FM10 Chapter 11

advertisement

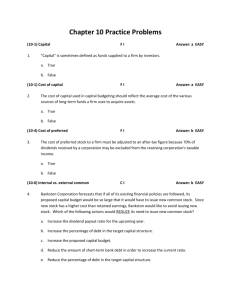

1 Ch 10: The Cost of Capital WACC = wdrd(1 - T) + wpsrps + wcers The Cost of Capital: Preliminaries What is it? Why we care? The Cost of Capital: Three Component Costs The Costs of Debt The Cost of Preferred Stock The Cost of Common Stock The Weighted Average Cost of Capital Flotation Cost Adjustment Risk-Adjusted Cost of Capital Divisional and Project Costs of Capital Other Issues 2 Cost of Capital: Georgia Pacific Co. “On a market-value basis, our debt-to-capital ratio was 47 percent. By employing this capital structure, we believe that our weighted average cost of capital is nearly optimized – at approximately 10 percent …..” from Georgia Pacific Co. Annual Report 3 The Cost of Capital Simply speaking, it refers to the opportunity cost that a firm incurs in raising capital to finance new projects. Opportunity cost: The return investors could earn on alternative investments of equal risk. Ways to finance new project o o “GE issued 6% 20-year bonds and borrowed capital from JP Morgan to invest on new technology for its electronic division.” “eBay paid 0.39 share to acquire each of the approximately 68 million fully diluted shares of PayPal. Based on eBay's closing price Thursday of $51.90 in 4 p.m. on the Nasdaq Stock Market trading, the deal was valued at $1.4 billion.” (from WSJ, October 14, 2002) 4 The Cost of Capital Depends on the risk associated with the firm’s activities What the firm must pay for capital in the capital markets Equal to the equilibrium rate of return demanded by investors in the capital markets for securities of that degree of risk Minimum rate of return required on new investments 5 Why Cost of Capital is Important We know that the return earned on assets depends on the risk of those assets Our cost of capital provides us with an indication of how the market views the risk of our assets 6 Why Cost of Capital is Important We need to earn at least the required return to compensate our investors for the financing they have provided Knowing our cost of capital can also help us determine our required return for capital budgeting projects 7 What types of long-term capital do firms use? Debt Long-term debt Equity Preferred Retained stock earnings and/or Common stock 8 WACC: Individual Components Typically, the WACC has three component costs including: Cost of Debt Cost of Preferred Stock Cost of Common Equity 9 Cost of Debt, rd(1-T) An investor requires return, rd, from investment on bonds. - return to an investor = cost to the company. Cost of Debt = YTM(1-T) Use the market price of the bonds to find YTM, or YTC if the bonds sells at a premium and likely to be called. The cost of debt is NOT the coupon rate. Use the current interest rate on new debt, not the coupon rate on existing debt. 10 Example: A 15-year, 12% semiannual bond sells for $1,153.72. What’s rd? 0 1 2 30 i=? ... 60 -1,153.72 INPUTS 30 N OUTPUT 60 -1153.72 60 I/YR PV PMT 5.0% x 2 = rd = 10% 60 + 1,000 1000 FV 11 Cost of Debt: Example Should we focus on before-tax or after-tax capital costs? Only after-tax cost is relevant because the interest on debt is tax-deductible. r d AT = rd BT(1-T) Interest is tax deductible, so rd AT = rd BT(1 - T) = 10%(1 - 0.40) = 6%. 12 Cost of Preferred Stock, rps Preferred dividends are expected to be paid every period forever (perpetuity concept) Flotation costs for preferred stocks are significant, so are reflected. Use net price. Preferred dividends are not tax-deductible, so no tax adjustment. Just rps. 13 Cost of Preferred Stock Example : What’s the cost of preferred stock when Pp = $113.10; Dividend = $10 per year; Flotation cost = $2 per share? rps D ps Pp $10 $113.10 $2 0.090 9.0%. 14 Cost of Common Stock, rs What are the two ways of common equity financing? Companies can issue new shares of common stock. Companies can retain and reinvest earnings. 15 Why is there a cost for reinvesting earnings? Earnings can be reinvested or paid out as dividends. After a firm generates earnings, who owns that money? The shareholders. But when the firm retain earnings it is not giving the money to the shareholders. In a way, the firm is investing the money for shareholders in their company. Those shareholders want some return on that money the firm is keeping. How much return do they expect? They want the same amount as if they had gotten the retained earning in the form of dividends, and bought more stock in the company. THAT is the cost of retained earnings.” 16 Continued Thus, there is an opportunity cost if earnings are reinvested. The shareholders could buy similar stocks and earn rs, or company could repurchase its own stock and earn rs. So, rs, is the cost of reinvested earnings and it is the cost of equity. 17 Three ways to determine the cost of common stock, rs: 1. CAPM: rs = rRF + (rM - rRF)b = rRF + (RPM)b. 2. DCF: rs = D1/P0 + g. 3. Bond-Yield-Plus-Risk Premium: rs = rd + RP. 18 What’s the cost of equity based on the CAPM? rRF = 7%, RPM = 6%, b = 1.2. rs = rRF + (rM - rRF )b. = 7.0% + (6.0%)1.2 = 14.2%. 19 What’s the DCF cost of equity, rs? Given: D0 = $4.19;P0 = $50; g = 5%. D0 1 g D1 rs g g P0 P0 $4.19105 . 0.05 $50 0.088 0.05 13.8%. 20 Find rs using the own-bond-yieldplus-risk-premium method. (rd = 10%, RP = 4%.) rs = rd + RP = 10.0% + 4.0% = 14.0% Here RP = the firm’s judgmental risk premium This RP CAPM RPM. Produces ballpark estimate of rs. Useful check. Ad hoc and subjective approach – suitable for privately-held firms 21 What’s a reasonable final estimate of rs? Method CAPM DCF rd + RP Average Estimate 14.2% 13.8% 14.0% 14.0% One of survey studies shows that the CAPM approach is by far the most widely used method, although most of firms use more than one approach. 22 What’s the WACC? We can use the individual costs of capital that we have computed to get our “average” cost of capital for the firm. This “average” is the required return on our assets, based on the market’s perception of the risk of those assets The weights are determined by how much of each type of financing that we use Suppose we have a target capital structure calling for 30% debt, 10% preferred stock, and 60% common equity. T=40%. 23 WACC Calculation: Final Stage WACC = wdrd(1 - T) + wpsrps + wcers = 0.3(10%)(1-0.4) + 0.1(9%) + 0.6(14%) = 1.8% + 0.9% + 8.4% = 11.1%. 24 Determining the Weights for the WACC The weights are the percentages of the firm that will be financed by each component. If possible, always use the target weights for the percentages of the firm that will be financed with the various types of capital. 25 Estimating Weights for the Capital Structure If you don’t know the targets, it is better to estimate the weights using current market values than current book values. If you don’t know the market value of debt, then it is usually reasonable to use the book values of debt, especially if the debt is shortterm. (More...) 26 A comprehensive example: IBM IBM needs an estimate of the weighted average of cost of capital for their firm. The firm has just paid a dividend of $1.27, a current stock price of $20.00, and an expected growth rate in dividends of 10%. The IBM’s beta is 1.25. The risk free rate is 5% and the expected return on the market portfolio is 13%. The company has bonds outstanding with a par value of $1,000, coupon rate of 8% paid semiannually, and 5 years until maturity. These bonds are selling in the market of $852.80. IBM also carries preferred stocks on its balance sheet. The preferred stocks sell for $35 per share and they pay a dividend of $3 per share. IBM faces 30% marginal tax rate, and has a target capital structure of 40% debt, 10% preferred stock, and 50% equity. 27 IBM example, Continued 1. 2. 3. 4. Calculate the cost of debt. Calculate the cost of common stock, using Dividend Discount Model and Capital Asset Pricing Model (CAPM). Take an average. Calculate the cost of preferred stock. Calculate the weighted average of cost of capital. 28 IBM example, Continued IMB currently considers producing a new mainframe computer. The financial analysts of the company agree that this new project will carry the same level of risk as the average risk of the company. The new investment will require $1,000,000 and expected cash inflows will be $250,000 annually for five years (net of tax). Should IBM take on this project? Compute Net Present Value (NPV) using the cost of capital we just computed. 29 WACC Estimates for Some Large U. S. Corporations (by Stern Stewart) Company Intel General Electric Motorola Coca-Cola Walt Disney AT&T Wal-Mart Exxon H. J. Heinz BellSouth WACC 12.9% 11.9 11.3 11.2 10.0 9.8 9.8 8.8 8.5 8.2 30 What factors influence a company’s WACC? Factors the firm cannot control Market conditions, especially interest rates and tax rates. Market risk premium Factors the firm can control The firm’s capital structure and dividend policy. The firm’s investment policy. Firms with riskier projects generally have a higher WACC. 31 Flotation costs One may argue that the firm incurs additional cost in raising debts. For example, hiring investment bankers. Flotation cost = commissions and fees paid to investment bankers and other incidental costs 32 Flotation costs: Can flotation cost be large enough for the issuing company to consider it in evaluating new projects? Source: IPO Prospectus 33 Flotation costs Flotation cost for bond financings is often small because most of bonds are privately placed, so ignore it. Most of equity is raised internally as retained earnings. In these cases, there are no flotation costs. However, if companies issue debt or new stock to the public, then flotation costs can be large. So omitting it in calculating the WACC may distort a true WACC. 34 Adjusting for Flotation costs: Cost of Debt Example: Coupon rate=10% annually paid coupons, par=$1,000, YTM=10%, and PB=$1,000. Suppose F(flotation cost) = 1% of the value of the issue. Since the firm should pay 1% of $1,000 to the investment bankers, the net proceed is $990. Now use a financial calculator 35 Adjusting for Flotation costs: Cost of Debt INPUTS 10 N OUTPUT -990 100 1000 PV PMT FV I/YR 10.11% After-tax cost of debt= rd(1-T) =10.11%(1-40%) = 6.07% 36 Why is the cost of internal equity from reinvested earnings cheaper than the cost of issuing new common stock? 1. When a company issues new common stock they also have to pay flotation costs to the underwriter. 2. Issuing new common stock may send a negative signal to the capital markets, which may depress stock price. 37 Adjusting for Flotation costs: Cost of New Common Stock, re Estimate the cost of new common equity: P0=$50, D0=$4.19, g=5%, and F=15%. D0 (1 g ) re g P0 (1 F ) $4.191.05 5 .0 % $501 0.15 $4.40 5.0% 15.4%. $42.50 38 Adjusting for Flotation costs: Cost of Preferred Stock Estimate the cost of preferred stock: Pn=$100 Dps=$5, g=5%, and F=10%. rps Dps Pn (1 F ) $5 $100 1 0.10 $5 5.6%. $90 Risk-adjusted cost of capital: Should the company use the composite WACC as the hurdle rate for each of its new projects? 39 NO! The composite WACC reflects the risk of an average project undertaken by the firm. Therefore, the WACC only represents the “hurdle rate” for a typical project with average risk. Different projects have different risks. The project’s WACC should be adjusted to reflect the project’s risk. Using the WACC as our discount rate is only appropriate for projects that are the same risk as the firm’s current operations. 40 Example Suppose you are a financial analyst of “Headache Free, Co.,” a leading pain relief drug manufacturer. You are about to report the WACC of the company to be 10%. The CEO of the company just announced that the company will invest in anti-AIDS drug research. Would you recommend that the company use the same 10% as a hurdle rate for anti-AIDS research project? No! The anti-AIDS research project is potentially riskier than the average of typical projects for a pain relief drug company. Should use a higher rate than 10%. Company WACC ≠ Individual Project WACC ≠ Divisional Project WACC 41 General Electric and its subsidiaries 42 Divisional Cost of Capital Rate of Return (%) 13.0 Project H 11.0 10.0 9.0 7.0 0 WACC Division H’s WACC Project L Composite WACC for Firm A Division L’s WACC RiskL Risk Average RiskH Risk 43 What procedures are used to determine the risk-adjusted cost of capital for a particular project or division? Estimate what the cost of capital would be if the project/division were a stand-alone firm. This requires estimating the project’s beta. Subjective adjustments to the firm’s composite WACC. 44 Example Assumptions: Target debt ratio = 10%. rd = 12%. rRF = 7%. Tax rate = 40%. betaDivision = 1.7. Market risk premium = 6% No preferred stock financing. 45 Beta = 1.7, so division has more market risk than average. Division’s required return on equity: rs = rRF + (rM – rRF)bDiv. = 7% + (6%)1.7 = 17.2%. WACCDiv. = wdrd(1 – T) + wcrs = 0.1(12%)(0.6) + 0.9(17.2%) = 16.2%. 46 How does the division’s WACC compare with the firm’s overall WACC? Division WACC = 16.2% versus company WACC = 11.1% (PRETEND that we calculated company WACC of 11.1% earlier.) “Typical” projects within this division would be accepted if their returns are above 16.2%. What if it is below 16.2% but still above 11.1%? 47 Subjective Approach Consider the project’s risk relative to the firm overall If the project is more risky than the firm, use a discount rate greater than the WACC If the project is less risky than the firm, use a discount rate less than the WACC You may still accept projects that you shouldn’t and reject projects you should accept, but your error rate should be lower than not considering differential risk at all 48 Subjective Approach: Example Risk Level Discount Rate Very Low Risk WACC – 8% Low Risk WACC – 3% Same Risk as Firm WACC High Risk WACC + 5% Very High Risk WACC + 10% 49 Three Mistakes to Avoid 1. When estimating the cost of debt, use the current interest rate on new debt, not the coupon rate on existing debt. 2. When estimating the risk premium for the CAPM approach, don’t subtract the current long-term T-bond rate from the historical average return on common stocks. 3. Use the target capital structure to determine the weights. If you don’t know the target weights, then use the current market value of equity, and never the book value of equity. If you don’t know the market value of debt, then the book value of debt often is a reasonable approximation, especially for short-term debt. 50 Some Problems in Cost of Capital Privately owned firms or Small business Firms whose stock is not traded Measurement problems Difficult to estimate accurate input data such as CAPM input variables and growth rate for Dividend Discount Model Costs of capital for projects of differing riskiness It is often difficult to estimate the level of risk for new project. Capital structure weights Difficult to estimate target capital structure Judgments must be exercised. 51 Costs of Capital for various industries by Value Line Our cost of capital provides us with an indication of how the market views the risk of our assets! 52 Summary The cost of capital is the minimum return demanded by investors. The cost of capital indicates how the market views the risk of the firm’s assets or investments. WACC includes three component costs. The flotation cost can be significant. The firm DOES incur opportunity cost when it retains and reinvest earnings. Overall firm-level WACC ≠ Individual project WACC