Capital Loan Program - Acadia Mortgage Solutions

advertisement

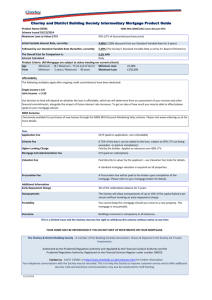

Capital Loan Program offered through Acadia Mortgage Solutions Inc. What is the Capital Loan Program? Financing through Acadia Mortgage Solutions from an institutional lender Specialized in small commercial & income producing properties Programs designed to meet the needs of small business owners & investors Equity-based lending (with a credit component) Loans always secured by the commercial real estate 2 Acadia Mortgage Solutions Inc. Traditional Money Sources Banks & Credit Unions Trust Companies Mortgage Bankers Investment Bankers Private Funding 3 Acadia Mortgage Solutions Inc. Capital Loan Program’s Place? Traditional Lenders CAPITAL LOAN PROGRAM 4 Private Funding Acadia Mortgage Solutions Inc. Small Commercial Lending Arena Traditional Lenders Best Rates Conservative LTVs Capital Loan Program Intermediate Rates Higher Rates Higher LTVs Long Closings Quicker Closings Strong Credit Wider Credit Range Full Documentation Private Money Case-by-case LTVs Fast Closings All Credit Considered Limited Documentation Minimal Documentation (Stated Program) Environmental Phase I & II Easier Environmental Process Marketable Properties Many Property Types 1 to 5 year terms Mid-Term and Long-Term Solution Environmental Varies All Property Types (min 2 yrs) Cross- Collateralization Strong DSCR (1.40 or more) Dependent & variable based on lender’s philosophy and business goals No Cross-Collateralization required Reasonable DSCR YOU ARE THE FOCUS! This program is a stable solution that specializes in small commercial mortgages Short Term Loans / Temporary Solution Underwriting requirements variable by investor Inconsistent / Variable based on many market factors (programs are designed specifically for small business owners, investors and business-for-self clients) High Application / Commitment Fees Reasonable fees! 5 High Application / Commitment Fees Acadia Mortgage Solutions Inc. Traditional Lender Requirements Full document programs often require the following documents as a minimum, sometimes just for a pre-approval… Bank Credit Application Lease Agreement Background Information Sheet Copy of Business License State of Personal History Equipment Listing Management Résumé Schedule of Business Debt Personal Financial Statement Environmental Phase 1 & 2 T4, T1, Notice of Assessment Insurance Information Financial Information: Business, Personal, & Affiliate Tax Returns Operating Statements Rent Roll …and more… Copy of Purchase Agreement The Capital Loan Program is a lower-document program designed to consider the special needs of small business owners and business-for-self clients! 6 Acadia Mortgage Solutions Inc. Who Needs the Capital Loan? Clients under-served by traditional lenders due to: Inability / Unwillingness to provide business and personal documentation Fast service required Too much credit exposure to the bank Loan requested is under bank’s minimum loan amount Requirement of significant cash out (Equity Take-Out) Higher LTV needed Secondary financing needed behind bank’s loan offer Changes in bank lending philosophy 7 Acadia Mortgage Solutions Inc. Who needs the Capital Loan? As an alternative to private financing solutions due to: Need for higher LTV Need / desire for Lower Fees Need / desire for lower interest rate Need / desire for longer term Ability show improved credit situation 8 Acadia Mortgage Solutions Inc. The Capital Loan Program Loan Amounts $100,000 - $750,000 Property Types Multi-Family (5+ Units) Office Retail Automotive Mixed Use Light Industrial / Warehouse Self Storage 9 Acadia Mortgage Solutions Inc. Deal View # 1. . . Mixed Use - $145,000 A+ Credit Borrower LTV 75% Owner Occupied First commercial property for this client Closed in 38 days 10 Acadia Mortgage Solutions Inc. Deal View # 2. . . Automotive - $435,000 Owner occupied Bank not willing to consider due to possible environmental concerns with this type of property Local bank branch referred the client to the mortgage broker 11 Acadia Mortgage Solutions Inc. Deal View # 3. . . Retail / Office - $920,000 Borrower’s credit 685 LTV 70% Investment property Closed in 45 days 12 Acadia Mortgage Solutions Inc. www.acadiamortgagesolutions.com