Powerpoint - ITUC

advertisement

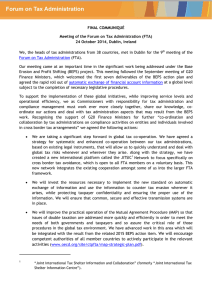

The G20 / OECD Action Plan to curb aggressive tax planning by multinationals African Trade Union Tax Justice Campaign: Providing alternatives for financing Effective Public Social Services Delivery and the implementation of Social Protection Floors Abuja, Nigeria 17- 18 January, 2014 The G20 action plan • G20 meeting in St Petersburg (Sep 20 13) adopts the OECD Base Erosion and Profit Shifting (BEPS) Action Plan to curb MNEs’ aggressive tax planning aiming at – (i) reducing the taxable income base (“base erosion”) or – (ii) moving profits away from economically relevant but high tax-jurisdictions to economically irrelevant but low-tax jurisdictions (“profit shifting”). • 15 measures, by 2015. • Implementation 2016-2018 BEPS • contractual arrangements within a MNE and between a parent company and its subsidiaries can significantly depart from the commercial arrangements (incl. risk). • These contracts are deemed valid because of the presumption that the contracting parties are acting in full autonomy from one another. – Does a subsidiary have sufficient legal “autonomy” however when it is contracting with its parent company? – Can we speak of a “contract” if, in substance, the contracting parties defend the same economic interests? Why now? • The figures – US: USD300bn (19%) of reportable income not properly reported to the IRS – EU: €1tr loss, €2000 per citizen, compares with total budget deficit EU27 of €524bn – Oxfam: £100bn lost in tax avoidance by rich individuals – BVI – China, Caiman Islands – Brazil, India – Marutius, etc. – ActionAid: almost half of all FDI to developing countries goes through tax havens • OECD public budget deficits are increasing • Domestic resource mobilisation in developing countries – half of Sub-Saharan African countries mobilise less than 17% of their GDP in tax revenues, below the minimum level considered by the UN as necessary to achieve the Millennium Development Goals Tax evasion vs avoidance • Tax evasion: – Illegal, part of the shadow economy, links with criminal activities & money laundering – transparency, access to bank account identity, force tax havens, automatic exchange of information • Tax avoidance – playing with the rules, part of the MNE business model – much more difficult to detect Key BEPS practices • Manipulating intra group transfer pricing; • Excessive deduction of debt interest and other payments; • Hard to value and shifting of intangibles; • Avoiding permanent establishment status; and • Opacity of MNE tax schemes. The changing structure of the MNE Today’s MNE Transfer pricing Hybrid mismatch Hard to value intangibles Orders, buys & owns commodities & raw materials License fee (USA) 4,3% Suppliers (France) Delivery of commodities & raw materials Empty Shell Primary contractor (Switerland) Delivery of finished products Re-sale, pricing set to meet 2,5% margin Limited risk distributors (France) Pays for manufacturing (processing cost + 6%) Industrial sites (France) Customers (France) Sale of the product, pricing set by the Alpha Europe Logistics & warehouses (France) Group-wide reporting What is missing • • • • Formulary apportionment method Country-by-country tax reporting made public Transparency of beneficial ownership Transparency over dispute resolution mechanisms • Developing country perspective • Impact on MNE workers Developing countries • Challenges – Capacity to monitor BEPS • telecom sector. • dedicating time, resource & audit staff, does not deliver quick results – OECD Transfer pricing guidelines not implemented • Kenya (2006), Uganda (2011), Ghana (2012) • Rwanda , Burundi and Tanzania not yet. – Bilateral agreements and treaties: • in most case favor the developed countries. • Limited treaty network • Some positive re. transfer pricing – July 2012, the Kenyan tax administration (KRA) - OECD/WB/IFC training programme • increase in the number of audit cases completed, revenue collected • recent case led to US$12.9m in additional revenue, another to US$10.9m. Impact on workers • Tax avoidance does not happen in a vacuum, it is another form of corporate short termism – harms government finance and public services. – But it also harms other stakeholders • For workers can be assimilated to a legal restructuring with short termist goals. – affects profit levels, capacity to invest – affects the distribution of wealth created by the company – tax planning is one form of “regulatory planning” that may undermine workers’ rights to collective bargaining (“aggressive social planning”) – Affects workers’ right to information (as a result of greater opacity) – weakening bargaining power.