Credit Management

advertisement

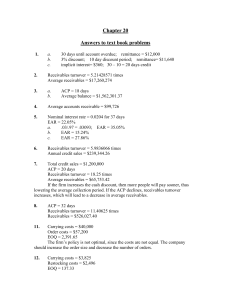

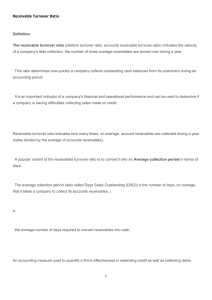

CREDIT MANAGEMENT The Cash Flows of Granting Credit Credit sale is made Customer mails check Firm deposits check Bank credits firm’s account Time Cash collection Accounts receivable COSTS & BENEFITS OF CREDIT MANAGEMENT OPPORTUNITY COST COLLECTION COST BAD DEBTS INCREASED SALES INCREASE IN MARKET SHARE INCREASE IN PROFITS TERMS OF PAYMENT • Cash Mode • Bill of Exchange • Letter of Credit • Consignment CREDIT POLICY VARIABLES The important dimensions of a firm’s credit policy are: • Credit standards • Credit period • Cash discount • Collection effort CREDIT STANDARDS Liberal Stiff • Sales Higher Lower • Bad debt loss Higher Lower • Investment Larger Smaller Higher Lower in receivables • Collection costs IMPACT ON RESIDUAL INCOME OF RELAXATION P = [S(1 – V) - Sbn] (1 – t ) – k I where P = change in Profit S = increase in sales V = ratio if variable costs to sales bn = bad debt loss ratio on new sales t = corporate tax rate I = increase in receivables investment Q.PSD Ltd. is considering relaxing its credit standards. S = Rs.15 million, bn = 0.10, V = 0.80, ACP = 40 days, k = 0.10, t = 0.4 P = [15,000,000 (1 – 0.80) – 15,000,000 x 0.10] (1 – 0.4) 15,000,000 – 0.10 x x 40 x 0.80 360 = Rs.766,667 CREDIT PERIOD Longer Shorter • Sales Higher Lower • Investment in Larger Smaller Higher Lower receivables • Bad debts IMPACT ON RESIDUAL INCOME OF LONGER CREDIT PERIOD P = [S(1 – V) - Sbn] (1 – t ) – k I INCREASE IN RECEIVABLES INVESTMENT I = (ACPn – ACP0) S S0 + V (ACPn) 360 where: I 360 = increase in receivables investment ACPn = new average collection period (after lengthening the credit period) ACP0 = old average collection period V S = ratio of variable cost to sales = increase in sales Q. X Limited is considering extending its credit period from 30 to 60 days. S = Rs.50 million, S = Rs.5 million, V = 0.85, bn = 0.08, k = 0.10, t = 0.40 P = [5,000,000 x 0.15 – 5,000,000 x 0.08] (0.6) 50,000,000 5,000,000 – 0.10 (60 – 30) x + 0.85 x 60 x 360 360 = [750,000 – 400,000] (0.6) – 0.10 [4,166,667 + 708,333] = – 277,500 LIBERALISING THE CASH DISCOUNT POLICY P = [S(1 – V) - DIS] (1 – t ) + k I DECREASING THE RIGOUR OF COLLECTION PROGRAMME RI = [S(1 – V) - BD] (1 – t ) – k I Cash Discounts • Often part of the terms of sale • There is a tradeoff between the size of the discount and the increased speed and rate of collection of receivables. • An example would be “3/10, net 30” – The customer can take a 3% discount if s/he pays within 10 days. – In any event, s/he must pay within 30 days. The Interest Rate Implicit in 3/10, net 30 A firm offering credit terms of 3/10, net 30 is essentially offering their customers a 20-day loan. To see this, consider a firm that makes a $1,000 sale on day 0. Some customers will pay on day 10 and take the discount. $970 0 10 30 Other customers will pay on day 30 and forgo the discount. $1,000 0 10 30 Calculation of Cost of Cash Discount Rate of discount x No. of days in a year 1- Rate of discount (Credit period-Discount period) Credit terms 2/10 Net 30 2/10 Net 45 1/10 Net 60 2/15 Net 30 Cost of trade credit(%) 36.72 20.99 18.18 48.98 28.3 Optimal Credit Policy Costs in dollars Total costs Carrying Costs Opportunity costs C* Level of credit extended At the optimal amount of credit, the incremental cash flows from increased sales are exactly equal to the carrying costs from the increase in accounts receivable. TRADITIONAL CREDIT ANALYSIS Five Cs of Credit Character : The willingness of the customer to honour his obligations Capacity : The operating cash flows of the customer Capital : The financial reserves of the customer Collateral : The security offered by the customer Conditions : The general economic conditions that affect the customer Case History : Checking customers past transaction to extend credit to the customer MONITORING OF ACCOUNTS RECEIVABLES • RECEIVABLES TURNOVER • AVERAGE COLLECTION PERIOD (ACP) • AGEING SCHEDULE • COLLECTION MATRIX RECEIVABLES TURNOVER • How quickly RECEIVABLES are CONVERTED in to CASH Receivables Turnover Rate = Total Net Sales Avg. Debtors* (*including Bills Receivables) AVERAGE COLLECTION PERIOD (ACP) • • • • Time (no. of Days) the Credit Sales are converted In to Cash ACP= 365/ Receivables Turnover AGEING SCHEDULE • Statement showing • AGE WISE GROUPING OF DEBTORS OR • Breaking up of Debtors • according to the LENGTH OF TIME • for which they have been OUTSTANDING Age Group (in Days) Amount Outstanding (Rs.) Percentage of Debtors to Total Debtors Less Than 30 40,00,000 40 31-45 20,00,000 20 46-60 30,00,000 30 Above 60 10,00,000 10 Total 1,00,00,000 100 COLLECTION MATRIX • • • • Shows the collection pattern (in months) for the CREDIT SALES made in a month Percentage of Receivables Collected During the Month of sales First following month Second following month Third following month Fourth following month January Sales 13 42 33 12 - February Sales 14 35 40 11 - March Sales April Sales May Sales June Sales 15 40 21 24 - 12 40 24 19 5 10 36 26 24 4 9 35 26 25 5 Factoring • The sale of a firm’s accounts receivable to a financial institution (known as a factor) • The firm and the factor agree on the basic credit terms for each customer. Customers send payment to the factor. Customer The factor pays an agreedupon percentage of the accounts receivable to the firm. The factor bears the risk of nonpaying Factor customers. Goods Firm TYPES OF FACTORING TYPES/ Service Short term finance Sales Ledger Administration Credit Protection Recourse Yes Yes No Non Recourse Yes Yes Yes Maturity No Yes No Invoice Discounting Yes No No