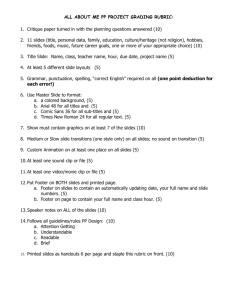

Price of food higher and more volatile Longer term analysis

advertisement

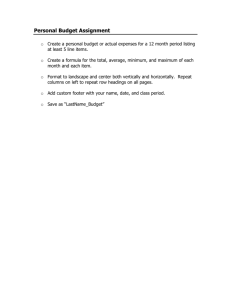

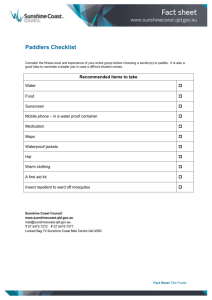

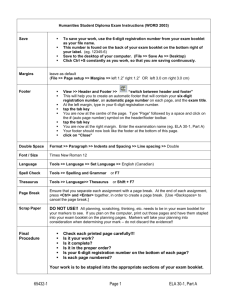

The Collaboration Journey of the Farming and Food Industry Hampshire Farming Conference 2011 David Neal-Smith European Food and Farming Partnerships LLP Introduction to EFFP The Curry Commission Started 2004 Reduction in agricultural support and protection Vision of very different food chain structure - Needed farmer involvement - Balance to retailer dominance Horizontal and vertical collaboration CONSUMERS FARMERS The economy catches a cold? Enter footer details Monday, March 14, 2016 Longer term analysis Feedback loops • Trade protection • Correlation with oil prices • Speculation Key demand drivers • Population & income growth • Shifting diets • Commodities for bio-fuels Price of food higher and more volatile Uncertainties • Russian export ban • Exchange rates Enter footer details Key supply drivers • Land availability •Water availability • Agricultural productivity •Climate change Food prices in perspective A century of grain prices The Great Grain Robbery 1973 The Second World War 1939 -1945 The Great Depression Source: EFFP research The Perfect Storm 2007 Affordability of food in perspective Consumer expenditure/retail food prices 100 Index Negative scenario Positive scenario ‘Age of prosperity’ 1986 – 2007 90 80 70 ‘Sombre decade’ 2010 onwards 60 50 40 Enter footer details 30 1987 1989 1991 1993 1995 1997 1999 2001 2003 2005 2007 2009 2011 2013 2015 2017 Strategic supply trinity b Security, stability and sustainability Supply Chain Success – what does it look like? Openfield and DHL – taking efficiency in logistics to a new level....... • Openfield – the largest farmer controlled grain marketing business in the UK • 4 million tonnes of combinable crops 7000 farmers • DHL Supply Chain – leading European logistics company working with EFFP to identify opportunities in agri-food supply chains • Identified potential 20% saving in grain haulage road miles by operating a centralised ‘Control Tower’ for Openfield • Operational from 2008 harvest 11 Enter footer details Arable growers – valuable long term collaboration with food manufacturers English Mustard Growers Cooperative working with Unilever to secure locally grown mustard for Colman’s 12 Enter footer details Potato producers collaborate to create dedicated crisping potato supply chain for United Biscuits New supply chains helps sustainability for the hills..... ‘National Trust’ branded beef into Booths Yorkshire and Lancashire supermarket chain 13 Enter footer details Swaledale lambs from seven hill farmers providing seasonal lamb to ASDA Sustainability benefits..... • Improved viability for hill farmers and farming • Environmental benefits through upland management with grazing livestock • Brand positioning opportunity for retailers whilst helping the agricultural industry 14 Enter footer details Large scale cooperative grain processing and storage leading to innovative marketing opportunities.... • Started in 1983 by 60 Cambridgeshire farmers who built 12,000 tonne store at Linton • Developed to 150,000 tonnes by 2005 with 300 members • New store constructed at Wilbraham, opened in 2009 increasing processing and storage to 300,000 tonnes • £20m invested including grant support through RDPE and earlier schemes 15 Enter footer details Camgrain now supply all Sainsbury’s in store bakeries.... An innovative new supply chain with Sainsbury’s, providing 60,000 tonnes of regionally sourced milling wheat to 360 in store bakeries. Benefits of this partnership: 16 • Long term premium market for Camgrain farmers • Platform to drive efficiencies within the supply chain • A sustainable source of supply to Sainsburys • A unique marketing proposition for Sainsburys; and • Ability to forward plan Enter footer details Key success factors…. Farmer investment Scale & service achieved through a collaborative approach Clear strategy – driven by the market needs and opportunities Focus on the customer and the benefits that can be achieved Resolving conflict! Price premium to the farmer in return for those benefits to the customer 17 Enter footer details

![[#OT-201] Inserting tracking scripts and footer on static html project](http://s3.studylib.net/store/data/008502538_1-4eb231c279e12e326c6735611513ab63-300x300.png)