Chapter 7 Financial Management Systems

advertisement

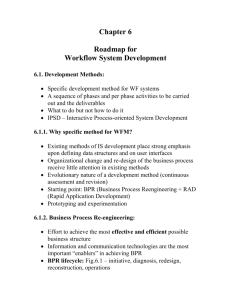

AGA Montgomery Chapter CGFM Exam Review Presented By Steven H. Emerson, CPA, CGFM, CGAP, CFE, CITP Information System Organized collection, processing, transmission and dissemination of information in accordance with defined procedures, whether automated or manual. Financial System Information system, comprised of one or more applications, that is used for any of the following: Collecting, processing, maintaining, transmitting and reporting data about financial events Supporting financial planning or budgeting activities Accumulating and reporting cost information Supporting the preparation of financial statements Information system that supports both financial and nonfinancial functions. The financial systems and the financial portions of mixed systems necessary to support financial management. The Financial Systems Integration Office (FSIO) is the successor to the Joint Financial Management Improvement Program of the Federal Government (JFMIP). The FSIO financial management system requirements Collect accurate, timely, complete, reliable and consistent information Provide for adequate agency management reporting Support policy decisions Support the preparation and execution of agency budgets Facilitate the preparation of financial statements, and other financial reports in accordance with accounting and reporting standards Provide information for budgeting, analysis and reporting, including consolidated financial statements Provide a complete audit trail to facilitate audits Maintaining the chart of accounts of the entity Maintaining the integrity of the accounting and reporting systems Accounting for all financial transactions of the entity Accounts payable Travel reimbursement Reporting on the financial results and the financial condition of the entity Monitoring budget execution Monitoring operating performance Managing financial assets, especially cash Maintaining financial controls Budget formulation Payroll Credit management Debt collection Cost analysis Performance measurement Financial system development and operation Overall system management, consisting of accounting classification management and transaction control General ledger management, consisting of general ledger account definition, accruals, closing and consolidation, general ledger analysis and reconciliation Funds management, consisting of budget preparation, funds allocation, budget execution and funds control Receivables management, consisting of customer information maintenance, receivable establishment, debt management and collections and offsets Payables management, consisting of payee information maintenance, payment warehousing, execution, confirmation and follow-up Cost management, consisting of cost setup and accumulation, cost recognition, cost distribution and working capital revolving fund Reporting, consisting of general reporting, external reporting, internal reporting and ad hoc query An existing system may rely on computing technology or software that is no longer supported by its producer The organization may have outgrown its existing system(s) either in volume of transactions or in number of activities New requirements may be imposed on the organization that require different processes The organization may conclude that newer applications will be more cost effective than older ones Gain an understanding both within and outside the financial management organization that it (finance) is the user of the system and what that entails Develop and strengthen the interface between the system developer and the user activities Define user requirements Communicate and monitor user requirements It is vital that the financial manager communicate to the software developer the needs of a financial management software system. Items such as: Chart of accounts requirements Budgetary control Encumbrance Commitment Obligation Voucher Ideally, both the requirements group and the development group need to be made up of accounting and IT personnel. The same as in developing financial management systems. Gaining an understanding both within and outside the financial management organization that it (finance) is the user of the system and what that entails Developing and strengthening the interface among the IT department, the purchasing function and other user activities Defining user requirements Communicating and monitoring user requirements No COTS product will exactly meet all of the identified requirements of a government Any COTS designed for the level of government of interest will support the accomplishment of the financial manager’s high-level objectives COTS will be successful only if the financial manager adapts to the COTS system, which may require process redesign or reengineering. Some governments decide to augment their COTS system with additional software or interfaces. This should be avoided due to: Augmenting the COTS tends to increase the cost of the project COTS vendors will not provide support for the augmented software or interfaces Subsequent releases or updates to the software will require updates to the augmented systems which will add additional costs to the total project Within the federal government certain agencies offer “cross-servicing” to other agencies on a fee-for-service basis Private sector businesses offer processing services to federal, state and local government agencies Benefits include: Avoidance of developmental and operational staff Assurance that hardware and software will remain current as technology changes A concern is lack of flexibility Purchasers must accept the product provided by the vendor Most cases do not have the ability to modify operations Many companies implemented Business Process Reengineering (BPR) in the 1990s due to a spate of publications including an article in the Harvard Business Review by Michael Hammer BPR presents the concept that organizations should eliminate functions that do not add value BPR should be properly implemented by starting at a clean slate Organizations should not assume any process is mandatory Organizations should envision the most effective and efficient way to achieve the organization’s goals BPR lost some of its luster because critics accused it of trying to increase productivity to maximum while disregarding aspects such as work environment and employee satisfaction BPR was also accused of being a technique for downsizing Many very large organizations have adopted the concepts of BPR, but they may not use the phrase “BPR” in their organization Account Cleanup and Data Conversion Account Cleanup Requires research and analysis of all accounts that have not been active to determine if they should be discontinued Balances of discontinued accounts should be transferred to another account or written off Non-valid accounts should not be carried into the new system Data Conversion Re-formatting data from the old system to the new A computer program can accomplish this New attributes may have to be entered manually Business Process Redesign The replacement or major modification of financial management systems offers the opportunity to re-think and re-design business processes In order to be successful, the redesigned business processes must be implemented in parallel with system changes In simplest terms, business process redesign: Mapping all activities in a process Identifying activities that do not create value for elimination Re-ordering of activities to a more logical stream A computer may replace human intervention Change Management “Sometimes it’s easier to change people than it is to change people” Changing staff is usually not an option and instead staff must be made comfortable and productive in the new environment Include all affected parties in the decision process People tend to buy into change in which they participate People who do the work tend to know more about the work Constant communication is important Most people do not react well to surprises Rejection at the worker level can undermine the best planned and most expensive applications Work Force Planning Successful implementation of a new financial management system will require a total rethinking of what is required of the work force Senior management must assess what skills will be required, the number of people with those skills and how the organization will get to implementation of the new system The U.S. Office of Personnel Management (OPM) has developed a model that has components that may not be appropriate to all organizations but provides a useful checklist OPM Model Checklist Set strategic direction Organize and mobilize strategic partners Set vision/mission/values/objectives Review organizational structure Conduct business process reengineering Set measures for organizational performance Supply, demand and discrepancies Analyze permanent work force demographics Describe nonpermanent work force Conduct skills assessment and analysis OPM Model Checklist – continued Develop action plan Design a work force restructuring plan Develop ways to address skills gaps Set specific goals Implement action plan Communicate the plan Conduct recruitment and training Implement retention strategies Restructure where needed Conduct organizational assessments Monitor, evaluate and revise Assess effectiveness Adjust plan as needed Address new work force and organizational issues Verification and Validation Verification that the system contains all of the processes and outputs that are expected Validation that the computations and outputs and reports are accurate and correct For small entities verification and validation would most likely be done by the financial manager who is both the sponsor of the project and the person responsible for the outputs of the system For large projects a third party may perform the verification and validation and this may be referred to as “Independent Verification and Validation” Ownership of Systems In very small and very large organizations the entire financial management systems are likely to be within the financial management organization and the question of who “owns” the system does not come up In many organizations the IT department owns the hardware and provides a computing service to financial management The finance department believes it owns the software and can make modifications at will The IT department believes the software is its property Ownership should be made clear in the IT policy of the organization Ownership of Data If IT happens to own both the hardware and software, IT should never own the financial data Financial management must maintain stewardship over the data Stewardship of the data includes: Data integrity – the quality, timeliness and reliability of data in the system Data collection synchronization – how data collection cycles are timed and cutoff dates and times set so that necessary data-feeds between systems can occur Reduced data redundancy – eliminating multiple occurrences of the same data. This is best accomplished by entering the data at the point where the transaction is initiated Data accessibility – ensuring that only authorized users can access the data Data availability – managing the data that needs to be transferred or exchanged between systems Flexibility – ensuring that data collected by the system has enough inherent flexibility so the system can adapt to change over time to meet new information requirements and adopt new financial performance reporting measures Ownership of Data – continued Stewardship functions fall into four categories Data definition – defining what data requirements and characteristics will be contained within the system Data creation and capture – defining how the data will be collected in the records and reports Data usage – ensuring that data is being used in line with its definition or that the definition is changed to reflect the users’ needs through feedback to the data definition function Data assurance – attesting to data integrity through feedback to the data creation and capture function Operational Issues Most critical operational issues between finance and IT are scheduling and priorities Operational meetings should occur between finance and IT to review and discuss past and future performance The finance department must clearly communicate its schedule requirements and seek priority for use of computing resources Internal Controls – consist of five components The control environment – organizational factors such as integrity, ethical values, competence, management philosophy and operating style. Tone of the organization Risk assessment – identification and analysis of relevant risks and risk factors to the organization and its objectives Control activities – general controls such as data center, software and access controls and application controls such as authorization, approval and segregation of duties. These controls will be commensurate with the inherent nature of the information, the possible consequences of errors, needed degree of reliability, cost-benefit of the control and vulnerability of agency assets to loss or misuse Information and communication – capturing pertinent information, financial and nonfinancial, from a variety of systems and other sources and communicating it to management on a regular basis Monitoring – process of consistent and continuous monitoring of internal control systems by managers as well as separate evaluations by independent auditors and reviewers The establishment of internal controls is the responsibility of management Internal controls are subject to review by independent auditors Internal controls are an integrated part of the overall management process to promote efficiency, reduce risk of asset loss and ensure reliability of financial information Evaluation Organizations should conduct a cost-benefit analysis for each financial management system to ensure: Alignment of system with organization’s mission needs Acceptability of information (internally and externally) Accessibility of information (internally and externally) Realization of projected benefits. Quantify improvements in performance results through measurement of program outputs Evaluation – continued Organizations should perform post-implementation reviews and should address the following questions: How effective is the system in supporting the meeting of stated program objectives and performance targets? How satisfied are the “customers” or “users” of the financial system and its information – the needs assessment? How efficiently does the system operate (in terms of resources such as time, dollars and other resources) to minimize resource consumption? Does the system’s accomplishment of its objectives and benefits outweigh cost and risk considerations? How well does the system maintain its integrity throughout the management cycle in terms of avoiding fraud and abuse? Historically administrative support systems have been developed or acquired separately and then attempted to “bridge” these separate systems together This “best of breed” approach has the advantage of providing each component of the organization with the best system for that component’s individual needs Enterprise Resource Planning systems or ERPs have recently been developed to offer large-scale integrated administrative support systems ERPs have the advantage of universal compatibility and end-to-end processing Flexibility is lacking and while the ERP will not fulfill anybody’s wish list, the enterprise-wide benefits may drive the separate components of the organization to alter their business processes to accommodate the ERP