Application for Promotion to Full Professor

advertisement

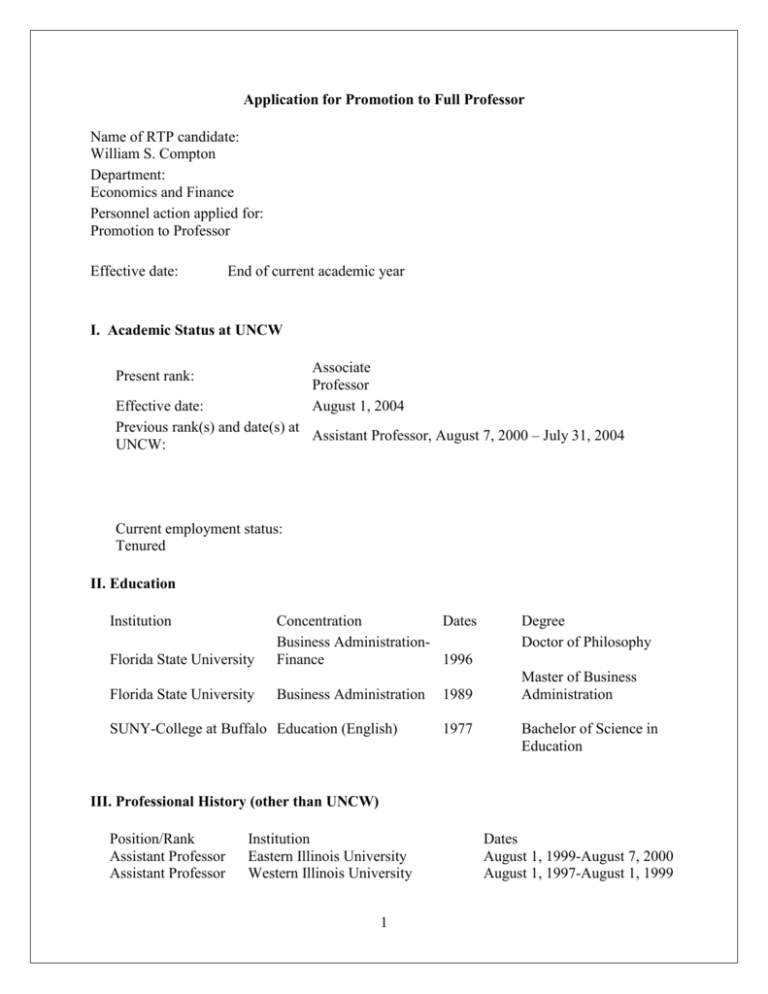

Application for Promotion to Full Professor Name of RTP candidate: William S. Compton Department: Economics and Finance Personnel action applied for: Promotion to Professor Effective date: End of current academic year I. Academic Status at UNCW Associate Professor August 1, 2004 Present rank: Effective date: Previous rank(s) and date(s) at Assistant Professor, August 7, 2000 – July 31, 2004 UNCW: Current employment status: Tenured II. Education Institution Florida State University Florida State University Concentration Dates Business AdministrationFinance 1996 Business Administration SUNY-College at Buffalo Education (English) 1989 1977 Degree Doctor of Philosophy Master of Business Administration Bachelor of Science in Education III. Professional History (other than UNCW) Position/Rank Assistant Professor Assistant Professor Institution Eastern Illinois University Western Illinois University 1 Dates August 1, 1999-August 7, 2000 August 1, 1997-August 1, 1999 IV. Contribution to Teaching A. Required subcategories: 1. Courses taught (a non-chronological list of course numbers and titles) (All courses taught at UNCW is in the Supporting Documentation) Course Title FIN 495 Seminar in Finance (Prague Consulting Project) FIN 335 Principles of Financial Management FIN 330 Principles of Investments FIN 330 Principles of Investments (televised hybrid classroom) FIN 336 Intermediate Financial Management FIN 439 Multinational Financial Management MBA 536 Investment Management MSA 539 Cases in Financial Management MSA 540 Cases in Investment Management FIN 498 Internship in Finance 2. Sample course materials (a small number of representative items is sufficient) In this section I provide sample course materials for all the courses that I am currently teaching: Fin 330 (Principles of Investments), Fin 336 (Intermediate Corporate Finance), Fin 335 (Principles of Financial Management), and Fin 495 (Seminar in Finance: The Prague Consulting Project). For each of the first three courses I provide (a) the syllabus; (b) one chapter of course notes; (c) selected homework or case assignments; and, (d) one exam. I also provide links where additional material may be accessed. For the Prague Consulting Project I provide the syllabus and additional course material exclusive to that course. Material for each sub-section (below) is provided in the Supporting Documentation. 2.a. Syllabus for Finance 330: Principles of Investments. The syllabus for this course is provided on line at http://www.csb.uncw.edu/people/comptonw/330syl.htm and updated each semester. 2.b. Chapter 1 notes for Finance 330: Principles of Investments. Notes are provided for all chapters at http://www.csb.uncw.edu/people/comptonw/330syl.htm. 2 2.c. Homework assignments for Finance 330: Principles of Investments. Homework assignments and extra credit are provided on line. I have provided 3 assignments (Chapter 1, 2, and 5) in the Supporting Documentation. A complete set of assignments is at http://www.csb.uncw.edu/people/comptonw/330syl.htm. 2.d. Exams for Finance 330: Principles of Investments. Three exams are given during the semester in the format shown in the Supporting Documentation. 2.e. Syllabus for Finance 336: Intermediate Corporate Finance. The syllabus for this course is provided on line at http://www.csb.uncw.edu/people/comptonw/336syl.htm and updated each semester. 2.f. Chapter 4 notes for Finance 336: Intermediate Corporate Finance. Notes are provided for all chapters at http://www.csb.uncw.edu/people/comptonw/336syl.htm. 2.g. Homework, mini-case, and team presentations assignments for Finance 336: Intermediate Corporate Finance. All assignments are provided on line for all 10 chapters. I have provided 2 homework assignments (Chapter 2, and 8), 2 mini-case assignments, and the complete team presentation assignment, along with the final peer evaluation form that students complete at semester’s end in the Supporting Documentation. A complete set of assignments is at http://www.csb.uncw.edu/people/comptonw/336syl.htm. 2.h. Exams for Finance 336: Intermediate Corporate Finance. Three exams are given during the semester in the format shown in the Supporting Documentation. 2.i. Syllabus for Finance 335: Principles of Financial Management. The syllabus for this course is on line at http://www.csb.uncw.edu/people/comptonw/335syl.htm and updated each semester. 2.j. Chapter 4 Notes for Finance 335: Principles of Financial Management. Notes are provided for all chapters at http://www.csb.uncw.edu/people/comptonw/335syl.htm. 2.k. Homework assignments for Finance 335: Principles of Financial Management. Homework assignments and extra credit are provided on line for all chapters in the format shown in the Supporting Documentation. I have provided 2 assignments (Chapters 9 and 12) in the Supporting Documentation. A complete set of is at http://www.csb.uncw.edu/people/comptonw/335syl.htm. 2.l. Exams for Finance 335: Principles of Financial Management. Three exams are given during the semester in the format shown in the Supporting Documentation. 2.m. Description and syllabus for Finance/Marketing 495: Seminar in Finance-the Prague Consulting Project. The syllabus for this course is provided online and updated each semester at http://www.csb.uncw.edu/people/comptonw/Classes/prague/New Class 2014. 3 2.n. Christmas break assignment for Finance/Marketing 495: Seminar in Finance-The Prague Consulting Project: Students must complete this assignment by the FIRST day of spring classes. It is designed to prepare the students for the journey ahead with some basic skills and knowledge that they will need for the consulting project. This assignment is provided online at http://www.csb.uncw.edu/people/comptonw/Classes/prague/New Class 2015. 2.o. This is the spring 2015 consulting assignment given to the Prague Consulting Project students. Every year it is different and is developed in consultation with GIOBA, the project host company. The project assignment for the class of 2015 is provided online at http://www.csb.uncw.edu/people/comptonw/Classes/prague/New Class 2015. 4 3. Summary of student evaluations: O.I.R. Report-November,25, 2014 5 4. Summary of peer evaluations of teaching (Complete peer evaluations are provided in the Supporting Documentation section IV.A.4.) 4.a. Faculty Peer Observation-April 3rd, 2014 (Dr. Kevin Sigler) 4.b. Faculty Peer Observation-April 4th, 2013 (Dr. Kevin Sigler) 4.c. Faculty Peer Observation-April 11th, 2012 (Dr. Nivine Richie) 4.d. Faculty Peer Observation-April 4th, 2011 (Dr. Kevin Sigler) 4.e. Faculty Peer Observation-March 26th, 2010 (Dr. Kevin Sigler) 4.f. Faculty Peer Observation-February 12th, 2010 (Dr. Nancy Hritz-UNCW Department of Health & Applied Human Science) 4.g. Faculty Peer Observation-November 24th, 2009 (Dr. Kevin Sigler) 4.h. Faculty Peer Observation April 23rd, 2008 (Dr. Robert Burrus) 4.i. Faculty Peer Observation February 6th, 2007 (Dr. Kevin Sigler) 4.j. Faculty Peer Observation October 12th, 2006 (Dr. Kevin Sigler) 4.k. Faculty Peer Observation March 22nd, 2005 (Dr. Kevin Sigler) 4.l. Faculty Peer Observation September 9th, 2004 (Dr. Kevin Sigler) 4.m. Faculty Peer Observation April 25th, 2003 (Dr. Chris Dumas) 4.n. Faculty Peer Observation June 18th, 2002 (Dr. Joe Farinella) 6 5. Academic advising within the department Semester Student # Fall 2014 35 Special transfer student advising August 13, 2014 Spring 2014 26 Fall 2013 36 Spring 2013 26 Fall 2012 29 Spring 2012 22 Fall 2011 27 Spring 2011 24 Fall 2010 28 Spring 2010 34 Fall 2009 31 Spring 2009 33 Fall 2008 35 Spring 2008 32 Fall 2007 33 Spring 2007 33 Fall 2006 33 Spring 2006 29 Fall 2005 29 Spring 2005 29 Fall 2004 29 Spring 2004 30 Fall 2003 30 Spring 2003 30 Fall 2002 30 Spring 2002 24 Fall 2001 24 Spring 2001 25 Fall 2000 25 7 B. Optional subcategories: 1. Courses developed/revised/new to the individual or to the university FIN 495 Prague Consulting Project MSA 540-spring 2001&2, fall 2002(Cases in Investment Management) Custom Published Textbook MSA 539-spring 2001&2, fall 2002(Cases in Financial Management) Custom Published Textbook MBA 536 spring 2005&6, fall 2006 (Investment Management) Custom Published Textbook 2. Special initiatives/incentives in teaching; cite specific examples May, 2014: Attended “Tawnya Means: Improving Teaching, Engagement & Assessment for Online or Experience and Knowledge Base” in the CSB November 4, 2013: Certificate of Attendance-UNC Wilmington Center for Teaching Excellence QEP Funded Proposals February 8, 2013: Certificate of Participation-ETEAL Critical Reflection Scoring Workshop April 17, 2013: Certificate of Attendance-Managing Group Projects to Maximize Learning and Minimize Chaos October 4-5, 2112: Attended the AACSB Applied Learning Conference in Tampa June, 2012: Attended a presentation by Dr. Ashe on the new IDEA Student Evaluation System that will replace SPOTS system at the UNCW Center for Teaching Excellence (pro-bono). May 9, 2012: Participated in the “Classroom of the Future Advisory Council” inaugural meeting December 1, 2011: Graduation Project Presentations Judge-Isaac Bear Early College High School November, 2011: Attended “Flipped Classroom” video tele-conference 8 3. Efforts to improve teaching, evidence of self-learning, and evidence of commitment to fostering the intellectual development of students (Comments from students, including those of the Prague Consulting Project class, are provided in the Supporting Documentation section IV.B.3.) 2013-2014 One of the great advantages of teaching in the Cameron School of Business is the quality of the study abroad experience at UNCW and the success of the Office of International Programs (OIP) in providing support and guidance at all levels. My own experience with OIP in teaching the Prague Consulting Project (Fin 495) has been very rewarding. That course requires the students to perform companyspecific research for companies located in Central and Eastern Europe (CEE) and to present the results of their research in person to the client in Prague, Czech Republic and thereby gain first-hand experience in fielding questions and working with business professionals in a culture outside their own. Additionally, students attend lectures delivered by local professors and/or local business practitioners while visiting Prague. These have been very useful to the students and have given them the opportunity to extend their networks overseas. Students also visit local or multi-national businesses (such as Riverside Partners, GE Money Bank, and Radio Liberty) operating in and around Prague. Last year (spring, 2014) the students developed a financial valuation and a marketing strategy for two firms in the transportation industry and their analysis included translating and analyzing the financial statements of the target firms and competitors in the Czech Republic and Central Europe. The 2015 class will be the sixth year for this program at UNCW and the fourth year that I have been involved with. At a recent conference (Fall 2013) of the Academy of Business Education I presented a paper on my experience teaching the Prague Consulting Project and had the opportunity to compare notes with academics from across the nation on study abroad programs. Through these discussions I learned that UNCW is well in advance of many institutions in the administration and leadership of its OIP office. I believe that actively encouraging our students to seek out and take advantage of the study abroad opportunities will garner support and (potentially) funding resources from campus-wide initiatives to provide experiential learning outside of the classroom. In 2014 I was awarded a $3,500 ETEAL Supported Pedagogy Initiative Grant for my continued work with the Prague Project. In my other teaching assignments, during the fall 2013 semester, I began using a hybrid, simulcast technology through the distance learning class in the Teaching Lab Building (TL 2053) for teaching Principles of Investments (FIN 330) to students in Jacksonville and Wilmington. The opening of the CSB Distance Education Classroom in November 2013 was the next major step toward providing a comprehensive online learning experience for students and I am now using this experience to collaborate on research documenting aspects of teaching in this environment with colleagues in the Economics and Finance department and the Marketing department of the CSB. 9 2011-2012 During the 2012 spring semester I began using case analysis in Fin 336 (Intermediate Corporate Finance) with graded mini-cases designed to develop knowledge and skills that the students would then apply during class presentations (team projects) in the last 2 weeks of class. These have been well received and give the students the public speaking and presentation skills that they need…and students love it. During the 2011 spring semester I made spreadsheet modeling in Excel a significant component of Fin 336 (Intermediate Corporate Finance). Students were required to use EXCEL to create cash flow spreadsheets, download stock price data and use the data to calculate betas and then download company data and use the data to compute company ratios. The capstone of the EXCEL projects was a detailed cash flow forecasting spreadsheet followed by an analysis of cash flows using standard decision criteria (NPV, IRR, payback, and accounting rate of return). The class required updated class notes (approximately 120 pages of notes and another 100 pages of supplements). It also expanded my use of internet videos (YouTube), to learn skills not acquired in class and as additional practice and support for topics covered in class. 2009-2010 In Fin 335 (Principles of Financial Management) I continued the use of YouTube videos to teach skills not taught in class and to enhance homework understanding and enjoyment. Students were asked to respond to the homework assignments with a rating system of each video so that I can cull out the bad videos and retain the useful ones. 2007-2008 I improved online lecture notes for all my classes and created internet links embedded in homework assignments to supplement course material. This year I continued a bonus points plan for students who read the chapters and answer (briefly) the thought provoking “Self-test Questions” embedded within each chapter. The students are better prepared each day and they love the opportunity to earn extra points for doing things that we used to do (back when I was an undergrad student) just to survive in class. I have expanded the use of motivational cues in my grading system, such as points for 100% attendance, for homework, and for reviewing chapters before the lecture, all of which has proven to be popular with the students. My course notes also continue to be popular with the students and it also supports of the current “paperless University” program. I also award bonus points for showing up for class the day after Halloween and St. Patrick’s Day and I added bonus points for the students who applied a stock valuation metric to GE stock. 2005-2006 I developed a new custom published textbook for MBA 536 (Investments). The new textbook included cases that I selected to be used by MBA teams in case analysis. I have used this method in the past, but adapting it to the class at 10 UNCW, with their wide range of skill levels and large class size (over 50), required considerable modification. I continue to scour the internet to access syllabi and course descriptions and ideas from faculty around the country, and scan practitioner’s journals for articles relating to teaching methodologies that have been successfully implemented in order to gather new ideas for my classes. This is particularly true for Fin 330 (Principles of Investments), since it will be a course that I hadn’t taught in four years and I was interested in finding new ways to present this material to finance and non-finance majors alike. I adopted a new textbook for Fin 330 (Principles of Investments). I personally evaluated the new text and discussed this textbook with a colleague at UNCW and at another institution. In Fin 336 (Intermediate Corporate Finance) my teaching methods are still primarily lecture plus significant problem assignments. This year I incorporated a bonus points plan for students who read the chapters and answer (briefly) the thought provoking “Self-test Questions” embedded within each chapter. The students are better prepared each day and they love the opportunity to earn extra points for doing things that we used to do (back when I was an undergrad student) just to survive in class. While my teaching methodology continues to be primarily lecture in the Intermediate Finance course, I have adopted a more interactive, case presentation methodology in the Fin 439 (Multinational Finance) class. Students are required to present cases as a group to the rest of the class, based on material presented in class and their own research efforts. I have thrown out the case presentations in Fin 439 (Multinational Finance) class, and simply adopted a 5 minute current events presentation for 3 students each class period. The students enjoy this and it gives them a chance to judge and be judged by their peers not only on the material but also on their public speaking skills. As I explained to them in class, it gives them an opportunity to speak to a group for a brief period of time (five minutes) which allows them to better gauge the time required for a short presentation. 2003-2004 My teaching methods of reaching out to the students on a more interactive and personal level continues to yield positive results. I have expanded the use of motivational cues in my grading system, such as points for 100% attendance and for homework, which has proven to be popular with the students. My course notes also continue to be popular with the students and it also supports of the current “paperless university” program. This year I was voted the “Favorite Professor in the Economics and Finance Department” by the students and was presented with a certificate at the May 2004 Faculty Appreciation Day ceremony. 11 Initiatives to improve courses: 1. Developed and improved online lecture notes for all courses. 2. Created video presentations to supplement course material using Betacalc to create a short demonstration on how to use Excel to run a regression and calculate beta. 3. Created Internet links embedded in homework assignments to supplement course material: 4. Developed and applied course survey to all classes that measures student response to online material and strives to identify areas of improvement. I have continued to eliminate the use of overheads and emphasize more use of the chalk board and active visual and verbal stimuli into my lectures. I have also expanded the use of motivational cues in my grading system, such as points for 100% attendance and for homework, which has proven to be popular with the students. My course notes also continue to be popular with the students and, in support of the current “paperless University” program, I have continued to direct students to the CSB “Student Resources Website” for instructional material. The following quote is drawn from the department chair’s evaluation for my RTP packet to associate with tenure: No other instructor in my department uses the latest teaching technology more than does Professor Compton. He worked closely with Dana Little of the UNCW-ITSD to develop audio/visual teaching modules. As an instructor in the area of finance, he makes extensive use of the internet in his class assignments to include multiple links to financial data bases. His syllabi are hyperlinked to allow the student to interact with him, to access numerous sites, and to access a variety of technical applications (interactive technology) that Professor Compton has developed to serve as examples. It is apparent to me that he is truly student oriented and wants each of his students to rise to their potential. As indicated above Professor Compton teaches in the graduate program, the Master of Science in Accountancy. He customized his required text for this course to more succinctly fit the nature of the course. (Luther Lawson, Department Chair) The following quote is drawn from the Dean of the Cameron School of business in his evaluation for my RTP packet to associate with tenure: Dr. Compton is a good, effective classroom teacher as demonstrated by both student and peer evaluations…Dr. Compton is among the leaders within the Cameron School of Business in his usage of ancillary technology in his classroom. By his usage of this technology, Dr. Compton helps his students better envision and understand critical financial principles. Dr. Compton is an extremely collegial individual that might 12 explain why he has helped the Department by teaching more different preparations than anyone else (and possibly more than anyone else with in the School). (Lawrence S. Clark, Dean) 2001-2002 I have found that less use of overheads and more use of the chalkboard and extemporaneous lecture are yielding greater interest by the students. It appears that they respond to active visual and verbal stimuli. I intend to incorporate more of that into my lectures in the future. I have also included numerous motivational cues in my grading system, such as points for 100% attendance and for homework, which should help to guide them to greater success in the Intermediate Financial Management course. I adopted a new textbook for Fin 336: Intermediate Corporate Finance by Brigham, Gapinski and Daves. The new textbook has been adopted to address numerous criticisms about the previous textbook (Ross, Westerfield, and Jaffe). I personally evaluated the new text, discussed this textbook with a colleague at another institution, and requested that a former student of Fin 336 review the new text. I developed a new course note packet to accommodate the new textbook. The new text and notes were adopted for the fall 2001 semester. The notes have been significantly revised in content and presentation. The presentation style of the notes has been redesigned to accommodate the more active classroom style that I have adopted, beginning in the summer 2001 session. Adopted a new, more active classroom presentation style in the summer 2001 session following discussions with Roger Hill and Pete Schuhmann. This approach will be further developed for the FALL/SPRING semesters. Complete comments from the summer session student evaluations following this change have been summarized and are also included with this Development Plan. These comments indicate the following: 1. Students overwhelmingly approve of the use of a course note packet and consider it a very beneficial part of the course. 2. Students’ evaluation of the STRENGHTS of the professor included: Enthusiasm, knowledge of the area, great organization and concern for students’ understanding, efficient in presenting the material, he knows everything about corporate finance and makes it more fun to learn. 3. Students’ listed the following as AREAS FOR IMPROVEMENT: Slow down and use more examples in class, spend more time on the subjects, slow down and maybe go over important things twice. 4. Students’ evaluation of the NATURE OF THE COURSE included: Challenging, very challenging but about the right level, and testing required knowledge of the material, not just memorization – excellent! 13 The new classroom style, which includes more active use of the chalkboard and less reliance on using overheads of the notes, appears to be working. Due to the students’ perception of the nature of the course as very challenging and difficult, I have found that a combination of notes and interactive class presentation appears to be a more effective approach. I will continue developing this style and add more in-class problems and question/answers sessions to slow down the pace. I created a new custom note set for MSA 539 (Cases in Financial Management) and MSA 540 (Cases in Investments Management) and discarded the custom published books original developed for the spring 2001 class. I also discarded the articles drawn from a Book of Readings (by Chew) as too difficult for accounting students with non-business backgrounds. 4. Grants and fellowships related to teaching at all levels including K-12 ETEAL Supported Pedagogy Initiative Grant (2014-2015: $3,500-competitive) Fin/Mkt 495: Prague Consulting Project 2014-2015 (William Compton & Fredrika Spencer)-UNCW’s Quality Enhancement Plan (QEP) supports faculty, staff, and students’ efforts to enhance academic achievement through applied learning. Initiative grants are awarded by ETEAL to encourage and reward applied learning with students during AY 2014-2015. Status: Grant awarded 10/22/2014 for $3,500. Project is underway. 5. Honors, listings, or awards related to teaching CSB Impact Professor every year 2000-2014: 42 Student comments May 5, 2014: Certificate of Appreciation for Outstanding Dedication to ETEAL (Experiencing Transformative Education through Applied Learning) May, 2004: Voted Favorite Economics & Finance Professor at CSB Faculty Appreciation Day 6. Membership in professional societies primarily devoted to teaching Member of the Academy of Business Education 7. Attendance at professional meetings or sessions primarily devoted to teaching Annual Meeting of the Academy of Business Education in Bermuda (September, 2013) Member of the inaugural University Classroom of the Future Advisory Council headed by Ms. Leah Kraus, Interim CIO-IT Systems (2011) 14 UNCW QEP ETEAL Critical Reflections Scoring Workshop (2013) Attendance at 6 UNCW Center for Teaching Excellence Workshop (2010- 2013) AACSB Applied Assessment Seminar in Tampa, Florida (2011) UNCW Education Abroad Training Workshop (2011) Attended the 11th Annual Economics Teaching Workshop at the Holiday Inn on Wrightsville Beach, North Carolina (2011) Panelist at the Annual Eastern Finance Association Conference on the topic of “Teaching Applications Using Trading Floors” (2002) Attended the inaugural “Teaching and Learning Economics through Writing” workshop sponsored by the UNCW Center for Teaching Excellence & the CSB Economics and Finance department (2001) V. Research, Scholarship, and Artistic Achievement A. Required subcategories: 1. Refereed publications (including juried or peer-reviewed performances, exhibits, artistic works, productions or writings) a. Published The following is a list of blind refereed publications. Complete works are found in section V.A.1. of the Supporting Documentation “The Durbin Amendment and Debt Card Fee Regulation: Its Impact on Card Companies, Variety Stores, and Restaurants,” Journal of Business and Economic Perspectives, Vol. 41, No. 1, 2014, 93-103 (Kuhlemeyer, G., Compton, W., Kunkel, R.) “Calendar Anomalies in Russian Stocks and Bonds” Managerial Finance, Vol. 39, No. 12, 2013, 1138-1154 (Compton, W., Kunkel, R., Kuhlemeyer, G.) “NBA Gambling Inefficiencies: A Second Look,” The Sport Journal, Vol. 15, 2012, 1-11 (Compton, W., Sigler, K.) “Adjusting Savings to Reach Retirement Goals,” Journal of Global Business Development, Vol. 3, No. 1, 2011, 77-79 (Compton, W. Sigler, K.) 15 “Ukrainian Financial Markets, An Examination of Calendar Anomalies,” Managerial Finance, Vol. 36, No. 6, 2010, 502-510 (Depenchuk, I., Compton, W., Kunkel, R.) “Is it Reasonable for State Courts to Mandate the Discount Rate?” Journal of Global Business Development, Vol. 2, No. 2, 2009, 94-102 (Compton, W., Farinella, J.) “The Weekend Effect and Intraday Returns: Evidence from the Asian Markets,” Journal of the International Society of Business Disciplines, Vol. 3, No. 5, 2007, 53-64 (Compton, W., Kunkel, R.) “The Turn-of-the-Month Effect in Real Estate Investment Trusts (REITs),” Managerial Finance, Vol. 32, No.12, 2006, 969-980 (Compton, W., Johnson, D., Kunkel, R.) “An Analysis of the January Effect in the Asian Markets,” Journal of the Academy of Finance, Vol. 1, No.1, 2003, 73-85 (Beyer, S., Compton, W., Ragan, K.) “Is There a Weekend Effect in Europe? An Analysis of Daily Returns, Non-Trading Returns, and Trading Returns,” Global Business and Finance Review, Vol. 8, No. 1, 2003, 77-87 (Compton, W., Kunkel, R.) “The Turn of the Month Effect Still Lives: The International Evidence,” International Review of Financial Analysis, Vol. 12, No. 2, 2003, 207-221 (Kunkel, R., Compton, W., Beyer, S.) “The Evolving Turn-of-the-Month Effect: Evidence from Pacific Rim Countries,” Global Business and Finance Review, Vol. 7, No. 1, 2002, 27- 37 (Compton, W.) “Examining America’s Logistics Programs Via the Internet,” Journal of Transportation Management, Vol. 12, No. 1, 2001, 19-33 (Hanna, J., Compton, W.) “Tax-Free Trading on Calendar Stock and Bond Market Patterns,” Journal of Economics and Finance, Vol. 24, No. 1, 2000, 64-76 (Compton, W., Kunkel, R.) “Historical Return Distributions for Puts, Calls, & Covered Call Options,” Journal of Financial and Strategic Decisions, Vol. 13, No. 1, 2000, 15-33 (Benesh, G., Compton, W.) 16 “A Tax-Free Exploitation of the Weekend Effect: A “Switching” Strategy in the College Retirement Equities Fund (CREF),” American Business Review, Vol. 17, No. 2, 1999, 17-23 (Compton, W., Kunkel, R.) “A Tax-Free Exploitation of the Turn-of-the-Month Effect: C.R.E.F.,” Financial Services Review, Vol. 7, No. 1, 1998, 11-23 (Kunkel, R., Compton, W.) “Optimal Asset allocation and Political Gridlock,” Midwest Review of Finance and Insurance, Vol. 12, No. 1, Spring 1998, 230-238 (Ebeid, F., Compton, W., Beyer, S.) “Industry Taxation: Commercial Banks Versus Manufacturers,” Midwest Review of Finance and Insurance, Vol. 12, No.1, Spring 1998, 1927 (Kunkel, R., Compton, W.) “A Possible Source of Bias in Options Studies Using the Berkeley Options Data Base,” Midwest Review of Finance and Insurance, Vol. 11, No. 1, Spring 1997, 99-106 (Compton, W., Benesh, G.) b. Accepted for publication NONE c. Under consideration NONE 2. Publications (or performances, exhibits, artistic works, productions or writings) not listed in the refereed category (e.g., abstracts, book reviews) a. Published "Using Virtual Stock Exchange in the Classroom," Proceedings of the 2003 Annual Meeting of the Academy of Finance in Chicago, IL. "Price-Cash Flow Analysis, A P/E Alternative," Proceedings of the 1997 Annual Meeting of the American Society of Business and Behavioral Sciences in Las Vegas, NV. b. Accepted for publication NONE c. Under consideration 17 NONE 3. Research grants or research fellowships a. Awarded (include dates and amounts) A complete description of research grants and status are found in section V.A.3. of the Supporting Documentation SHAHS Research and External Support Grant (2014-2015: $4,500) CSB Summer Research Grant (2013: $6,000) BB&T Summer Research Grant (2011: $4,200) CSB Summer Research Grant (2002: $4,800) CSB Summer Research Grant (2001: $4,200) First Union Research Grant (2001: $4,000) b. Applied for (include dates and status) NONE 4. Grants or research fellowships for off-campus study or professional development NONE a. Awarded (include dates and amounts) b. Applied for (include dates and status) 5. Presentations (including readings, lectures) at professional meetings "A Faculty-led, Undergraduate Short-term Study Abroad, Consulting Experience," 2013 Annual Meeting of the Academy of Business Education in Bermuda. "Ukrainian Financial Markets: An Examination of Calendar Anomalies," 2009 Annual Meeting of the Academy of Finance in Chicago, IL. "The Turn-of-the-Month Effect in Real Estate Investment Trusts (REITs)," 2005 Annual Meeting of the Southern Finance Association in Key West, FL. 18 "Quantifying the Monetary Variation of Using Different Accepted RiskFree Rates," 2004 Annual Meeting of the Academy of Economics and Finance in Charleston, SC. "The Evolving Turn-of-the-Month Effect: Evidence from Pacific Rim Countries,” 2003 Annual Meeting of the Southern Finance Association in Charleston, SC. "Day-of-the-Week Returns During Trading and Non-Trading Periods: Evidence from Europe," 2003 Annual Meeting of the Academy of Economics and Finance in Savannah, GA. "Using Virtual Stock Exchange in the Classroom," 2003 Annual Meeting of the Academy of Finance in Chicago, IL. "The Fading Pacific Basin January Effect," 2002 Annual Meeting of the Eastern Finance Association in Baltimore, MD. "The Turn-of-the-Month Effect Still Lives: The International Evidence," 2001 Annual Meeting of the Financial Management Association in Toronto, ONT. "Tax-Free Trading on Seasonal Stock and Bond Market Patterns," 1999 Annual Meeting of the Financial Management Association in Orlando, FL. "A Tax-Free Exploitation of the Weekend Effect," 1998 Annual Meeting of the Financial Management Association in Chicago, IL. "A Tax-Free Exploitation of the Turn-of-the-Month Effect," 1998 Annual Meeting of the Eastern Finance Association in Williamsburg, VA. "Optimal Asset Allocation and Political Gridlock," 1998 Annual Meeting of The Midwest Academy of Finance and Insurance in Chicago, IL. "Industry Taxation: Commercial Banks vs. Manufacturers," 1998 Annual Meeting of the Midwest Academy of Finance and Insurance in Chicago, IL. "Price-Cash Flow Analysis, A P/E Alternative," 1997 Annual Meeting of the American Society of Business and Behavioral Sciences in Las Vegas, NV. 19 "A Possible Source of Bias in Options Studies Using the Berkeley Options Data Base," 1997 Annual Meeting of the Midwest Academy of Finance and Insurance in Chicago, IL. "Historical Return Distributions for Common Option Strategies," 1996 Annual Meeting of the Southern Finance Association in Key West, FL. "Overreaction to Negative Earnings," 1995 Annual Meeting of the Eastern Finance Association in Hilton Head, SC. 6. On-going research projects, programs and goals "Live vs Live Streaming: Comparing Identical Cohorts" – co-investigators William Compton, James Hunt, & Adam Jones) Complete work is found in section V.A.6. Supporting Documentation. “An exploratory analysis of hotel REITs: Implications for New Hanover and surrounding counties”- co-investigators William Compton & Nancy Hritz. Details provided in section V.A.6. Supporting Documentation. “A faculty-led, undergraduate short-term study abroad, consulting experience”- coinvestigators William Compton, Fredrika Spencer, & Nivine Richie. Details provided in section V.A.6., Supporting Documentation. B. Optional subcategories: 1. Honors or awards for: a. Research or artistic efforts b. Professional development efforts 2. Membership in professional societies American Association of Individual Investors Academy of Business Education Financial Management Association Academy of Financial Services Eastern Finance Association Southern Finance Association Southwestern Finance Association Midwest Business Administration Association 3. Attendance at professional meetings 2013 Annual Meeting of the Academy of Business Education in Bermuda. 2009 Annual Meeting of the Academy of Finance in Chicago, IL. 2005 Annual Meeting of the Southern Finance Association in Key West, FL. 2004 Annual Meeting of the Academy of Economics and Finance in Charleston, SC. 20 2003 Annual Meeting of the Southern Finance Association in Charleston, SC. 2003 Annual Meeting of the Academy of Economics and Finance in Savannah, GA. 2003 Annual Meeting of the Academy of Finance in Chicago, IL. 2002 Annual Meeting of the Eastern Finance Association in Baltimore, MD. 2001 Annual Meeting of the Financial Management Association in Toronto, ONT. 1999 Annual Meeting of the Financial Management Association in Orlando, FL. 1998 Annual Meeting of the Financial Management Association in Chicago, IL. 1998 Annual Meeting of the Eastern Finance Association in Williamsburg, VA. 1998 Annual Meeting of The Midwest Academy of Finance and Insurance in Chicago, IL. 1997 Annual Meeting of the American Society of Business and Behavioral Sciences in Las Vegas, NV. 1997 Annual Meeting of the Midwest Academy of Finance and Insurance in Chicago, IL. 1996 Annual Meeting of the Southern Finance Association in Key West, FL. 1995 Annual Meeting of the Eastern Finance Association in Hilton Head, SC. 4. Supervision of graduate or undergraduate theses or extensive projects that involve research or artistic efforts Hector Martin Bernabeu-Cameron School of Business. The Determinants of the Value of Soccer Players in the Top Five European Leagues. Defended May 2014-UNCW Honors College. (Faculty Supervisor: Dr. William Compton) 5. Special research or artistic efforts (e.g., participating on a team at an off-campus laboratory, performing in a statewide orchestra) 6. Special initiatives in on-campus scholarly or professional development 7. Faculty engagement. a. Research or artistic efforts related to engagement. b. Grants awarded and applied (include dates and status) related to engagement c. Funded outreach, such as funding to public schools and STEM involvement. d. Technology Transfer and Patents. e. Collaborative efforts with the community resulting in recognized benefits for the public good. f. Reviewed publications resulting from work in the community. 8. Continuing education, workshops, symposia, or other specialized training programs attended or completed 9. Formal off-campus traineeships 10. Professional consultancies resulting in professional development a. Paid b. Pro bono 11. Other scholarly or professional efforts 21 VI. Service A. Required subcategory: Service to the university 1. University committee memberships, leadership positions, or administrative duties ETEAL Advisory Committee (2013-present) Certificate of Appreciation for Outstanding Dedication to ETEAL (May 5, 2014) University Studies Committee (2011-2013) Multiple faculty receptions for University Studies Committee and ETEAL at the Clock tower Lounge 2. College or school committee memberships, leadership positions, or administrative duties CSB Assurance of Learning Committee (2011-present) CSB Strategy Committee (2012-present) CSB Business Week Faculty Host (2014, 2012, 2011) Provided speaker Jack Ford for 2011 Business Week CSB Freshman Convocation Small Group Leader (2012, 2011) CSB dinner with Harvey Pitt, former SEC Chair (2012) 3. Department committee memberships, leadership positions, or administrative duties 2005 E&F search committee with Dr. William Sackley in Denver, Co. (hired Cet Ciner) All departmental duties as assigned B. Optional subcategories: 1. Service to the university a. Student counseling; student advising other than routine work with department advisees (as in the Center for Academic Advising, clubs, campus groups, etc.) Grant proposal reviewer at the UNCW Center for Teaching Excellence (11/2013compensated) Attended a faculty reception for University Studies Committee at the Clock tower Lounge, 8/2012 (pro-bono) 22 b. Other service to the university 2. Service to professional or scholarly organizations a. Leadership in professional or learned societies b. Leadership in seminars or short courses taught to professionals in the candidate's discipline c. Professionally related activities (e.g., manuscript editor or editorial board member, artistic juror, grant or accreditation reviewer, advisor/leader/director in workshops or consultations) i. Paid ii. Pro bono 2014: I was a reviewer for Managerial Finance and reviewed the article “Monetary Policy and Firm’s Capital Structure”, Wilmington, North Carolina (pro-bono) 3/2013: I reviewed 4 papers for the 2013 Academy of Business Education in Bermuda (probono) 9/2012: I reviewed 8 papers for the 2013 Eastern Finance Association Conference in St. Pete Beach, Florida (pro-bono) 2012: I was a reviewer for the Financial Services Review and reviewed the article “Investigating the Effectiveness of Alternative Investment Strategies for REIT Portfolios”, Wilmington, North Carolina (pro-bono) 2009: I served as discussant at the Annual Academy of Finance meeting in Chicago, Illinois (probono) 2007: Served as outside committee member for Joseph Goebel’s promotion to associate with tenure at IUPUC-Division of Business, Columbus, Indiana (pro-bono) 2005: I was a reviewer for the Financial Review and reviewed the article “An Update on Market Anomalies in Daily Bond Returns”, Wilmington, North Carolina (pro-bono) 2003: I served as discussion moderator at the Academy of Economics & Finance annual meeting in Savannah, Georgia (pro-bono). 2003: I served as session chair at the Annual Southern Finance Association meeting in Charleston, South Carolina (pro-bono). 2003: I served as discussant at the Annual Southern Finance Association meeting in Charleston, South Carolina (pro-bono). 2002: I attended the end-of-the-year social of the Caper Fear NCWTA at the request of the students, Wilmington, North Carolina (pro-bono). 23 2002: I served as session chair at the Annual Meeting of the Financial Management Association in San Antonio, Texas (pro-bono). 2002: I served as a session chair at the 2002 Annual Eastern Finance Association Conference in Baltimore, Maryland (pro-bono). 2002: I served as a panelist at the 2002 Annual Eastern Finance Association Conference on “Teaching Applications Using Trading Floors” with Betty J. Simkins (Oklahoma State) and Roy A. Wiggins III in Baltimore, Maryland (pro-bono). 2002: I reviewed 2 papers for the 2002 Academy of Finance annual conference in Chicago, Illinois (pro-bono). 2002: I was a reviewer for the International Review of Financial Analysis and reviewed the article “Impact of the Federal Open Market Committee Meetings and Scheduled Macroeconomic News on Stock Market Uncertainty”, Wilmington, North Carolina (probono). 2002: I was a reviewer for the Global Business & Finance Review and reviewed the article “Intra-industry Effects across Countries”, Wilmington, North Carolina (pro-bono). 2001: I was a reviewer for the Global Finance Journal and reviewed the article “The diminishing Weekend Effect: Experience of Five G7 Countries”, Wilmington, North Carolina (probono). 2001: I was a reviewer for the Financial Review and reviewed the article “Levels of Multinationality as an Explanation for Post-Announcement Drift”, Wilmington, North Carolina (pro-bono). d. Other professional service 3. Community service a. Professionally related activities (e.g., boards, offices, presentations, workshops, continuing education programs, newspaper or magazine articles for the lay public) i. Paid ii. Pro bono 5/2011: I was a guest speaker and presented a seminar on investing for the Personal Financial Literacy for Civics and Economics Teachers of North Carolina event at the Watson College of Education in Wilmington, North Carolina (pro-bono) 2002: Speaker for an Executive Advisory Board Luncheon at the UNCW Executive Development Center in Landfall, Wilmington, North Carolina (pro-bono) b. Other community service 24 2002: Member and served as visitation chairperson for the non-profit Wilmington Lions Club, Wilmington, North Carolina (pro-bono) 2002: Led students of the Cameron School of Business FMA and NABE clubs on their annual “Adopt a Highway” cleanup on Carolina Beach Road, Wilmington, North Carolina (probono). 2001: Led students of the Cameron School of Business FMA and NABE clubs on their annual “Adopt a Highway” cleanup on Carolina Beach Road, Wilmington, North Carolina (probono). VII. Chair’s Evaluation A. Required subcategories: 1. Summary and evaluation of teaching that includes both student and peer evaluation of teaching as well as all other aspects of evaluation so that no single component of teaching evaluation is overweighted 2. Summary and evaluation of research, scholarship, and artistic achievement that includes a critical assessment of the value to the discipline of the applicant's contributions 3. Summary and evaluation of service B. Optional subcategories: 1. An explanation of any special circumstances that, in the chair's opinion, justify variation from the standards for promotion and/or tenure stated in the Faculty Handbook. 2. Comments submitted by senior faculty (Paraphrased comments may be used at the discretion of the chair. Neither quoted comments nor the identity of the source may be included without the permission of the senior faculty member being quoted.) VIII. Certification The evaluating officer shall: A. Certify the names of senior faculty who were assembled and consulted for this recommendation. B. State the department's current definition of "senior faculty" as determined by the chair and members of the department in consultation with the dean (a copy of which must be on file in the dean's office). C. State the numerical vote of the assembled senior faculty (the number for/against/abstaining; the officer shall not identify how individual faculty cast their votes). 25 D. If a majority of the senior faculty has prepared a separate, elaborated dissenting recommendation, insert that recommendation prior to forwarding the dossier to the dean. That recommendation must be signed by a majority of the senior faculty and should follow the same guidelines for content as that of the chair. 26