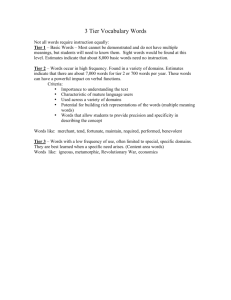

Enhanced Cash Tier (60 Days – 1 Year)

advertisement

Fitting Enhanced Cash Into Your Investment Management Process Presented By: Scott Prickett, CTP, Managing Director Portfolio Manager Patti Glock, Associate Vice President Client Services Manager Outline The Current Environment Rate Levels Economy Labor Housing Consumer Government-Sponsored Enterprise-GSEs ~ (FNMA, FHLMC) The “Big Picture” Allocation of Your Operating Funds Tiers Historical Returns of Tier Groups Enhanced Cash Management Tools Summary 2 Market Dynamics and Rate Trends What is the market/economic environment right now? Interest Rate Trends Secular Perspective Analyze both long and short-term trends Investment Economics Monetary Policy Fiscal Policy Economic Indicators Labor Market Housing Consumer Sentiment 3 2 Year Treasury Historical Perspective 4 5 Year Historical U.S. Unemployment Rate 5 5 Year Historical Change in Non-Farm Payroll 6 5 Year S&P Case-Shiller 20 (YoY) 7 5 Year Housing Starts 8 5 Year Consumer Confidence (YoY) 9 GSE (Agency) Securities FNMA (Fannie Mae) and FHLMC (Freddie Mac) Recent Developments Outlook 10 The Big Picture Overview of the Operating Fund Investment Management Process Review investment statutes and solidify your investment policy. Establish broker/dealer guidelines and perform due diligence. Establish custody/safekeeping arrangements. Create a cash flow forecast. Identify liquid funds and core funds. (ALLOCATION) Develop an investment strategy. (ALLOCATION) Monitor the markets and investment results. (ALLOCATION) Stay disciplined but adjust when needed. 11 Considerations for the Long Term Allocation of Operating Funds Liquidity Allocation LGIPs MMFs (S&P rated LGIP Index and Merrill Lynch 0-3 Mo are commonly used benchmarks.) Enchanced Cash Allocation-Core Funds 60 Days-1 Yr WAM, Duration 2 Year Maximum Maturity (Merrill Lynch 0-1 Year T-Note Benchmark) Short Term Allocation-Core Funds 1 Yr-2 Yr WAM, Duration 3 Yr Maximum Maturity (Merrill Lynch 1-3 Yr Treasury Agency Benchmark) The average maturity (duration) of your operating portfolio is arguably the single greatest determinant of investment performance. 12 Operating Funds Can Be Allocated Into Different Tiers •Core Funds Enhanced Cash Tier Short-Term Tier •Each tier is distinct and can be benchmarked 50 45 40 35 30 Liquidity Tier (0–60 Days, WAM) 25 20 15 10 Enhanced Cash Tier (60 Days–1 Year) 5 0 Short-Term Tier (1–3 Years) Jan Feb March April May June July Aug Sept Oct Nov Dec 13 Liquidity Allocation (Tier) Provides the highest degree of principal protection. Designed to provide perfect liquidity (constant NAV). Maintain balances at a level to provide for daily liquidity needs. Maintain an appropriate cushion (comfort level). Liquidity Tier (0-60 Days, WAM) 14 Short-Term Allocation (Tier) Designed for funds with holding periods of one to three years. Comes with a higher degree of principal volatility. Objective is to maximize returns. Yield and total return should be used when evaluating the short-term allocation tier. Historically a short-term portfolio allocation (Merrill Lynch 1-3 Year Treasury Index) has outperformed Money Market Funds (LGIP 30D Index) by 192 basis points over the past ten years. Short-Term Tier (1-3 Years) 15 Return Expectations: A Look at Historical Returns for Commonly Used Benchmarks December 31, 2009 Maturity Duration 10 Years 5 Years 1 Year 3 Month T-Bill .25 2.75 2.83 0.14 S&P Rated LGIP Index (LGIP30D) .16 2.97 3.16 0.51 1 Year T-Note (CMT) .95 3.03 3.07 0.47 Merrill Lynch 0-1 Year Treasury .51 3.33 3.36 0.49 2 Year T-Note (CMT) 1.94 3.30 3.19 0.95 Merrill Lynch 1-3 Year Index 1.88 4.89 4.45 2.17 Source: Bloomberg 16 Enhanced Cash Allocation (Tier) An enhanced cash strategy is designed to improve on returns provided by typical Money Market Funds and LGIPs while still meeting the primary goals of safety, of principal and liquidity. Historically an enhanced cash portfolio (Merrill Lynch 0-1 Year Note Index) has outperformed Money Market Funds (LGIP 30D Index) by 36 basis points over the past ten years. Total return and yield should be used when evaluating enhanced cash strategies. A longer duration results in slightly higher principal (price) volatility. Enhanced Cash Tier (60 Days – 1 Year) 17 Enhanced Cash Allocation (Tier) There is no industry recognized standard definition of Enhanced Cash Funds (maturities as well as credit quality may vary). Typical duration (WAM) range is 6 Months to 1 Year with a maximum maturity of 2 Years. Historically, incremental risk vs. the increase in returns is very low. Enhanced Cash Tier (60 days -1 Year) 18 Enhanced Cash Characteristics Position vs. LGIPs/MMFs and Short-Term Portfolios Risk LGIP/MMF Enhanced Cash Short-Term Bond 1.5 - 2 Years Common Target Portfolio Duration 0-60 Days 6 Months To 1 Year Eligible Investments 2a-7 Statute/Policy Statute/Policy Maximum Maturity 13 Months 2 Years 5 Years LGIP 30 Day Or 3 Mo T-Bill 0-1 Year Index 1-3 Years Commonly Used Benchmark 19 Why Benchmark Short-Term Cash Portfolios? The assessment of risk and return expectations Determination of opportunity costs Evaluate Investment Strategy Allows performance attribution to Yield Curve Positioning Sector Selection Credit Decisions Communication of Variation from Benchmark/Strategy Benchmark Selection Criteria Reflective of liquidity needs and risk tolerance Similar duration as portfolio Should have similar credit quality and eligible instruments Consistently calculated and will most often be obtained from a third party 20 Performance Benefits for an Enhanced Cash Allocation Strategy Example #1 • $25 Million Total Fund Investment Balance • Blended Percentage Based upon 40% LGIP, 60 % Merrill 0-1 Year Agency Index Year S&P AAA rated LGIP 30D Index Earnings Blended LGIP & 0-1 Year Treasury Return Earnings Earnings Difference 2000 6.02% $1,505,000 6.32% $1,581,050 $76,050 2001 4.10% $1,025,000 4.83% $1,206,500 $181,500 2002 1.65% $412,500 1.99% $497,550 $85,050 2003 .97% $242,500 1.16% $288,850 $46,350 2004 1.12% $280,000 1.15% $286,450 $6,450 2005 2.91% $727,500 2.87% $717,300 $(10,200) 2006 4.75% $1,187,500 4.71% $1,177,000 $(10,500) 2007 5.02% $1,255,000 5.28% $1,319,050 $64,050 2008 2.62% $655,000 3.06% $763,750 $108,750 2009 .51% $127,500 0.50% $124,050 $(3,450) 10 Yr Cum 2.97% $7,417,500 3.18% $7,961,550 $544,050 21 Performance Benefits for an Enhanced Cash Allocation Strategy Example #2 $25 Million Total Fund Investment balance Blended Percentage Based upon 40% LGIP, 30 % 1 Year Treasuries, 30% Merrill 1-3 Year Agency Index Year S&P AAA rated LGIP 30D Index Earnings Blended LGIP, 1 Yr Treas. & 1-3 Yr Agency Return Earnings Earnings Difference 2000 6.02% $1,505,000 6.93% $1,732,325 $227,325 2001 4.10% $1,025,000 5.82% $1,455,875 $430,875 2002 1.65% $412,500 3.16% $789,600 $377,100 2003 .97% $242,500 1.43% $356,725 $114,225 2004 1.12% $280,000 1.15% $287,950 $7,950 2005 2.91% $727,500 2.55% $636,675 $(90,825) 2006 4.75% $1,187,500 4.66% $1,164,625 $(22,875) 2007 5.02% $1,255,000 5.66% $1,415,650 $160,650 2008 2.62% $655,000 4.17% $1,041,850 $386,850 2009 .51% $127,500 1.00% $249,975 $122,475 10 Yr Cum 2.97% $7,417,500 3.65% $9,131,250 $1,713,750 22 Risk/Return Profile of the 3 Tiers •Extending the term can add performance but also additional risk. Risk/Return of Treasury Benchmarks 10 Years Ended 12/31/09 Duration Overall Return Quarters With Negative Returns S&P Rated LGIP Index .18 2.96% 0 of 40 0-1 Year Treasury Index .51 3.30% 0 of 40 1-3 Year Treasury Index 1.72 4.47% 4 of 40 3-5 Year Treasury Index 3.80 6.00% 14 of 40 Index Source: Bloomberg – Merrill Lynch Index • Short-term portfolios minimize risk at the expense of return. • Longer-term portfolios provide significant risks with marginal gain. • Average 10 Year historical yield for the 2 Year Treasury = 3.26%. • Average 10 Year historical yield for the 5 Year Treasury = 3.99%. 23 Management Tools Enhanced Cash Portfolios Yield Curve Analysis Spread Analysis GAP Analysis Credit Analysis Security Selection 24 Yield Curve and Spread Analysis Review of Basic Curve Types Recent Yield Curve Trends Analyze Specific Sector of the Yield Curve Analyze Yield Curve for the Specific Security Example of GAP (Breakeven) Analysis Spread Analysis 25 Review of Basic Curve Types Yields Positive or “Normal” Flat Inverted Maturities 26 Historical Yield Curve 27 Spread Analysis A systematic comparison of alternative securities. Helps quantify investment decisions. Spread analysis is not one dimensional. Within market sectors Between market sectors 28 Money Market Curves &Yield Spreads 29 U.S. Treasury vs. Agencies 30 Securities Specific Spread Analysis Relative Value 31 GAP (Breakeven) Analysis Two Examples GAP Analysis GAP Analysis is a mathematical way to evaluate short-term strategies on a BREAKEVEN basis. GAP Analysis compares two short-term investments VERSUS an equivalent longer term investment. 33 GAP Analysis Examples Option A: On September 10, 2010 you have the opportunity to buy a 14-month Agency Security yielding 0.35%. Option B: On September 10, 2010 you buy a 6-Month Agency Security yielding 0.21% and a 2nd 8-Month Agency when the 1st matures. Calculate the rate you need to earn from the 2nd Agency security to break even. (Make up the yield difference.) 34 GAP Analysis 1st Example 0.35% (Full Term = 439) 0.21% ? (Head = 178 Days) (Tail = 261 Days) Sept 10, 2010 March 7, 2011 Nov 23, 2011 35 GAP Analysis Example #1 (Bloomberg) 36 GAP Analysis 1st Example 0.35% (Full Term = 439) 0.21% 0.65% (Head = 178 Days) (Tail = 261 Days) Sept 10, 2010 March 7, 2011 Nov 23, 2011 37 GAP Analysis 2nd Example 0.72% (Full Term = 744) 0.35% ? (Head = 439 Days) (Tail = 305 Days) Sept 10, 2010 Nov 23, 2011 Sept 23, 2012 38 GAP Analysis Example #2 (Bloomberg) 39 GAP Analysis 2nd Example 0.72% (Full Term = 744) 0.35% 1.25% (Head = 439 Days) (Tail = 305 Days) Sept 10, 2010 Nov 23, 2011 Sept 23, 2012 40 Portfolio Management Summary Review Recent Yield Curve Trends. Analyze the Specific Portion of Curve you are Interested in. Analyze Curve for Specific Maturity. Use Spread Analysis to Compare Alternative Securities. Use Gap Breakeven Analysis When Applicable. 41 Summary Enhanced cash and or short-term allocation strategies are not designed to replace Money Market Funds. Should be used to supplement an investor’s cash allocation to facilitate the pursuit of higher returns over time without sacrificing safety of principal or liquidity. Inefficiencies embedded in the yield curve and security selection strategies provide the opportunity to be competitive with assigned benchmarks. A combination of two or all three of these strategies, matching different liquidity and risk tolerance tiers can provide significant increases in the performance of your short-term funds. The average maturity (duration) of your operating fund portfolio is arguably the single greatest determinant of investment performance. 42