syllabus - Cameron School of Business

advertisement

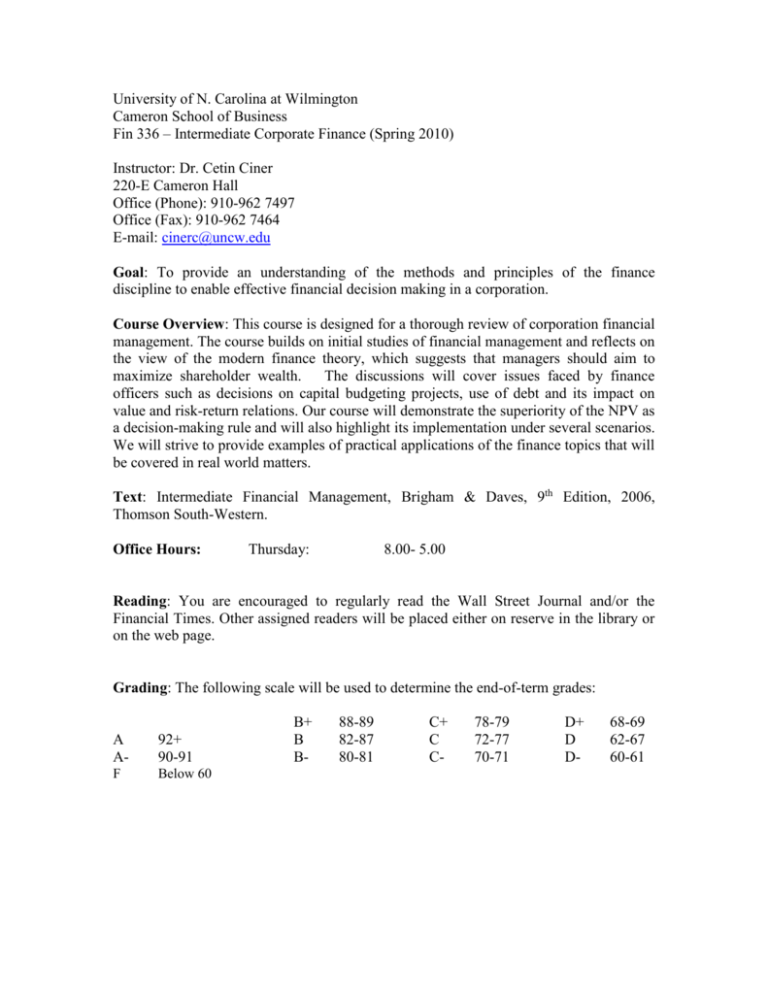

University of N. Carolina at Wilmington Cameron School of Business Fin 336 – Intermediate Corporate Finance (Spring 2010) Instructor: Dr. Cetin Ciner 220-E Cameron Hall Office (Phone): 910-962 7497 Office (Fax): 910-962 7464 E-mail: cinerc@uncw.edu Goal: To provide an understanding of the methods and principles of the finance discipline to enable effective financial decision making in a corporation. Course Overview: This course is designed for a thorough review of corporation financial management. The course builds on initial studies of financial management and reflects on the view of the modern finance theory, which suggests that managers should aim to maximize shareholder wealth. The discussions will cover issues faced by finance officers such as decisions on capital budgeting projects, use of debt and its impact on value and risk-return relations. Our course will demonstrate the superiority of the NPV as a decision-making rule and will also highlight its implementation under several scenarios. We will strive to provide examples of practical applications of the finance topics that will be covered in real world matters. Text: Intermediate Financial Management, Brigham & Daves, 9th Edition, 2006, Thomson South-Western. Office Hours: Thursday: 8.00- 5.00 Reading: You are encouraged to regularly read the Wall Street Journal and/or the Financial Times. Other assigned readers will be placed either on reserve in the library or on the web page. Grading: The following scale will be used to determine the end-of-term grades: A A- 92+ 90-91 F Below 60 B+ B B- 88-89 82-87 80-81 C+ C C- 78-79 72-77 70-71 D+ D D- 68-69 62-67 60-61 Graded Materials Mid-term examination I Mid-term examination II Final examination Homework and participation Total 25 points 25 points 40 points 10 points 100 points Examinations: All examinations will be closed-note, closed book and will consist of multiple choice questions. However, you can use a single 3x5 note card that contains only formula. You must turn in the card with your exam, if you choose to use one. Additional Points: Academic Honesty: As a student at UNCW, you are pledged to uphold and support the UNCW Student Academic Honor Code: The University of North Carolina Wilmington is a community of high academic standards where academic integrity is valued. UNCW students are committed to honesty and truthfulness in academic inquiry and in the pursuit of knowledge. This commitment begins when new students matriculate at UNCW, continues as they create work of the highest quality while part of the university community, and endures as a core value throughout their lives. Guidelines in support of the Honor Code, including definitions of cheating and plagiarism, may be found at: http://www.uncw.edu/policies/documents/03_100FINALHONORCODE_Aug2009.pdf Disabilities: Appropriate academic support is available for any student with a documented disability. Please notify me and/or contact the Office of Disability Services (3746) for further information. Calculator: A financial calculator, and the ability to use it, is required for this course. The BA II+ is recommended and should be brought to class every day. Time Value of Money exercises, including a list explaining BA II+ keys, are available online. Homework Policy: Assignments will consist of end of chapter problems that will be announced in class. Homework will be collected in class only, please do not email. Syllabus Chapter 1/6 Introduction/ Risk and Return 1/11 cont’d 1/13 cont’d 1/18 No Class 1/20 Bonds and their valuation 1/25 cont’d 1/27 Stocks and their valuation 2/1 cont’d 2/3 Accounting for Financial Management 2/8 Review 2/10 Midterm Examination I 2/15 Financial Statement Analysis 2/17 cont’d 2/22 Financial Planning and Forecasting Financial Statements 2/24 cont’d 3/1 Determining the Cost of Capital 3/3 cont’d 3/8 No class 3/10 No class 3/15 Corporate Value and Value-based Management 3/17 cont’d 3/22 Review 2 4 5 7 8 9 10 11 3/24 No class- Business Week 3/29 Midterm Examination II 3/31 Capital Budgeting: Decision Criteria 4/5 cont’d 4/7 Capital Budgeting: Estimating Cash Flows 4/12 cont’d 4/14 Bankruptcy, Reorganization and Liquidation 4/19 cont’d 4/21 Multinational Financial Management 4/24 Review for Final Examination 12 13 25 27