 83 84 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 𝑥̃ Figure 2: Production levels with taxes. When the effect of taxes is included, production level can either increase or decrease, depending on the prices of inputs and output, the production functions, and the externality. 28 Figure 3: Graphic description of production level determination for cases under the “relation, with taxes” condition. 29