Disability Services Commission Annual Report 2014*2015

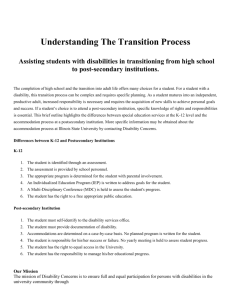

advertisement