Overview & Trends in the Global Sukuk Market

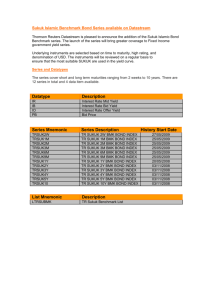

advertisement

What is International Islamic Financial Market (IIFM) ? IIFM is the international Islamic financial market’s organization focused on the Islamic Capital & Money Market (ICMM) segment of the Islamic Financial Services Industry (IFSI). Its primary focus lies in the standardization of Islamic financial products, documentation and related processes at the global level. IIFM was founded with the collective efforts of the Islamic Development Bank, Autoriti Monetari Brunei Darussalam, Bank Indonesia, Central Bank of Bahrain, Central Bank of Sudan and the Labuan Financial Services Authority (Malaysia) as a neutral and nonprofit organization. Besides the founding members, IIFM is supported by its permanent member State Bank of Pakistan as well as by a number of regional and international financial institutions and other market participants as its members. The main strength of IIFM is pooling of expertise from banks, legal, accounting and other market participants who work together under the guidance of Shari’ah scholars 1 What IIFM provides to the Industry? Addressing the standardization needs of the industry & creating awareness Universal platform to market participants through 'Global Working Groups' for the development of Islamic Capital and Money Market Shari’ah harmonization in documentation, products and processes 2 Documentation & Product Standardization - Why Standardize? Reduces cost of evaluation and negotiation of documentation Provides balance and fairness Increases efficiency, liquidity and certainty Benchmark to provide a reference point Example: Use of IIFM MATP documentation in SWIFT Message Standardization Reduces the price divergence between Islamic transactions and conventional transactions 3 Documentation & Product Standardization – A Market Based Approach Standardization of existing practices Review of market practices Development with Industry consultation Shari’ah guidance & approval Legal environment & law reform Enforceability Standardization through innovation Market requirement & research Consultation by industry experts & development Shari’ah guidance applicability/practicality legal environment & law reform 4 Overview & Trends in the Global Sukuk Market Sukuk Emergence 2011 > 2010 2009 2002 > 2001 1990 1988 Sukuk Ruling (The Fiqh Academy of the OIC ) Shell MDS RM125 Million Sukuk Issue (based on BBA structure) Kumpulan Guthrie $100 Million Malaysian International Sukuk Issue (Ijarah structure) Short-term Ijarah Sukuk by Central Bank of Bahrain SOURCE: IIFM SUKUK ISSUANCE DATABASE International Sukuk Issuances in Bahrain, Pakistan, Indonesia, UAE, Germany, Qatar, Saudi Arabia Sukuk Issuance by IDB First International Sukuk issued in Indonesia KT Turkey Sukuk Limited $100 Million Series of Indonesian Sovereign Retail Sukuk IFC Sukuk $ 100 Million GE Sukuk $ 500 Million PLUS Expressway Berhad, Malaysia $ 9.7 Billion Sukuk Saudi Arabian Civil Aviation Authority $ 7.2 Billion Sukuk Khazanah Nasional’s offshore denominated Sukuk (Chinese Yuan) Qatar Central Bank’s $ 9 Billion Domestic Ijarah Sukuk Sukuk issuance by Japanese corporate Malaysia Global Wakalah Sukuk $2 Billion International Sukuk Issuances Bahrain -$750 M ADIB– $500 M HSBC - $500 M ADCB - $500 M 5 Overview & Trends in the Global Sukuk Market Total Global Sukuk Issuance Sovereign, Quasi Sovereign & Corporate Issuances (All Currencies), Period 1 st Jan 2001 – 31st Dec 2011 10,244 2011 67,679 2,679 2010 43,392 7,000 2009 18,277 2,140 2008 16,457 13,859 2007 12,115 2006 3,413 2005 2,503 2004 1,680 2003 2002 1,130 241 2001 425 747 0 Domestic International Grand Total (US $ Millions) 35,028 17,919 International 8,767 Domestic 5,637 4,730 10,000 20,000 30,000 40,000 Amount in USD Millions 50,000 60,000 70,000 80,000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 Grand Total 747 241 4,730 5,637 8,767 17,919 35,028 16,457 18,277 43,392 67,679 218,875 425 1,130 1,680 2,503 3,413 12,115 13,859 2,140 7,000 2,679 10,244 57,189 1,172 1,371 6,410 8,140 12,180 30,034 48,887 18,597 25,277 46,071 77,923 276,064 SOURCE: IIFM SUKUK ISSUANCE DATABASE 6 Overview & Trends in the Global Sukuk Market Country-wise Breakdown of Total Global Sukuk Issuance by Volume Sovereign, Quasi Sovereign & Corporate Issues – All Currencies (Jan 2001 – Dec 2011) Country Malaysia UAE Saudi Arabia Sudan Qatar Bahrain Indonesia Pakistan Cayman Islands Kuwait Jersey Brunei Darussalam USA Turkey UK Singapore Germany Jordan Japan Gambia Iran Yemen Grand Total Number of Issues 2285 43 25 23 7 234 75 39 6 11 2 21 3 2 2 5 1 1 1 49 1 2 2838 SOURCE: IIFM SUKUK ISSUANCE DATABASE Volume (US $ Million) 169,878 32,946 17,099 13,344 11,568 10,654 6,780 4,568 2,679 2,026 1,250 1,176 767 450 271 192 123 119 100 30 28 15 276,064 % of Total Value 61.54% 11.93% 6.19% 4.83% 4.19% 3.86% 2.46% 1.65% 0.97% 0.73% 0.45% 0.43% 0.28% 0.16% 0.10% 0.07% 0.04% 0.04% 0.04% 0.01% 0.01% 0.01% 100% 7 Overview & Trends in the Global Sukuk Market Breakdown of Total Global Sukuk Issuance by Issuer Status Sovereign, Quasi Sovereign & Corporate Issues by Volume – All Currencies (Jan 2001 – Dec 2011) Domestic Sukuk Sovereign USD 103,241 Million 47% QuasiSovereign USD 7,313 Million 3% SOURCE: IIFM SUKUK ISSUANCE DATABASE International Sukuk Corporate USD 37,125 Million 65% Corporate USD 108,322 Million 50% Sovereign USD 13,985 Million 24% QuasiSovereign USD 6,078 Million 11% 8 Overview & Trends in the Global Sukuk Market Structural Breakdown of Domestic Sukuk Issuance (% by Volume) Sovereign, Quasi Sovereign & Corporate Issues – All Currencies (Jan 2001 – Dec 2011) Mudaraba USD 9,123 4% Murabaha USD 83,456 38% Istisna‘a USD 3,469 2% Musharaka USD 44,413 20% Ijarah USD 49,613 23% Salam USD 1,683 1% Exchangeable USD 408 0% Investment / Al Istithmar USD 8,978 4% Bai' Al Tawarruq Principle USD 49 0% SOURCE: IIFM SUKUK ISSUANCE DATABASE Wakalah USD 2,125 1% Hybrid USD 2,283 1% Bai' Al Inah Principle USD 1,637 1% Bai' Bithaman Ajil USD 11,639 5% 9 Overview & Trends in the Global Sukuk Market Structural Breakdown of International Sukuk Issuance (% by Volume) Sovereign, Quasi Sovereign & Corporate Issues – All Currencies (Jan 2001 – Dec 2011) Ijarah USD 25,168 44% Mudaraba USD 4,725 8% Exchangeable USD 6,190 11% Murabaha USD 1,243 2% Hybrid USD 2,854 5% Musharaka USD 9,364 16% Al Wakalah Bel-Istithmar USD 1,201 2% SOURCE: IIFM SUKUK ISSUANCE DATABASE Wakalah USD 4,454 8% Salam USD 1,990 4% 10 Overview & Trends in the Global Sukuk Market Structural Developments International Corporate Sukuk Issues 2001 – 2005 Ijarah (Dominant structure) 2005 – 2008 Musharaka, Mudaraba, Exchangeable, Convertible 2008 – 2010 Ijarah, Murabaha and Wakalah 2010 – 2011 Wakalah Bel Istithmar, Hybrid Structures SOURCE: IIFM SUKUK ISSUANCE DATABASE 11 Overview & Trends in the Global Sukuk Market Sukuk Trends – Impact Due To Downturn International Sukuk Issuance 2007 - $ 13.8 billion 2008 - $ 2.15 billion 2009 - $ 7.5 billion 2010 - $ 2.7 billion 2011 - $ 10.3 billion SOURCE: IIFM SUKUK ISSUANCE DATABASE 12 Overview & Trends in the Global Sukuk Market Developments in Sukuk Market (Post Crisis) Call back of a portion of Sukuk Dubai Islamic Bank $200million - Cash tender offer @ 88% of face value Sukuk Issuance based on Reverse Enquiry Monetary Authority of Singapore Domestic Retail Sukuk Issuance Indonesia Islamic Government Investment Securities Issuances State Bank of Pakistan Investment Sukuk Issuance Islamic Development Bank Fixed Rate of Profit Issuances Bahrain, Indonesia and IFC Sukuk Issuance in International Jurisdictions & Other Currencies National Bank of Abu Dhabi’s RM 500 million Sukuk & Khazanah Nasional’s SGD 1.5 billion Sukuk 13 Overview & Trends in the Global Sukuk Market Sukuk Defaults and Restructuring – Lessons from Corporate Issuance Investment Dar (Kuwait) East Cameron (US) Golden Belt (Saudi Arabia) Tabreed (UAE) $463 Million IIG (Kuwait) Tamweel (UAE) 14 Overview & Trends in the Global Sukuk Market Asset Based vs Asset Backed Are Sukuk holders investment pari pasu with other secured or unsecured creditors? Do Sukuk holders have title transfer? In case of Real Estate, is property freehold? 15 Sukuk Standardization To encourage and increase market share of Asset Backed Sukuk through standardization Development of the Concept Paper to establish market requirements 16 Hedging Requirements in Sukuk Islamic Banks retail portfolio mostly consist of fixed profit rate assets on a Murabaha basis while liabilities to corporate customers are on floating rate benchmarks Rate of Return mismatch in Assets & Liabilities require protection against steep rise or fall in reference rates of return Islamic Banks’ foreign currency exposures such as deposits, import & export L/C’s, Sukuk etc., The foreign currency exposures need to be managed to avoid loss due to volatility in the international currency markets 17 Sukuk - Rate of Return Hedging Issue Date 10 Jan 2012 24 Nov 2011 22 Nov 2011 06 July 2011 06 July 2011 31 Oct 2010 25 Oct 2010 05 Oct 2010 01 Sep 2010 10 Feb 2010 07 Jan 2010 27 Nov 2009 24 Sep 2009 09 June 2009 14 May 2009 23 April 2009 16 March 2009 25 Feb 2009 13 Sep 2007 05 June 2007 12 March 2007 29 Sep 2006 02 June 2006 11 June 2005 Issuer Saudi Arabian Civil Aviation Authority Abu Dhabi Islamic Bank Government of Bahrain Government of Malaysia Government of Malaysia Abu Dhabi Islamic Bank, UAE Islamic Development Bank Qatar Islamic Bank Celcom Transmission Berhad, Malaysia Government of Indonesia Dar Al Arkan, Saudi Arabia General Electric US Government of Bahrain Government of Bahrain Government of Malaysia Government of Indonesia Panerbangan Malaysia Berhad, Malaysia Government of Indonesia Government of Malaysia Silterra Malaysia Sdn. Berhad, Malaysia Rantau Abang Capital Berhad, Malaysia Khazanah Nasional Berhad, Malaysia Aaber Petroleum Investment Company, UAE Islamic Development Bank SOURCE: IIFM SUKUK ISSUANCE DATABASE Issuing Currency SAR USD USD USD USD USD USD USD RM IDR USD USD BHD USD RM USD RM IDR RM RM RM USD USD USD Amount (USD Millions) 7200.00 500.00 750.00 800.00 1200.00 750.00 500.00 750.00 572.00 862.00 450.00 500.00 437.80 750.00 1420.80 650.00 405.80 464.50 1060.61 529.00 606.06 750.00 460.00 500.00 Issue Type Sovereign Corporate Sovereign Sovereign Sovereign Corporate Quasi-Sovereign Corporate Corporate Sovereign Corporate Corporate Sovereign Sovereign Sovereign Sovereign Quasi-Sovereign Sovereign Sovereign Corporate Corporate Corporate Corporate Quasi-Sovereign Rate of Return per annum 2.50 % 3.78 % 6.27 % 4.65 % 2.99 % 3.75 % 3.55 % 3.86 % 5.50 % 8.70 % 10.75% 3.4% 3.75 % 6.25 % 5.00 % 8.8 % 3.85 % 12.00 % 3.58 % 3.90 % 4.10 % 5.07 % 6.89 % 3.74 % 18 Sukuk - Rate of Return Hedging Dar Al-Arkan – Sukuk Issuance & Profit Swap Facts Dar Al Arkan US$ 450 million Sukuk Largest Saudi Real Estate Developer Fixed Profit Rate of 10.75% p.a. Tenor 5 years (Feb 2010 to Feb 2015) US$ 225 million Profit Swap (fixed to floating) Cost saving of 280 bp (3 month floating rate 7.95%) Source: www.arabianbusiness.com/dar-al-arkan-issues-450m-sukuk-at-11-source-27731.htm 19 Collateralization & Sukuk IIFM Reference Paper on I’aadat Al Shira’a (Repo Alternative) and Collateralization published on 28th July 2010 Purpose The Reference Paper aims to provide general information on the concept, operational mechanism and uses of conventional repurchase agreements (known as Repo or Sale and Repurchase agreements) and explore the possibilities for I’aadat Al Shira’a (repurchase) as an alternative to Repo The aim is to provide for the Islamic financial institutions, another tool to effectively manage its liquidity as well as to help it finance its inventory of Asset, Sukuk and equities 20 Collateralization & Sukuk Collateralization Prospects in Islamic Finance Institutions may initiate this concept which will give similar results as those achieved by a repo. Moreover, this concept will allow Islamic financial institutions to raise cash to fund the inventory while providing the cash investor a return which is further comforted in form of collateral Further efforts are being initiated by IIFM and several bilateral trades between banks are being done to test the product 21 Collateralization & Sukuk Collateralized Product – Utilization of Sukuk In order to make use of parties Sukuk portfolios and to initiate the process while further research and deliberation on finding an ideal ‘IS’ structure may continue, the working team is of the view that a collateralized structure is one of the options which perhaps can be initiated now given the industry’s urgent requirement for a workable liquidity management tool. The proposal is to make use of Sukuk, which are currently not utilized in a bank’s portfolio, through either a Murabaha or Wakalah arrangement. Since Murabaha is more developed and widely used, the working team is of the view that the following proposed structure may be initiated in various jurisdictions so that not only do funds remain within the Islamic system but the required legal procedures can be managed at the jurisdiction level (the suggestion is to seek required legal changes in OIC countries to facilitate the process). Sukuk collateralization through a Wakalah arrangement is another option which, if required, can be further developed by the IIFM working team if requested by the industry. 22 Collateralization & Sukuk Issues for Consideration 1. Taking Security: For this structure to be practical, it would need to be possible to take security over the securities quickly, effectively and robustly. In addition it needs to be possible for Party A to re-hypothecate the securities over which Party B has granted security. 2. Securities used as security for the obligation to pay Deferred Purchase Price: It is presumed that the securities used as security will be limited to Shari’ah compliant securities. 3. Margin Maintenance: The margin maintenance methodology also needs to be resolved and again needs to be quick, effective and robust. Easiest form would be to add or return Sukuk depending on collateral level agreement Continued… 23 Collateralization & Sukuk Issues for Consideration (Continued…) 4. Broker Credit Risk: The parties will be taking a credit risk on the commodity broker in respect of its obligations. However, this is similar to standard commodity Murabaha documentation. 5. Re-hypothecation: In conventional repo, the buyer has an ability to make use of the repo’d securities in its own business, which adds to the economic value of the repo to the buyer. How to replicate this in Shari’ah complaint way needs to be determined. Potentially Title Transfer Agreement may achieve the desired result. 6. Accounting Treatment: The applicable accounting treatment would need to be clarified. 24 Collateralization & Sukuk IIFM may put together standard product guidelines and required documentation for Collateralized Murabaha where Islamic Custodian Bank or Clearing Company may provide the required services for local market. Based on findings and as recommended in the reference paper, institutions are using this structure. Recently ADIB and NBAD made an announcement on entering into Islamic repo using this structure. The standard documentation for this product will be: 1) Guidelines on Product & Document 2) Collateralized Murabaha Agreement 3) Pledge Agreement 4) “IS” Global Master Agreement 5) Collateral Management Document & Client Service Documents 25 Collateralization & Sukuk Next Steps Collateralized Product Consultative meeting Q1 2012 26 Thank You www.iifm.net