to obtain the presentation

advertisement

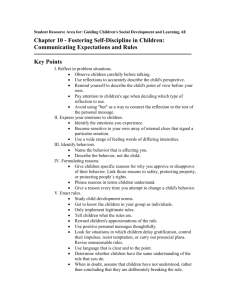

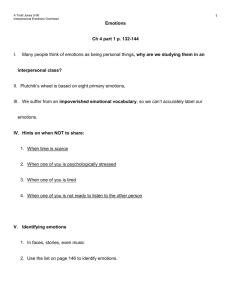

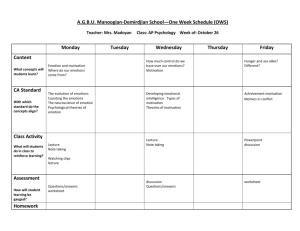

Conference on Behavioral Economics and Experiments AFSE-JEE Lyon, 23-25 May 2007 The Physionomics of Tax Evasion: Cheating Rationally or Deciding Emotionally? Giorgio Coricelli (ISC, CNRS, Lyon) Matteus Joffily (ISC, CNRS, Lyon) Claude Montmarquette (CIRANO, U. of Montreal) Marie-Claire Villeval (GATE, CNRS, U. of Lyon, and IZA, Bonn) Motivation Standard view of tax evasion: cheating on taxes is a game Allingham and Sandmo 72, Yitzhaki 74) Ignores the impact of social interactions on behavior: Multiple equilibria (Schelling 78; Akerlof 80) Social multiplier effect (Glaeser, Scheinkman, Sacerdote 03) Impact of social interations on tax evasion: Social conformity effect (Gordon 89, Myles and Naylor 96, Fortin, Lacroix and Villeval 07) Social learning effect Fairness effect (Spicer and Becker 80) Satisfaction effect (Cowell 90, Pommerehne et al. 94) Literature largely ignores the role of emotions Why are emotions important in this context? If there is a psychic cost in evading taxes, not accounting for it will reduce the predictive power of the model Assumption: the psychic cost can be related to 2 types of emotions: - Internally-oriented emotions (guilt, anxiety) if the individual has not reported all his income and has been audited and punished - Externally-oriented emotions (shame) if the cheating behavior is made public to the group Problems: - Emotions are usually either ignored or mentionned as an indirect explanation of behavior in the interpretation of data - When do emotions arise? When people report their income? When they are audited? This paper: An experimental measure of internally and externally-oriented emotions in tax evasion A standard tax evasion game with risk in which we allow for social interactions including a physiological measure of emotions (Skin Conductance Measures) Originality: - A study of the role of emotions in tax evasion - Distinct physiological measures of emotions when people report their income when they receive a feedback on audit - Physiological measures of emotions in the context of social interactions - Manipulation of the dissemination of information (a ceteris paribus change) to differenciate internally-oriented and externally-oriented emotions Experimental design • The game N=8 4 individual income levels: 50, 100, 150 and 200 Distribution of income is not made common knowledge Random allocation of income levels A unique tax rate: 55% 2 individual audit probabilities: – If the reported income is among the 4 highest reported income: 35% – If the reported income is among the 4 lowest reported income: 65% One decision: how much income to report? • Payoffs - No audit: пi = (income – tax on reported income) - Audit and no evasion: пi = (income – tax) - Audit and evasion: пi = (income – tax - fine) with tax rate applied to the actual income and fine = tax rate * evaded income • Information – Common knowledge: tax rate, individual income, audit probabilities – No information about the distribution of income in the group, the actual probability of audit, the number of cheaters • Equilibrium prediction No income to be reported under risk neutrality • 2 treatments – Benchmark treatment the agent receives an income s/he reports her/his income s/he is audited or not s/he receives her/his payoff – Picture treatment The agent knows that her/his picture will be disseminated in the room if an audit shows that s/he has not reported her/his full income Only one picture disseminated on each screen An audited cheater can only see his/her own picture • A within-subject comparison 30 periods Alternation of sets of 5 periods with either the Benchmark or the Picture treatment Physiological measure of Electrodermal Activity (EDA) • EDA is primarily related to the activity of the eccrine sweat glands located on the palmar and plantar surface. Those glands are predominately controlled by the sympathetic division of the autonomic nervous system (ANS). (Dawson et al, 2000) • EDA activity can be decomposed into a tonic component, EDA level, and a phasic component, EDA response. Modified from Ebling et al, 1992 Modified from Dawnson and Nuechterlein, 1984 Skin Conductance Response (SCR) • EDA responses measured with a constant voltage (0.5V) applied between two electrodes (Ag-AgCl) placed on the palmar surface are called Skin Conductance Response (SCR). • Psychophysiological studies have shown a high correlation between SCR and emotional arousal elicited by external stimuli. (Bradley et al, 2001) Biopac Systems, USA SCR Quantification • SCR can be described by several parameters: amplitude (0.2-1.0µS), latency (1- 3s), rise time (1-3s) and half recovery time (2-10s). The most frequently reported parameter in psychophysiological studies is the amplitude. • When a stimulus is repeated several times and an average amplitude of the SCR is to be calculated (Dawson et al, 2000): SCR Amplitude refers to the mean value computed across only those trials in which a measurable (nonzero) response occurred; SCR Magnitude refers to the mean value computed across all stimulus presentation including those without a measurable response. Dawson et al, 2000 Experiment: EDA Recording & Processing • Signal Recording: BIOPAC MP150W + TEL100C Constant voltage excitation at 0.5VDC Ag-AgCl electrodes Conductible gel (Biopac GEL101) Analogical low-pass filtering at 35Hz Sampling rate at 100 Hz Biopac Systems, USA • Data Reduction: EDA signal is off-line low-pass filtered at 0.5Hz Detected SCR amplitudes are threshold at 0.02µSiemens Stimulus-specific SCRs have onset 0.7-3.7s after stimulus onset INV DEC2.D - salomon 1.D - iroise 2.C - barentsz 1.C - rouge2.B - noire 1.B - caspienne 2.A - sargasse 1.A - marmara 4.90 9.93 7.73 9.51 6.79 2.00 -2.00 2.00 -2.00 0.82 -0.82 2.00 0.00 -2.00 0.82 -0.82 0.00 10.88 21.76 minutes 32.64 umhos 6.30 umhos umhos 6.01 umhos umhos 8.98 7.73 Volts 10.48 Volts umhos umhos 4.59 Volts AUD umhos 11.58 7.54 6.47 Volts PIC 13.34 Volts PAY Simultaneous EDA recording from 8 subjects Control questions - Self-reported emotions: Self-report of the « intensity of sentiments » and the « nature of sentiments » (positive -> negative) on a 7-level Likert scale at the end of each of the 30 periods - A kind of PANAS test (Positive and Negative Affect Schedule) with selfreported sentiments regarding two scenarii (audit of a subject who evaded tax, w/ and w/o picture dissemination) happiness, guilt, regret, joy, shame, sadness, stress, annoyance 7-level Likert scale at the end of the session - Attitudinal post-experimental questionnaire Attitude towards fraud in public transportation, tax evasion by shopkeepers, non-respect of the traffic rules 7-level Likert scale A parsimonious test of attitudes towards risk From Gneezy and Charness, 2006 Endowment of 15 points (= show-up fee of €3) How much of this endowment to invest in a risky asset? P(success)= 0.5 Payoff function: -If the investment is a success: i 15 I i 2.5I i -If the investment is a failure: i 15 I i Choice of the amount invested at the beginning of the session and random draw at the end of the session Procedures • 6 sessions Conducted at GATE, Lyon (France) 48 undergraduate Ss from the local engineering and business schools Computerized experiment with REGATE (Zeiliger, 00) Average duration: 90 minutes • Payoffs Payment of the average payoffs in two randomly drawn periods at the end of the session 100 points = 15 €, paid in cash in a separate room by a person not aware of the content of the experiment 3 € as a show-up fee Average earnings: 19.33 € Preliminary results Proportion of reported income Proportion of reported income 75 70 65 60 Benchmark T Picture T 55 50 45 40 50 100 150 200 Income levels The proportion of reported income is higher: - for the low incomes - in the Picture treatment for each income level Amplitude of SCR and income Audit 0,25 0,25 0,2 0,2 SCR-amplitude SCR-amplitude Decision 0,15 0,1 0,05 0,15 0,1 0,05 0 50 100 150 200 0 50 Income in points 100 150 200 Income Amplitude of SCR increases in income level Likely due to the fact that higher income Ss report a lower proportion of their income Amplitude of SCR by evasion behavior and by treatment 0,2 0,18 0,16 0,14 0,12 No evasion 0,1 Evasion 0,08 0,06 0,04 0,02 0 Decision - Benchmark Decision - Picture Audit - Benchmark Audit - Picture Tax evasion raises emotions The difference in emotional intensity between evaders and non-evaders is maximum at the time of audit and in the picture treatment A 2-step estimation procedure to control for endogeneity First step: Determinants of the reported income (in proportion of income) Random-effects tobit model Ss with high income in points report less Ss report more in the Picture treatment Males, less wealthy Ss, less risk averse Ss, and students in business report less Ss who have a poor opinion of traffic offenders and fare dodgers report more Second step: Determinants of the SCR amplitude Random-effects Tobit model with predicted % of reported income Guilt Shame Emotions arise with a lower reported proportion of income, picture dissemination, risk aversion Hesitant Ss feel more emotions An audit in the previous period increases decision SCR, and a punishment in the current period increases audit SCR Conclusion Srong results Tax evasion raises emotions Existence of a shame situation reduces cheating Emotions matter: punishment increases SCR due to internally-oriented emotions (guilt, regret); picture dissemination increases SCR due to externallyoriented emotions (shame) Risk averse Ss report more but, controlling for tax evasion, do not feel more emotions Implications Emotions influence economic behavior Creating a situation of guilt and shame generates emotions Possible extensions: Other estimations / other SCR indicators Reinforcement of the shame / guilt environment