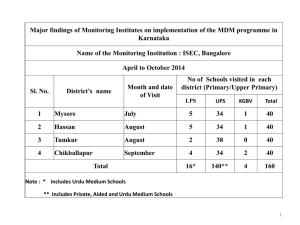

Transactions in 2004-2006

advertisement

Prospects for Securitisation in Russia: Key Consideration Securitisation in Russia and the CIS London, October 2006 Contents Transactions in 2004 - 2006 Securitisable assets Reasons to securitise Structure considerations Problem areas Looking forward 2 J Au uly gu 20 st 0 5 S 20 O ept 05 c No to b 2 00 ve er 5 De mb 200 ce e r 5 m 20 be 0 r 5 Ja 200 n 5 Fe 200 M b2 6 ar 0 ch 06 Ap 20 ril 0 6 M 200 ay 6 Ju 20 ne 06 Ju 200 A u ly 6 gu 20 st 0 6 Se 20 O pt 06 c No to b 2 00 ve er 6 De mb 20 ce e r 0 6 m 20 be 0 r2 6 00 6 Volumes of transactions in 2004-2006 4 000 3 500 3 000 2 500 2 000 1 500 1 000 500 0 Deal size Cumulative 3 Transactions in 2004-2006 Date Originator Ratings of Originator Assets Amount Legal Maturity Coupon Rating of the Issue/Senior Tranche July 2004 Gazprom BB- positive (S&P) and BB stable (Fitch) Future export receivables US$1,250million 15,5 7.201% BBB- (S&P) and BBB- (Fitch) February 2005 Rosbank Ba3 stable (Moody’s) and B stable (Fitch) Credit card treceivables US$300million 5 9.75% Ba3 (Moody’s) and B+ (Fitch) July 2005 CCC stable by S&P Auto loans US$ 49.8million 5 3ML+175bp (capped Baa3 (Moody’s) at 8.75%) December 2005 HCFB Ba3 stable (Moody’s) / B- Consumer loan portfolio Euro 263million 6,5 Euribor+250bp Baa2 (Moody’s) March 2006 RSB Ba2/B+ Consumer loan portfolio Euro 300million 3 Euribor+165bp Baa2/BBB March 2006 Alfa Bank Ba2/BB-/B+ DPR US$350million 5 3ML+165bp Baa3 March 2006 RZD Baa2 Leasing receivables RUR13,73billion 6 8.375% Baa2/BBB- July 2006 Vneshtorgbank Baa2/BBB Residential mortgages US$88.3million 28 (WAL 3.59) 1ML+100bp A1/BBB+ August 2006 City Mortgage Residential mortgages US$72.57million 27 (WAL 3.8) 1ML+160bp (capped Baa2 at 9.25%) Bank Souyz 4 In the pipeline Originator Ratings of Originator Am ount MDM Bank Car loans US$450million MDM Bank DPR US$400million Vneshtorgbank DPR US$300million RSB Credit cards receivables US$300million Agency for Mortgage Lending Mortgages US$150million Delta Credit Mortgages US$50million Bank Avangard Car loans US$150illion Bank Souyz Car loans US$100million 5 Securitisable assets ABS: Car loans Consumer loans Credit cards US$ Car loans 8% 10% 20% Consumer loan portfolio DPR Leases 14% Leasing receivables 19% SME loans Mortgages 29% Future flows Credit cards receivables MBS: Residential Commercial 6 Reasons to securitise Funding: Capital: New investor base Repeating transactions Longer term Regulatory capital Improve returns Risk: Assets versus cash 7 Structure considerations Warehouse Conduit Term deal Public versus private Synthetic transactions Open versus closed pool 8 Ja n F '0 M eb 0 arc ' 0 h' 0 0 Ap 0 M r' 0 a 0 Ju y'0 ne 0 J u ' 00 ly Au ' 00 g Se ' 00 pt Oc '0 0 No t' 00 v De '0 0 c J a '0 0 n F '0 M eb 1 arc ' 0 h' 1 0 Ap 1 M r' 0 a 1 Ju y'0 ne 1 J u ' 01 ly Au ' 01 g Se ' 01 pt Oc '0 1 No t' 01 v De '0 1 c J a '0 1 n F '0 M eb 2 arc ' 0 h' 2 0 Ap 2 M r' 0 a 2 Ju y'0 ne 2 J u ' 02 ly ' Au 02 g Se ' 02 pt Oc '0 2 No t' 02 v De '0 2 c '0 Ja 2 n F '0 M eb 3 arc ' 0 h' 3 0 Ap 3 M r' 0 a 3 Ju y'0 ne 3 J u ' 03 ly Au ' 03 g Se ' 03 pt Oc '0 3 No t' 03 v De '0 3 c J a '0 3 n' F 0 M eb 4 arc ' 0 h' 4 0 Ap 4 M r' 0 a 4 Ju y'0 ne 4 J u ' 04 ly Au ' 04 g Se ' 04 pt Oc '0 4 No t' 04 v De '0 4 c J a '0 4 n F '0 M eb 5 arc ' 0 h' 5 0 Ap 5 M r' 0 a 5 Ju y'0 ne 5 J u ' 05 ly ' Au 05 g Se ' 05 pt Oc '0 5 No t' 05 v De '0 5 c '0 5 RUR'million Problem areas Small pools of assets Centre versus regions Assets are not standardised Legislation and tax issues RUR versus USD assets (hedging) Lending in RUR Jan'00 to Dec'05 4 500 000 4 000 000 3 500 000 3 000 000 2 500 000 2 000 000 1 500 000 1 000 000 500 000 0 9 Looking forward Increase of the amounts Becoming cheaper Capital relief importance (Basle II) Domestic market and development of the regions 10 Contacts Tengiz Kaladze Managing Director International Interbank Funding MDM Bank +7-495-745-9640 (direct tel.) +7-495-797-9507 (tel) +7-495-797-9522 (fax) +7-495-233-0935 (mobile) tkaladze@mdmbank.com 11 MDM Bank Established in 1993 as a Moscow-based bank focused on trading Today, one of the largest privately-owned banking groups in Russia by assets (Year-end 2005: USD5.6 bn ), capital (YE 2005: USD886 mn) and net profit (YE 2005: USD134 mn) Owned by two Russian entrepreneurs, Andrey Melnichenko (one of the Group’s original founders) and Sergey Popov, his long-standing business partner Three core business areas: corporate banking, investment banking and retail banking Business is based on financial intermediation between non-related parties: total related party exposure is capped at 10% of assets MDM has one of the highest credit ratings among Russian privately-owned banking groups from Moody’s (Ba2), Fitch (BB-) and Standard & Poor’s (B+; positive outlook) The only Russian financial institution with a corporate governance rating from Standard & Poor’s; the rating was increased to CGS-6.0 in December 2005 Received numerous awards from Euromoney, Emerging Markets, Global Finance and The Banker in 2003-2005; Global Finance also named MDM Bank the Best Bank in Russia in four categories: Best Foreign Exchange Bank Best Domestic Eurobond Arranger Best Domestic Mergers and Acquisitions Arranger Best Bank in Corporate Governance 12