An economic analysis presented to the competition authority

advertisement

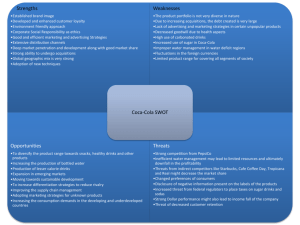

Fantasy Just Energy Inc. Merger An Economic Analysis Presented to the Competition Authority 11 March 2009 1 The Transaction Fantasy is to purchase Just Energy Inc. for 500 Million The Parties Fantasy : Nation’s leading processor and distributor of bottled water. Also active in functional beverages. Entered energy drink production 2 years ago (Emerge). Just Energy: #1 energy company. 2 Executive Summary The proposed merger is pro-competitive: - Product market is functional beverages Market shares are sufficiently small to annul any competitive concerns - Even with narrower market definition: Expansion and Entry are inexpensive and timely Strong countervailing buyer power Significant efficiencies will be realized, leading to lower prices 3 Product Market Correct definition – Functional beverages Indications for market definition: Serve same function Effect of sales of energy drinks on sales and prices of other alternatives Price correlations between goods 4 Product Market Functionality and Substitutability Energy Drinks and other functional beverages all serve the same function (energy burst), and are used for identical purposes. They also compete for shelf space. HENCE: Proper Market Definition: Functional Beverages = energy drinks + sports drinks + enhanced water 5 Product Market Functional Beverages 100 90 80 Sports Drinks Market share 70 60 50 Energy Drinks 40 30 Enhanced 20 Water 10 0 Energy drink success came at expense of sports drinks! 6 Market Shares In functional beverage market Market Share SportAde Thrive CraveAde Emerge E-Water Co. Bom Dia Others 32% 21% 9% 5% 7% 2% 25% Pre-merger HHI = 1624 Change in HHI = 210 Post-Merger HHI = 1834 With wider market definition (including soda) post-merger HHI less than 500 and change less than 100. 7 Overly narrow market definition assumed The competition authority’s view: Market is defined nation-wide Market includes energy drinks only, but excludes soda and even functional beverage alternatives Structure of national energy drink “market”: 66% Thrive 15% Fantasy’s Emerge 7% Bom Dia 4% Star/Astro 2% Meta/Shaolin-Zing 1-2% Ever/Tilt 4-5% Others 8 Merger is not anti-competitive even in an energy drink ‘market’ Competitors can easily expand production Most current competitors produce well below capacity Ease of entry: Firms poised to enter market Low cost of entry, consumers willing to switch Strong countervailing buyer power Convenience stores & supermarkets do not accept price increases Significant efficiencies Cost savings will be passed on to consumers 9 Ease of Expansion Most competitors are producing well below capacity Capacity Utilization Bom Dia 35% Meta/S-Zing 33% Star/Astro 92% Ever/Tilt 53% Bom Dia sales rapidly increasing In addition, cost of expansion minimal – 5MM Competitors would supply any decrease in output by merging parties 10 Ease of Entry Cost of Entry Processing Plant Production Line 15-25MM 5-10MM Timely entry – about 6-9 months from inception to production Numerous companies that can enter quickly (e.g., Pangea Beverages) Fantasy entered in 8 months, at a total cost of 25MM! 11 Ease of Entry Market Penetration Consumers have demonstrated willingness to switch between products Sports drink share of functional bev sales has decreased w/ rise of energy drinks Switch from sodas and sports drinks to energy Speedy penetration of emerge and Bom Dia: Emerge – captured 15% of energy sales in first year! Bom Dia – captured 7% of energy sales in first nine months! 12 Strong Buyer Power Retail stores do not accept price increases Highly concentrated: Top 4 convenience chains have more than 70% market share Battle for shelf space: Suppliers even have to pay fees for shelf space Stores would de-list supplier when attempting to raise prices Trend towards private labels: threaten to replace external supplier by own private label when not supplying at low prices 13 Significant Efficiencies Savings estimated at over 60MM per annum! Savings from: Increased production utilization Reduced purchasing costs Elimination of overhead Reduced payments for promotions More efficient utilization of branches Reduced shipping costs due to more optimal route structure Cost Savings will undoubtedly be passed on to consumers leading to lower prices 14