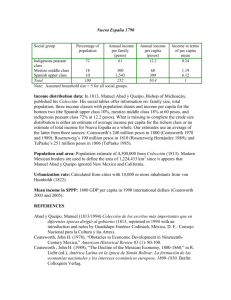

post-closing trial balance

advertisement

Capitulo 4 Hojas de Trabajo Objetivo de Estudio #1 Preparación de una hoja de trabajo Hoja de Trabajo (WorkSheet) Una hoja de trabajo es una forma de múltiples columnas que puede ser usada en el proceso de ajuste y en la preparación de estados financieros. Es una herramienta de trabajo para los contadores y no es un record permanente. El uso de una hoja de trabajo debe hacer la preparación de entradas de ajuste y estados financieros mas fácil. ILLUSTRATION 4-1 FORM AND PROCEDURE FOR A WORK SHEET Work Sheet Account Titles Trial Balance Cr. Dr. Adjustments Cr. Dr. Adjusted Trial Balance Cr. Dr. Income Statement Cr. Dr. (Ledger account titles) (Additional account titles for adjustments) 1. Prepare un Balance de comprobación En la hoja de Trabajo 2. Entre ajustes necesarios 3. Entre Los balances ajustados 4. Pase los balances a las Columnas correspondientes 5. Total the statement columns, compute net income (or net loss), and complete work sheet Balance Sheet Cr. Dr. Hoja de trabajo El uso de la hoja de trabajo es opcional Cuando una es usada, los estados financieros son preparados de la hoja de trabajo. Ajustes son jornal izados y costeados desde la hoja de trabajo luego de que los estados financieros sean preparados. Pasos para preparar una hoja de trabajo 1 Prepare un “trial balance” en la hoja de trabajo 2 Entre los ajustes en las columnas de ajustes 3 Entre los balances ajustados en las columnas del “trial balance ajustado” 4 Extienda las cantidades del “adjusted trial balance” a las columnas del estado financiero apropiado 5 Totalice las columnas de los estados y compute el ingreso neto (net icome) o la perdida (net loss), y complete la hoja de trabajo Preparación de una hoja de trabajo 1 Preparación del Trial Balance Pioneer Advertising Agency WorkSheet For the Month ended October 31, 2002 Trial Balance Account Titles Cash DR CR 15,200 Advertising Supplies Preparid insurance Of f ice Equipment 2,500 600 5,000 Notes Payable 5,000 Accounts Payable 2,500 Unearned Fees 1,200 C.R.Byrd Capital C.R. Byrd Draw ings 10,000 500 Fees Earned 10,000 Salaries Expense Rent Expense Totals Advertising Supplies expenses Insurance expense Accum Depr- of f ice Equipment Depreciation expense interest Expense Accounts Receivable Interest Payable Salaries payable Totals 4,000 900 28,700 28,700 Adjusted Trial Balance Adjustment DR CR Dr CR Preparación de una hoja de trabajo 2 Entradas de Ajuste Pioneer Advertising Agency WorkSheet For the Month ended October 31, 2002 Trial Balance Account Titles Cash DR Adjusted Trial Balance Adjustment CR DR CR Dr 15,200 Advertising Supplies 2,500 a 1,500 600 b 50 d 400 e 200 c 40 Interest Payable f 50 Salaries payable g Preparid insurance Of f ice Equipment 5,000 Notes Payable 5,000 Accounts Payable 2,500 Unearned Fees 1,200 C.R.Byrd Capital C.R. Byrd Draw ings d 400 10,000 500 Fees Earned 10,000 Salaries Expense g 1,200 Advertising Supplies expenses a 1,500 Insurance expense b 50 Rent Expense Totals 4,000 900 28,700 28,700 Accum Depr- of f ice Equipment Depreciation expense c 40 interest Expense f 50 Accounts Receivable e Totals 200 3,440 1,200 3,440 - Preparación de una hoja de trabajo 3 Entrada de balances ajustados Pioneer Advertising Agency WorkSheet For the Month ended October 31, 2002 Trial Balance Account Titles Cash DR Adjusted Trial Balance Adjustment CR DR CR Dr 15,200 Advertising Supplies Preparid insurance Of f ice Equipment CR 15,200 2,500 a 1,500 1,000 600 b 50 550 5,000 5,000 Notes Payable 5,000 5,000 Accounts Payable 2,500 2,500 Unearned Fees 1,200 C.R.Byrd Capital C.R. Byrd Draw ings d 400 10,000 10,000 500 Fees Earned 500 10,000 Salaries Expense Rent Expense Totals 800 4,000 g d 400 e 200 1,200 5,200 900 28,700 10,600 900 28,700 Advertising Supplies expenses a 1,500 1,500 Insurance expense b 50 50 Accum Depr- of f ice Equipment c 40 40 Depreciation expense c 40 40 interest Expense f 50 50 Accounts Receivable e 200 200 Interest Payable f Salaries payable g Totals 3,440 50 50 1,200 1,200 3,440 30,190 30,190 PREPARING A WORKSHEET 4 EXTEND ADJUSTED BALANCES Pioneer Advertising Agency WorkSheet Adjusted For the Month ended October 31,Statement 2002 Trial Balance Income Account Titles Cash Dr CR Dr Cr 15,200 Advertising Supplies Preparid insurance Of f ice Equipment 1,000 550 5,000 Notes Payable 5,000 Accounts Payable 2,500 Unearned Revenues 800 C.R.Byrd Capital C.R. Byrd Draw ings 10,000 500 Service Revenues Salaries Expense Rent Expense Balance Sheet Dr Cr 15,200 1,000 550 5,000 5,000 2,500 800 10,000 500 10,600 10,600 5,200 900 5,200 900 Totals Advertising Supplies expenses Insurance expense 50 Accum Depr- of f ice Equipment 40 interest Expense 50 200 22,450 50 1,200 19,590 22,450 2,860 22,450 50 Salaries payable Net Income 40 50 200 Interest Payable Totals 40 40 Depreciation expense Accounts Receivable 1,500 50 1,500 1,200 30,190 30,190 7,740 2,860 10,600 10,600 10,600 ADJUSTING ENTRIES JOURNALIZED GENERAL JOURNAL Date 2002 Oct. 31 31 31 31 31 31 31 Account Titles and Explanation a Advertising Supplies Expense Advertising Supplies b Insurance Expense Prepaid Insurance c Depreciation Expense Accumulated Expense d Unearned Fees Fees Earned e Accounts Receivable Fees Earned f Interest Expense Interest Payable g Salaries Expense Salaries Payable Ref. Debit Credit 1,500 1,500 50 50 40 40 400 400 200 200 50 50 1,200 1,200 PREPARATION OF FINANCIAL STATEMENTS INCOME STATEMENT PIONEER ADVERTISING AGENCY Income Statement For the Month Ended October 31, 2002 Revenues Service revenue Expenses Salaries expense Advertising supplies expense Rent expense Insurance expense Interest expense Depreciation expense Total expenses Net income $10,600 The income statement is prepared from the income statement columns of the work sheet. $5,200 1,500 900 50 50 40 7,740 $ 2,860 PREPARATION OF FINANCIAL STATEMENTS OWNER’S EQUITY STATEMENT PIONEER ADVERTISING AGENCY Owner’s Equity Statement For the Month Ended October 31, 2002 C.R. Byrd, Capital, October 1 Add: Investments Net income Less: Drawings C.R. Byrd, Capital, October 31 $ The owner’s equity statement is prepared from the balance sheet columns of the work sheet. $10,000 2,860 -0- 12,860 12,806 500 $12,360 PREPARATION OF FINANCIAL STATEMENTS BALANCE SHEET PIONEER ADVERTISING AGENCY Balance Sheet October 31, 2002 Liabilities and Owner’s Equity Assets Cash Accounts receivable Advertising supplies Prepaid insurance Office equipment Less: Accumulated depreciation Total assets $ 15,200 200 1,000 550 $5,000 40 4,960 $21,910 Liabilities Notes payable Accounts payable Interest payable Unearned revenue Salaries payable Total liabilities Owner’s equity C.R. Byrd, Capital Total liabilities and owner’s equity The balance sheet is prepared from the balance sheet columns of the work sheet. $ 5,000 2,500 50 800 1,200 9,550 12,360 $21,910 STUDY OBJECTIVE 2 Explain the process of closing the books. ILLUSTRATION 4-5 Cuentas temporeras vs Permanentes Temporeras (NOMINAL) Estas cuentas se cierran PERMANENTE (REAL) Estas cuentas no se cierran Todas las cuentas de Ingreso Todas las cuentas de Activos Todas las cuentas de Gastos Todas las cuentas de deuda Retiros del Dueño Cuentas de Capital del Dueño Entradas de Cierre Entradas de Cierre formalmente reconoce en el mayor (ledger) la transferencia del ingreso neto o la perdida y los retiros del dueño, al capital del dueño. Jornalizacion y posteo de entradas de cierre es un paso requerido en el ciclo de contabilidad. Una cuenta temporera,Income Summary, es usada en el cierre de cuentas de ingresos y gastos para minimizar la cantidad de detalles en la cuenta permanente del capital del dueño. ILLUSTRATION 4-6 DIAGRAM OF CLOSING PROCESS PROPRIETORSHIP (INDIVIDUAL) EXPENSES (INDIVIDUAL) REVENUES 2 1 INCOME SUMMARY 1 Debitas cada cuenta de ingreso por su balance, y acreditas Income Summary por el total de ingreso. 2 Debitas Income Summary por el total de gastos, y acreditas cada cuenta de gasto por sus balances. ILLUSTRATION 4-6 DIAGRAM OF CLOSING PROCESS INCOME SUMMARY 3 OWNER’S CAPITAL 3 Debitas o Acreditas Income Summary y acreditas o debitas el capital por la cantidad del net income o net loss ILLUSTRATION 4-6 DIAGRAM OF CLOSING PROCESS OWNER’S CAPITAL 4 OWNER’S DRAWING 4 Debitas owners capotal; por el balance en la cuenta de returo s y acreditas las cuentas de retiro por la misma cantidad. ILLUSTRATION 4-7 CLOSING ENTRIES JOURNALIZED GENERAL JOURNAL Date 2002 Oct. 1 Date 2002 Oct. 31 Account Titles and Explanation Service Revenue Income Summary (To close revenue acccount) INCOME SUMMARY Explanation Debit Credit 10,600 No. 400 Balance 10,600 Date 2002 Oct. 31 Ref. 400 350 Debit Credit 10,600 10,600 SERVICE REVENUE Explanation Debit 10,600 Credit No. 350 Balance 10,600 –0– ILLUSTRATION 4-7 CLOSING ENTRIES JOURNALIZED GENERAL JOURNAL Date 2002 Oct. 31 Account Titles and Explanation Income Summary Salaries Expense Advertising Supplies Expense Rent Expense Insurance Expense Interest Expense Depreciation Expense (To close expense accounts) Date 2002 Oct. 31 31 INCOME SUMMARY Explanation Debit 7,740 Credit 10,600 Ref. Debit 350 7,740 726 631 729 722 905 911 No. 350 Balance 10,600 2,860 Credit 5,200 1,500 900 50 50 40 ILLUSTRATION 4-7 CLOSING ENTRIES JOURNALIZED GENERAL JOURNAL Date 2002 Oct. 31 Date 2002 Oct. 31 31 Account Titles and Explanation (3) Income Summary C. R. Byrd, Capital (To close net income to capital) INCOME SUMMARY Explanation Debit Credit 10,600 7,740 2,860 No. 350 Balance 10,600 2,860 –0– Date 2002 Oct. 31 31 Ref. Debit 350 301 2,860 C. R. BYRD, CAPITAL Explanation Debit Credit 2,860 Credit 10,000 2,860 No. 301 Balance 10,000 12,860 ILLUSTRATION 4-7 CLOSING ENTRIES JOURNALIZED GENERAL JOURNAL Date 2002 Oct. 31 Date 2002 Oct. 31 31 Account Titles and Explanation (4) C. R. Byrd, Capital C. R. Byrd, Drawing (To close net income to capital) C. R. BYRD, DRAWING Explanation Debit Credit 500 500 No. 350 Balance 500 –0– Date 2002 Oct. 31 31 31 Ref. 350 301 Debit Credit 500 500 C. R. BYRD, CAPITAL Explanation Debit Credit 10,000 500 No. 301 Balance 10,000 12,860 12,360 CAUTIONS RELATING TO CLOSING ENTRIES Unos detalles relacionados a las entradas de cierre: 1 Evite el duplicar los balances de ingresos o gastos en vez de llevarlos a zero. 2 No cierre la cuenta de retiro atraves del Income Summary. La cuenta de Owner’s drawing no es un gasto y no es un factor determinante del ingreso neto POSTING CLOSING ENTRIES Todas la cuentas temporeras tienen balances cero luego de postear las entradas de cierre. Los balances de owner’s capital representan el total de equidad del dueño al final del periodo de contabilidad Ninguna entrada es jornalizada ni posteada durante el ano a la cuenta de owner’s capital. Como parte del proceso de cierre, las cuentas temporeras son totalizadas, balanceadas y doble ruled. Las cuentas permanentes (assets, liabilities, and owner’s capital) no se cierran. ILLUSTRATION 4-8 POSTING OF CLOSING ENTRIES Salaries Expense 4,000 (2) 5,200 1,200 5,200 726 (1) 5,200 1 2 Advertising Supplies Expense 1,500 (2) 1,500 Rent Expense 900 (2) Service Revenue 10,600 10,000 400 200 10,600 10,600 631 (2) (3) 729 900 Income Summary 7,740 (1) 10,600 2,860 10,600 350 10,600 3 Insurance Expense 50 (2) 722 50 (4) 2 Interest Expense 50 (2) C. R. Byrd, Capital 500 10,000 (3) 2,860 905 301 12,360 50 4 Depreciation Expense 40 (2) 40 711 C. R. Byrd, Drawing 500 (4) 500 306 400 STUDY OBJECTIVE 3 Describe the content and purpose of a post-closing trial balance. POST-CLOSING TRIAL BALANCE Luego de que todas las entradas de cierre han sido jornalizadas y posteadas, un balance de comprobacion luego de cierre (post-closing trial balance)se prepara. El proposito de este balance de comprobacion es proveer la igualdad de las cuentas permanentes que se van a mover para el proximo periodo de contabilidad. ILLUSTRATION 4-9 POST-CLOSING TRIAL BALANCE PIONEER ADVERTISING AGENCY Post-Closing Trial Balance October 31, 2002 Debit Cash The post-closing trial Accounts Receivable balance is prepared from the Advertising Supplies permanent accounts in the Prepaid Insurance ledger. Office Equipment Accumulated Depreciation — Office Equipment Notes Payable The post-closing trial balance Accounts Payable provides evidence that the Unearned Revenue journalizing and posting of Salaries Payable closing entries has been Interest Payable properly completed. C. R. Byrd, Capital Credit $ 15,200 200 1,000 550 5,000 $ 40 5,000 2,500 800 1,200 50 12,360 $ 21,950 $ 21,950 STUDY OBJECTIVE 4 Mencionar los pasos requeridos para el ciclo de contabilidad STEPS IN THE ACCOUNTING CYCLE 1 Analizar las transacciones del negocio 2 Jornalizar las transacciones 3 Posteo a las cuentas del mayor 4 Prepare un balance de comprobacion 5 Jornalizar y Postear las entradas de ajuste STEPS IN THE ACCOUNTING CYCLE 6 Preparar un balance de comprobacion ajustado 7 Preparar los estados financieros: Income statement, Owner’s Equity Statement, Balance Sheet 8 Jornalizacion y posteo de las entradas de cierre 9 Preparar un balance de comprobacion luego de cierre REVERSING ENTRIES A reversing entry es realizada al principio del proximo periodo de contabilidad El proposito de las entradas es el simplificar el registro de transacciones subsecuentes a las entradas de ajuste Reversing entries son mayormente usada para reversar 2 tipos de entradas de ajustes las : accrued revenues and accrued expenses. ILLUSTRATIVE EXAMPLE OF REVERSING ENTRY 2002 Oct. 26 Initial Salary Entry Salaries Expense Cash 4,000 4,000 (To record Oct. 26 payroll) Adjusting Entry 31 Salaries Expense Salaries Payable 1,200 Income Summary Salaries Expense 5,200 1,200 (To record accrued salaries) Closing Entry 31 (To close salaries expense) Reversing Entry Nov. 1 9 Salaries Payable Salaries Expense (To reverse Oct. 31 adjusting entry) Subsequent Salary Entry Salaries Expense Cash 5,200 1,200 1,200 4,000 4,000 (To record Nov. 9 payroll) STUDY OBJECTIVE 5 Explain the approaches to preparing correcting entries. CORRECTING ENTRIES Errores que ocurren al registrar transacciones deben ser corregidos tan pronto estos sean descubiertos por al preparar entradas de correccion. Entradas de correccion son inecesarias siempre y cuando los records esten libre de errores, pueden ser jornalizadas y posteadas cuando el error sea descubierto. Esto envuelve cualquier combinacion de cuentas de los estados de situacion y los estados de ingresos y gastos ILLUSTRATIVE EXAMPLE OF CORRECTING ENTRY 1 May 10 10 20 Incorrect Entry Cash Service Revenue (To record collection from customer an account) Correct Entry Cash Accounts Receivable (To record collection from customer an account) Correcting Entry Service Revenue Accounts Receivable (To correct entry of May 10) 50 50 50 50 50 50 ILLUSTRATIVE EXAMPLE OF CORRECTING ENTRY 2 Incorrect Entry May 18 Delivery Equipment Accounts Payable 45 45 (To record purchase of equipment on account) Correct Entry 18 Office Equipment Accounts Payable 450 450 (To record purchase of equipment on account) Correcting Entry June 3 Office Equipment Delivery Equipment Accounts Payable (To correct entry of May 18) 450 45 405 STUDY OBJECTIVE 6 Identificar las secciones de un Estado de Situacion Cualificado ILLUSTRATION 4-17 STANDARD BALANCE SHEET CLASSIFICATIONS Estados financieros son mas utiles cuando sus elementos son clasificados en subgrupos significativos. Un classified balance sheet generalmente tiene las siguientes clasificaciones estandars: Liabilities and Owner’s Equity Assets Current Assets (Activos Corrientes) Current Liabilities (Pasivos Corrientes) Long Term Investments Long Term Liabilities (Pasivos a Largo Plazo) (Inversiones a Largo Plazo) Property Plant and Equipment (Propiedad, Planta y Equipo) Intangible Assets (Activos Intangibles) Owner’s Equity Activos Corrientes Activos Corrientes son el cash (efectivo) y todos los aquellos recursos que se pueden convertir en efectivo o vendidos, o consumidos dentro de un periodo de 1 año de la fecha del estado de situacion o el ciclo de operación del negocio, el que sea mas largo. Activos Corrientes son presentados en el orden de liquidez El civlo de operación de una compania es el tiempo promedio que se requiere de cash a cash al producir ingresos. Ejemplos de activos corrientes son inventario, cuentas por cobrar y efectivo Inversiones a Largo Plazo Long-term investments son recursos que se pueden convertir en efectivo, pero su conversion en efectivo no se espera que se realice dentro de un año o dentro del ciclo de operacion. Ejemplos incluyen inversiones en bonos de otra comapañía o inversiones en terrenos para la re-venta 10 shares XYZ stock PROPERTY, PLANT, AND EQUIPMENT Tangible resources of a relatively permanent nature that are used in the business and not intended for sale are classified as property, plant, and equipment. Examples include land, buildings and machinery. INTANGIBLE ASSETS Intangible assets are noncurrent resources that do not have physical substance. Examples include patents, copyrights, trademarks, or trade names that give the holder exclusive right of use for a specified period of time. CURRENT LIABILITIES Current liabilities are obligations that are reasonably expected to be paid from existing current assets or through the creation of other current liabilities within one year or the operating cycle, whichever is longer. Examples include accounts payable, wages payable, interest payable, and current maturities of long-term debt. LONG-TERM LIABILITIES Obligations expected to be paid after one year are classified as long-term liabilities. Examples include long-term notes payable, bonds payable, mortgages payable, and lease liabilities. OWNER’S EQUITY The content of the owner’s equity section varies with the form of business organization. In a proprietorship, there is a single owner’s equity account called (Owner’s Name), Capital. In a partnership, there are separate capital accounts for each partner. For a corporation, owners’ equity is called stockholders’ equity, and it consists of two accounts: Capital Stock and Retained Earnings. ILLUSTRATION 4-25 CLASSIFIED BALANCE SHEET IN ACCOUNT FORM PIONEER ADVERTISING AGENCY Balance Sheet October 31, 2002 Assets Current assets Cash Accounts receivable Advertising supplies Prepaid insurance Total current assets Property, plant, and equipment Office equipment Less: Accumulated depreciation Total assets $ 15,200 200 1,000 550 16,950 $5,000 40 4,960 $21,910 A classified balance sheet helps the financial statement user determine 1 the availability of assets to meet debts as they come due and 2 the claims of short- and long-term creditors on total assets. ILLUSTRATION 4-25 CLASSIFIED BALANCE SHEET IN REPORT FORM Liabilities and Owner’s Equity Current liabilities Notes payable Accounts payable Interest payable Unearned revenue Salaries payable Total current liabilities Long-term liabilities Notes payable Total liabilities Owner’s equity C. R. Byrd, Capital Total liabilities and owner’s equity The balance sheet is most often presented in the report form, with the assets above liabilities and owner’s equity. $ 1,000 2,500 50 800 1,200 5,550 4,000 9,550 12,360 $21,910