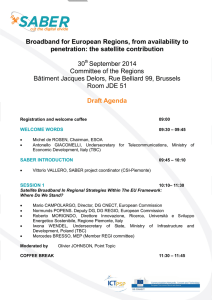

SABER INDUSTRIES, INC

advertisement

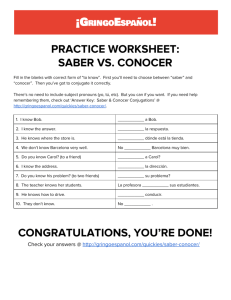

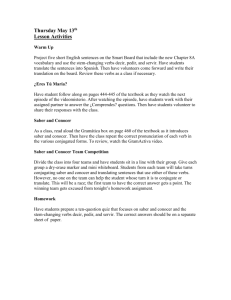

Finance and Accoutning for Engineers MT 251 Vanderbilt University School of Engineering David A. Berezov, CPA MBA Adjunct Professor of Management of Technology Saber Industries, Inc. David A. Berezov President SABER C-250 SABER C-250 SABER C-550 SABER C-550 SABER C-550 SABER C-1200 SABER C-1200 SABER C-2200 SABER C-800TT SABER C-1200TT SABER C-1200TT SABER C-1200TT SABER C-1200TT SABER RB-550 SABER WIDE BELT C-1200 SABER WIDE BELT SABER WIDE BELT SABER CVF-1200 SABER WIDE MACHINE SABER WIDE MACHINE SABER WIDE BELT C-1200 Finance and Accoutning for Engineers MT 251 Vanderbilt University School of Engineering David A. Berezov, CPA MBA Adjunct Professor of Management of Technology Course Description Topics are studied from the perspective of Engineering Professionals working in business organizations Topics Covered • • • • • • Time Value of Money Capital Budgeting Capital Formation Financial Accounting and Reporting Performance Measurements Working Capital Management Course Objectives • Develop an understanding of what is required for an otherwise successful engineering project to be considered a financial success. • Develop an understanding of what is required for business enterprises undertaking such projects to be considered financially successful. The Problem • Why do some finance and accounting managers say, “ The Engineers just don’t get it” ? • Why do some engineers refer to business skills as “Soft Skills”? A Question of Context ? • The Value “111”, is it “one hundred eleven”, “seven” or “two hundred seventy three” • (decimal, binary or hex) We shipped $12,000 product this month and collected payments of $8,000, What are our “Sales” for the month, $12,000 or $8,000 ? (“accrual” method or “cash” method ) Even the hand calculators are loaded with different functions • Engineering calculators; Sin, Cos, Tan, Pi, Log, Deg, Rad • Financial Calculators: • • • • • PV – Present Value FV – future value IRR – Internal rate of return PMT – Payment I – Interest rate Finance and Accounting for Engineers views individual projects and businesses as though they were machines. Simple Business Machines Projects are viewed as machines fueled by capital, operated over time and producing a measurable output. We start with the time value of money as applied to simple cash flows including future sums, annuities and perpetuities. We then investigate the more complex cash flows engineered in the capital budgeting process, and introduce the element of risk. What’s the FV of an initial $100 after 3 years if i = 10%? 0 1 2 3 10% 100 FV = ? Finding FVs (moving to the right on a time line) is called compounding. After 1 year: FV1 = PV + INT1 = PV + PV (i) = PV(1 + i) = $100(1.10) = $110.00. After 2 years: FV2 = PV(1 + i)2 = $100(1.10)2 = $121.00. After 3 years: FV3 = PV(1 + i)3 = $100(1.10)3 = $133.10. In general, FVn = PV(1 + i)n. Complex Machines • Simple cash flows are expanded to complex business enterprises. We review the basics of financial accounting and reporting with the goal of teaching the engineer the language of the financial community. With the terminology in hand, we look at inventory and its relation to product development activities Performance Measurements We then look at performance measurements for business enterprises; with the goal of learning what is normal, extraordinary and troublesome for various types of businesses. Capital Fuel For Financial Machines • Debt Capital • Equity Capital • Cost of Capital • Financial Leverage Financings • • • • • • • Corporate Bond issues Municipal Bond Issues Preferred Stock Issues Common Stock Loans IPO’s Construction Loans Working Capital Loans Working Capital We examine the day to day aspects of working capital management. The objective is to understand how business growth and contraction affect the firm’s cash position. Taxation • • • • • Federal Corporate Income Taxation Federal Personal Income Taxation Federal Estate and Gift Taxation State Income Taxation Local and State Business Taxes – Sales taxes – Property taxes – Personalty Taxes Informed Interviewees • Information on firms interviewing students Annual Reports SEC From 10K Proxy Statements Statistics Employer Firms Total # Firms 5.6M # Emp. 110.7M Receipts $18.2T # Employees <500 500+ 5.6M 55.7M $7.5T 16.7K 55.0M $10.7T