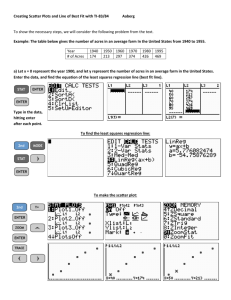

mid term lands - Genesis Land Development

advertisement

Genesis Land Development Corp. Uncommon Communities Presenters: Jeff Blair, CEO Simon Fletcher, CFO Forward Looking Statements Certain information included in this presentation constitutes forward-looking statements or information (“forward-looking information”) under applicable securities legislation. This information relates to future events or future performance of Genesis Land Development Corp. (“Genesis”). When used in this presentation, the words "may", "would", "could", "will", "intend", "plan", "anticipate", "believe", "estimate", "forecast", "predict", "seek", "propose", "expect", "potential", "continue", and other similar expressions, are intended to identify forward looking information. This information involves known and unknown risks, uncertainties, and other factors that may cause actual results or events to differ materially from those anticipated in such forward looking information. Such forward-looking information is provided for the purpose of providing information about management's current expectations and plans relating to the future. Reliance on such information may not be appropriate for other purposes, such as making investment decisions. Although management believes that the expectations reflected in such forward-looking information are reasonable, no assurance is given that such expectations will prove to be correct. Many factors could cause Genesis’ actual results, performance or achievements to vary from those described herein. Should one or more of these risks or uncertainties materialize, or should assumptions underlying forward-looking information prove incorrect, actual results may differ materially from those described in this presentation. Forward looking-information in this presentation may include, among others, information pertaining to the following: the completion of property, lot and homes sales, the timing and benefits thereof; the use of proceeds from any financing; opportunities and prospects; development of property, acquisition and disposition plans and opportunities and the timing thereof; potential development and sale of lots and homes, factors upon which Genesis will decide whether or not to undertake a specific course of action; expectations regarding Genesis’ ability to obtain capital; and With respect to forward-looking information in this presentation, Genesis has made assumptions, regarding, among other things: the completion of dispositions and the timing thereof; the impact of increasing competition; the timely receipt of all required regulatory approvals; building development rates and absorption rates; the timing and costs of construction, taxes and environmental matters; the ability of Genesis to successfully market its lots and homes; Genesis’ ability to obtain additional financing on satisfactory terms; property and home prices and exchange rates; and Genesis’ ability to attract and retain qualified personnel. Furthermore, the foregoing list is not exhaustive of all factors and assumptions which may have been used. Genesis’ actual results could differ materially from those anticipated as a result of the risk factors set forth below, including: failure to complete dispositions on the terms agreed upon or at all; competition; liabilities and risks including environmental liability and risks, inherent in development and construction operations; alternatives to and changing demand for lots and homes; changes in legislation and the regulatory environment, such as uncertainties with respect to environmental legislation; title defects; the availability of qualified personnel; and the availability of construction materials and related equipment in the particular areas where such activities will be conducted, economic and financial conditions in Canada; the behaviour of financial markets, including fluctuations in interest rates; availability of equity and debt financing; strategic actions including dispositions; adverse hydrology conditions; regulatory and political factors within Canada; the possible impact of international conflicts and other developments; and other risks and factors detailed from time to time in Genesis’ Annual Information Form and other documents available at www.SEDAR.com. The forward-looking information contained in this presentation is made as of the date hereof and Genesis undertakes no obligation to update publicly or revise any forward-looking information, whether as a result of new information, future events or otherwise, unless required by applicable securities laws. The forwardlooking information contained in this presentation is expressly qualified by this cautionary statement. All values are in Canadian dollars. 2 Corporate Snapshot History Key Points Established in 1993 Listed on TSX 1999 Eleven Years of positive earnings. Symbol: TSX : GDC Large inventory of approved lands in high growth areas. Share Price: Solid asset base. $3.33 52 Week High / Low: $3.59 / $2.30 Common Shares Outstanding: 44,659,912 Positioned benefit from mature land base Market Capitalization: $148,767,467 (All stock data as at September 6, 2012) 3 Earnings Per Share- (EPS) 4 2011 Results Summary • • • • • • • • • • $0.25 EPS on revenues of $95.760 million Non income producing debt reduced by $11.5 million Agreement for $31.7 million commercial sale to Rio-Can Completed servicing of 332 lots Sold 255 residential lots Sold 3 multi family sites totaling 16.02 acres Cost of borrowing reduced from 8.21% to 6.57% Genesis Builders Group (GBG) sold 100 residential units GBG closed 68 residential units GBG opened 6 show homes in 4 communities 5 Calgary Market Overview Population Growth for Calgary Metropolitan Area (CMA) Calgary Population = 1.1 million, CMA = 1.2 million. Calgary CMA increase of 12.6% (2006-2011) Net in-migration to the CMA expected to be 21,000 in 2012 and 18,000 in 2013. City of Calgary population expected to increase by 170,700 between 2011 and 2021 with an annual growth rate of 16,484 per year Airdrie population increase of 47.1% (2006-2011). Population expected to increase from 47,000 in 2012 to 56,000 in 2018 and 63,000 in 2023 Housing Market CMA Starts Q2-2012 New Home Price: $581,415 Balanced resale market & low interest rates Q2-2012 = 7,044 Q2-2011 = 3,530 +8% over Q2-2011 – $536,624 * Statistics Canada Census,CREB – Calgary’s Economic Edge 2012, City of Calgary, City of Airdrie CMHC Residential Construction Digest, CMHC Housing Now 6 Calgary Area and Land Holdings Airdrie * Airdrie Future Lands Bayside, Canals 170 Acres (approx.) 417 Acres Mitford North East Calgary Saddlestone 160 Acres (Cochrane) 157 Acres Delacour * 1,797 Acres (approx.) North West Calgary Symons Valley Sage Hill Crossing Sage Meadows Kinwood ** Sherwood Kincora 416 Acres NOTE: * Shown net of 836 acres held in Limited Partnerships (LP’s) ** Joint Venture with Melcor North East * Calgary Lands 315 Acres Mountain View 144 Acres 7 British Columbia Land Holdings 8 Added Value Concept 9 Full Cycle Land Inventory IMMEDIATE LANDS • Serviced Lot Inventory (CMA): • Approved Lands (CMA): 424 Lots (8/31/12) 815 Acres – 235 acres of commercial/industrial – 580 residential acres providing for +/-4,600 future residential units. MID TERM LANDS • Raw Land – Alberta 1,637 Acres LONG TERM LANDS • Raw Land – AB/B.C. (Partially Approved/Developed) 3,295 Acres • L.P. Lands (Partially Approved) 1,333 Acres TOTAL 7,080 Acres 10 Land Program NE Calgary Immediate Development Land Taravista &Taralake completed Saddlestone 160 acres 972 Single Family lots 975 Multi Family doors 5 year program 2011/12 – PH1–4 = 295 lots PH 5-6= 1 Commercial lot, 1 Multifamily site & 153 Single Family lots 11 Land Program NW Calgary SYMONS VALLEY Immediate Development Land 300 acres fully approved Sage Meadows Phases 1 – 2 = 200 lots Future single family lots ±76 Future multi-family doors ± 1575 9.2 acre mixed use site SAGEHILL SHOPPING CENTER 138 acres (gross) ± 33 acres conditional sale to Riocan 900,000 square ft office space 4,400 multi-family units ± 1million square ft commercial 12 Land Program Airdrie AIRDRIE BAYSIDE & CANALS Immediate Development Land • Bayside Phase 7 – 150 lots • Bayside 9 – 106 lots • Additional 344 acres fully approved providing ± 2,750 future residential doors. Future Development Land • 318 acres annexed March 2012 13 County of Rockyview MID-TERM LANDS • Total Landholdings of 2,692 acres. • 307 acres with approved Concept Plan ± 1,500 residential doors • Further planning underway • 610 acres Industrial/Commercial 14 Home Building GBG CLOSINGS SINCE 2006 Average ±100 home closing over the last 6 years Note: 2012 & 2013 are forecasts 15 Key Performance Indicators: Corporate 16 Key Performance Indicators: Land 17 Key Performance Indicators: GBG 18 Strategic Objectives • Sale of non core assets • Elimination of non income producing debt • Improve balance sheet • Reduce borrowing costs • Increase home sales and closings • Accelerate monetization of approved land holdings • Evaluate and advance opportunities to wrap up limited partnerships • Adopt a rolling five year business plan • Establish and monitor key performance indicators 19