2016-2017 Financial Aid Night Presentation

advertisement

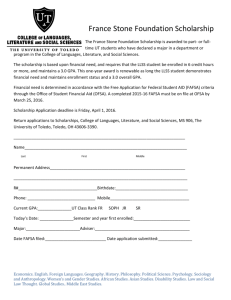

2016-17 Financial Aid Presentation Daniel M. Tramuta Associate Vice President for Enrollment Services New York State Financial Aid Administrators Association (NYSFAAA) - Past President Eastern Association of State Financial Aid Administrators (EASFAA) - State Rep State University of New York at Fredonia tramuta@fredonia.edu 716.673.3253 Overview of Higher Education Landscape Challenges & Opportunities • • • • • • • • • • • • Demographics Decline in HS Graduates out to 2022 Selectivity Matrix Program Demand Retention Merit-Based Arms Race Scholarship – increased tuition discounting to find price point Cost & Affordability Debt at Graduation Return on Investment New Academic Programs Growth in STEM Programs http://www.fredonia.edu/finaid/stem.asp Projected change in the number of high school graduates 2010 to 2019 Factors Most Noted in Choosing & Staying at a College 1. Majors & Career Programs Offered 2. Cost/Affordability 3. Location/Campus Characteristics/Faith Support 4. Campus Size/Safety 5. Characteristics of Enrolled Students 6. Selectivity 2014 Undergraduate Degree Demand – ACT Test Takers The Financial Aid Funnel - How & When to Apply? • • • • • • • • • Apply for Admission (Fall of Senior Year) Collect documents Create a FSA ID & Password at https://fsaid.ed.gov Fill out the 2016-17 FAFSA on the Web Worksheet (Do Not Mail this Worksheet) (Dec.) Complete FAFSA online at www.fafsa.gov in January 2016 (Estimate the information) Once your federral Tax return is completed go back to update your FAFSA via IRS Data Retrieval Tool Print the confirmation page Use the corresponding state scholarship link on the FAFSA Confirmation Page to apply for TAP Keep records Create a FSA ID & Password Prior to Completeing the FAFSA Create Account – Link PIN FAFSA: IRS Data Retrieval Tool •F CHhhhonnects to IRS for tax datConnects to IRS for tax data of completed tax returns •Electronic filers – about 2 weeks after submittal •Use for original FAFSA and corrections •a of completed tax returns •Electronic filers – about 2 weeks after submittal •Use for original FAFSA and corrections AFSA: IRS Data Rdata of Should I pay someone to help me find or apply for student financial aid? • FREE help is available • Make sure you are not paying for free information • Know what you are getting for your money • Need more info: 1-800-4FEDAID What Makes up a Financial Aid Package? Sources of Financial Assistance Federal & State Grants GGrant Programs – PELL Grant Must have a FAFSA calculated EFC between $0 – $5,199 Max. Award: $5,775 T – NYS TAP Grant TAP Grant Based on NYS net taxable income NY Net Income ceiling is $80,000 Max. Award: $5,165 STEM Incentive Program Tuition scholarship at SUNY or CUNY Eligibility Need to graduate in top 10% of high school class Need to study in STEM Field Need to maintain a 2.5 average Five-year service contract to work in NY state in a STEM field More information: www.hesc.ny.gov or Scholarship Unit at 1-888-697-4372 NY-AIMS Award of $500 Eligibility NY State high school graduate Achieved academic excellence ‒ Top 15% ‒ 3.3 GPA or above ‒ Honor Regents diploma or a score of 3 or higher on two advanced placement exams Based on unmet need Applications and more information available in May More information: www.hesc.ny.gov or Scholarship Unit at 1-888697-4372 Federal Work Study Federal Work Study Based on financial need Earnings based on NYS minimum wage scale Traditionally on-campus employment Usually 6 to 10 hours per week Federal Stafford Loan Subsidized Unsubsidized 4.29% 4.29% Capped at 8.25% Capped at 8.25% Not based on Based on need need is in Federal government pays interestfinancial while student school $3,500 for freshmen Maximum Direct Loans for freshmen: $5,500 FASTWEB.COM Fastweb recently matched you to these new scholarships! Apply today, so you don't miss out! • • That was easy–you didn't even have to search! Check out your new scholarships: Kelly Tanabella Music Theatre Scholarship (Amount: $4,000) Log in to see the rest of your personalized scholarship matches: What do I do now? You're never going to win scholarships if you don't apply. Simply choose one of the scholarships on your matches list, read through the detailed info and click on the scholarship provider's website to find out how to apply. Why was I matched to these scholarships? We matched you to these scholarships because of the info you have in your profile. If these scholarships aren't what you had in mind, you have the power to make them better. Update your profile by filling out as much as possible and keep your info current. That way, we'll find better, more personalized scholarship matches for you. Administration Rollout of PPY September 14, 2015 • In Des Moines, Iowa, President Obama announces action to implement PPY on the 2017-18 FAFSA • On October 1, 2016, the FAFSA for the 2017-18 award year will be released by the Department of Education. 19 Identifying Implications • The move to PPY could have some important implications for colleges and universities • Budget and tuition planning timelines may need to be adjusted if award determinations are made in the fall instead of the spring • Recruitment and admissions offices may need to alter messaging as high school seniors will receive financial aid information much earlier • Earlier distribution of acceptance letters • Earlier distribution of financial aid award letters 20 Using Prior-Prior Year Tax Income Data on the FAFSA • • • • The Free Application for Federal Student Aid (FAFSA) becomes available every January 1, and currently requires a family's tax information from one year prior. Families are encouraged to file the FAFSA as soon as possible to maximize their odds of receiving financial aid. But with tax deadlines months later, most have to estimate their tax information on aid applications and make corrections later. In the worst case scenario, some families miss out on financial aid funds that are disbursed on a first-come basis. Education Secretary Arne Duncan enacted a change this past Sunday that would fix this widespread issue. By using income from two years ago, otherwise known as prior-prior year (PPY) tax income data, families could file the FAFSA with tax information they already have, making the process quicker and easier. By taking advantage of the existing ability to import tax information directly from the IRS onto the FAFSA form, families will spend less time gathering paperwork and would make far fewer errors. The use of prior-prior year income also presents an opportunity to align admissions and financial aid decisions and give millions of families more time to plan for actual college costs, rather than sticker prices or projections. Low-income families experience very little income fluctuation from year to year and most would not see a significant change in their eligibility for a Pell Grant with a switch to prior-prior year income. Prior-prior year income is the closest thing we have to a "silver bullet" for an industry in search of meaningful solutions. With earlier aid awards, financial aid administrators would have more time to help families evaluate their options and make informed financial decisions. 21 Using Prior-Prior Year Tax Income Data on the FAFSA With the switch to PPY, students and families will be able to: • • • File the FAFSA earlier. As you know, the FAFSA is made available January 1 of each calendar year, yet it is uncommon for a family or individual to be prepared to file an income tax return in the month of January. Under the new PPY system, the 2017-18 FAFSA will be available in October 2016, rather than January 1, 2017, and students can use the PPY’s completed income tax return. More easily submit a FAFSA. The IRS Data Retrieval Tool (DRT), which allows automatic population of a student’s FAFSA with tax return data and decreases the need for additional documentation, can be used by millions more students and families under PPY, since tax data from two-years prior would be readily available upon application. Receive earlier notification of financial aid packages. If students apply for aid earlier, colleges can in turn provide financial aid notifications to students earlier, ensuring that students and families have more time to prepare for college costs. Notifying students earlier of their financial aid packages will also leave more time for one-on-one counseling with students and families. * Next year’s (2016-17) aid applicants will be using the same prior year federal income (2015) for two consecutive years 22 What PPY Could Mean for High School Counselors? • Improved discussions about financing college – Earlier and more realistic conversations about financial viability – Improved College ScoreCard (CollegeScorecard.ed.gov) • Financial Aid/FAFSA information nights held earlier – May include more colleges/universities to assist • Fall workload increases • College/University requests for earlier visits 23 Potential Impacts on Student and Family Behavior • Shifting priorities in college search • Changed college application patterns – Earlier and/or later applicants? Both? • Earlier and more informed enrollment decisions • Mixed views on stress 24 Potential Impacts on Admission and Recruitment Behavior • Earlier discussions about financial viability • Admissions staff cross-training • Rolling admissions could be at an advantage – Acceptances and financial aid decisions sent together? • Challenges to articulating value proposition • Adoption of early decision/early action programs • Changes in yield projection accuracy – Econometric modeling may not be as accurate – Methodically enhance yield activities/resources – Potentially have earlier, stronger indicators of class yield 25 Appeals Based on Unusual Circumstances • Loss of Income, e.g. in academic year 201516, loss of Income in 2015 vs 2014 • Medical/Dental expenses NOT PAID by insurance • Death, separation, divorce...... • 1-Time Fluctuation in Income • Elementary/Secondary Private School Tuition Expenses • Follow the procedures of the Financial Aid Office where student is attending. 26 SUNY Statewide Student Financial Aid Days • Saturday, January 16, 2016 • Saturday, February 20, 2016 Ask questions about the financial aid application(s), types of aid available and the actual awarding process Most campuses will offer web access and personal assistance to complete FAFSA’s online Register at www.suny.edu/student in early December 2015 Questions?