Principles of Business, Finance and Marketing

advertisement

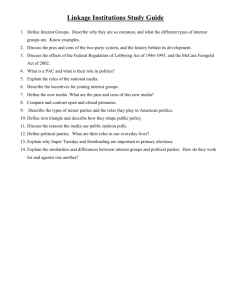

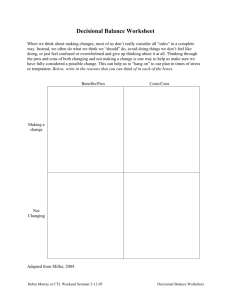

PRINCIPLES OF BUSINESS, FINANCE AND MARKETING Units 1 & 2 Economic Decisions and Systems UNIT 1.01 Satisfying Wants & Needs Economic Choices Economic Systems Supply and Demand SATISFYING WANTS AND NEEDS Wants Not necessary for survival, but add comfort and pleasure to our lives i.e. video games, designer clothes, Needs Things that are necessary for survival i.e. food, clothing, shelter Question: Is a car a want or a need? BASIC ECONOMIC PROBLEM Unlimited wants and needs, limited economic resources Scarcity Not having enough resources to satisfy every need Limited supplies of goods and services Someone’s going to go without ECONOMIC CHOICES Opportunity Cost Value of the next best alternative that you were not able to chose Trade Off – what you make when you give something up to have something else Job College College vs. Work Annual Year 1 2 3 4 5 6 7 10 15 20 25 $ $ $ $ $ $ $ $ $ $ $ Income/ Expense 20,000 20,000 20,000 20,000 20,000 20,000 20,000 20,000 20,000 20,000 20,000 Cumulative $ $ $ $ $ $ $ $ $ $ 40,000 60,000 80,000 100,000 120,000 140,000 200,000 300,000 400,000 500,000 Annual Income/ Expense $ (20,000) $ (20,000) $ (20,000) $ (20,000) $ (20,000) $ 50,000 $ 50,000 $ 50,000 $ 50,000 $ 50,000 $ 50,000 Cumulative $ $ $ $ $ $ $ $ $ $ (40,000) (60,000) (80,000) (100,000) (50,000) 150,000 400,000 650,000 900,000 DECISION MAKING PROCESS 6 Steps Define the problem Identify the alternatives List all pros and cons Choose among alternatives Act on your choice Evaluate your decision Example Can’t get to work Walk, bike, car, mooch ride Lazy, embarrassing, cool CAR! Spend $20K on used car Can’t afford gas FACTORS THAT AFFECT DECISION-MAKING Values Things that are important to you in life Goals Things a person wants to accomplish i.e. college degree, starting a business Freedom of Choice – the freedom to make decisions independently while accepting the consequences of those decisions ECONOMIC RESOURCES Factors of Production Natural Resources: raw materials (water, oil, trees) Renewable resources can be replaced Non-renewable resources cannot be replaced Human Resources : people who contribute physical or mental energy Capital Resources : tools, equipment, buildings, money, etc. used to produce goods and services ENTREPRENEURIAL RESOURCES Initiative to combine natural, human and capital resources to produce goods or services The 3 economic questions 1. What to produce? 2. How to produce? 3. What needs and wants to satisfy? Who decides this determines a countries economic system ECONOMIC SYSTEMS Traditionalism or Traditional Economy Do things the way they’ve always been done Pros: everyone has a role in the economy; economic life is stable Cons: discourages new ideas; growth is limited Examples: parts of Africa, Latin American rain forest ECONOMIC SYSTEMS Communism or Command Economy Government owns/controls all resources Pros: everyone has a job and benefits; can make a dramatic change in a short time on production of goods Cons: consumer goods rank low on priority list, few consumer wants are met; lack of incentive to work hard Examples: North Korea, China, Cuba ECONOMIC SYSTEMS Capitalism or Market Economy People owns/controls all resources Pros: produce goods & services people want and need; freedom of choice; income: input ratio; competition keeps prices lower Cons: wealth of economy not equally distributed Examples: US, Japan, Canada, Great Britian ECONOMIC SYSTEMS Socialism or Mixed Economy Government owns major industries; allows for private ownership of other businesses Pros: gov’t and private business work together; insurance/social security benefits provided Cons: high tax rates; smaller spendable income; discourages private business Examples: Sweden, France THE US ECONOMIC SYSTEM Private Property Business or individual owns their own property, not the government Freedom of Choice Freedom to make decisions independently while accepting the consequences of those decisions Profit Amount of money available to a business after all costs and expenses have been paid Competition Rivalry among businesses to sell their goods and services ECONOMIC DECISION-MAKING The process of choosing which needs and wants will be satisfied Consumer – person who buys and uses goods & services Producer – business that makes the goods & services Demand – the quantity of a good or service that consumers are willing to buy The cheaper an item is, the more people will want/be able to afford it (and visa versa) Supply – the quantity of a good or service that businesses are willing and able to provide The more expensive it is to produce, fewer businesses are willing to make it (and visa versa) Consumers set demand, producers establish supply SUPPLY AND DEMAND ACL 1200 1000 Price of 3-day Pass 800 600 400 Demand 200 0 100000 150000 200000 250000 300000 350000 Number of Passes Sold 400000 450000 500000 550000 SUPPLY AND DEMAND ACL 1200 1000 Price of 3-day Pass Supply 800 600 400 200 0 100000 150000 200000 250000 300000 350000 Number of Passes Sold 400000 450000 500000 550000 SUPPLY AND DEMAND ACL 1200 1000 Price of 3-day Pass Supply 800 Market Price 600 400 200 0 100000 Demand 150000 200000 250000 300000 350000 Number of Passes Sold 400000 450000 500000 550000 UNIT 1.02 KEY CHARACTERISTICS OF THE PRIVATE ENTERPRISE SYSTEM Private Enterprise System Role of the Individual as a Producer Role of the Individual as a Consumer Role of the Individual as a Citizen PRIVATE ENTERPRISE SYSTEM An economic system that rewards firms for their ability to perceive the needs and demands of consumers Capitalism 20 million US businesses in operation 3 main types of business 1. Sole Proprietors 2. Partnerships 3. Corporations Fortune 500 HOW DO BUSINESSES AND CONSUMERS INTERACT? Role of the Individual as a Producer Role of the Individual as a Consumer Role of the Individual as a Citizen INDIVIDUAL AS A PRODUCER Contribution to Economy Goals – Things a person wants to accomplish, such as getting a college education, buying a car, or starting a business Values – Things that are important to you in life Standard of Living Measure of how well people in a country live Quality and quantity of wants and needs that are satisfied Often determined by your choice of career Career Choices www.careercruising.com ENTREPRENEUR Someone who takes a risk in star ting a business to earn a profit The bad news: Over 1 million businesses start up in America each year Over 500,000 close each year Most start ups close within 16 months The good news: Average income for small business owner is $233,600 PROFIT The amount of money available to the business af ter all costs and expenses have been paid How to increase profits? Increase sales Increase price Decrease costs INDIVIDUAL AS A CONSUMER Consumes goods and services Vitale role in economic system Buy/Not-Buy decision effects what goods and services are produced Heavily targeted by businesses Pay for Needs First Food Clothing Shelter Consumer Wants are a Huge Market! GALLUP DAILY: U.S. CONSUMER SPENDING HOUSEHOLD SPENDING BY CATEGORY STRENGTH OF THE CONSUMER Customer Service Key 70% of Americans are willing to spend 13% more with companies they believe provide excellent customer service 78% of consumers have bailed on a transaction because of poor customer service Advocacy Groups Protect people from corporate abuse (unsafe products, predatory lending, false advertising, etc.) Prevention & Awareness (anti-smoking groups, parental advisory labels, etc.) INDIVIDUAL AS A CITIZEN Bill of Rights 1. Freedom of religion, speech, press, assembly, and petition . 2. Right to keep and bear arms in order to maintain a well regulated militia. 3. No quartering of soldiers. 4. Freedom from unreasonable searches and seizures. 5. Right to due process of law, freedom from self-incrimination, double jeopardy. 6. Rights of accused persons, e.g., right to a speedy and public trial. 7. Right of trial by jury in civil cases. 8. Freedom from excessive bail, cruel and unusual punishments . 9. Other rights of the people. 10.Powers reserved to the states. CITIZEN’S ECONOMIC RESPONSIBILIT Y Vote Pay Taxes Obey the Law WHAT HAPPENS IF ECONOMIC RESPONSIBILIT Y IGNORED? UNIT 1.03 Different Types of Businesses Forms of Business Ownership Determining Type of Business Ownership Other Considerations T YPES OF BUSINESS Sole Proprietor Partnership Corporation SOLE PROPRIETOR A business owned by one person Most common legal form of ownership for new businesses 15-20 Million sole proprietors in United States Accounts for 75% of businesses in US SOLE PROPRIETOR Pros: Control the entire business Keep all of the profits Make decisions quickly Easy to establish Pay fewer taxes Cons Unlimited liability PARTNERSHIP A business owned by 2 or more persons who share responsibilities and profits/losses Partnership Agreement (not filed with the government) Name of the new business Amount each person is to invest in the business Amount each partner is to draw in salary/profit How profits/losses after salaries are paid will be shared in proportion to each partner’s investment Responsibilities of the partners in the entity What will happen in the event of death of a partner(s) 3 Million business partnerships in United States PARTNERSHIP Pros: Combine talents and financial resources Share in responsibility of running the business and making decisions Relatively easy to establish Pays less taxes than a corporation Cons: Unlimited liability Potential for disagreements Loss of partner could mean end of business CORPORATION A business organization that operates as a legal entity separate from its owners Recognized as a person under the law Articles of Incorporation Sell Stock Most revenue generated from this type of business CORPORATION Key Terms Stockholders/Shareholders: People who own stock in a corporation Board of Directors: A group of people elected by shareholders to guide a corporation Corporate Officers: are the directors and senior level management of a corporation Charter: a license to operate from that state Proxy: ability of a shareholder to vote on the affairs of a company CORPORATION Pros: Limited liability Share of the profits No management responsibility Can raise money by selling stock Easier to get credit Cons: Legal red tape Increased tax burden BUSINESS OWNERSHIP DISTRIBUTION DETERMINING T YPE OF BUSINESS OWNERSHIP the potential risks and liabilities of your business the formalities and expenses involved in establishing and maintaining the various business structures your income tax situation your investment needs OTHER T YPES OF BUSINESSES Franchise Extractor Producer Processor Manufacturer Distribution Service Firms FRANCHISE A contractual agreement to sell a company’s products or services in a designated geographic area FRANCHISE Franchisee: the person or group of people who have received permission from a parent company to sell its products or services Franchisor: the parent company that grants permission to a person or group to sell its products or services McDonald’s 75% of restaurants worldwide are owned by franchisees Minimum $500,000 non-borrowed funds (25% cash) Monthly Service Fee – 4% of sales FRANCHISE Pros: Name brand recognition Established method of doing business Access to centralized advertising Professional help in startup/training Cons: High startup costs in purchasing rights to use the business name Must follow corporate standards OTHER T YPES OF BUSINESSES Extractors: A business that grows products or takes raw materials from nature Producers: A business that gathers raw products in their natural state Processors: Businesses that change natural materials (raw goods) into a more finished form for manufacturers to process further i.e. paper mills, oil refineries, steel mills, etc. OTHER T YPES OF BUSINESSES Manufacturers: A business that takes an extractor’s products or raw materials and changes them into a form that consumers can use Industrial production i.e. General Motors, GE, Dell, Intel Service Firms: A business that does things for you instead of making products Intangible goods i.e. hospitality, banking, legal OTHER T YPES OF BUSINESSES Distribution: Wholesale: A middle firm that assists with distribution activities between businesses i.e. Sams, CostCo Retail: A business that sells directly to the consumer i.e. Gap, Target, UNIT 1.04 The Business Cycle Measuring Economic Activity THE BUSINESS CYCLE Recurrent periods during which the nation’s economy moves in and out of recession and recovery phases Major ups and downs of economy Short Term (2-3 years) Long Term (50-60 years) BULL MARKET Peaks Growing economy Increasing investor confidence Anticipation of future price increases BEAR MARKET Troughs General decline in the stock market over a period of time Transition from high investor optimism to widespread investor fear and pessimism price decline of 20% or more over at least a two-month period sometimes referred to as "The Heifer Market" PROSPERIT Y A phase of the business cycle where most people who want to work are working and businesses produce goods & ser vices in record numbers. Economic Growth 1945-1973 $200B in war bonds matured GI Bill financed well-educated work force Middle class swelled Increase in GDP and Productivity RECESSION A period where demand begins to decline, businesses lower production of goods & ser vices, unemployment begins to rise, and GDP growth slows for several quar ters Reduced Economic Activity GDP negative for 2 or more quarters 1.5% rise in Unemployment in 12 months Late 2000s Collapse of the housing market Bank failures High Unemployment Low Consumer Confidence Escalating Debt Inflation Rising gas and food prices DEPRESSION A phase marked by high unemployment, weak sales of goods & ser vices, and business failures Sustained, long-term economic downturn Large increases in Unemployment Reduced credit availability Large number of bankruptcies Deflation Bank failures THE GREAT DEPRESSION 1929 – late 1930s Stock Market Crash October 29 th “Black Tuesday” Massive Bank Failures Millions lost jobs Global in scale Economic Indicators United States Great Britain France Germany Industrial Production -46% -23% -24% -41% Wholesale Prices -32% -33% -34% -29% Foreign Trade -70% -60% -54% -61% Unemployment +607% +129% +214% +232% DEPRESSION OR RECESSION? 1930s 1. Overproduction in agriculture 2. US banks recalling international loans 3. Large stockpiles of agricultural commodities released in to market 4. Gold standard 5. Deflationary policies reduced government spending 2008 1. 8 th year in a row world’s 6B people consumed more food than produced 2. US owes world between $4 $5T 3. World’s stockpiles at lowest in 37 years 4. No currency is redeemable in gold 5. Increased government spending RECOVERY A phase of the business cycle in which unemployment begins to decrease, demand for goods & ser vices increases, and GDP begins to rise again High levels of growth following a Recession Government stimulus packages Are we in a Recovery now? Timeline of late 2000 global recession ECONOMIC INDICATORS Gross Domestic Product (GDP) Inflation Consumer Price Index (CPI) Productivity Unemployment Debt Consumer Confidence GROSS DOMESTIC PRODUCT The total value of all final goods & ser vices produced in a countr y in one year GDP = private consumption + gross investment + government spending +(expor ts – impor ts) Of ten reflects a countr y’s Standard of living INFLATION An increase in the general price level When prices increase, each unit of currency buys fewer goods & services Caused by excessive growth of the money supply CONSUMER PRICE INDEX Shows change in the average prices of goods & ser vices bought by consumers over a period of time Related to inflation Shows how much your money can buy PRODUCTIVIT Y The quantity of a good an average worker produces in an hour Measure of output from a production process GDP per hour worked UNEMPLOYMENT State of being without paid work, though willing and able to work and actively seeking work Proportion of labor force that is without paid work DEBT money borrowed by the federal government of the US at any one time through the issue of securities by the Treasur y and other federal government agencies Deficit – the dif ference between the total amount spent by Congress and the amount received by the IRS Was $14.7T last year, this year it’s $16.0 TRILLION US National Debt Clock Surplus – revenues exceed spending Balanced Budget – revenues = spending President Clinton, 1998-2001 ? STRENGTH OF US ECONOMY TO OTHER COUNTRIES Top 10 largest world economies Gross domestic product in $ trillion World Rank Country GDP 1 United States 14.7 2 China 5.75 3 Japan 5.4 4 Germany 3.31 5 France 2.56 6 United Kingdom 2.26 7 Italy 2.04 8 Brazil 2.02 9 Canada 1.56 10 Russia 1.47 Trading Economics