James Madison University

advertisement

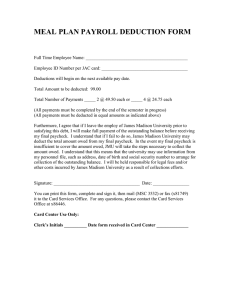

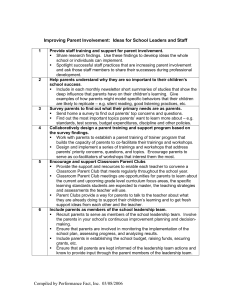

NCASFAA Spring 2012 Conference April 17, 2012 Wrightsville Beach, NC 1 Approximately 20,000 students, of which 18,000 are undergraduates Primarily 18-21 year olds who graduate high school and enroll full-time in college Male = 40% & Females = 60% In-state = 73% & Out-of-state = 27% Minority students = 13% 2 Mission Statement: We will ASSIST with identifying and obtaining resources to finance higher education; DELIVER funds in a timely and equitable manner; and EDUCATE, so that informed financial decisions can be made. 3 Dollars and Sense (will discuss more later) Faculty/Staff workshop series Workshops through various student organizations Workshops for parent groups Parent/Family Magazine articles Financial Literacy section of website (www.jmu.edu/finaid), includes items such as: ◦ ◦ ◦ ◦ CashCourse (NEFE) PowerPoints Budget case studies Many others and more to come Developing ecampus enhancements to assist with loan debt/repayment education Approximately 700 people attend our workshops 4 Where we pitched it: ◦ Student Focus Group Very supportive ◦ General Education Cluster Fit & Multiple Sections ◦ College of Education Referred ◦ College of Business Credentialing/ownership ◦ College Student Personal Administration (CSPA) Program Structured Program…delete a course to make room for this ◦ Orientation Time issues…full schedule (led to another program) ◦ President’s Office ◦ Outreach and Engagement (SUCCESS!) 5 Adult Degree Program (ADP) Bachelor’s of Individualized Study designation course (IS 275) 3 credit hours Open to any student as an elective Monday, 2:30pm – 5:00pm 6 Registration fills up after the first day Mostly graduating seniors Override requests are plentiful Holding class size at 25, but could easily run multiple sections Students consistently request adding this course to the GenEd curriculum 7 Foundations in Personal Finance College Edition (The Lampo Group) Supplemental materials gathered from: ◦ Self created ◦ Bankrate.com ◦ Family Economics & Financial Education (The University of Arizona) at http://fefe.arizona.edu/ ◦ Security and Exchange Commission Office of Investor Education and Advocacy at www.investor.gov ◦ The Ten Commandments of Financial Happiness (Jean Chatzky) ◦ Beyond Paycheck to Paycheck (Michael Rubin) ◦ Extra Credit – The 7 Things Every College Student Needs to Know about Credit, Debit & Cash (Bill Pratt) ◦ The Millionaire Next Door (Stanley and Danko) ◦ Personal Finance, Eight Edition, 2006 (Garman and Forgue) ◦ Various other resources 8 Students Watch video on Blackboard and complete workbook assignment before class Submit weekly journal article Read the assigned chapter Complete weekly Chapter Test (take home) Participate in activities and discussions in class, based on instructor created PowerPoint and other resources Financial Plan is due the last class 9 This is where you really learn what is on the mind of the student You will see a progression of them identifying their issues and problem solving resolutions You will witness their failures and successes They will validate what you do in the classroom They will give you ideas of what to bring into future classes Let’s look at a sample 10 Let’s Review It! 11 In 2011-12 we began putting a student’s loan debt on the award notice In 2012-13 we are working towards including the estimated monthly repayment amount Financial Education Committee (Mission and S.W.O.T.) ◦ ◦ ◦ ◦ ◦ ◦ ◦ ◦ ◦ Parent Relations Orientation College of Business Health Center University Business Office Career and Academic Planning Fraternity and Sorority Life Student Government Association Financial Aid 12 Brad Barnett, MS, AFC, CPFM SASFAA President James Madison University Senior Associate Director of Financial Aid E-mail: barnetbd@jmu.edu 13