Unit 5 Marketing

advertisement

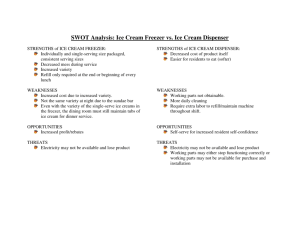

Marketing Objectives for MEBI’s 1. 2. 3. 4. To sale 200,000 litres of ice cream in first season (5 months). To achieve 5% markets share in 5 years. Create awareness of the product of 70% in the first year. To have product available in all the major retailers in the first year of launch. Market background for (UK) On average, each person in the UK eats 9 liters of ice cream every year. The people of Scotland and Northern Ireland eat more ice cream on average than those in England and Wales. The ice cream market has been experiencing sales in recent years(0). As the markets increase people’s attentions are turning towards healthy eating which creates a big gap for potential market of healthy indulgent products. Ice cream, which is the ultimate indulgence for many people, more companies are focusing on providing healthier, lower fat and lighter ice cream for health-conscious consumers to avoid obesity or diabetes. Nowadays, more and more companies are focusing on using high quality and premium ingredients and making up by upper-scale packaging to attract middle and upper class. As a result the self-cost of healthier ice cream would be higher and premium ice cream is inevitable. Besides the market of ice cream raw material such as milk, sugar would also affect the ice cream market. United Kingdom Market Analysis using PEST (macro analysis). Market analysis would be done by the use of PEST. PEST helps in analysing macro environmental factors of United Kingdom (UK) which helps in creating business strategy for the company. PEST consists of Political, Economic, Social and Technological factors. PEST Description Political Due to government policies prices are rising in all the sectors (VAT increased from 12 to 20%) Stable government encouraging manufacture sector as well as supporting developing of sustainable food production. Economical UK economy currently faces inflation of 4.4% (Allen,2011). Unemployment in UK is 8%. UK currently stands in fourth position after US. The annual growth rate for 2011 is 0.70% which has increased from 2008 which was -5%. Social Average population age of UK is 39.7 as per 2010. Average income has increased by 2.1% in 2010 Due to education more people are having lifestyle change which is inkling them towards health awareness and hence they buy more healthy products. Improved transportation and technology means less reliance on local or seasonal produce. Technological UK being a first world country is technologically more advanced with more research and development facilities. Being technologically sound less man power is needed with more output. Technology advancement helps in customer satisfaction. UK produces 8% of the worlds scientific papers which is 12% only second to US. Table No-1 PEST Competitors Market Analysis for MEBI’s Competitors Marketing Mix:Using the 4P’s of marketing mix:- The main company UNILEVER has different products in the ice cream market with differentiated product offerings the various brands that are under UNILEVER are 1)HaagenDaz’s, 2) Carte D’Or, 3) Ben & Jerry’s, 4) Walls. Haagen-Daz’s Product Price Place Carte D’Or Ben & Jerry’s Haagen-Daz’s Carte D’Or light 1) Ben & Jerry’s Cookie Dough ice vanilla 1ltr cookie dough, cream 500ml 2.phish, 3. (Premium Chocolate fudge product). brownie, 4. caramel chew chew (for children) all products are available in 500ml (Premium product) £4.15 £3.45 Available in all the small & large retailers like ASDA, Morrison’s, TESCO, Sainsbury’s. They have sales of the product all over UK. Have sales all They target mainly over UK. In all the major retailers. the major retail outlets. do Promotion They promotions monthly with the help of large retailers and provide 50% off on their normal price. With the help of retailers they are able to sell it at offers like buy 1 get 1 free which may be monthly or after 5 weeks. Walls Tesco 1) Walls cream of Cornish(1ltr), 2.soft scoop vanilla (2ltr), 3.viennetta vanilla/mint (650ml). 1.TESCO caramella (1ltr), 2. Chocolationo (900ml), 3. Vanellitta (1ltr), 4. Cherrylicious (900ml) 1. £4.45, 2. £2.22, 3. 1. £2.8, 2. £1.92, 3. 1. £1.65, 2. £1.99, £2.22, 4. £2.22 £1.00 3.1.65, 4. £2.20 Being a Unilever brand its available all over UK and in all major retail outlets. Have 1905 outlets all over UK with its own supply chain. Considerate mostly major cities. Has almost reached to every place in UK. They mostly have The offer ranges offer for 10 days from to 30 to 50% and slash the rates off on the actual to half price. price varying according to the place. Mostly sell the products cheap than its competitors by providing offers like buy 1 get 1 free. Table No-2 Competitors Analysis for Ice cream market. Marketing mix for MEBI’s using the 4 P’s (micro analysis):4P’s Description Product Healthy product with saffron flavour, 500ml, liked by people of all ages, Good quality, Suitable for people routing for good quality. Price Price being highly competitive which is lower than most of the competitors except retailers who sell their product at lower price (TESCO). Customers asking for lower price high quality which our product has with new flavour and taste is advantageous for us. Place Would target mostly Yorkshire covering all the major retailers as well as small retailers to make the product available easily to the local public, and providing convenience. Promotion Would mostly do promotions 3 weekly which most of the competitors don’t do, and would also be supported by the advertisement giving product information and availability. Table No-3 Marketing Mix for MEBI’s Promotion Mix: a successful promotion mix uses a balance of its five tools in a planned and structured way. Type Advertising Sales Promotion Description Time & Date T.V, radio & news papers (Sun Times), cinema halls. Six months from the launch date (March to September). Discount offers like Buy 1 get 1 Free, half price. 22nd March to 19th April (Half price & Buy 1 get 1 Free). MEBI’s promotions help in simulating buying. Personnel selling Sales persons giving free samples outside Malls, supermarkets. From 1st March for 3 weeks (Free sample). Direct marketing Opening of website. (During sales promotion we will be noting down personal email ID while giving free samples, for notifying about new product launches). Will provide all the information of all the products available showcasing the brand name which help in increasing brand image. Notification from 15th March till 30th September. E-advertisement We will do advertisement on the sites of all the major retailers, if needed we will do advertisement on e.g. Yahoo. In the next season i.e. 2013 Table No-4 Promotion Mix SWOT AnalysisStrength 1) The company has strong finances and can back new projects. 2) Low price 3) Long product shelf life. 4) Good promotion schemes. Weakness 1) The firm is New in market with no experience of the industry. 2) Financial Situation as compared to competitors. 3) Don’t have retail shops. 4) Large bargaining power of suppliers/retailers. 5) High inventory cost. Opportunity 1) Building brand image and having a strong brand with the help of advertisement. 2) Maintaining better quality product- with the help of research and development. 3) Younger audience searching for convenience products. 4) New product development- will help in differentiation. 5)UK market- will cover all the four sectors of UK 6) Brand awareness- with the help of sales promotions. 7) Fewer competitors 3 to 4 around our price range. 8) Increase in sale of our product by future forecasted sales. 9) Gap in the market for low fat ice cream. 10) Health conscious customers looking for good quality products. Table No-5 Current situation analysis of MEBI’s. Threats 1) Rising labour cost 2) Established players are superior to MEBI’s in finance, production and operations. 3) Strongest brand in the market Unilever. 4) Customers loyalty towards old brands 5) Want more sales promotion with cheap product offerings & better quality which will affect our return on income. 6) Cheaper products available in market 7) Retailers own labels are strong. 8) Frequent switching of some segments of customers. Marketing StrategyAfter the analysing all the company strengths and weakness opportunities and threats of MEBI’s we can form a strategy with the help of PORTER’s Generic strategies model. PORTER’s Generic Strategies: - Helps in analysing Competitive strategy for MEBI’s Differentiation Broad Scope Narrow Cost Differentiation Cost Leader Differentiation Focus Cost Focuser By using the porters generic strategy MEBI’s opt for narrow market by focusing only on the Yorkshire market by providing products at lower cost. This strategy will help MEBI’s to gain more customer loyalty, being more competitive in the market, can focus on the targeted customers more by offering better quality and increase in sales. This strategy will also help in gaining more market share and form a base for future expansion. Once the company grows with increased knowledge of the market and more customer loyalty then in the second phase MEBI’s can enter broader scope. STP Analysis:- Segmenting, Targeting & Positioning. Segmenting Age,gender,behaviour Targeting Positioning Highest consumption of ice cream is by the young & middle aged individuals who are also health concious We want our product to be postioned as value for money , good quality with good recognising our good brand image IMPLEMENTATIONS – Product Ice cream is one of the most loved desserts by everyone, but there’s less availability of healthy ice creams in market due to the acceptability issues with texture, smoothness, creaminess, etc. The earlier testing results showed the product is liked by the entire panellist keeping all in mind. We have developed a healthy ice cream ‘Low Fat Saffron Ice cream with Rose water’ which will be available in an attractive 500ml pack. This will be suitable for all the age groups who are seeking health conscious open to try different brand products. Our product quality is high like that of a premium ice cream with great taste high quality and use of all natural ingredients. The fat content of our ice cream is 4.45%, energy- 336.8KJ/100ml. This product is a convenience product which would be easily available. Product life cycle- Our product on the product life cycle graph is where the star is, so based on this our organisations marketing policies will be adjusted. Place – As said earlier MEBI’s will be first targeting the Yorkshire market because on an average, each person in the UK eats 9 litres of ice cream every year. Whereas the population of Yorkshire & The Humber is over 5.3 millions therefore to achieve the objective of MEBI’s i.e. selling 200,000 ltrs of ice cream in first season is possible. And the next year it will enter the southern UK and the following year will cover the whole UK. So in order to cover all these areas we will need to have an efficient and effective distribution channel which will enable more sales and get a warm reception from the retailers. We will be using the following type of distribution channel. MBEI's Distributor Retailer Consumer This channel will be used to reach the small and large retail shops, hotels, corner shops, & restaurants and large retailers like TESCO, ASDA, Morrison’s, Sainsbury’s. This channel help do mass distribution; it will also help in reaching the consumers who don’t have easy access to major retailers and thus we can make our product available to them, will also help us to reach almost all the corners of every area. Price – Price of our product will be less i.e. £1.60 for 500ml as compared to other products available in the market. The price can be kept low as we manufacture our product in Yorkshire and initially we are targeting only Yorkshire area therefore other expenses like transportation would be less. Being lower Priced we can gain more sales and create more brand loyalty of our product in new market. Price has a psychological impact on the consumer and being lower priced than the competitors product would help in being more competitive which help in the strategy of having more market share in the narrow market. Lower price strategy will encourage more customers to try the product and on tasting the product they will discover the high quality of our product and so this will create a value for money impression about the product in the minds of the consumer. After finding out that the product has great new flavour and also has many health benefits and still it’s a cheap product consumers will genuinely start buying our product, and also help in word-of-mouth publicity. Promotion – Being a new product promotion is very important for brand awareness and providing information about the product features and the availability. The promotion will mainly be classified into two types mainly advertisement and sales promotion. These two types of promotion will help us improve awareness about our product and brand and will also help increase sales. 1. Sales Promotion: For the Customers: The promotions will take place at mainly crowded places E.g. outside Malls and superstores by our salesmen standing outside the places and providing free taste samples and also give them leaflets with product information. More promotions like buy one get one free, half price that will be available to attract and inform more consumers about the new product. For the Retailers when they buy in bulk they will be given large discount so as to encourage them to keep more of MEBI’s products. 2. Advertisement – For the Customers: Advertisements on T.V (During E.P.L. matches), Radio (During Evenings 106 Capital FM), Newspapers (Sun Times), in cinema halls during summer vacations to target younger crowd. For the Retailers: The advertisement offerings would also be supported by placing banners and poster outside the superstores as well as at the point of sales The placement of the advertisement needs to be perfect so as to fulfil our first priority to get the attention of our target audience who are 15to 60 year old. Controls – Objectives To sale 200,000 litres of ice cream in the first season. To achieve 5% markets share in first 5 years. Create awareness of the product of 70% in the first year. To have product available in all the major retailers in the first year of launch. Controls After 3months after the launch of the product the sales would be checked according to the demand in market for our product. At the end of every year it will be checked that how much market share MEBI’s has achieved by the time and according to that the promotions will be increased. 70% product awareness in the first year in Yorkshire region---- market research will be carried out after first 3 months to check the awareness level in the Yorkshire region. To have our product in 90% of the retail stores----- after first 5 months this objective has to be checked and judged and according decisions would be taken. Contingency plan: - If the above plan fails to stand up to the expectations of the company then MEBI’s will directly sell the product to the big retailers and to the vans selling ice cream in their own label brands. References1. http://www.defra.gov.uk/ 2. http://www.direct.gov.uk/en/MoneyTaxAndBenefits/Taxes/BeginnersGuideToTax/VAT/DG_190 918 3. Allen, G., (2011), Inflation: Economic Indicators page – Commons Library Standard Note, http://www.parliament.uk/briefing-papers/SN02792 4. http://www.statistics.gov.uk/cci/nugget.asp?id=6 5. http://www.bbc.co.uk/schools/gcsebitesize/design/foodtech/socialenvironmentalissuesrev1.sht ml 6. www.ukti.gov.uk 7. http://www.unilever.co.uk/Images/Unilever_AR10_tcm28-260444.pdf 8. http://www.unilever.co.uk/aboutus/AnnualReportandAccounts2010/?WT.GNAV=Annual_Repor t_&_Accounts_2010 9. http://ar2011.tescoplc.com/pdfs/financial/group_income_statement.pdf 10. http://ar2011.tescoplc.com/pdfs/financial/group_balance_sheet.pdf 11. http://ar2011.tescoplc.com/pdfs/Overview/financial_highlights.pdf 12. http://www.statistics.gov.uk/cci/nugget.asp?id=2231 13. http://www.ice-cream.org/facts-types-and-usage-of-ice-cream-4.htm