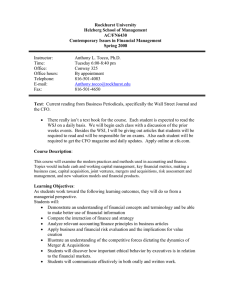

topics outline - Rockhurst University

advertisement

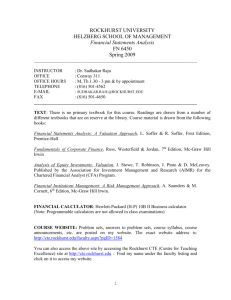

ROCKHURST UNIVERSITY HELZBERG SCHOOL OF MANAGEMENT Essentials of Finance FN 3000 Spring 2011 (Revised) ______________________________________________________________________________ INSTRUCTOR: Dr. Sudhakar Raju OFFICE: Conway 311 OFFICE HOURS: M, W 2 – 3.30 pm & by appointment TELEPHONE: (816) 501-4562 E-MAIL : SUDHAKAR.RAJU@ROCKHURST.EDU FAX: (816) 501-4650 ______________________________________________________________________________ REQUIRED TEXT: Ross, Westerfield and Jordan, Essentials of Corporate Finance, McGraw-Hill Irwin Inc., Seventh Edition. (Earlier editions are also acceptable). CALCULATOR: Hewlett-Packard (H-P) 10B II Business calculator. (Note: Programmable calculators are not allowed. The use of programmable calculators in class examinations will be construed as cheating) COURSE WEBSITE: Problem sets, answers to problem sets, practice exam questions, course syllabus, course announcements, etc. are posted on my website. You can access the website by accessing the Rockhurst CTE (Centre for Teaching Excellence) site at http://cte.rockhurst.edu. Find my name under the Faculty Directory listing and click on it to access the website. COURSE DESCRIPTION: This course is an introduction to the important areas of corporate managerial finance. Emphasis is placed upon developing an understanding of the tools and methodologies available to the financial manager for decision-making in such areas as capital budgeting, working capital management, capital structure and profit planning and control. Prerequisites: AC 2000 and AC 2100, or AC 4500; EC 2000 and EC 2100 (or EC 2050 and EC 2150), or EC 4550; Statistics or EC 4500; Junior Standing. COURSE OBJECTIVES: After completing this course, students should be able to: 1. Read, analyze and interpret financial statements and financial ratios. 2. Value financial instruments and determine cost of capital. 3. Apply financial and quantitative techniques. 4. Select and implement appropriate capital budgeting and valuation techniques to evaluate projects. 5. Effectively communicate the results of financial analysis. 6. Discuss the ethical dimensions of financial decision-making. 1 COURSE REQUIREMENTS 1. A college level Algebra (Finite Mathematics) class 2. A college level Economics or Accounting class 3. Basic knowledge of EXCEL EVALUATION Exam 1 Exam 2 Exam 3 Quizzes/Papers/Projects Optional Comprehensive Exam: 25% 25% 25% 25% Comprehensive exam that may be substituted for any of the above exams ___________________________________________________________________ TOTAL 100% Your final grade for the course is determined as follows: A = 91 - 100% A- = 88 - 90% B+ = 85 - 87% B = 80 - 84% B- = 76 - 79% C+ = 67 - 75% C = 63 - 66% C- = 60 - 62% D+ = 57 - 59% D = 51 - 56% F = 0 - 50% 2 POLICIES 1. ASSIGNMENTS: You will get the most from the lectures if you get the required reading done before you come to class. I will also hand out problem sets periodically. 2. ATTENDANCE: You are required to come to all classes. If you are absent from a class you should get notes from a classmate and you are, of course, responsible for any tests or assignments missed. Excessive absences will result in a semester grade of DF. The college policy on attendance is contained in the Rockhurst University Catalog. 3. MAKE-UP EXAMS: If you miss a mid-term examination, the mid-term exam must be made up by taking the comprehensive exam. Make-up exams are considered on a case by case basis. The HSOM follows the University’s policy and schedule regarding make-up final exams in accordance with the final exam schedule published by the Office of the Registrar. Make up exams will only be administered by the HSOM on the dates and times indicated by the registrar. In addition, a $20 dollar fee will be collected from the student per university policy. 4. STUDENTS WITH DISABILITIES: Rockhurst University is committed to providing reasonable accommodations for students with disabilities. Please contact Sandy Waddell in Access Services (Massman Hall, Room 7, 501-4689, sandy.waddell@rockhurst.edu) to provide documentation and request accommodations. If the Access Office has already approved accommodations, please communicate with the instructor(s) of this course regarding these arrangements by the second week of class in order to coordinate receipt of services. 5. RU OFFICIAL POLICY REGARDING STUDENT CONTACT INFORMATION: Student contact information must be kept current in order to receive important notices from Rockhurst University. Your contact information is online via your Banner Web account. Please check your local address, local phone number, and emergency contact information on Banner Web and revise as needed. All important university notices will be sent only to your RU email address. Please check your RU email account in addition to any other email accounts you may have. Accounts are activated at the Computer Services Help Desk (Conway 413). 6. RU ACADEMIC HONESTY POLICY: RU does not tolerate plagiarism and cheating. The Rockhurst University Catalog provides examples of academic dishonesty and outlines the procedures, penalties, and due process accorded students involved in academic dishonesty. All infractions will be immediately referred to the Dean's office. In your research paper, make sure you provide citations for all ideas and information that are not your own. 7. CLASSROOM ETIQUETTE: RU requires its students to convey themselves with decorum. Leaving in the middle of class, using cell phones and pagers during class, surfing the Internet during lectures, talking with other students, reading newspapers, etc. violates appropriate classroom conduct. Usage of laptops during class lectures is not allowed. Violation of appropriate classroom conduct may result in being dropped from the course. I reserve the right to make any amendments to this syllabus. 3 TOPICS OUTLINE SECTION 1: FINANCIAL STATEMENTS ANALYSIS CHAPTER 1 INTRODUCTION TO FINANCIAL MANAGEMENT Forms of Business Organization Goal of Financial Management Financial Markets and the Corporation CHAPTER 2 FINANCIAL STATEMENTS, TAXES & CASH FLOWS Features of Bonds, Preferred Stock & Common Stock The Balance Sheet The Income Statement Cash Flows CHAPTER 3 WORKING WITH FINANCIAL STATEMENTS Sources and Uses of Cash Financial Statements Analysis: Ratio Analysis DuPont Analysis Internal & Sustainable Growth EXAM 1: TBA (To be Announced) SECTION 2: THE BASICS OF VALUATION CHAPTER 4 THE TIME VALUE OF MONEY Present and Future Value of a Lump Sum Present and Future Value of an Annuity Annual Percentage Rate, Effective Annual Rate CHAPTER 5 DISCOUNTED CASH FLOW VALUATION Multiple Cash Flows Annuities & Perpetuities Loan Types & Loan Amortization Mortgages & Auto Loans Retirement Planning EXAM 2: TBA (To be Announced) 4 SECTION 3: FINANCIAL MARKETS, BOND & EQUITY VALUATION CHAPTER 6 INTEREST RATES & BOND VALUATION Bond Features, Bond Values and Yields Types of Bonds Interest Rate Risk Interpreting Bond Quotes from the Wall Street Journal The Term Structure of Interest Rates CHAPTER 7 EQUITY MARKETS & STOCK VALUATION Common Stock & Preferred Stock Stock Valuation Models Zero Growth, Constant and Non-Constant Growth Models Institutional Organization of Stock Markets: NYSE Interpreting Stock Quotes from the Wall Street Journal SECTION 4: PROJECT VALUATION & CAPITAL STRUCTURE CHAPTER 8 NET PRESENT VALUE & OTHER INVESTMENT CRITERIA Regular and Discounted Payback Methods Net Present Value Internal Rate of Return Mutually Exclusive & Independent Projects NPV Profiles and the Cross-Over Rate Unconventional Cash Flows CHAPTER 12 & 13 COST OF CAPITAL & CAPITAL STRUCTURE Cost of Debt & Cost of Stock The Effect of Financial Leverage Optimal Capital Structure EXAM 3: Monday, May 2, 2011 (Tentative) COMPREHENSIVE EXAM: Monday, May 9, 10.30 am – 12.30 pm IMPORTANT DATES March 7-11, 2011 April 22-25, 2011 May 4, 2011 Spring Break; No Class Easter Break: No Class Study Day; No Class 5