C f C ll Conference Call

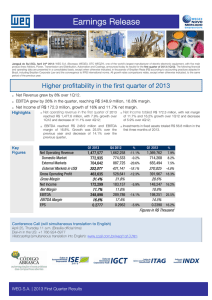

advertisement

Conference C f C Call ll 2012 and 4Q12 February 28th, 2013 Disclamer The statements that may eventually be made during this conference call relating to WEG’s business perspectives, projections and operating and financial goals and to WEG’s potential future growth are management beliefs and expectations, as well as information that are currently available. These statements involve risks, uncertainties and the use of assumptions, as they relate to future events and, as such, depend on circumstances that may or may not be present. Investors should understand that the general economic conditions, conditions conditions of the industry and other operating factors may affect WEG’s future performance and lead to results that may differ materially from those expressed d in i such h ffuture t considerations. id ti 4Q12 Conference Call Page 2 February 28, 2013 Agenda Sérgio Schwartz – Executive Vice President Highlights Revenues growth and performance Laurence Beltrão Gomes – Finance and Investor Relations Officer. Costs, Expenses, EBITDA Cash Flow Capex Sérgio Schwartz – Executive Vice President Outlook and final remarks Questions and answers 4Q12 Conference Call Page 3 February 28, 2013 Highlights Yearly Figures Net Operating Revenue Domestic Market External Markets External Markets in US$ Gross Operating Profit Gross Margin Quarterly Net Income Net Margin EBITDA EBITDA Margin EPS 2012 6,173,878 3,016,662 3 157 216 3,157,216 1,609,721 1,880,856 30.5% 655,979 10 6% 10.6% 1,053,545 17.1% 1 0573 1.0573 2011 5,189,409 2,902,958 2 286 451 2,286,451 1,361,689 1,556,051 30.0% 586,936 11 3% 11.3% 882,340 17.0% 0 9461 0.9461 % 19.0% 3.9% 38 1% 38.1% 18.2% 20.9% 11.8% 19.4% 11.8% 2010 4,391,973 2,670,443 1 721 530 1,721,530 982,835 1,386,952 31.6% 519,782 11 8% 11.8% 789,110 18.0% 0 8371 0.8371 % 18.2% 8.7% 32 8% 32.8% 38.5% 12.2% 12.9% 11.8% 13.0% Figures in R$ Thousands 4Q12 Conference Call Page 4 February 28, 2013 Net Operating Revenue Annual Evolution In US$ million External Market 6 174 6,174 19% Domestic Market 4,502 4,211 5,189 4% 4,392 18% 3,157 2 286 2,286 -6% 6% 1,842 1,684 1,722 2 660 2,660 2 526 2,526 2 670 2,670 2,903 , 3,017 2008 2009 2010 2011 2012 4Q12 Conference Call Page 5 February 28, 2013 Highlights Quarterly Figures Q4 2012 1,662,258 774,533 887 725 887,725 Q3 2012 1,613,067 798,626 814 441 814,441 % 3.0% -3.0% 9 0% 9.0% 431,141 401,460 7.4% 528,641 498,587 6.0% 31.8% 30.9% Net Income 183,157 184,756 Net Margin 11 0% 11.0% 11 5% 11.5% 300,603 284,276 EBITDA Margin 18.1% 17.6% EPS 0 29 2 0.2952 0 29 8 0.2978 Net Operating Revenue Domestic Market External Markets External Markets in US$ Gross Operating Profit Gross Margin EBITDA 4Q12 Conference Call Page 6 Q4 2011 % 1,468,551 13.2% 781,938 -0.9% 686 613 29.3% 686,613 29 3% 380,772 13.2% 445,686 18.6% 30.3% -0.9% 156,248 17.2% 10 6% 10.6% 5.7% 258,210 16.4% 17.6% -0.9% 00.2518 2 18 17.2% Figures in R$ Thousand February 28, 2013 Net Operating Revenue Quarterly Evolution In US$ million External Market Domestic Market 1,662 52% 50% 53% 1,529 1,469 1,277 1,613 1 370 1,370 1 317 1,317 1,126 47% 48% 43% 44% 59% 57% 56% 53% 52% 48% 50% 47% Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 41% 2011 4Q12 Conference Call 2012 Page 7 February 28, 2013 Business Areas Revenue breakdown In R$ million 7% 6% 6% 6% 7% 6% 8% 7% 13% 11% 11% 10% 9% 9% 10% 10% 23% 25% 24% 23% 22% 25% 27% 60% 58% 60% 61% 63% 57% 55% 2Q11 3Q11 4Q11 1Q12 2Q12 3Q12 4Q12 24% 57% 1Q11 Industrial Equipment 4Q12 Conference Call GTD Domestic Use Page 8 Paints & Varnishes February 28, 2013 Costs of Goods Sold Materials 66% Materials 65% 2012 2011 Others C Oth Costs t 10% Depreciation 4% 4Q12 Conference Call Labor 21% Other Costs 9% Labor 21% Page 9 Depreciation 4% February 28, 2013 Main impacts on EBITDA in R$ million 454.3 638.3 530.2 FX Impact on Revenues 109.5 COGS (ex depreciation) 882.3 50.4 Selling Expenses Volumes, Pi Prices & Product Mix Changes EBITDA 2011 4Q12 Conference Call General and Administrative Expenses 15 1 15.1 1 053 5 1,053.5 Profit Sharing Program EBITDA 2012 Page 10 February 28, 2013 Working Capital In % of Net Revenue 50,0% 40,0% Working Capital 30,0% Clients 20 0% 20,0% I Inventories t i 10 0% 10,0% Advances from Clients Suppliers 0,0% , 4Q05 4Q12 Conference Call 4Q06 4Q07 4Q08 4Q09 Page 11 4Q10 4Q11 4Q12 February 28, 2013 Capex Program 10.2% In R$ million Capex % Net Revenue 9.3% 8.1% 7.4% 5.8% 457 3.7% 146 2003 2004 4Q12 Conference Call 2005 5.3% 3.6% 305 206 126 5.4% 226 233 2009 2010 3.9% 238 188 111 2006 2007 2008 Page 12 2011 2012 February 28, 2013 Strategic Planning WEG 2020 Aspirations and strategic direction 20.000 0 6.174 5.189 4.392 18% 19% 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 4Q12 Conference Call Page 13 February 28, 2013 Contacts Laurence Beltrão Gomes www.weg.net/ir Finance and Investor Relations Officer laurence@weg.net Luís Fernando M. Oliveira Investor Relations Manager +55 (47) 3276-6973 l i f luisfernando@weg.net d @ t twitter.com/weg_ir 4Q12 Conference Call Page 14 February 28, 2013