Presentation – 4Q12 Results

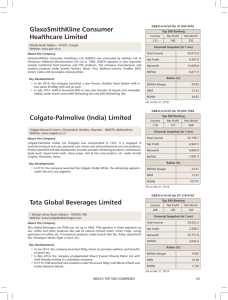

advertisement

Conference Call 4º Quarter of 2012 Highlights Consumption grew 5.2% compared to 4Q11, manly driven by the major temperature and by the commercial segment whch increased its consumption by 13.5%. In 2012 the consumption grew 2.0%. Adjusting by the clients with long-term default the consumption increase was 3,0%; OPERATIONAL Collection rate (LTM) for the last 12 months reached 98.0%, 60 bps above the same period last year; Non-technical losses reached 45.4% over the low-voltage market, due to the change in criteria of clients with long-term default; In 2012, investments amounted R$796.8 million, been R$694.1 million for the distribuition segment only. 24.5% increase in Net Revenue (without construction revenue) reaching R$ 1,963.6 million in the 4Q12 and R$ 6,943.1 million in 2002, an increase of 12.9%. RESULTS R$ 483.9 million EBITDA in 4Q12, 49.5% increase. In 2012, EBITDA reached R$ 1,456.2 million, 17.7% higher than in the 2011. R$ 160.0 million of net Income in 4Q12, an increase of 21.3%. In 2012, net income was up 24.0%, totaling R $ 423.9 million. CAPITAL MARKETS On March 25, Board of Directors approved the proposal to distribute additional dividends of R$ 91,770,327.00, or R$ 0.45 per share, to be decided at the OGM in April. Net debt of R$ 4,273.1 million, and multiple for covenants effect of 2.9x. Energy Consumption Distribution – Quarter TOTAL MARKET (GWh) ¹ +1.5% Out ros Cativos +5.2% 5,716 25.9ºC 5,655 24.6ºC 5,673 5,965 26.1ºC 23.9ºC 15% With the consumption no longer billed by the change in criteria, the total energy consumption increase in the concession Série1 be 6.3% over area would 2011. Comercial 4Q09 4T09 4Q10 4T10 4Q11 4T11 4Q12 4T12 4T09 4T10 4T11 4T12 1Note: Free 14% Industrial 7% Others 15% Commercial 30% 29% To preserve comparability in the market approved by Aneel in the tariff adjustment process, the billed energy of the free customers Valesul, CSN and CSA were excluded in view of these customers’ planned migration to the Basic Network. Residential 34% Energy Consumption Distribution – Year TOTAL MARKET (GWh) ¹ +2.9% +2.0% 21,492 22,384 22,932 Out ros Cativos 23,384 15% 27,5 25,5 23,5 25.0ºC 24.5ºC 24.0ºC 24.3ºC 21,5 With the consumption no longer billed by the change in criteria, the total energy consumption increase in 2009 the concession area would 2010over 2011. be 3.0% 2012 2009 2009 2010 2010 2011 2011 2012 2012 Comercial Commercial 29% 29% 15,5 2009 2010 2011 2012 To preserve comparability in the market approved by Aneel in the tariff adjustment process, the billed energy of the free customers Valesul, CSN and CSA were excluded in view of these customers’ planned migration to the Basic Network. 1Note: Industrial 7% Others 15% 2011 19,5 17,5 Free 14% Residential 35% Total Market ELECTRICITY CONSUMPTION (GWh) TOTAL MARKET – QUARTER +5.2% 5,965 5,673 2,006 2,032 1,752 -1.3% 1,010 558 4T11 4Q11 4T12 4Q12 RESIDENTIAL 165 1,988 192 996 612 452 384 4T11 4Q11 4T12 4Q12 INDUSTRIAL 1,587 4T11 4Q11 1,795 4T12 4Q12 COMMERCIAL CAPTIVE 851 769 +13.5% +1.3% FREE +4.9% 5,114 4,904 905 46 949 47 860 903 4T11 4Q11 4T12 4Q12 OTHERS 4T11 4Q11 4T12 4Q12 TOTAL Total Market ELECTRICITY CONSUMPTION (GWh) TOTAL MARKET – YEAR +2.0% -3.2% 22,932 23,384 3,056 3,330 +9.1% 8,418 8,149 -0.5% 3,944 2011 2011 2012 2012 RESIDENTIAL 6,967 657 7,599 743 3,925 2,213 2,396 1,731 1,528 2011 2011 2012 2012 INDUSTRIAL 6,310 2011 2011 6,856 2012 2012 COMMERCIAL CAPTIVE FREE +3.0% 19.877 3,603 3,712 185 191 3,417 3,521 2011 2011 2012 2012 OTHERS 20.054 2011 2011 TOTAL 2012 2012 Collection COLLECTION RATE 12 MONTHS COLLECTION RATE BY SEGMENT YEAR 97.4% 98.0% 94.3% 96.4% Total Total Varejo Retail 2011 2011 101.0% 98.8% 102.6% 102.5% 97.4% 98.0% Grandes Clientes Large Clients Poder PublicPúblico Sector Dec/11 dez-11 Dec/12 dez-12 2012 2012 Loss Prevention ENERGY RECOVERY GWh LOSS (12 MONTHS) -26.0% 45.4% 40.4% 41.2% 42.2% 169.3 43.1% 33.3% 7,582 7,665 7,838 8,047 5,247 5,316 5,457 5,615 8,536 125.2 Reflets the change on treatment's criteria in the approach to long term delinquent customers, based on Aneel Resolution 414. 6,007 2011 2011 2012 2012 INCORPORATION GWh 2,335 Dec/11 dez /11 2,349 Mar/12 mar/ 12 2,381 Jun/12 jun/ 12 2,432 Sep/12 s et /12 2,529 Dec/12 dez /12 Non-technical losses GWh Technical losses GWh % Non-technical losses/ LV Market % Non-technical losses / LV Market - Regulatory +12.5% 140.4 2011 2011 157.9 2012 2012 Net Revenue NET REVENUE BY SEGMENT (2012)* Commercialization NET REVENUE (R$MN) 4.1% Generation +9.6% 6.3% 7,613.1 6,944.8 Distribution 89.6%** 669.3 794.7 * Eliminations not considered ** Construction revenue not considered +19.2 12.9% 2,162.9 1,815.1 199.3 237.8 24.5% 1,577.3 1,963.6 4Q11 4T11 4Q12 4T12 6,150.1 6,943.8 NET REVENUE FROM DISTRIBUTION (2012) Network Use (TUSD) 2011 2011 Construction Revenue Revenue w/out construction revenue 2012 2012 (Free + Concessionaires) 9.4% Residential 41.1% Others (Captive) 12.6% Industrial 6.8% Commercial 30.1% Não is; e nc iáv ge r e ; 82,57% 8,5 1.32 Operating Costs and Expenses DISTRIBUTION MANAGEABLE COSTS (R$MN) COSTS (R$MN)* 4Q12 -12.4% 4T12 1,258.9 Non manageable (distribution): R$ 1,328.5 (82.6%) 1,103.4 -46.7% 279.7 149.1 Generation and Commercialization: R$ 131.3 (8.2%) (9.3%) ç ão e Ge r a lizaç ão e r c ia Com ,3; 8,16% ; 131 * Eliminations not considered ** Construction revenue not considered 4Q11 4T11 e is; nc iáv Ge r e ; 9 ,2 7 % 1 149, Manageable (distribution): R$ 149.1 R$ MN 4Q12 4T12 2011 2011 2012 2012 4Q11 4Q12 Var. 2011 2012 Var. PMSO 149.6 176.0 17.6% 646.8 692.0 7.0% Provisions 56,8 250.2 340.8% 299.4 473.1 58.0% PCLD 35.3 109.4 210.2% 251.3 282.6 12.5% Contingencies 21.5 140.8 554.9% 48.1 190.5 296.0% Depreciation 72.3 80.4 11.1% 306.8 293.3 -4.4% Other operational/ revenues expenses 1.0 (357.5) - 6.0 (355.0) - 279.7 149.1 -46.7% 1,258.9 1,103.4 -12.4% Total EBITDA CONSOLIDATED EBITDA (R$MN) D 1.1 istrib 2 7 u iç ,4; ã 75 o ; ,59 % EBITDA BY SEGMENT* 2012 +17.7% 1,456.2 Distribution 75,2% (EBITDA Margin: 17,4%) 1,237.8 Ge raç ã 2 2 o; 3 3 ,55 6,4 % ; +49.5% 483.9 323.6 Commercialization 1,9% (EBITDA Margin: 9,5%) 4T11 4Q11 4T12 4Q12 2011 2011 2012 2012 Generation 23,0% (EBITDA Margin: 76,4%) Co me r *Eliminations not considered 2 7 , c iali 8; z 1,8 aç ão 6% ; EBITDA EBITDA – 4Q11 / 4Q12 (R$ MN) + 73.4% + 49.5% 386 366 133 617 484 356 32 324 (194) (356) EBITDA Ativos e Ajustado Passivos 2T11 Adjusted Regulatórios Regulatory EBITDA Assets and 4Q11 Liabilities EBITDA 2T11 EBITDA 4Q11 Receita Líquida (41) Custos Não Custos Provisões EBITDA Ativos e EBITDA Gerenciáveis Gerenciáveis 2T12 Passivos Ajustado (PMSO) Other 2T12 Net NonManagable Provisions EBITDARegulatórios Regulatory Adjusted operational/ Revenue Managable Costs (PMSO) 4Q12 Assets and EBITDA revenues Costs Liabilities 4Q12 EBITDA EBITDA – 2011 / 2012 (R$ MN) + 34.5% + 17.7% 794 325 381 1,325 87 2011 Liabilities 1,456 1,238 (706) EBITDA Ativos e Ajustado Passivos 2T11 Adjusted Regulatórios Regulatory EBITDA Assets and 1,782 EBITDA 2T11 EBITDA 2011 Receita Líquida (175) (75) Custos Não Custos Provisões EBITDA Ativos e EBITDA Gerenciáveis Gerenciáveis 2T12 Passivos Ajustado (PMSO) Other 2T12 Net NonManagable Provisions EBITDARegulatórios Regulatory Adjusted Revenue Managable Costs (PMSO) operational/ 2012 Assets and EBITDA revenues Costs Liabilities 2012 Net Income ADJUESTED NET INCOME Lucro Líquido e Lucro Líquido Ajustado 4Q11 / 4Q12 (R$ MN) 4T11/4T12 - R$ Milhões + 61.8% + 21.3% 160 88 153 21 (53) 160 132 (68) EBITDA Ativos e EBITDA LL Ajustado Ativos e 4T11 Ajustado -Net Passivos 2T11 Adjusted Regulatory 4Q11 4T11 passivos 2T11 Income Regulatórios Assets and 4Q11 Regulatórios Liabilities 248 Receita Custos Não Custos EBITDA Gerenciáveis Resultado Gerenciáveis Impostos Líquida EBITDA Financial Taxes Financeiro (PMSO) Result (11) Provisões Outros Others EBITDA 4T12 2T12 4Q12 Ativos e EBITDA Ativos e LL Ajustado Passivos Ajustado Regulatory Adjusted-Net passivos 4T12 Regulatórios 2T12 Assets and Regulatórios Liabilities Income 4Q12 Net Income ADJUESTED NET INCOME 2011 / 2012 (R$ MN) Lucro Líquido e Lucro Líquido Ajustado 2011/2012 - R$ Milhões + 59.9% + 24.0% 215 218 399 58 6 342 EBITDA Ativos e EBITDA Ajustado Passivos 2T11 LL AjustadoRegulatórios Ativos e 2011 2T11 Net Adjusted Regulatory 2011 - 2011 Income 2011 passivos Assets and Regulatórios Liabilities (85) Receita Líquida 424 (57) Custos Não Custos Gerenciáveis Gerenciáveis EBITDA Resultado (PMSO) Impostos EBITDA Financial Taxes Financeiro Result 639 Provisões Outros Others EBITDA 2T12 2012 2012 Ativos e EBITDA Passivos Ajustado Ativos e LL 2T12 Ajustado Regulatórios Regulatory Adjusted passivos - 2012 Net Assets and Regulatórios Liabilities Income 2012 Dividends 8.2% 9.9% 4.2% 8.1% 100% 76.3% 351 203 Payout 2009 2010 5.4% 2.4% 351 257 50% 2008 363 3.3% 86.5% 81.0% 203 2007 3.4% 432 351 100.0% 6.1% 1.7% 408 100% 8.1% 2011 Minimum Dividend Policy 2012 408 187 432 205 363 351 187 182 87 182 170 87 92 118 92 1S08 2S08 1S09 2S09 1S10 2S10 1S11 2S11 1S12 2S12 1S13 Dividends Interest on Equity Dividend Yeld* *Based on the closing price the day before the announcement. 9 Indebtedness Real of R$ 375 million in October reduced the cost of debt and extended the amortization schedule TheCpre ustopayment AMORTIZATION SCHEDULE* (R$ MN) NET DEBT 1,796 Average Term: 4,2 years 3,383.2 4,273.1 671 481 2.9 2010 2.7 2009 Dec/11 set/12 9M09 3T10 Dec/12 dez/12 Custo Nominal 9.84% 2011 2014 2014 2013 2013 R ea l Custo9M10 Net Debt / EBITDA 2010 886 784 * Principal only COST OF DEBT 2012 11.08% Custo Real 2015 2015 2016 2016 After Após 2017 2017 Others 2.0% 2011 11.03% TJLP 25.1% 8.21% 5.30% 2009 2009 2007 4.87% 4.25% 2010 2011 2011 2009 2010 2008 Nominal Cost Custo Nominal 2009 US$/Euro 0.8% 2.24% CDI/Selic 72.1% 2012 2012 set/10 Real Cost Custo Real 2010 2011 *ConsideringHedge 2012 Investments CAPEX BREAKDOWN (R$ MN) 2012 CAPEX (R$ MN) Co m b te a Pe r d às a $ 19 s 9 ,8 Losses Combat 199.8 453.8 446.9 2008 2008 2008 2009 2009 2009 181.8 774.8 518.8 2010 2010 2010 2011 2011 2011 694.1 2012 2012 9M11 Investments in Electric Assets (Distribution) Develop. of Distribution System 215.7 9M12 Others 206.8 Commerc./ Energy Eficiency 26.1 Novo sp de g r oje tos e r aç $ 1,9 ão 116.9 Generation Projects 1.9 Generation Maintenance 23.7 Man ute n ç ge r a ão de çã $ 23 o ,7 92.9 102.7 Co m erci /Efic alizaç ão iê Ene r nc ia gé ti $ 26 ca ,1 563.8 796.8 utr o s 0 6,8 546.7 153.8 De se nv Siste olv. do m Distr a de ibuiç $ 21 ão 5 ,7 700.6 Quality Improvement 122.7 r ia d a ade ,7 928.6 Regulatory Framework The Provisional Measure 579 was enacted on September 11, 2012 and thereafter converted into Law 12,783 providing for electric power concessions, reduction of sector charges and reasonable tariffs which although these have not directly affected Light, as its concessions will expire only in 2026, resulted in the following developments: on January 24, 2013, Resolution issued by Aneel approved an average reduction of 19.63% in Light SESA’s tariffs. For residential consumers (low voltage), the reduction was 18.10%. The measure will have no impact on the company’s result or cash flow since it reflects an equal reduction in costs. on the same date, the distribution of power plants energy quotas was ratified, which had their concession renewed: (i) but lower to the distribution companies’ contracting needs, thus, causing an involuntary exposure, and only for Light it accounted for average 156 MW; and (ii) made distribution companies to start sharing the hydrological risks, which before was only supported by generation companies As of October 2012, an adverse hydrological situation was characterized in Brazil’s electricity sector, the basis of which is mainly hydric, enforcing the System National Operator to dispatch all the thermal power plants available in the system, thus significantly rising the costs of distribution companies by increasing fuel expenditures in availability agreements, increasing System Service Charges due to energy security and acquisitions on the spot market in order to answer that involuntary exposure. Regulatory Framework On March 8, 2013, the federal government issued the Decree 7,945 preventing the coverage of non-manageable costs related to thermal plant dispatch, involuntary exposure and hydrological risk not covered by the 2013 tariff, as follows: Eletrobrás will transfer the resources of Energetic Development Accout (CDE) directly to the concessionaires on the same dates and to the same accounts as the respective monthly transfers of the Electricity Trading Chamber (CCEE) financial guarantees. Aneel will publish the monthly dispatches with the amounts to be transferred by Eletrobrás via the CDE (energy development account). System Service Charge (ESS) – The monthly transfer will be determined by the difference between the amounts settled in the CCEE and the tariff coverage defined in the last adjustment. Involuntary Exposure associated with the quotas – The monthly CDE transfer will cover the difference between the difference settlement price (PLD) and the acquisition tariff of the repositioning amount recognized in Light’s last tariff adjustment. Hydrological Risk - The net monthly amount settled in the CCEE will be transferred directly via the CDE. The remaining energy purchase and ESS costs not covered by the decree, including fuel costs of availability contracts not included on tariffs, will continue going towards the formation of the regulatory assets and liabilities (CVA) to be determined in Light’s November/13 Tariff Revision. The Public Hearing opened for regulating decree proposes a transfer rate until 3% of the balance of CVA, the rest will be payed "in cash" from CDE funds. Important Notice This presentation may include declarations that represent forward-looking statements according to Brazilian regulations and international movable values. These declarations are based on certain assumptions and analyses made by the Company in accordance with its experience, the economic environment, market conditions and future events expected, many of which are out of the Company’s control. Important factors that can lead to significant differences between the real results and the future declarations of expectations on events or business-oriented results include the Company’s strategy, the Brazilian and international economic conditions, technology, financial strategy, developments of the public service industry, hydrological conditions, conditions of the financial market, uncertainty regarding the results of its future operations, plain, goals, expectations and intentions, among others. Because of these factors, the Company’s actual results may significantly differ from those indicated or implicit in the declarations of expectations on events or future results. The information and opinions herein do not have to be understood as recommendation to potential investors, and no investment decision must be based on the veracity, the updated or completeness of this information or opinions. None of the Company’s assessors or parts related to them or its representatives will have any responsibility for any losses that can elapse from the use or the contents of this presentation. This material includes declarations on future events submitted to risks and uncertainties, which are based on current expectations and projections on future events and trends that can affect the Company’s businesses. These declarations include projections of economic growth and demand and supply of energy, in addition to information on competitive position, regulatory environment, potential growth opportunities and other subjects. Various factors can adversely affect the estimates and assumptions on which these declarations are based on. Contacts João Batista Zolini Carneiro CFO and IRO Gustavo Werneck IR Manager + 55 21 2211 2560 gustavo.souza@light.com.br www.light.com.br/ri