Cash and Receivables

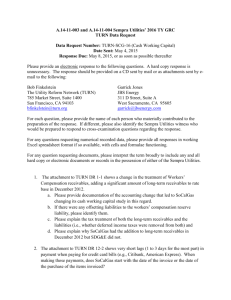

advertisement

Intermediate Financial Accounting I Cash and Receivables Objectives of this Chapter I. Discuss the asset valuation methods. II. Identify items to be included in the cash account and discuss how cash and related items are reported. III. Explain accounting issues related to valuation of accounts receivables -trade discount, sales discount, sales returns and allowance, and uncollectible accounts. Cash and Receivables 2 Objectives of this Chapter (contd.) IV.Discuss the means to use accounts receivable as a financial instrument -pledge, assign and factor. V. Discuss the valuation of notes receivable and the disposition of notes receivable. Cash and Receivables 3 I. Assets Valuation Methods A. Acquisition Cost (Historical Cost): Used in the initial recording for all assets except for: 1. Investment in debt securities-held-tomaturity. 2. Long-term monetary assets (i.e., Longterm N/R). B. Current Entry Value (Replacement Cost): Applied in the inventory valuation (LCM). Cash and Receivables 4 Assets Valuation Methods (contd.) C. Current Exit Value (net selling price or market value): Applied in the valuation of trading securities and securitiesavailable-for-sale. D. Net Present Value: Applied in the valuation of investment in debt securities-held-to-maturity and long-term monetary assets. Note: SFAS 159 allows the fair value option for financial assets and liablitlieis. Cash and Receivables 5 Cash and Receivables Liquidity: The amount of time expected to elapse until an asset is converted into cash. Liquid assets: Assets are available for conversion into cash quickly (i.e., cash, receivables, trading securities, etc..). Liquidity is an indication of a company’s ability to meet its obligation. Cash and Receivables 6 II. Cash What are included in the cash account? A. Cash on hand: B. Cash in bank: Cash and Receivables 7 Cash (contd.) What are excluded from the cash account (source: FRR No. 1): Foreign currency with severe restrictions - separate cash account. Certificates of deposits (CDs) Temporary Investments. Bank overdrafts - current liabilities (i.e., A/P) unless available cash is present in another account in the same bank (offsetting is required in this case). Cash and Receivables 8 Cash (contd.) What are excluded from the cash account (source: FRR No. 1): Postdated checks- Receivables. IOUs - Receivables. Travel Advances - Prepaids. Employees’ Advances - Receivables. Postage stamps -Office supplies. Special purpose funds - Investments. Compensating balances - Restricted cash. Short-term papera (i.e., commercial paper) - S-T investments. a. Investments with maturity of 3 to 12 months. Cash and Receivables 9 Restricted Cash Compensating balances are examples of restricted cash which may require separate reporting. Other restricted cash: petty cash, cash for payroll, cash for dividends. If the amount is material, separate reporting is required. Cash and Receivables 10 Compensating Balances (CB) Cash CB: The portion of any deposit maintained by a corporation to support an existing borrowing arrangements (ASR No. 148). CB will increase the effective interest rate. CB may also be payment for bank services rendered to the company. Cash and Receivables 11 Compensating Balances (contd.) Cash If the CB is significant and is to support short-term borrowing, the CB should be stated separately among the “cash and cash equivalent item” in current assets.. If the CB is significant and is to support long-term borrowing, the CB should be classified as noncurrent assets in either “Investments” or “ Cash on Other Assets” using a caption such as “Deposit Maintained as Compensating Balance”. Cash and Receivables 12 Compensating Balances (contd.) Cash The following two situations only require a footnote disclosure of the CB, not a separate reporting: 1) CB arrangement exists without agreements that restrict the use of cash amount shown on the balance sheet statement; 2) CB arrangement is to assure future credit availability. Cash and Receivables 13 Other Cash Related Topics Electronic Fund Transfer (EFT): Cash Equivalents: short-term, highly liquid investments that are both Readily convertible to known amount of cash, and So near their maturity that they present insignificant risk of change in value. Cash and Receivables 14 Cash Equivalents (CEs) In general, only investments with original maturity of three months or less qualify under these definitions. Examples: Treasury bills, Commercial paper, and Money Market Funds. Hard lesson learned: reporting the auctionrate notes as CEs by Kohl’s and ADC Telecommunications resulting in sizeable write-downs of these CE during the credit crunch due to no market exist for these investments. Cash and Receivables 15 Cash Equivalents (CEs) Although these auction-rate notes often have long maturity dates (i.e., 30-year), they were traded on daily basis prior to the credit crunch in 2008. This is how the holders of these notes argued to present them as CEs. When the market for these notes froze (i.e., no buyers of these notes), the value of these assets dropped significantly to warrant a sizeable write down. Cash and Receivables 16 Cash Equivalents (CEs) FASB is considering to separate reporting of cash from CEs. In July 2010, FASB staff proposed to report cash equivalents (i.e., money market fund) as short-term investments. This project was reassessed as a low priority project and no action was taken recently. Cash and Receivables 17 Using Bank Account General checking accounts Imprest bank accounts Lockbox Cash accounts Cash and Receivables 18 Cash Management and Control Cash Management: 1)to maintain sufficient balance of cash on hand for day-to-day operation; 2)to prevent large amount of idle cash on hand. Cash Control: to prevent losses of cash by theft of fraud 1. Immediate deposit of cash. 2. Cash payment by checks except for small amounts. 3. Separation of duties. 4. Bank account reconciliation. Cash and Receivables 19 III.Receivables Receivables: claims held against customers and others for money, goods or services. Current Receivables: expected to be collected within one year or one operating cycle, whichever is longer. Cash and Receivables 20 Receivables (contd.) Trade Receivables: amount owed by customers for goods sold and services rendered as part of normal business operations (i.e., accounts receivable and notes receivable). Nontrade Receivables: all others (i.e., interest receivable, advances to employees, deposits to cover potential damages, etc.) Cash and Receivables 21 Balance Sheet Presentation of Receivables (Illustration 7-3, KWW, 14th e) Cash and Receivables 22 Trade Receivables Accounts Receivable (A/R): oral promises of the purchasers to pay for goods sold and services rendered. They are usually collected in 30-60 days. Thus, A/R is always reported as a current asset with the net realizable value (i.e., A/R minus the allowance for uncollectible accounts). Cash and Receivables 23 Trade Receivables (contd.) Notes Receivable (N/R): written promises to pay a certain sum of money on a specific future date. N/R can be long-term or short-term and can be interesting-bearing or noninterest bearing. Cash and Receivables 24 Trade Receivables (contd.) Short-term N/R is reported at net realizable value (face amount – allowances for uncollectibles accounts). Long-term N/R is reported at present value or the fair value (i.e., the quoted market prices of identical assets in active markets). Cash and Receivables 25 Valuation of A/R & N/R Journal Entry of Transaction Valuation of A/R or N/R Adjustment(s) 1. Cash xx Sales xx 2. A/R xx Sales xx No Volume Dis. Sales R&A Cash Discount, Sales R&A, Volume Dis., Uncollectible Acc. Net Realizable Value (NRV) 3. N/R xx Short-Term- NRV Sales xx Long-TermPresent Value or Fair value Cash and Receivables Sales R&A Uncollectible accounts (for short-term) 26 Adjustments Related to Sales 1. Volume Dis. (Trade Discounts) 2. Cash Discounts (Sales Discounts) 3. Sales Returns and Allowances 4. Uncollectible Accounts Cash and Receivables 27 1. Volume Discount When to Recognize the Adjustments: Not reflected on the J.E. Unit price = $10 Volume Dis. => 5% if purchase 100 or more units Sale => 200 units J.E.: Cash 1,900 OR A/R 1,900 Sales 1,900 Sales 1,900 Cash and Receivables 28 2. Cash Discounts (Sales Discounts) When to Recognize the Adjustments: both Methods are acceptable. A. Recognized at time of sale (Net Price Method) B. Recognized at time of occurrence (Gross price Method) Cash and Receivables 29 2A. Recognized at Time of Sale (Net Price Method) Sales = $100, terms 2/10, n/30 12/26/x1 A/R 98 Sales 98 a. 1/2/x2 Cash A/R 98 98 Cash and Receivables 30 2A. Recognized at Time of Sale (Net Price Method) (contd.) If discounts were not taken: b. 1/31/x2 Cash A/R 100 Cash Discounts Not Taken 98 2 Finance charge or Cash Dis. Forfeited (interest revenue) Note: If the discount period expired on 12/31, adjustment is required to bring the A/R to the gross amount. Cash and Receivables 31 2B. Recognized at time of occurrence (Gross price Method) Sales = $100, terms 2/10, n/30 12/26/x1 A/R 100 Sales 100 a. 1/2/x2 Cash Sales Discounts AR If discounts were not taken: b. 1/31/x2 Cash A/R Cash and Receivables 98 2 100 100 100 32 3. Sales Returns & Allowances (FASB 48) A. The amount of sales R&A is not significant. B. The amount of sales R&A is significant and six conditions are not met. C. The amount of sales R&A is significant and six conditions are met. Cash and Receivables 33 3A. The amount of Sales R&A Is Not Significant If the amount of sales R&A is not significant, sales R&A are recognized at time of occurrence: Sales Returns & Allowances A/R (or cash) Cash and Receivables xxx xxx 34 3B. The Amount of Sales R&A Is Significant and Six Conditions Are Not Met If the amount of sales R&A is significant, and the following six conditions are not met, postpone the revenue recognition until all six conditions are met or the return period expired. Cash and Receivables 35 Six Conditions (SFAS No. 48) 1. Sales price is determinable or fixed; 2. Buyers have paid or have the obligation to pay the sales price; 3. The buyer’s obligation would not be changed due to theft or damage of the product after purchase; 4. Sellers are not responsible for the performance of the product; Cash and Receivables 36 Six Conditions (SFAS No. 48) 5. Buyers and sellers are two separate economic entities; 6. The amount of returns can be estimated. If the amount of returns is significant and these conditions are not met, revenue cannot be recognized. Cash and Receivables 37 3C. The Amount of Sales R&A Is Significant and Six Conditions Are Met Sales can be recognized in the period in which the sales are made. Also, at the end of the same period, the amount of sales returns would be estimated and recognized. 10/5/x1 A/R 10,000 Sales 10,000 12/31/x1 Sales R&A 1,000 Allow. for sale R& A 1,000 (estimate 10% returns) 1/10/x2 Allowance for sales R&A 900 A/R 900 Cash and Receivables 38 4. Uncollectible Accounts The Allowance Method for Uncollectible Accounts: Estimate the bad debt (B/D) expense at the end of the period and recognize the expense (SFAS No. 5). Adjusting entry for B/D expense: Estimated B/D expense = $2,000 12/31 B/D Expense 2,000 Allowance for Doubtful Accounts 2,000 When B/D actually occurred: (i.e.,$200 B/D) Allowance for doubtful Accounts 200 A/R 200 Cash and Receivables 39 4. Uncollectible Accounts (contd.) If $100 of the B/D recovered: A/R 100 Allow. for Doubtful Acct. Cash A/R 100 100 100 The current practice is complied with the matching principle. The direct write-off method (recognize the B/D expense when it occurs) is not recommended. Cash and Receivables 40 Presentation of Allowance for Doubtful Accounts Cash and Receivables 41 Three Methods in the Estimation of B/D Expense 1. Percentage-of-sales (income statement approach). 2. Percentage-of-accounts receivable (balance sheet approach). 3. Aging of accounts receivable (B/S approach using individual account information). Cash and Receivables 42 1. Percentage-of-Sales (I/S Approach) Example: Net credit sales = $20,000 Estimated B/D exp. = 2% of net credit sales Adjusting Entry 12/31 B/D Expense 400 Allow. for Doubtful Accounts Cash and Receivables 400 43 2. Percentage of A/R (B/S Approach) A/R Balance = $50,000 Estimated B/D = 1% of A/R Balance of the allow for doubtful accounts prior to the adjustment = $300 The new balance of the allow. for doubtful accounts = $50,000 x 1% = $500 Bad Debt Expense = $500 - 300 = 200 Adjusting Entry B/D expense Allowance for Doubtful accounts Cash and Receivables 200 200 44 3. Aging of A/R Method The balance of the allowance prior to adj.= $100 Age Amount B/D% Allowance Amount 0-30 10,000 4 400 31-60 7,000 10 700 61-90 Over 90 4,000 2,000 17 26 680 520 Total 2,300 B/D Expense= $2,300 - $100 = $2,200 Adj. Entry: B/D expense 2,200 Allowance for Doubtful Account. 2,200 Cash and Receivables 45 Earnings Management Discretionary accruals require a large degree of managers’ judgment Managers can use the discretionary accruals to manage earnings. Examples of discriminatory accruals: bad debt expense, warranty expense, sales returns (when expecting sig. returns), etc. Cash and Receivables 46 Earnings Management Using Accruals: The Case of Nortel Background: A Canadian communication company filed bankruptcy in 2009. It was hit very hard by the technology stock price decline in the early 2000s. Accounting Scandals: Nortel overstated its bad debt expense of 2002 in order to reduce its bad debt expense of 2003 (thus, increase its earnings) even though the outstanding accounts receivables were similar for both years. Cash and Receivables 47 Earnings Management Using Accruals: The Case of Nortel (contd.) Cash and Receivables 48 Earnings Management Using Accruals – Sun Trust Banks Similar to Nortel, some banks also overstated the loan loss reserve (an expense) for outstanding loans in a good earnings year and reduce the reserve in the following year to manage earnings. Cash and Receivables 49 Earnings Management Using Accruals – Sun Trust Banks (contd.) The SEC brought action against Sun Trust in 1999, alleging Sun Trust manipulated its earnings by overstating loss reserve when it was not experiencing significant loan losses. The SEC required Sun Trust to reverse the $100 million of loan loss reserve. source: KWW,14th e, p377 and “The Mythical FDIC Fund by William M. Isaac*, AM BKR Final, 8/27/08). Cash and Receivables 50 Presentation of Receivables (see Illustration 7-23 of KWW 14th e) General Rules : Segregate the different types of receivables. Appropriately offset the valuation accounts against the proper receivables. Disclose any loss contingencies. Disclose any receivables pledged as collateral. Disclose the nature of credit risk, especially the concentration of credit risk of receivables (i.e., receivable with common characteristics.). Cash and Receivables 51 Cash and Receivables 52 Interest on Receivables Most of the A/R does not bear interest if the customers pay the amount within the term period. However, if payment is not made within the term period, the customer may have to pay interest on the unpaid balance. Cash and Receivables 53 Example A Interest on Receivables Credit sale of $1,000 was made on 3/1/x1, terms 2/10 and n/30. Financial charge is 1% per month on the unpaid balance. The customer paid the first half of the A/R on 5/1/x1 and the second half on 6/1/x1. Cash and Receivables 54 Example A (contd.) Journal Entries: 3/1/x1 A/R 1,000 Sales 5/1/x1 Cash A/R Interest Revenue 6/1/x1 Cash A/R Interest Revenue 1,000 510 500 10 a 505 500 5b a. 1% x 1000 b. (1,000-500) x 1% Cash and Receivables 55 Example B Interest on Receivables Installment Sales (with Interest): Sales Price = $1,200 CGS = $900 Sales were made on 5/1/x1, four equal payments of $322.83 were made on 8/1/x1, 11/1/x1, 2/1/x2 and 5/1/x2 with 3% of quarterly interest rate. $1,200 = X 3.7171 X = $322.83 Cash and Receivables 56 Example B (contd.) Accrual Method: Journal Entries 5/1/x1 A/R 1,200 Sales Revenue 1,200 8/1/x1 Cash 322.83 A/R 286.83 Interest Revenue 36 1 11/1/x1Cash 322.83 A/R 295.43 Interest Revenue 27.40 2 1. 3% 1,200 2. (1,200 - 286.83) 3% Cash and Receivables 57 Example B (contd.) 2/1/x2 Cash 322.83 A/R 304.30 Interest Revenue 18.53 1 5/1/x2 Cash 322.83 A/R 313.43 Interest Revenue 9.40 2 1. (1,200 - 286.83 - 295.43) 3% 2. (1,200 - 286.83 - 295.43 - 304.30) 3% A/R 1,200 286.43 - 5/1/x1 295.43 - 8/1/x1 304.30 - 2/1/x2 313.43 - 5/1/x2 Cash and Receivables 58 IV. Financing with Accounts Receivable –to accelerate the receipt of cash from receivables Two ways: 1. Secured borrowing Pledge (General Assignment) Assign (Specific Assignment) 2. Sale of receivables (Factoring) With recourse Without recourse Cash and Receivables 59 IV. Financing with Accounts Receivable (contd.) Advantages: 1) Immediate use of cash (i.e., pledge, assign and factor); 2) Avoid the cost of billing and collection (i.e., factor). Disadvantages: 1) Service charge (i.e., assign and factor); 2) Interest charge (i.e., pledge and assign) Cash and Receivables 60 IV. Financing with Accounts Receivable - Reasons Pledge and Assign: Cash shortage and other ways of borrowing are not available or too expensive. Factor: In some industries (i.e., durable goods), product financing is mandatory to be competitive. Companies in these industries often created wholly-owned subsidiaries specializing in receivables financing. Cash and Receivables 61 IV. Financing with Accounts Receivable – Reasons (Contd.) Factor (cont.): To avoid billing and collection costs. To avoid violation of existing lending agreements. From a purchaser’s point of view, buying receivables may be an alternative of making profits when reaching its legal lending limit. Note: Credit card sale is a form of factor without recourse. Cash and Receivables 62 Pledge of A/R (General assignment of A/R) Pledge of A/R: Use A/R as a security (collateral) to borrow money from financial institutions. No journal entries are required for the pledge. Information related to the pledge is disclosed in the footnote. Cash and Receivables 63 Pledge of A/R Example Borrow $100,000 by pledging all receivables for the borrowing: Journal Entry: Cash Notes Payable 100,000 100,000 Notes: The company’s trade accounts are pledged as collateral for the $100,000 notes payable Cash and Receivables 64 Pledge of A/R Example (contd.) When the note is due and paid, the following entry will be recorded: Notes Payable 100,000 Interest Expense 3,000 Cash 103,000 Assume a 12% interest and a 3-month duration. Cash and Receivables 65 Pledge of A/R Example (contd.) If the note is not paid on the maturity date, the lending institution can seize and collect the pledged A/R. The borrower (the company) continues to have the control of the A/R. Cash used to pay off the note can be from any sources including proceeds received from the pledged A/R. Cash and Receivables 66 Assignment of Accounts Receivable (specific) Use A/R as a means to borrow money from banks or financial institutions. Specific A/R are assigned as collateral for the borrowing. Companies (the borrowers) continue to have the control of the A/R assigned and continue to collect assigned A/R from the customers. Cash and Receivables 67 Assignment of Accounts Receivable (contd.) The amount collected from the assigned A/R must be remitted to the lending institution periodically. The proceeds collected from the assigned A/R cannot be used for any other purposes until all loans are paid off. The lender usually charges: 1) a service charge (i.e., 5% of the loan amount), 2) interest on the loan. Cash and Receivables 68 Example of (Specific) Assignment (Illustration 7-16 of KWW , 14th e with little modification for April collections.) On March 1, 2010, Howat Mills Inc. (HM), assigns $700,000 of its accounts receivable to Citizens Bank as collateral for a $500,000 borrowing. HM continues to collect the A/R; the account debtors are not notified of the assignment (a non-notification assignment). Citizens Bank charges a finance charge of 1% of the A/R assigned. The annual interest on the note is 12%. Settlement by HM to the bank is made monthly for all cash collection on the assigned receivable. Cash and Receivables 69 Example of Assignment (contd.) Howat Mills Inc Citizens Bank Issuance of note and assignment of A/R on 3/1: Cash 493,000 Interest Exp. 7,000 Notes Payable 500,000 N/R 500,000 A/R Assigned 700,000 Cash 493,000 A/R 700,000 Interest Revenue 7,000 Collection in March of $440,000 of assigned A/R less cash discounts of $6,000. Sales returns of $14,000 were received. Cash 434,000 Cash Discounts 6,000 No Entry Sales Returns 14,000 A/R Assigned 454,000 Cash and Receivables 70 Example of Assignment (contd.) Howat Mills Inc Citizens Bank Remitted March collections plus accrued interest ($500,000 x 0.12 x 1/12 = 5,000) to the bank on 4/1: Interest Exp. 5,000 Cash 439,000 Notes Payable 434,000 Interest Rev. 5,000 Cash 439,000 N/R 434,000 Collection in April of $144,000 of assigned A/R and $2,000 write-off as uncollectible: Cash 144,000 Allow. for No Entry Doub. Acct. 2,000 A/R Assigned 146,000 Cash and Receivables 71 Example of Assignment (contd.) Howat Mills Inc Citizens Bank Remitted the balance due of 66,000 ($500,000-434,000) plus interest on May 1 ($66,000 x 0.12 x 1/12) Notes Payable 66,000 Cash 66,660 Interest Exp. 660 N/R 66,000 Cash 66,660 Interest Rev. 660 To transfer the remaining A/R assigned to A/R when the loan is paid off: A/R 100,000 A/R Assigned 100,000 No Entry Cash and Receivables 72 An Alternative: Accounts Receivable Are Not Transferred to A/R Assigned Howat Mills Inc Citizens Bank Issuance of note and assignment of A/R on 3/1: Cash 493,000 Interest Exp. 7,000 Notes Payable 500,000 N/R 500,000 Cash 493,000 Interest Revenue 7,000 Collection in March of $440,000 of assigned A/R less cash discounts of $6,000. Sales returns of $14,000 were received. Cash 434,000 Cash Discounts 6,000 No Entry Sales Returns 14,000 A/R 454,000 Cash and Receivables 73 Accounts Receivable are Not Transferred to A/R Assigned (cont) Howat Mills Inc Citizens Bank Remitted March collections plus accrued interest ($500,000 x 0.12 x 1/12 = 5,000) to the bank on 4/1: Interest Exp. 5,000 Cash 439,000 Notes Payable 434,000 Interest Rev. 5,000 Cash 439,000 N/R 434,000 Collection in April of $144,000 of assigned A/R and $2,000 write-off as uncollectible: Cash 144,000 Allow. for No Entry Doub. Acct. 2,000 A/R 146,000 Cash and Receivables 74 Accounts Receivable are Not Transferred to A/R Assigned (cont.) Howat Mills Inc Citizens Bank Remitted the balance due of 66,000 ($500,000-434,000) plus interest on May 1 ($66,000 x 0.12 x 1/12) Notes Payable 66,000 Cash 66,660 Interest Exp. 660 N/R 66,000 Cash 66,660 Interest Rev. 660 To transfer the remaining A/R assigned to A/R when the loan is paid off: No Entry No Entry Cash and Receivables 75 Example of Assignment (contd.) The balance sheet statement of HM on 4/1 after the remittance of $434,000 cash collected from A/R Assigned in March, the balance of the A/R assigned account is $246,000 ($700,000 - $454,000) and the balance of the Notes Payable account is $66,000 ($500,000$434,000). These two accounts will be presented on the balance sheet statement as : Current Assets: Accounts Receivable Assigned $246,000 Notes Payable (66,000) Equity in A/R Assigned $180,000 Cash and Receivables 76 Sale (Factor) of Accounts Receivable A common type of sale of A/R is a sale to a factor. Factors are finance companies or banks that buy receivables from businesses for a fee and then collect the receivables directly from the customers. Cash and Receivables 77 Sale (Factor) of Accounts Receivable In the case of factor, A/R would be transferred to the purchaser. The buyer would collect the accounts, not the seller. The seller relinquishes all rights pertaining to the future collection of A/R. Cash and Receivables 78 Sale (Factor) of A/R (contd.) Sale of A/R (commission is 0.75% to 1.5%) is a common practice in some industries such as textile, apparel, footwear, furniture, etc. For some industries, sales financing is necessary in order to be competitive. Credit card transaction is also a type of factoring arrangement (commission is 4 to 5%). Cash and Receivables 79 Sale (Factor) of A/R (contd.) Credit Card Sale (Contd.) The buyer (the card issuer) of the receivable charges the seller (the merchant) a commission for the receivables purchased. The buyer collects directly from customers (card holder). Cash and Receivables 80 Accounting for Factor Factor without recourse Factor with recourse Recourse is a right of a buyer of receivables to receive payments from the seller when debtors fail to pay. Cash and Receivables 81 Factor without Recourse (A Sale of Receivables) In the case of factor without recourse, the buyer assumes the risk of uncollectibility and absorbs any credit losses (i.e., bad debts). Thus, factor without recourse is a sale of receivables both in form and in substance. Cash and Receivables 82 Example of Factor without Recourse (Source: Illustrations 7-18 Kieso, etc. textbook with some modifications.) Crest Textiles factors $500,000 of A/R with ABC Bank on a without recourse basis. The receivables are transferred to ABC bank on 5/1. ABC bank charges 3% of financial charge for factor without recourse and retain an amount equals to 5% of the A/R to cover sales returns and discounts. Credit losses (bad debts) are absorbed by ABC bank due to factor without recourse. The ABC bank expects $4,100 of uncollectible accounts from the receivables purchased. Cash and Receivables 83 Example of Factor without Recourse (contd.) Crest Textiles 5/1 Cash 460,000 Due from Factor 25,000 Loss on Sale of Rec. 15,000 A/R 500,000 ABC Bank A/R 500,000 Due to Crest Texti. 25,000 Interest Rev. 15,000 Cash 460,000 Recognition of Bad Debt Exp.: Bad Debt Exp. 4,100 Allow. For Doub. Acct. 4,100 Cash and Receivables 84 Example of Factor without Recourse (contd.) Crest Textiles ABC Bank Transactions in May and June: collects of $483,800 by ABC bank; sales R&A of $9,500; sales discounts taken of $2,600 and $4,100 bad debts written off by ABC bank. . Cash 483,800 Sales R&A 9,500 Due to Sales Dis. 2,600 Crest Texti.12,100 Due from A/R 495,900 Factor 12,100 Allow. for Doub. Acct. 4,100 A/R 4,100 Cash and Receivables 85 Example of Factor without Recourse (contd.) Crest Textiles ABC Bank Final settlement between Crest Text and ABC Bank: Cash 12,900 Due to Crest Texi 12,900 Due from Factor 12,900 Cash 12,900 Note: The factor’s (ABC Bank) income from this factor is $15,000 - 4,100 (Interest revenue – bad debt expense). Cash and Receivables 86 Factor with Recourse (source: Kieso, etc. textbook) When receivables are sold with recourse, the seller “guarantees payment to the buyer in the event the debtor fails to pay” (or the payment of the debtor is less than expected by the purchaser). Thus, the seller retains the risk of uncollectibility. Cash and Receivables 87 Factor with Recourse SFAS No. 140 requires that a sale of receivables with recourse be recognized as a sale only if all three conditions are met, otherwise, the sale with recourse should be treated as a secured borrowing. Cash and Receivables 88 Three Conditions Factor with Recourse 1. The transferred assets have been isolated from the transferor (beyond the reach of the seller and its creditors); 2. Each buyer (transferee) has the right to pledge or exchange the assets it received and no constrains attached; 3. The seller does not maintain effective control over the transferred assets through repurchase agreement. Cash and Receivables 89 Factor with Recourse (Contd.) A recourse is an example of “continuing involvement” in a transfer of receivables In the case of factor with recourse and meeting all three criteria, the transaction will be recorded as a sale with the recognition of assets obtained and liabilities expected. The buyer (transferee) usually charges a higher fee in the case of factor without recourse than in the case of factor with recourse. Cash and Receivables 90 Example of Factor with Recourse (Source: illustrations 7-18, 7-19 and 7-20 of Kieso, etc. textbook) Crest Textiles factors $500,000 of A/R with ABC Bank on a with recourse basis. The receivables are transferred to ABC Bank on 5/1. ABC Bank charges 3% of financial charge for factor with recourse and retains an amount equals to 5% of the A/R to cover sales returns and discounts. Credit losses (bad debts) are absorbed by Crest Textiles, Inc. due to factor with recourse. The Crest Textiles, Inc. expects $6,000 of uncollectible accounts from the receivables factored. Cash and Receivables 91 Factor with Recourse : Example (Contd.) – All Three Conditions Are Met and Treated As a Sale Crest Textile Cash 460,000 Due from Factor 25,000 Loss on Sale of Receivable 21,000* A/R 500,000 Recourse Liability 6,000 ABC Bank A/R 500,000 Due to 25,000 Crest Interest Rev. 15,000 Cash 460,000 *$21,000= $500,000x3% +6000 or Net Proceeds = $460,000+25,000 -6000=479,000. $21,000 = $500,000 – 479,000 Cash and Receivables Example of Factor with Recourse (contd.) Crest Textiles ABC Bank Transactions in May and June: bad debts occurred, $6,000; sales R&A occurred,$9,500; sales discounts taken, $2,600. The A/R collected, $481,900 (i.e., $500,000-12,100-6000). . Cash 481,900* Sales R&A 9,500 Due to Sales Dis. 2,600 Crest 12,100 Due from A/R 494,000 Factor 12,100 Due to Crest 6,000 Recourse Liability 6,000 A/R 6,000 Due from Factor 6,000 *500,000-12,100-6,000 Cash and Receivables 93 Example of Factor with Recourse (contd.) ABC Bank Crest Textile (Treated as a Sale) Settlement between Crest and ABC 6,900a Cash Due from Factor 6,900 Due to Crest 6,900 Cash 6,900 a. $6,900 is $6,000 less than $12,900 in the case of factor without recourse. This is due to the bad debt amount $6,000 is absorbed by Crest Textile in the case of factor with recourse. Cash and Receivables 94 What if only $5,000 bad debts occurred in stead of the expected $6,000 in factor with recourse example on p78? Crest Textiles ABC Bank Transactions in May and June: bad debts occurred, $5,000; sales R&A occurred,$9,500; sales discounts taken, $2,600. A/R collected, $482,900 (*500,000-12,100-5,000). . Cash 482,900* Sales R&A 9,500 Due to Sales Dis. 2,600 Crest 12,100 Due from A/R 495,000 Factor 12,100 Due to Crest 5,000 Recourse Liability 6,000 A/R 5,000 Due from Factor 5,000 Loss on Sale of Rec. 1,000 Cash and Receivables 95 What if only $5,000 bad debts occurred (contd.) : ABC Bank Crest Textile (Treated as a Sale) Settlement between Crest and ABC 7,900a Cash Due from Factor 7,900 Due to Crest 7,900 Cash 7,900 a. $7,900 is $5,000 less than in the case of factor without recourse. This is due to the bad debt amount $5,000 is absorbed by the seller (Crest Textile) in the case of factor with recourse. Cash and Receivables 96 The Profits of the Buyer (Transferee)under Factor With Recourse Unlike factor without recourse, the profits for the buyer in the factor with recourse always equal the interest revenue (i.e., $15,000 in the above examples) due to bad debts being covered by the seller . Using previous examples: When bad debts=$6,000, the profits of ABC = $489,100-$460,000-$6,900 =$15,000. When bad debts =$5,000, the profits of ABC=$482,900-460,000-7,900=$15,000. Cash and Receivables 97 V. Notes Receivable Note receivable: A written promissory note; can be interest bearing or noninterest bearing. Short-term N/R: Recorded at the amount expected to be collected (i.e., NRV). Interest bearing: Accrued interest recognized at the end of a period. Non-interest bearing Cash and Receivables 98 Notes Receivable (contd.) Long-term N/R: 1. Recorded at net present value 2. End of period valuation –NPV or the fair value (SFAS 159) Note: Reporting a long-term note receivable at the fair value is an option. Once chose, the fair value method will be used for all subsequent periods. Cash and Receivables 99 Notes Receivable Case I: Non-Interesting Bearing Example Receiving a 3 month non-interest bearing note on 11/1/x1 with a face amount of $10,000. 11/1/x1 N/R 10,000 Sales 10,000 12/31/x1 No adjusting entry for accrued interest because the note is a non-interest bearing note. 1/31 Cash 10,000 N/R 10,000 If the note is dishonored on 1/31 => A/R 10,000 N/R 10,000 Cash and Receivables 100 Notes Receivable Case II: Interesting Bearing Example Short-term note with interest bearing; annual interest rate = 12%. Receiving a 3-month interest bearing note on 11/1/x1. Face amount is $10,000 and the annual interest rate is 12% Cash and Receivables 101 Case II (contd.) 11/1/x1 N/R 10,000 Sales 10,000 12/31/x1 Interest Receivable 200 Interest Revenue 200 1/1/x2 Reversing Entry: Interest Revenue 200 Interest Receivable 200 1/31/x2 Cash 10,300 N/R 10,000 Interest Revenue 300 Cash and Receivables 102 Discount of Notes (to a bank or to any finance institution) Example: A 3-month note with a face amount of $10,000 (received on 11/1/x1) is discounted on 12/1/x1. Interest rate of the note = 12% (annual) Int. rate charged by the bank = 18% (annual) Cash and Receivables 103 Discount of Notes (contd.) 1. Maturity value of the note = $10,000 + 10,000 12% 3/12 = $10,300 2. Interest charged by the bank (discount) = $10,300 x 18% x 2/12 = $309 1/31/x2 12/1/x1 11/1/x1 Bank is receiving $10,300 on 1/31/x2 Bank is lending $10,300 on 12/1/x1 Cash and Receivables 104 Discount of Notes (contd.) Proceeds received by the firm from discounting the note (the bank will deduct the interest charge from the proceeds): $10,300 - 309 = $9,991 Cash and Receivables 105 Discount of Notes (contd.) J.E. on 12/1: Cash Loss on Dis. of Note N/R Discounted Interest Revenuea 9,991 109 10,000 100 a.Interest earned by the firm from holding the note for one month (11/1 ~ 12/1) = $10,000 12% 1/12 =100 Footnote (FASB): Contingent liability of discounted note of $10,000 Cash and Receivables 106 Discount of Notes (contd.) On 1/31/x2, the note is paid, the following entry will be recorded: N/R discounted 10,000 N/R 10,000 If on 1/31/x2, the note is dishonored, the following entry will be recorded: (Assuming the bank charge $10 fee) N/R Discounted 10,000 Loss on Dishonored Note 10,310 N/R 10,000 Cash 10,310 Cash and Receivables 107 Long-Term Notes Receivable Initial Recording: Net present value End of Period: Net present value or the fair value. Cash and Receivables 108 Long-Term N/R Example A Receiving a 2-year note on sales of goods on 1/1/x1. The face amount of this note is $100,000 and the annual interest of the note is 10%. The interests are paid annually and the market interest rate is 12%. Present value of the note: $100,000 0.79719 + 10,000 1.69005 =96,620 Cash and Receivables 109 Example A (contd.) Long-Term N/R 1/1/x1 Notes Receivable 100,000 Sales Revenue 96,620 Discounts on N/R 3,380 Effective Interest of 20x1 = PV of note on 1/1/x1 12% = ($100,000 - 3,380) 12% = 11,594.4 Cash and Receivables 110 Example A (contd.) Long-Term N/R 12/31/x1 (recording receiving of $10,000 interest) Cash 10,000 Discount on N/R 1,594.4 Interest Revenue 11,594.4 P.V. of the note on 1/1/x2 = 100,000 - (3,380 - 1594.4) = 98,214.4 Effective Interest of 20x2 = PV on 1/1/x2 12% = 98,214.4 12% = 11,785.7 Cash and Receivables 111 Example A (contd.) Long-Term N/R 12/31/x2 (recording int. received on 12/31/x2): Cash 10,000 Discount on N/R 1,785.7 Int. Revenue 11,785.7 12/31/x1 (recording face amount of N/R received on maturity date): Cash 100,000 N/R 100,000 Discount on N/R has been amortized to zero after two years of amortization using the effective interest method. Cash and Receivables 112 Example B: Notes Received for Property, Goods and Services Example: Lenex sold a lot to Impex as an office site. Lenex accepted a 3-year note with a maturity value of $ 93,169 and with no stated interest rate. The land originally cost Lenex $30,000 and had an appraised fair value of $70,000 on the selling date. Cash and Receivables 113 Notes Received for Property, Goods and Services (contd.) J.E.: N/R 93,169 Dis. on N/R Land Gain 23,169 30,000 40,000 When the market interest rate is unknown, the imputed interest rate is calculated as: $70,000 = $93,169 x ? ? = 70,000/93,169 = 0.7513 0.7513 is the present value factor of 10%, 3 periods and therefore, the imputed interest rate is 10%. Cash and Receivables 114 Notes Received for Property, Goods and Services (contd.) The discount on N/R will be amortized in the next three years as follows: Discount on N/R . Interest Revenue Year 1 Year 2 Year 3 7,000 7,700 8,469 7,000 7,700 Cash and Receivables 8.469 115 Notes Received for Property, Goods and Services (contd.) If the effective rate of the note is known, the present value of the note will be calculated using the effective interest . The gain will be the difference between the P.V. of the note and the cost of the land. The discount amount will be the difference between the maturity value (i.e., $93,169) and the P.V. of the note. Cash and Receivables 116 Example B (skip p114-121) Long-Term N/R On 12/31/x1 La Tourette Inc. rendered services to Husky Corp. at an agreed price of $73,844.10, accepting $18,000 down and agreeing to accept the balance in four equal installments of $18,000 receivable each 12/31. An assumed interest rate of 11% is imputed. Record the journal entries for La Tourette for the sale and for the receipts and interest on the following dates: 1. 12/31/20x1 2. 12/31/20x2 3. 12/31/20x3 4. 12/31/20x4 5. 12/31/20x5 Cash and Receivables 117 Example B (contd.) Long-Term N/R PV of $18,000 annuity @11%, four payments = 18,000 3.10245 = 55,844.10 Thus, the revenue from the services = 18,000 + 55,844.10 = 73,844.10 12/31/x1 Cash 18,000 Notes Receivable 72,000 Discount on N/R 16,155.9a Revenue from Services 73,844.10 a. (18,000 4) - 55,844.10 = 16,155.9 Cash and Receivables 118 Example B (contd.) Long-Term N/R 12/31/x2 (recording install. Payment of $18,000 and the amortization of discount on N/R): Cash 18,000 N/R 18,000 Discount on N/R 6,142.85 Interest Revenue 6,142.85a a. Interest Revenue of 20x2 = pv of note on 1/1/x2 (or 12/31/x1) 11% = 55,844.1 11% = 6,142.85 Cash and Receivables 119 Example B (contd.) Long-Term N/R 12/31/x3 Cash 18,000 N/R 18,000 Discount on N/R 4,838.56 Interest Revenue 4,838.56a a. Interest Revenue of 20x3 = pv of note on 1/1/x3 11% = (55,844.1 - 18,000 + 6,142.85) 11% = 43,986.95 11% = 4,838.56 Cash and Receivables 120 Example B (contd.) Long-Term N/R 12/31/x4 (recording install. Payment of 18,000 and the amortization of discount on N/R): Cash 18,000 N/R 18,000 Discount on N/R 3,390.81 Interest Revenue 3,390.81a a. Interest Revenue of 20x4 = pv of note on 1/1/x4 11% = (43,986.95 - 18,000 + 4,836.56) 11% = 30,825.51 11% = 3,390.81 Cash and Receivables 121 Example B (contd.) Long-Term N/R 12/31/x5 Cash 18,000 N/R 18,000 Discount on N/R 1,783.68 Interest Revenue 1,783.68a a. Interest Revenue of 20x5 = pv of note on 1/1/x5 11% = (30,825.51 - 18,000 + 3,390.81) 11% = 16,216.31 11% = 1,783.68 Cash and Receivables 122 Notes Received for Cash and Other Rights Avon Co. accepts a 3-year, $100,000, zero-interest-bearing note from Andrew Co. plus the right to purchase 50 machines at a bargain price in exchange for $100,000 in cash. Assume that the current rate is 10% (for a similar note without the right): Cash and Receivables 123 N/R Received for Cash and Other Rights (contd.) J.E. for Greene: N/R 100,000 Prepaid Purchase 24,868 Cash 100,000 Discount on N/R 24,868 The $24,868 will be amortized as interest revenue in next 3 years. The prepaid purchase will be amortized (proportionally to 50 machines) to increase the purchase price of machines. Cash and Receivables 124 Fair Value Option (SFAS 159 or ASC825-10-25) Companies may choose the fair value option when the financial instrument is originally recognized or when an event triggers a new basis of accounting (i.e., acquisition). Once chosen, the company has to use the fair value option in subsequent periods. If the company does not elect the fair value option for the financial instrument at the initial recognition, it may not use this option for the instrument in subsequent periods. Cash and Receivables 125 Fair Value Option – An Example Assume that Loftus Company has notes receivable with a fair value of $70,000 and a carrying amount of $58,000 (e.g. with $60,000 face amount and $2,000 discount on N/R) on 12/31/2011. The company chose the fair value option for these receivables on the first valuation of these recently acquired receivables. Adjusting Entry: Fair Value Adjustment-N/R 12,000 Unrealized holding gain or loss* 12,000 * Reported in the income statement Cash and Receivables 126 Fair Value Option – An Example For all subsequent periods, the change in fair value of the note will be reported as an unrealized holding gain or loss. For example, assuming the fair value of the note at December 31, 2012 is $65,000, Loftus will record the following adjusting entry on 12/31/2012: Unrealized holding gain or loss 5,000 Fair Value Adj. – N/R 5,000 Cash and Receivables 127 Impairment Measurement and Reporting on Investment in Loan Receivables A loan receivable impaired when it is probable that it will not collect all amounts due (both principle and interest). Measurement: Compare the recorded investment (i..e, the NRV or the carrying amount) with the present value of the expected future cash flows using the historical expected interest rate. 128 Impairment Measurement and Reporting (contd.) Example (illustration 7B-3 onP355 of KWW textbook): Carrying amount of investment $100,000 The PV of expected future cash flows on the investment at 10% historical effective interest rate is $87,566. The loss on impairment = 100,000 – 87,566 = 12,434. 129 Impairment Measurement and Reporting (contd.) Recording of impairment losses: Bad Debt Expense 12,434 Allowance for Doubtful Accounts 12,434 Write-off of impaired receivables: Allowance for Doubtful Accounts 12,434 Notes Receivables 12,434 130 Securitization A sale of securities (i.e., bonds or commercial paper) backed (collateralized ) by a pool of assets. These assets can be mortgage receivables (i.e., mortgage-backed securities), consumer loans (i.e., assets-backed securities), and corporate bonds (i.e., collateralized debt obligations). Cash and Receivables 131 Securitization (contd.) Securitizations are popular for two reasons: 1. Investors have a strong appetite in acquiring collateralized securities. 2. Companies and lenders with large amounts of receivables have incentives to engage in securitization. 132 Securitization Performed by The Company When a company uses its assets (i.e., auto loan receivables) as collaterals to issue bonds (i.e., assets-backed securities), the receivables will remain on its balance sheet. The company’s liability will be increased from the increase of bonds payable. As a result, this transaction will have an adverse effect on its return on assets and debt/equity ratios. 133 The Special Purpose Entity A special purpose entity (SPE) is usually created by a third party (referred to as a sponsor) which is independent of the company with receivables (referred to as the transferor). The SPE serves the purpose of buying receivables from the transferor and issuing securities collateralized on the receivables transferred from the transferor. 134 The Special Purpose Entity (contd.) The SPE can be in the form of a trust, partnership or corporation and is legally distinct from the transferor. 135 Procedures of Securitization Performed by A SPE 1. The transferor will first transfer its receivables to the SPE. 2. The SPE issues securities (i.e., commercial paper due in 30-60 days) collateralized on receivables transferred. 3. The cash received by the SPE from issuing securities goes back to the transferor to pay off the receivables transferred. 136 Procedures of Securitization Performed by A SPE (contd.) The SPE is served as a “pass through”. The sponsor of the SPE charges the transferor fees for creating and operating the SPE. The transferor can continue to service the loan for a fee. 137 Off Balance Sheet Financing SFAS 140 (2000): If the SPE is a qualifying SPE* ,the transferor does not have to consolidate the balance sheet of the SPE. As a result, both the receivables and the liabilities from issuing securities will appear only on the balance sheet of the SPE, not the transferor or the sponsor. *The SPE has at least 3% (10% under FIN 46 (R)) of the fair value of its total assets invested by a third party. 138 Off Balance Sheet (B/S) Financing (contd.) With a qualifying SPE, the transferor obtain an off-balance sheet financing. Problems Associated with off B/S financing: If the receivables defaulted, the transferor may be forced to take back receivables or the banks eat losses. A mismatch of long-term assets with short-term borrowing on the capital structure of the SPE. 139 Subprime Mortgage Crisis in 2007 Many of the subprime mortgage receivables defaulted in 2007 due to the reckless lending in the early to mid2000s. When investors realized that the underlying assets for the SPEs’ securities were subprime mortgage receivables, SPEs had a hard time to issue new commerce paper to refinance the existing commercial paper. 140 Subprime Mortgage Crisis in 2007 (contd.) As a result, many sponsors (i.e., banks) of the SPEs had to pay off the commercial paper issued by the SPEs when it matures due to the agreements with the transferors. These banks would, therefore, take these subprime mortgage receivables into their balance sheets. 141 Subprime Mortgage Crisis in 2007 (contd.) The banks would subsequently recognize losses (i.e., impairment loss on the subprime mortgage receivables) on these receivables. 142 SFAS 166 and SFAS 167 The concept of qualifying SPE is eliminated by SFAS No.166 issued in June 2009, and became effective as of the beginning of the first annual reporting period beginning after Nov. 2009 (i.e., January 2010). SFAS 167 redefine variable interest entity and the assessment method in determining the primary beneficiary. 143 Consolidation of SPEs (source: KWW textbook , appendix 17B and FIN 46 ( R)). Based on FIN 46 (R) (2003), a SPE is a variable interest entity (VIE ) when 1) wirth insufficient equity (i.e., thinly capitalized), or 2) with equity holders cannot make decisions, or 3) with equity holders have inproportionate controlling interest (i.e., holding 60% of voting rights but receiving 20% of benefits). 144 Consolidation (contd.) (source: KWW textbook , appendix 17B and FIN 46 ( R)). Once an entity is identified as a VIE, a risk-and-reward model, not the voting-interest-model, is used in determining the consolidation party. The voting-interest-model: the party with more than 50% of voting rights of an entity should consolidate the entity (ARB 51). 145 Consolidation (contd.) (source: KWW textbook , appendix 17B and FIN 46 ( R)). The risk-and-reward model of FIN 46 (R ): the party who assumes majority of the risks and receive majority of benefits associated with the entity is the primary beneficiary party and should consolidate the entity. 146 Avoiding Consolidation under FIN 46 ( R ) A SPE with at least 10% of the fair value of the total assets invested by a third independent party is considered not thinly capitalized and is a qualifying SPE, not a VIE, under FIN46 (R). A qualifying SPE is not subject to consolidation by the sponsor or transferor under FIN 46 ( R). 147 IFRS Insights (Source: KWW 14th e, p428-429) The accounting on reporting related to cash and cash equivalent is essentially the same under both IFRS and GAAP except for the reporting of bank overdrafts, reported as cash under IFRS. The allowance for doubtful accounts sometimes refers as provisions for doubtful accounts. The fair value option is similar under GAAP and IFRS but not identical. Cash and Receivables 148 IFRS Insights (contd.) IFRS and GAAP differ in the criteria used to account for transfers of receivables. IFRS focused on risks and rewards and loss of control while GAAP uses loss of control as the primary criterion. Also, IFRS allows partial transfer, GAAP does not. Cash and Receivables 149