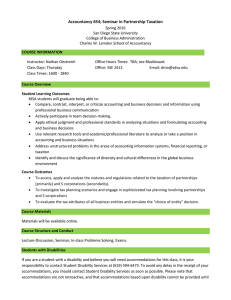

ACCOUNTING 302

advertisement

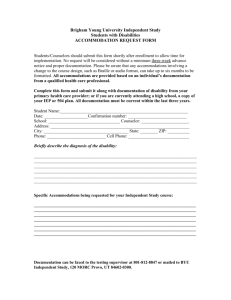

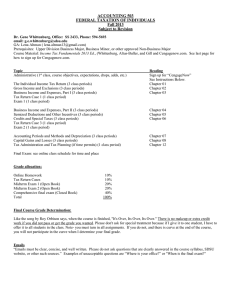

Accounting 655 Tax Planning for Individuals Fall 2015 – Room EBA 340 Prerequisite: Acctg. 322, Acctg. 503 or Acctg. 650 (Required to obtain credit for Acctg. 655) Instructor: Office: John R. Cooper SSE 2429 E-mail: jcooper@mail.sdsu.edu Office Hours: 3PM to 4PM Monday (& by Appointment) Course Description The purpose of this course is to provide students with an understanding of individual tax planning opportunities and concepts. The course will be taught from the perspective of a tax consultant but much of the material covered in the course will be relevant to the preparation of individual income tax returns. Real world examples and situations will be utilized as frequently as possible to provide a framework for demonstrating tax planning concepts. Textbook/Software Tax Planning for High Income Individuals, Thompson Reuters ( o Available online at SDSU Library – www.checkpoint.riag.com o User: sa74-45 through sa74-59 PW: SDSU2005 BNA Tax Projection Software (Provided to Students at no charge) Internal Revenue Service Code of 1986 (Provided on Blackboard) Internal Revenue Service Regulations (Provided on Blackboard) Selected articles from professional journals (Provided on Blackboard) Evaluation Students will be evaluated on the following assignments: Participation Individual quizzes*/Take Home Projects Group quizzes Case Studies 10% 25% 15% 50% 100% The lowest score on one individual and one group quiz will be dropped. Note- you must turn in all assignments. If you do not, and there is curve at the end of the course, you will not participate in the curve when I determine your final grade. Course Schedule Date Topics Text Sections 1-26 Introduction to Individual Income Tax Planning Review of Individual Income Tax §200-§206.13; §210-§210.4 2-02 BNA Tax Planning Software 2-09 Alternative Minimum Tax Considerations §1204-§1204.30 2-16 Estimated Tax Requirements & SE Tax Concepts §1203-§1203.10 2-23 Planning Opportunities for the Self Employed (Part 1) §400-§406.23 3-02 Planning Opportunities for the Self Employed (Part 2) §407-§409.86 3-09 Retirement Plans for the Self Employed §1100-§1101.90; §1105-§1110.38 3-16 Tax Benefits of Home Ownership including Vacation Homes & timeshares; Foreclosures & Short Sales §300-§306.56; §712-§712.43 §308-§308.9 3-23 Entity Selection, IRC §1202, 1045 and §1244 §700-§709.57 3-30 Spring Break 4-06 Tax Deferred Exchanges 4-13 Tax Issues in Marital Dissolutions, Maximizing §1000-§1009.10 Interest Deductions Case Study #1 Due 4-20 Executive Compensation, Restricted Stock, §83(b) §500-§506.8; §507-§507.37 Election, ISO’s & §409A 4-27 Legal Settlements, Use of Losses §703-§705.26 5-04 Property Sales, Net Investment Income Tax §702-§702.57; §614-§614.87 5-11 Final Exam Week - Quiz on Prior Week Case Study #2 Due §710-§710.112 MSA Program Goals & Student Learning Outcomes MSA students will graduate being able to: Compare, contrast, interpret, or criticize accounting and business decisions and information using professional business communication Actively participate in team decision making. Apply ethical judgment and professional standards in analyzing situations and formulating accounting and business decisions Use relevant research tools and academic/professional literature to analyze or take a position in accounting and business situations Address unstructured problems in the areas of accounting information systems, financial reporting, or taxation Identify and discuss the significance of diversity and cultural differences in the global business environment Acctg 655 contributes to these goals of the BSBA and the MSA through its student learning outcomes: 1. Identify and apply tax planning to the following concepts: 2. Avoidance of interest and penalties for underpayment of taxes. 3. Minimizing self-employment taxes. 4. Unique opportunities available for self-employed taxpayers. 5. Maximizing interest deductions. 6. Application of the passive loss rules. 7. Structure and application of IRC 1031 exchanges. At the end of this course students should be able to: 1) Apply the individual tax formula and identify the components necessary to compute gross income, individual federal taxable income, and the federal income tax liability. 2) Identify potential tax planning opportunities and be able to demonstrate application of alternative planning opportunities. 3) Illustrate the effects of various tax planning alternatives including avoidance of underpayment penalties and interest, minimizing self-employment taxes, maximizing the interest deduction and yearend general planning strategies. 4) Examine the tax implications of tax free exchanges, selection of business entity, and various types of tax favored retirement plans. 5) Formulate tax planning conclusions and recommendations for individual taxpayers. STUDENTS WITH DISABILITIES If you are a student with a disability and believe you will need accommodations for this class, it is your responsibility to contact Student Disability Services at (619) 594-6473. To avoid any delay in the receipt of your accommodations, you should contact Student Disability Services as soon as possible. Please note that accommodations are not retroactive, and that accommodations based upon disability cannot be provided until you have presented your instructor with an accommodation letter from Student Disability Services. Your cooperation is appreciated. ACADEMIC HONESTY The University adheres to a strict policy regarding cheating and plagiarism. These activities will not be tolerated in this class. Become familiar with the policy (http://www.sa.sdsu.edu/srr/conduct1.html). Any cheating or plagiarism will result in [Insert your policy on cheating or plagiarism, e.g. failing this class and a disciplinary review by Student Affairs.] Examples of Plagiarism include but are not limited to: Using sources verbatim or paraphrasing without giving proper attribution (this can include phrases, sentences, paragraphs and/or pages of work) Copying and pasting work from an online or offline source directly and calling it your own Using information you find from an online or offline source without giving the author credit Replacing words or phrases from another source and inserting your own words or phrases Submitting a piece of work you did for one class to another class If you have questions on what is plagiarism, please consult the policy and this helpful guide from the Library GRADE OF INCOMPLETE A grade of Incomplete (I) indicates that a portion of required coursework has not been completed and evaluated in the prescribed time period due to unforeseen, but fully justified, reasons and that there is still a possibility of earning credit. It is your responsibility to bring pertinent information to the instructor and to reach agreement on the means by which the remaining course requirements will be satisfied. The conditions for removal of the Incomplete shall be reduced to writing by the instructor and given to you with a copy placed on file with the department chair until the Incomplete is removed or the time limit for removal has passed. A final grade is assigned when the work agreed upon has been completed and evaluated. An Incomplete shall not be assigned when the only way you could make up the work would be to attend a major portion of the class when it is next offered. Contract forms for Incomplete grades are available at the Office of the Registrar website