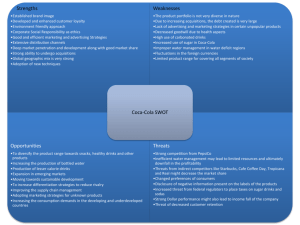

Social, Cultural, and Demographic Forces

advertisement

AGENDA Introduction Economic Forces Social, Cultural, and Demographic Forces Technological Forces Global Segments Competitive Forces Conclusion Bart Torrey Chad Bart Edward Leslie Edward Introduction + $154 Billion Industry Segments of the Industry Soft Drinks-$53.4 bill Beer-$53.28 bill Sports Drinks-$1.4 bill Bottled Water-$4 bill Fruit Drinks-$1.4 bill Worldwide Beverage Consumption Coffe & Tea 33% Water 46% Alcohol 6% Other 3% Soft Drinks 4% Juice 8% Growth Rates: Fastest Growing – Water - 9.5% – Sports Drinks - 8.3% Others – Soft Drinks-3.4% – Fruit Drinks-1.7% – Beer - 1.4% Driving Forces Expanding Market Power Desire to fill Consumer Need Personalization of the Market Segments Building Brand Recognition Maximization of Growth Potential Economic Forces Growth rate GDP GDP per capita Inflation Unemployment Economics Around the Globe GDP Growth GDP per capita Inflation $8.511 trillion 3.9% $4.42 trillion 7.8% $1.8 trillion 2.7% $31,500 $23,100 $8,300 $3,600 $22,100 1.6% Unem4.5% ployment U.S. $2.9 trillion -2.6% $815 billion 4.8% .9% 18.6% -.8% .9% 4.4% 2.6% 10% 10.6% Japan Mexico China Germany Discretionary Income in the U.S. Income is increasing in American households Consumers are spending more Consumers are saving less Impact of Economic Factors Demand on beverages should remain stable Brand label beverages should do well Low interest rates and low inflation provide new business opportunities Other Economic Factors to Consider Lower restrictions on trade and investment in foreign countries Foreign currencies are weak against the U.S. dollar Yen German Mark Mexican Peso various Asian currencies Markets for the Industry Markets are becoming international Latin American, Eastern European, and Asia-Pacific region countries are favorable Japan China Brazil Mexico Lithuania Thailand United Kingdom Social, Cultural, and Demographic Forces Ethnic/Age Demographics Hispanics-33% African-Americans14% Asian-American-49% Baby Boomers – health – convenience Younger generation Target Market Focus on tradition Stress convenience Marketing Strategies/ Expenditures DP/SU 21% Triarc 4% Coca-Cola 44% Pepsi 31% •Sports •Tradition Beverage Technology Product Labeler C H I C L A L N Pressure Sensor Life Top Package Injects Probiotic Bacteria ( Reuteri ) Bacteria lives 5 to 6 Days Extended Shelf Life “Good Bacteria” Superior Plastics Keep beverages from going flat Increased Shelf Life Gas-Tight Barriers Liquid Crystal Polymers “Chill Can” Bad Idea? Heat the Whole World with Greenhouse Effect Same Effect on Global Warming as Driving Car 200 Miles Not EPA Approved Synthetic Cork Guards against Cork Contamination Affinity Polyoleifin Plastomer Natural Cork 8% Failure Research/Survey Taste is one of top Determining Factors Desire for “Adult Sophisticated and Complex Taste” Strategy Implemented by Ocean Spray World Segment Coverage Area Important Factors Mergers Currency rates Health and Stability of economies World Cup Soccer North America Highest per capita consumption in the world Largest market sales Growth potential relatively small Latin America Population 481 million Young population Many individual cultures and tastes Europe Population of 866 million Strong increase with new governments in Eastern Europe Potential growth very high Middle and Far East Population of 3.6 billion Largest potential for growth Largest population concentration on Earth +29 billion 8 ounce servings per day Africa Population of 594 million Introduction of bottled drinks into everyday life increase amount of exposure on individual communities Competitive Forces Porter’s Five Forces Model Rivalry Among Competing Firms Level of intensity Implications Implications of Intensity New Product Introductions Sales Promotion Offers Price Wars Media Spending Media Expenditures 60.00% 50.00% 40.00% Coca-cola Pepsi Dr.Pepper RC 30.00% 20.00% 10.00% 0.00% 1994 1995 1996 1997 1998 Media Spending Fact Soft drink companies spent more than $530 million to promote their brands in 1998. Potential Entry of New Competitors Barriers to Entry Need for High Brand Experience Large Equity Curves Financial for Existing Resources Brands Substitute Products Wine/Spirits Milk Juices Fruit Drinks Coffee/Tea Gourmet Drinks Water Bargaining Power of Suppliers Competitive Prices Dependable Service Product Quality Supplier Reliability Turnaround Time Bargaining Power of Consumers Buying Private Label Brands Product Loyalty Changing Demands Fact One of every four beverages consumed in America is a soft drink Average over 56 gallons of soft drinks per year per individual. Mergers The Coca-Cola Company merges with Cadbury Schweppes Complements Snack Food Industry – potato chips – chocolate – peanuts Conclusion $154 Billion Dollar Industry Thriving World Market with High Growth Potential More “Health Conscious” World Intense Competition with Barriers to Entry Thank You