Designing a Comprehensive and Realistic Industrial Strategy A VDF

advertisement

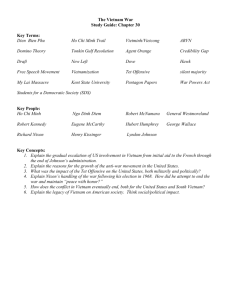

Designing a Comprehensive and Realistic Industrial Strategy Kenichi Ohno Project Leader on the Japanese side Vietnam Development Forum (GRIPS-NEU) February 25, 2004 The Purpose To offer concrete & realistic ideas for industrial strategy formulation Based on the past & present research cooperation between Vietnam & Japan --MPI-JICA (Ishikawa Project, 1995-2001) --NEU-JICA (2000-2003) --Vietnam Development Forum (GRIPS-NEU, 2004-2008) Japan’s Near-Consensus View on Vietnam Vietnam has potential to industrialize and join East Asian dynamism Combining high-quality labor, FDI, and technical absorption is the key However, poor policy is preventing the realization of Vietnam’s full potential --FDI inflow and technical absorption are slower than potential --Domestic and foreign businesses are frustrated (including Japanese firms) Three Aspects of Vietnam’s Industrial Policy Problem Unclear overall vision & strategy Lack of good master plans for individual industries Lack of unity and coordination among different ministries and levels This paper mainly discusses the first problem (overall vision and strategy) Menu for Discussion Defining an industrial country Setting the fundamental course Industrial policy formulation How to import East Asian dynamism Overall industrial vision: suggested contents Japan’s new ODA policy 1. Defining an Industrial Country Industrialization by 2020 is the national goal, but what does it mean concretely? The goal should be realistic and achievable under good effort The goal should reduce policy uncertainty and promote strategic planning of enterprises Industrialization as a process Simon Kuznets (1973) defines Modern Economic Growth (=industrialization) as follows: Rapid growth of population and per capita output Rapid urbanization and changes in economic structure These changes are sustained for a long time Industrialization as a process Ryoshin Minami (1986) defines industrialization as follows: Durability—manufacturing industries grow continuously and at high speed Contribution to overall growth— manufacturing industries are the largest contributing factor to GDP Structural change—manufacturing industries shift constantly from low-tech to high-tech Problems with Classic Definition It defines the process but not the end state (what is an “industrial country”?) It is derived from historical growth of Europe, US and Japan (not LDCs) It does not assume strong globalization pressure It is too general (not numerical or operational) For Vietnam we suggest the following: Industrialization should be defined concretely in the context of East Asian dynamism and production networks External factors should be highlighted (FDI, China, competitiveness, trade liberalization, technical transfer, etc.) Relative income criterion, not absolute Thailand should be the reference country for 2020 (do at least as Thailand does and even better) Concrete Criteria for Vietnam 2020 1. Relative income—join the middle group (China + ASEAN4) 2. Export structure—Manufacturing is (75%) or more 3. Selected leading status—Vietnam becomes No.1 or No.2 exporter in the world for a few high-tech items, based on industrial agglomeration and high quality 4. Supporting industries—significant amounts of parts and inputs are domestically produced (but not 100%) 5. Supporting services—domestic skilled labor provides a large part of design, production management, marketing, etc. replacing foreigners 2000 1800 1600 1400 1200 1000 800 600 400 200 0 Possible Paths of Per Capita GDP Plan High Low 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 USD For reference: Income in 2002 Malaysia ($3,880) Thailand ($1,990) Philippines ($970) China ($960) Indonesia ($820) Laos ($330) Cambodia ($300) Higher Income Group Japan ($33,000) Hong Kong ($24,000) Singapore ($20,900) Taiwan ($12,600) Korea ($10,000) (ADB data) Why Thailand? Similar population size (61 million) Income level of $2,000 (reasonable target for Vietnam 2020) High manufactured export ratio (76%) Excels in a few products—electronics & cars, with sizable supporting industries Problems with Thailand (VN should avoid) --Excess urbanization & social problems --Urban-rural income gap does not narrow --Not-so-skilled labor & slow technical absorption Manufactured Exports (% of total exports) 100% Japan Top Group 80% Taiwan Thailand Korea 2nd Group Singapore 60% China Malaysia 40% Latecomers Thailand Philippines 20% Vietnam Indonesia Vietnam 2002 2001 2000 1999 1998 1997 1996 1995 1994 1993 1992 1991 1990 1989 1988 1987 1986 1985 1984 1983 1982 1981 1980 1979 1978 1977 1976 1975 0% Source: ADB, Key Indicators of Developing Asian and Pacific Countries , 2003/2001/1993; IMF, International Financial Statistics Yearbook 1990. For Japan, Japan Statistical Yearbook 2003/2002/1999, Statistics Bureau/Statistical Research and Training Institute, Ministry of Public Management, Home Affairs, Posts and Telecommunications, Japan. 2. Setting the Fundamental Course Vietnam should not debate the fundamental strategy forever. It must decide what to do and announce it clearly so businesses can operate in a stable policy environment. Which sectors are promoted and prioritized: SOEs, private sector, or FDI? What are the long-term policies for tariff reduction, localization and technical transfer? Which are the key industries and how will they be supported? Ongoing Debate State-led view (Some Vietnamese) State should guide and direct the market; otherwise, growth will be too slow or imbalanced. Invest in upstream industries fast. FDI-led view (Japan team; some Vietnamese) FDI is key for competitiveness; policy should support investors and follow global market dynamics. Help local firms link with FDI networks. SME-led view Market-led view Comparison #1 Who should lead? Localization policy State-led View FDI-led View State should guide market; growth is imbalanced or too slow without it Use reward/penalty to speed up local supply of inputs Absorb critical mass of FDI with open & low-cost business climate Encourage natural & demand-led localization (don’t force it) Upstream State must invest sector upstream if FDI or (materials & private firms don’t inputs) do it Don’t invest unless globally competitive; vertical integration shouldn’t be aimed Comparison #2 State-led View ImportState must support subst. and protect it if industries necessary; job & industrial concern Export Little contribution industries to VN’s economy (garment, due to low local electronics...) value-added Trade Inevitable, but liberaliza- national interest tion must be considered in the process FDI-led View Let market decide under tariff reduction; but help firms with realistic plans Very important; encourage them with open & lowcost FDI climate Choose appropriate speed to encourage efficiency & avoid social crisis Fundamental Direction (My Suggestion) Declare the following as key industrial strategy: 1. VN is irreversibly committed to integration and market orientation 2. Government will play a key role in promoting industries and reducing various social costs 3. FDI is the main pillar of growth up to 2020; local firms are assisted to link up with FDI firms 4. SMEs are important as: (i) domestic source of income & jobs (ii) supporting industries (iii) global competitors (some) 5. SOEs will be selectively reformed: --Separation of winners & losers --Gradual reform for social concern --Two-track approach: Let SOEs decline relatively as private sector develops faster, instead of forced “big-bang” privatization Taiwan: Industrial Growth (%) Taiwan’s Two-Track Approach 40 30 Private 20 10 0 SOEs -10 1953 1955 1960 1965 1970 1975 1980 1985 1990 Taiwan: Share of Industrial Production SOEs 100 80 60 40 Private 20 0 1953 1955 1960 1965 1970 1975 1980 1985 1990 3. Industrial Policy Formulation We propose the following shifts in emphasis: From quantity to quality (=international competitiveness) From product orientation to process orientation From picking individual industries to setting a broad direction From Quantity to Quality Current industrial plans are expressed in “desired quantities”—output, exports, domestic supply ratios, investments, etc. Creation of global competitiveness should be the goal, not desired quantities Competitiveness include: Cost, time, specialization, small lot production, choosing the appropriate production model for VN, marketing, after-purchase support, etc. How to Analyze Situation and Set Goals STEP ONE: Study recent global and regional trends of that industry. STEP TWO: Compare numerically the competitiveness of Vietnam and the rival country (China, Thailand, etc. depending on each industry). This defines the gap that must be narrowed. STEP THREE: Design concrete measures to raise VN’s competitiveness to the level of the rival country (and above). Set realistic goals and time schedule. Mobilize all means which are permitted by WTO and other international commitments. MORE LATER From Product to Process The idea that computer & DVD are high-tech while food & garment are low-tech, is mistaken. For any product, high and low skills are combined at different stages. Products are not high-tech, but processes are. VN can perform only low-tech processes now. The real question is how to expand from lowtech to high-tech over time. Value-Added in Computer Production Value Hightech Software Processor Memory LCD Brand name Sales channels Sales management Monitor HDD Motherboard Lowtech Vietnam should start with assembly but gradually improve capability Design & parts Upstream Assembly Marketing Downstream Source: Adopted from Yumiko Okamoto, “Electronics and Electrical Industries,” in K. Ohno & N. Kawabata eds, Industrial Strategy of Vietnam, Nihon Hyoronsha, 2003, p.101 (Vietnamese translation in 2003, p.116) How to Improve Value Do low-tech processes well and be No.1 in quality, delivery, complexity, etc Ex. Men’s white shirt Ladies fashion Learn from--and replace--foreigners Ex. Factory management, procurement Gradually move both upstream (design, inputs) and downstream (marketing) Industry A Industry B Industry C textile electronics motorbike Vietnam should first concentrate and improve on skilled laborintensive processes. From this base, vertical expansion should be achieved gradually (not forced). Upstream Next step Current size Downstream Further step From Picking Individual Industries to Broad Guidance Needless to say, market & government must be mixed properly in development Government should generally support certain production processes without pre-judging specific industries It is the market, not government, which decides the ultimate fate of each industry Ranking Individual Industries? Many studies classify VN’s industries according to “competitiveness” (effective protection, RCA, labor content, etc.) However... They rely on past data, not future potential Dynamic comparative advantage partly depends on policy (not predetermined) Competitiveness should be evaluated for processes, not for products Which Industries (Processes) Should Be Leading? We propose to target the following processes (1) Top priority: skilled labor-intensive In the next few decades, VN’s dynamic comparative advantage lies in skilled labor– intensive manufacturing. VN should fully realize this potential by: --Removing current barriers & problems --Actively supporting such processes Already successful (promote further) Garment, footwear, electronic assembly, handicraft, some furniture, pottery, frozen seafood, etc. Also support other skilled-labor intensive processes Software, agro processing, kitchen ware, household goods, toys, etc. However, support should be given generally without specifying which firm or product should win: --Information, marketing, management, procurement --Technical transfer, training, quality standards, R&D --Tax & tariff privileges, public investment, ODA (TA) In addition, the following activities which support the leading industries should also be promoted (2) Hard supporting industries Parts and intermediate materials for leading industries However: --100% domestic supply should not be aimed --Natural promotion, not forced (3) Soft supporting industries (industrial services) Design capacity, global marketing & procurement, telecom, transportation, power, water, housing, etc. --Initially assisted by the state, later by enterprises themselves (4) Industries to fulfill growing domestic demand Steel, chemicals, plastic, paper, cement, and other material industries of import-substitution type If they are all imported, it would be a burden on the balance of payments However: --100% domestic supply should not be aimed --Low cost and competitiveness must be achieved under careful learning and gradual trade liberalization 4. How to Import East Asian Dynamism In the globalization age, industrial strategy formulation must also include the following three issues: Attracting a critical mass of FDI Building optimal regional linkage Breaking the “glass ceiling” (going beyond Thailand) Attracting a Critical Mass of FDI FDI is the key for VN’s industrialization VN’s FDI absorption is still too small to ignite a full industrial transformation Ex. Thailand & Malaysia in late 1980s Main exports: Rice, tin, rubber Electronics Manuf. export ratios: 30-40% 70-80% Agglomeration is necessary One “Canon” effect is not enough; 50-100 FDI firms need to be attracted in each sector FDI Inflow into Vietnam 9 800 8 700 No. of projects (right scale) US$ billion 7 Approved (left scale) 6 5 600 500 400 4 300 3 200 2 Implemented (left scale) 1 100 0 Source: Ministry of Planning and Investment. 2002 2001 2000 1999 1998 1997 1996 1995 1994 1993 1992 1991 1990 1989 1988 0 Japanese Electronics FDI in ASEAN Cumulative number of manufacturing establishments 180 160 P arts & devices 140 Telecom & com puters 120 A udio & visual 100 80 60 40 20 0 M alaysia Thailand Indonesia S ingapore P hilippines V ietnam Source: Electronic Industries Association of Japan (2000), quoted by Yumiko Okamoto, "Electronics and Electrical Industries,"in K. Ohno & N. Kawabata, eds, Industrialization Strategy of Vietnam , Nihon Hyoronsha (2003). Agglomeration Initial concentration has an accelerating effect Silicon Valley Fragmentation PB: production block SL: service link International division of labor in parts production & assembly SL PB SL PB SL PB PB SL PB SL How to Participate in Asian Dynamism Become a link in the regional production network by agglomerating a particular process in Vietnam --New products are always emerging (esp. electronics) --MNCs are constantly looking for alternative location Illustration Vietnam Parts Assembly Materials Taiwan R&D Design Japan China Parts Marketing Hong Kong Thailand Software India Japanese Firms: Choosing FDI Host Countries China Merits: Size, cheap & abundant labor, engineering, material supply, etc Demerits: policy & legal climate, lack of IPR protection, energy shortage, risk of concentration ASEAN Too costly: Singapore Malaysia Thailand Reliable but less exciting ? Too unstable: Vietnam Exciting but risky Philippines Indonesia Myanmar Survey on 606 Japanese MNCs "Which Location Is Most Attractive?" TOP FIVE ANSWERS 0 2 4 6 China (Central Coast) China (Southern Coast) Thailand China (Northern Coast) Vietnam Source: Nikkei Newspaper and Japan Center for Economic Research, September 2003. The scale is from 0 to 10. 8 Building Optimal Regional Links While localization (agglomeration) is important, not everything should be localized: Internalize processes in which VN has dynamic comparative advantage Outsource other things from the rest of Asia If this choice is made incorrectly, VN will lose competitiveness VN is ideally located to become a bridge between China & ASEAN (all Japanese business men say so) Breaking the “Glass Ceiling” Technical absorption Agglomeration STAGE ONE Simple manufacturing under foreign guidance Vietnam STAGE TWO Have supporting industries, but still under foreign guidance Creativity STAGE THREE Technology & management mastered, can produce high quality goods STAGE FOUR Full capability in innovation and product design as global leader Japan, US, EU Korea, Taiwan Thailand, Malaysia No ASEAN countries have broken through the invisible barrier between Stage Two & Three. Preparing to Go Beyond While VN’s immediate goal is agglomeration (Stage 2), it should also prepare for technical absorption (Stage 3) Vietnam can become the first country in ASEAN to break through the barrier if its high skilled labor is combined with --Good government policy --Good enterprise management 5. Overall Industrial Vision: Suggested Contents Historically, Japanese economists designed industrial strategies along the following lines: What is the current global situation? What is the domestic situation? Action plan A What is our position in the world economy? What are the key national goals? Action plan B Action plan C Action plan D Example: Postwar Reconstruction Report Saburo Okita et al, Postwar Reconstruction of the Japanese Economy (MOFA, Sep.1946) PART I Chap 1: Basic Trends of the World Economy Chap 2: International Environment of the Japanese Economy Chap 3: Peculiarities of the Japanese Economy Chap 4: Conditions Newly Confronting the Japanese Economy Chap Chap Chap Chap 1: 2: 3: 4: Part II Basic Problems of Economic Reconstruction Guaranteeing the People’s Livelihood Restructuring the Economy Specific Problems of Economic Reconstruction --Living standards and exports and imports --Industrial structure in the future, which includes: Textile, sundry goods, machinery, chemical, electricity, livestock, fishery, shipping, tourism --Future employment pattern --Future national income --Promotion of technology, etc. For Vietnam 2020 Since VN faces far greater integration pressure than Japan in 1946, even more external considerations are necessary: East Asian dynamism & networks China, ASEAN rivals, WTO, FTAs, etc FDI dynamics Localization strategy Technical absorption How to join regional production network Industrial Vision for Vietnam (My Suggestion) Part I: Analysis of the Current Situation Chap 1: Global Review Chap 2: Regional Review (China, ASEAN) Chap 3: Vietnam’s Current Position --Industrial achievements --Position in regional network & global competition --Vietnam as an FDI host --Trade commitments --Comparison with China & Thailand, etc Part II: Industrial Strategy Up To 2020 Chap 4: Fundamental Strategy for Industrialization Chap 5: Industrial Goals for 2020 Chap 6: Leading Industries and Supporting Industries Chap 7: Reform of Industrial Policy Formulation Chap 8: Linking Industrial Policy with Trade Policy Chap 9: FDI Attraction and Promoting Parts Suppliers Chap 10: Optimal Regional Linkage Chap 11: Technical Transfer and Improving Domestic Capability Chap 12: Interim Roadmap Japan’s New ODA Policy Japan’s ODA Charter was revised in 2003 Japan’s Country Assistance Strategy for Vietnam was also revised in 2003 by myself and Mr. Mitsuru Kitano (Counselor, Japanese Embassy in Hanoi) Both were discussed intensively by the Council of Comprehensive ODA Strategy headed by Foreign Minister Kawaguchi (of which I am a member) New ODA Charter: Key Points Dual Goals: --Contribute to world peace & prosperity --Pursue Japan’s national interest (security & economic) Issues: poverty, growth, global issues, peace Asia is the main area, but ODA should be given selectively & in support of competitiveness & regional integration Policy dialogue with recipient country Increased participation of stakeholders Decentralization: more authority to embassy ODA Strategy for VN: New Points Drafted by Embassy (not Tokyo) Support VN in (i) growth; (ii) social problems; (iii) institution building Enhanced sector studies—ODA for all sectors but selectively within each sector Future ODA volume will depend on policy improvements, especially in trade & FDI Policy dialogue with Vietnamese government and other stakeholders will be strengthened. Current Concern of Our Embassy With respect to MOI: Power sector is important for Japan’s ODA Japan is deeply interested in the evolution of motorbike and automobile policies With respect to Japan’s ODA in general: We are more interested in private sector growth (domestic & FDI) than SOE reform Japan’s ODA is conditional on policy improvements (not to be taken for granted) We will integrate policy dialogue, TA & loans in our ODA to Vietnam The End