12092009-KYC - State Bank of India

advertisement

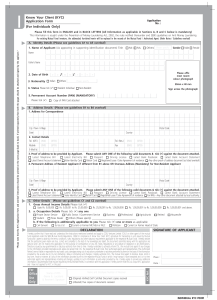

SOUND MIND LEADS TO SAFE BANKING KNOW YOUR CUSTOMER What is KYC? “KYC (Know Your Customer) is a framework for banks which enables them to know / understand the customers and their financial dealings to be able to serve them better.” All banks have been advised by The Reserve Bank of India (RBI) to follow certain ‘KYC Guidelines’ Objectives of KYC To enable the Bank to identification of its relationship have positive Is in the interest of customers to safeguard their hard earned money When does KYC apply? KYC will be carried out at the following stages: Opening a new account In respect of accounts where documents as per current KYC standards have not been submitted while opening the initial account Opening a Locker Facility where these documents are not available with the Bank for all the Locker facility holders When the Bank feels it necessary to obtain additional information from existing customers based on conduct of account When there are changes to signatories, mandate holders, beneficial owners etc. For non-account holders approaching the Bank for high value one-off transactions like Drafts, Remittances etc. Proof needed from customers regarding KYC RBI mandates three proofs to be collected from customers: Photograph Proof of identity Proof of address These are to be submitted by the customer both at the time of opening of account as well as at the time of change of address. Small Deposit Accounts Small deposit accounts are those accounts where, Balance does not exceed Rs. 50,000/- and Annual turnover does not exceed Rs. 1,00,000/- Simplified KYC norms prescribed for Small Deposit accounts Customers can open this type of accounts by getting introduced by existing fully KYC compliant account as also attestation of address / photograph by him. Contact Point in Banks for KYC Contact point for customers in the Bank will be the Relationship Manager / official who opens the account and is the contact person during transactions MONEY LAUNDERING What is Money Laundering? Money laundering refers to the conversion of money illegally obtained to make it appear as if it originated from a legitimate source. It is being employed by launderers worldwide to conceal proceeds of criminal activity associated with it, such as drugs / arms trafficking, terrorism and extortion. Effect on Customers For prevention of opening of accounts in false identities, Banks have to ask for proof of customer’s identity and address during opening of new accounts Being asked for these documents does not imply that the customers are suspected of money laundering It is a necessity to identify all prospective account holders or customers as anybody including a criminal could falsely use another customer’s identity, if the respective documents are not obtained. What proof of identity will you need? Best identification documents are those issued by a Government authority, having a photograph, address and signature One document can be used to establish both identity and address, else two or more documents will suffice Some proofs of Identity & Address for Individuals: Passport Election ID card Driving License Voter ID card Proofs of Identity & Address for companies, Trusts, Firms: Partnership Deed Trust Deed Memorandum & Articles of Association Certificate of Incorporation etc. What proof of identity will you need? (Contd.) Documents used for Identity only for individuals: Documents used for Address only for individuals : Pan card ID card of reputed employers Salary Slip Electricity Bill Telephone Bill Ration Card Prevention of Money Laundering Act (PMLA) 2002 Mandates banks to report certain transactions to the nominating agency under instructions issued by RBI in consultation with the Indian Government and Indian Bank’s Association It specifies that, Demand drafts, mail transfers and travelers cheques for Rs. 50,000/- and above can be issued only by debit to customer’s account or cheque etc, and not against cash payment Demand drafts, mail transfers and travelers cheques for Rs. 50,000/- and above can be paid by banks only by credit to customer’s account or through other banking channels and not cash Help us to Help You By being patient when a Bank staff asks you to provide documents to prove your identity / address By maintaining confidentiality of your account details and identity documents For any further queries, please contact 1800112211 (tollfree from BSNL/MTNL) or 080-26599990.