Now - Home Tutors Delhi

advertisement

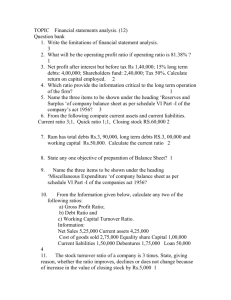

Unique UNIQUE Pvt. TUTORIALS ® B-4/164 Sector-8 Rohini New Delhi 110085 Ph: 98101-90005, 99101-90005,011-4357-3657,011-6574-8080 Q1 X Ltd. has a current ratio of 2.5:1 and quick ratio of 1.5:1. Its current assets are Rs. 2, 00, 000. Calculate the value of stock. (Value of Stock 80, 000; CBSE 1991) Q2 X Ltd. has a current ratio of 4.5:1 and quick ratio of 3:1. If its inventory is Rs. 36, 000, find out its Total Current Assets, and Total Current Liabilities and Quick Assets. (Current Liabilities 24, 000; Current Assets 1, 08, 000 Quick Assets 72, 000; CBSE 1991) Q3 Calculate the stock Turnover Ratio from the following: Particulars Opening Stock Purchases Carriage Inward Wages Manufacturing Expenses Gross profit Rs. 75, 000 1, 00, 000 4, 000 11, 000 9, 000 61, 000 Particulars Sales 3, 00, 000 Less Return 50, 000 Closing Stock 2, 60, 000 Rs. 2, 50, 000 10, 000 2, 60, 000 (Stock Turnover Ratio 4.45 Times; COGS 1, 89, 000; Average Stock 42, 500; CBSE 1991) Q4 From the following information, determine the Opening Stock and Closing Stock. Stock Turnover Ratio 5 times. Total Sales Rs. 2, 00, 000, Gross Profit Ratio 25%. Closing Stock is more by Rs. 4, 000 than the opening stock. (Closing Stock 32, 000; Opening Stock 28, 000; CBSE 1991) Q5 Calculate the Stock Turnover Ratio from the following: Opening Stock Rs. 29, 000; Closing Stock Rs. 31, 000; Sales Rs. 3, 20, 000; Gross Profit Ratio 25%. (Stock Turnover Ratio 8 Times; CBSE 1991) Q6 Following figures have been extracted from J.M.D Ltd.: Stock in the beginning of the year Rs. 60, 000; Stock at the end of the year Rs. 1, 00, 000; Stock Turnover Ratio 8 Times; Selling Price 25% above cost. Compute the amount of gross profit and sales. (Gross Profit 1, 60, 000; Sales 8, 00, 000; CBSE 1991) Q7 A trader carries an average stock of Rs. 40, 000 (cost). His stock turnover is 8 times. If he sells goods at a profit of 20% on sales, find out his profit. (Gross Profit 80, 000; CBSE 1991) Q8 Commute the Debtors Turnover ratio from the following: 20X1 20X2 Year I Year II (Rs) (Rs) Gross Sales 9, 00, 000 7, 50, 000 Debtors in the beginning of year 83, 000 1, 17, 000 Debtors at the end of year 1, 17, 000 83, 000 Sales Returns 1, 00, 000 50, 000 (Debtor Turnover Ratio 2001-8; 2002-7 Times; CBSE 1991) Q9 Following is the Trading and Profit and Loss A/c of a firm for the year ending 31.3.20X2: Particulars Rs. Particulars Rs. By: Subhash Thakur. Cell.99101-90005 Page 1 Unique UNIQUE Pvt. TUTORIALS ® B-4/164 Sector-8 Rohini New Delhi 110085 Ph: 98101-90005, 99101-90005,011-4357-3657,011-6574-8080 Stock Purchases Wages Gross Profit c/d 35,000 2,25,000 6,000 1,84,000 Sales Stock at end 4,50,000 Administrative Expenses Selling and Distribution Expenses Loss on Sale of plant Net profit 10,000 14,000 10,000 1,50,000 4,00,000 50,000 4,50,000 Gross profit b/d 1,84,000 1,84,000 1,84,000 Calculate Operating ratio. (Operating ratio 60 %;) Q10. Following figures have been extracted from the books of Elite Electrical: Net Sales Rs.30,00,000; Cost of goods sold Rs.20,00,000; Net Profit Rs.3,00,000; Current Assets Rs.6,00,000; Current Liabilities Rs.2,00,000; Paid up share Capital Rs.5,00,000; Debentures Rs.2,50,000. Compute: (i) Gross Profit Ratio (ii) Working Capital Turnover ratio (iii) Debt Equity (GPR 33 1/3%; WCTR 7.5 Times DER 1.2) Q11. A firm had current assets of Rs.1, 50,000.It then paid a current liability of Rs.30, 000. After this Payment the current ratio was 2:1. Determine the size of current liability and working capital later and before the Payment was made. (Current liabilities After Payment 60,000; Current Liabilities before Payment 90,000; Working Capital before Payment 60,000; Working Capital after Payment 60,000) Q12. From the following figures compute the Debtors Turnover Ratio: Year I (Rs.) Year II(Rs.) Gross Sales 9, 50,000 8, 00,000 Sales Returns 50,000 50,000 Debtors in the beginning 86,000 1, 17,000 Debtors at the end of year 1, 17,000 86,000 Provision for doubtful debts 7,000 6,000 Q13. Current Ratio is 2:5 working capital is Rs.60, 000.Calculate the amount of current assets and current liabilities. (Current Assets 1, 00,000; Current Liabilities 40,000) Q14. X Ltd. has a current ratio of 4:5 and quick ratio of 3:1.If its inventory is Rs. 72, 000, find out its total current assets and total Current liabilities. (Current Assets 2, 16,000; Current Liabilities 48,000) Q15. Quick Ratio 1:5, Current Assets Rs.1, 00,000; current liabilities Rs.40, 000. Calculate the value of Stock. (Value of Stock 40,000) Q16. A firm has current ratio of 4:1 and quick ratio of 2.5:1. Assuming inventories are Rs.22, 500.find out total Current assets and total current liabilities. (Current Assets 60,000; Current Liabilities 15,000) Q17. From the following as certain Debt-equity ratio: Equity Share Capital Rs.2,00,000, General Reserve Rs.1,60,000, 10%Debentures Rs.1,50,000,Current liabilities Rs.1,00,000. Preliminary Expenses Rs.10, 000. (Debt Equity Ratio-3:7) Q18. Opening Stock Rs.29, 000; Closing Stock Rs.31, 000; Sales Rs.3, 00,000. Gross profit 25%on cost. Calculate Stock Turnover By: Subhash Thakur. Cell.99101-90005 Page 2 Unique UNIQUE Pvt. TUTORIALS ® B-4/164 Sector-8 Rohini New Delhi 110085 Ph: 98101-90005, 99101-90005,011-4357-3657,011-6574-8080 Ratio. Q19. (Stock Turnover Ratio-8 times) Calculate Debtors Turnover Ratio and Average Collection period in terms of months from the following: Credit Sales for the year Rs. 60,000. Debtors Rs.5, 000, Bills Receivable Rs.5, 000. (Debtor Turnover ratio 6 times; Average Collection period 2 months) Q20. From the following data, calculate: (a) Gross profit ratio. (b) Current Ratio (c) Debt equity ratio Net Sales Rs.30, 000; Cost of Sales Rs.20, 000, Net profit Rs.3, 000, Current Assets Rs.6, 000. Stock Rs.1, 000, Current liabilities Rs.2, 000, paid up share capital Rs.5, 000, Debentures Rs.2, 500. (GPR 331/3 % Current Ratio 3:1; Debt Equity Ratio 1:2) Q21. A business has a current ratio of 3:1. Its net working capital is Rs.4, 00,000 and its stocks are valued at Rs.2, 50,000. Calculate Quick ratio. (Quick Ratio 7:4) Q22. From the following information, calculate the Stock Turnover Ratio and the gross profit ratio. Opening Stock Rs.18, 000. Closing Stock Rs.22, 000. Purchases Rs.46, 000, Wages Rs.14, 000, Sales Rs.80, 000. Carriage inwards Rs.4, 000. (Stock Turnover Ratio 3 times; Gross Profit ratio 25%) Q23. From the following information, calculate the Debt Equity Ratio and the current ratio: share capital Rs.1,50,000, Bills Payable Rs.13,000, Creditors Rs.57,000, Debentures Rs.2,75,000 debtors Rs.95,000. Bank balance Rs.45, 000, Long term loan Rs.1, 00,000, General Reserve Rs.20, 000. (Debt Equity Ratio-2.2:1; Current Ratio 2:1) Q24. From the following information, calculate the Debt Equity Ratio and the current ratio: Particulars Debentures Bank Balance General Reserve Share Capital Q25. Rs. 1,40,000 30,000 40,000 1,20,000 Particulars Long term Loans Debtors Creditors Bills payable Rs. 70,000 70,000 66,000 14,000 (Debt Equity Ratio-1.31:1; Current Ratio 1.25:1) From the following information, calculate the Debt Equity Ratio and the current ratio: Particulars Opening Stock Purchases Sales Rs. 24,000 73,000 1,20,000 Particulars Closing Stock Wages Carriage inwards Rs. 26,000 20,000 9,000 (Stock Turnover Ratio 3 times; Gross Profit ratio 25%) Q26. From the following particulars, you are required to compute (i) Current Ratio (ii) Gross profit Ratio. Stock Rs.50, 000, Debtors Rs.40, 000, Bills receivable Rs.10, 000, Advantage paid Rs.4,000.Cash in hand Rs.30,000, Creditors Rs.60,000, Bills Payable Rs.40,000, Bank Overdraft Rs.4,000.Net Sales Rs.7,00,000. Gross Profit Rs.50, 00,000, Net Profit Rs.30, 000. (Current Ratio 1.29:1; Gross Profit ratio 7.14%) By: Subhash Thakur. Cell.99101-90005 Page 3 Unique UNIQUE Pvt. TUTORIALS ® B-4/164 Sector-8 Rohini New Delhi 110085 Ph: 98101-90005, 99101-90005,011-4357-3657,011-6574-8080 Q27. Calculate the amount of opening Debtors and closing debtors from the following figures: Debtors Turnover Ratio 4 times, Cost of Goods Sold Rs.6, 40, 000, Gross profit ratio 20%, Closing Debtors were Rs.20, 000 more than at the beginning, Cash Sales being 33 1/3 % of Credit Sales. (Total sales Rs.8, 00,000; Opening Debtors 1, 40,000, Closing Debtors 1, 60,000) Q28. Calculate Current Assets of a Company from the following information: Stock Turnover Ratio 4 times, Stock at the end Rs.20,000 more than that in the beginning Sales Rs.3,00,000. Gross profit Ratio 25% current liabilities Rs.40, 000. Quick Ratio 0.75. (Current Assets 96,250) Q29. Calculate the current Assets of a Company from the following information: (i) Stock Turnover Ratio: 5 times (ii) Stock at the end is Rs.15, 000 more than stock in the beginning. (iii) Sales Rs.2, 00,000 (iv) Gross profit Ratio 25% (v) Current Liabilities Rs.50, 000 (vi) Quick ratio 0.75 (Closing stock 37,500; Current Assets 75,000) Q30. The following is the Balance sheet of X Ltd. as on 31st December, 1998: Liabilities Equity Share Capital Reserves Profit of the year Bank overdraft Trade Creditors Rs 2,00,000 90,000 60,000 30,000 1,00,000 Assets Land and Building Plant & Machinery Stock Debtors Cash Rs 1,50,000 80,000 1,40,000 80,000 30,000 4,80,000 4,80,000 Calculate quick ratio. (Quick ratio 0.85:1) Q31. From the following information, calculate the Debt Equity Ratio and the current ratio: Particulars Share Capital Creditors 12% debentures Long term loan Rs. 2,50,000 45,000 2,80,000 1,10,000 Particulars Bills Payable Debtors Bank balance General Reserve Rs. 15,000 60,000 30,000 25,000 (Debt Equity Ratio-1.42:1; Current Ratio 1.5:1) Q32. X Ltd. has a current ratio of 3.5:1 and quick ratio of 2:1.If the stock is Rs.24, 000, calculate total current liabilities and current assets. (Current liabilities 16,000; Current Assets 56,000) Q33. Priya Ltd. has a current ratio of 3:1. If its Stock is Rs.40, 000 and total current liabilities are Rs.75, 000. Find out its quick ratio, (Quick ratio 2.46:1) Q34. A Ltd. has a current ratio of 3.5:1 and acid test ratio of 2:1. If the inventory is Rs.30, 000. Find out its total current assets and total current liabilities. (Current liabilities 20,000; Current Assets 70,000) Q35. From the following details, calculate (i) Opening Stock (ii) Closing Stock: Stock turnover ratio 6 times. Gross profit 20% on Sales. Sales Rs.1, 80,000. Closing Stock is Rs.15, 000 in excess of opening stock. By: Subhash Thakur. Cell.99101-90005 Page 4 Unique UNIQUE Pvt. TUTORIALS ® B-4/164 Sector-8 Rohini New Delhi 110085 Ph: 98101-90005, 99101-90005,011-4357-3657,011-6574-8080 (Opening Stock 16,500; Closing Stock 31,500) Q36. From the following information, calculate Debtors Turnover ratio and average collection period. Opening Debtors Rs.37,000 Closing Debtors Rs.43,000 Sales Rs.6, 00,000 Cash Sales Rs.80, 000 (Debtors Turnover Ratio 13 times; Avg. collection period 28.08 days) Q37. Calculate Opening ratio from the following Trading & Profit and loss account of M/s Sudhi Ltd. for the Year ending 31 st December, 20X1. Particulars Rs. Stock (1.1.20X1) Purchases Wages Gross Profit 45,000 1,10,000 15,000 1,85,000 Particulars Rs. Sales (Less: Sales Returns) Closing Stock(31.12.20X1) 3,00,000 55,000 3,55,000 6,000 8,000 14,000 1,67,000 Administrative Expenses Selling Expenses Interest Paid Net profit 3,55,000 1,85,000 10,000 Gross profit Rent Received 1,95,000 1,95,000 (Operating Ratio 43%) Q38. On the basis of following information, calculate (i) Gross profit ratio (ii) Working capital turnover ratio (iii) Debt equity ratio. Net Sales Rs.30,00,000; Cost of goods sold Rs.20,00,000; current assets Rs.6,00,000; current liabilities Rs.2,00,000; Paid up share capital Rs.5,00,000; Debentures Rs.2,50,000; loan Rs.1,25,000. (Gross Profit ratio 331/3%; Working capital turnover ratio 7.5 times; debt equity ratio 0.75) Q39. From the following information, calculate: (i) Gross profit ratio (ii) Stock turnover ratio (iii) Debtors turnover ratio Sales Rs.1, 50,000; Cost of goods sold Rs.1, 20,000: Opening stock Rs.27, 000; Closing Stock Rs.33, 000; Debtors Rs.14, 000; Bills Receivable Rs.6,000. (Gross Profit ratio 20%; Stock turnover ratio 4 times; debtor turnover ratio 7.5times) Q40. From the following information, calculate the Gross profit ratio and Stock turnover ratio. Particulars Sales Opening stock Rs. 2,00,000 35,500 Particulars Purchases Closing Stock Rs. 1,69,000 44,500 (Gross Profit ratio 20%; Stock turnover ratio 4 times) Q41. Mr.Atul owns a business and give the following figures: By: Subhash Thakur. Cell.99101-90005 Page 5 Unique UNIQUE Pvt. TUTORIALS ® B-4/164 Sector-8 Rohini New Delhi 110085 Ph: 98101-90005, 99101-90005,011-4357-3657,011-6574-8080 Particulars Sales Gross profit Current Assets Current liabilities 1993(Rs.) 9,00,000 2,25,000 3,00,000 1,50,000 1994(Rs.) 18,00,000 3,60,000 4,50,000 2,50,000 He is of the opinion that his manager Rajeev is very efficient as there is an increase in profit from Rs.2, 25,000 to Rs.3, 60,000 by his efforts. A gain his current assets are increasing from Rs.3, 00,000 to Rs.4, 50,000 whereas current liabilities are increasing only by Rs.1, 00,000 and thus his short term financial position is also becoming strong. Do you agree with him? State yes/no. Give reasons for your answer. Q42. Calculate (i) Stock turnover ratio (ii) Debtors turnover ratio from the following details : Particulars Annual Sales Opening Stock Credit Sales Bill receivable Rs. 2,00,000 38,000 60,000 5,000 Particulars Gross profit Closing Stock debtors Rs. 25% on cost 41,500 5,000 (Stock turnover ratio 4 times; ; debtor turnover ratio 6 times) Q43. The following are the summarized Trading , profit and loss account of Hindustan product for the year ended 31.12.1996 and the balance sheet of the Company as on that date: Particulars Opening Stock Purchases Direct Expenses Gross Profit Rs. 99,000 5,45,000 15,000 3,40,000 Particulars Sales Closing Stock 9,99,000 Selling and Distribution Expenses Loss on sale of assets Net profit 2,40,000 40,000 60,000 Rs. 8,00,000 1,99,000 9,99,000 Gross profit 3,40,000 3,40,000 3,40,000 Balance Sheet Liabilities Equity Share Capital Profit and Loss A/c Creditors Outstanding Expenses Rs 2,90,000 60,000 1,15,000 15,000 Assets Land Stock Debtors Cash 4,80,000 Calculate the following ratio: (i) Quick Ratio; Rs 2,30,000 1,99,000 21,000 30,000 4,80,000 (ii) Stock Turnover Ratio. By: Subhash Thakur. Cell.99101-90005 Page 6 Unique UNIQUE Pvt. TUTORIALS ® B-4/164 Sector-8 Rohini New Delhi 110085 Ph: 98101-90005, 99101-90005,011-4357-3657,011-6574-8080 (Quick ratio 0.39:1; Stock; Stock turnover ratio 3.09 times) Q44. From the following information calculate Stock Turnover ratio, operating ratio. Opening Stock Rs.28.000; Closing Stock Rs.22.000; purchases Rs.46, 000; Sales Rs.90, 000. Sales Returns Rs.10, 000; Carriage inwards Rs.4, 000; Office Expenses Rs.4, 000; Selling and Distribution Expenses Rs.2, 000; Capital Employed Rs.2, 00,000. (Stock turnover ratio 2.24 times; Operating Ratio 77.5%) Q45. From the following information calculate following ratio: (i) Gross profit ratio (ii) Working Capital Turnover ratio (iii) Debt equity ratio (iv) Proprietary ratio Information: Net Sales Rs.20,00,000; Cost of Goods Sold Rs.12,00,000; Current assets Rs.6,00,000; Current liabilities Rs.3,00,000; Paid up share capital Rs.8,00,000; 12% Debentures Rs.4,00,000. (Gross Profit ratio 40%; Working capital turnover ratio 6.67 times; debt equity ratio 0.50:1; Proprietary ratio 50.33%) Q46. From the following information given below, calculate any three of the following ratio: (i) Gross profit ratio (ii) Working Capital Turnover ratio (iii) Debt equity ratio (iv) Proprietary ratio Information: Net Sales Rs.5,00,000; Cost of Goods Sold Rs.3,00,000; Current assets Rs2,00,000; Current liabilities Rs.1,40,000; Paid up share capital Rs.2,50,000; 13% Debentures Rs.1,00,000. (Gross Profit ratio 40%; Working capital turnover ratio 8.33 times; debt equity ratio 0.40:1; Proprietary ratio 51%) Q47. (a) The current ratio of a Company is 2:1 State giving reasons which of the following would improve, reduce or not change the ratio: (a) Repayment of a current liability (b) purchasing goods on cash (c) Sale of office equipment for Rs.4,000(Book Value Rs.5,000) (d) Sale of goods for Rs.11,000(cost Rs.10,000) (e) payment of dividend. Q47. (b) The Debt Equity ratio of X Ltd. is 1:2. Which of the following would increase, decrease or not change the debt equity ratio? (a) Issue of Equity Shares (b) Cash received from Debtors (c) Sale of goods on cash basis (d) Redemption of Debentures (e) Purchase of goods on credit (f) Issue of Debentures (g) Conversion of Debenture into Preference shares Q48. Calculate: (a) Stock Turnover ratio (b) Debtors Turnover Ratio from the following details: Annual Sales Rs.2, 00, 000: Gross profit 25% on cost: Opening Stock Rs.38, 500; Closing Stock Rs.41,500: Credit Sales Rs.60,000; Debtors Rs.5,000; Bills Receivable 5,000. (Stock turnover ratio 4 times; ; debtor turnover ratio 6 times) Q49. The following information is provided to you: Particulars Share Capital 15% Loan Tax paid during the year Rs. 1,60,000 1,00,000 40,000 Particulars General Reserve Sales for the year profit after interest and Tax Rs. 50,000 2,00,000 80,000 From the above information, calculate debt equity ratio. By: Subhash Thakur. Cell.99101-90005 Page 7 Unique UNIQUE Pvt. TUTORIALS ® B-4/164 Sector-8 Rohini New Delhi 110085 Ph: 98101-90005, 99101-90005,011-4357-3657,011-6574-8080 (Debt Equity Ratio-0.31:1) Q50. AB Ltd. has a current ratio of 4.5:1 and a quick ratio of 3:1. If its stock is Rs.36,000 find out its current assets and current liabilities. (Current liabilities 24,000; Current Assets 1, 08,000) Q51. A Company earns a gross profit of 20% on cost. Its credit sales are twice its cash sales. If the credit sales are Rs.4, 00,000. Calculate the gross profit ratio of the Company. (Gross Profit ratio 16.67%) Q52. With the help of the given information calculate the following ratio: (i) Operating ratio (ii) Quick ratio (iii) Working capital turnover ratio and (iv) Total Assets to debt ratio. Information: Equity Share Capital Rs.1,00,000; 12% Preferences share capital Rs.80,000; 12% debentures Rs.60,000; General Reserve Rs.40,000; Sales Rs.3,00,000; Opening Stock Rs.10,000; Purchases Rs.1,20,000;Wages Rs.30,000; Closing Stock Rs.30,000;Selling and distribution expenses Rs.10,000. Other current Assets Rs.2, 00,000 and Current Liabilities Rs.1, 20,000. (Operating Ratio 46.67%; Quick ratio 5:3; WCTR 2.73 times; Total assets to debt ratio 6.67:1) Q53. Calculate the following ratio with the help of the following information: (i) Operating Ratio (ii) Current Ratio Information: Equity Share Capital Rs.5,00,000; 12% debentures Rs.6,00,000;9% Preferences share capital Rs.3,00,000; General Reserve Rs.1,00,000; Sales Rs.10,00,000; Opening Stock Rs.80,000; Purchases Rs.6,00,000;Wages Rs.1,00,000; Closing Stock Rs.1,00,000;Selling and distribution expenses Rs.20,000. Other current Assets Rs.5, 00,000 and Current Liabilities Rs.3, 00,000. (Operating Ratio 70%; Current Ratio 2:1) Q54. Calculate the following ratio with the help of the following information: (i) Operating Ratio (ii) Quick Ratio Information: Equity Share Capital Rs.1,00,000; 9% debentures Rs.60,000; 8% Preferences share capital Rs.80,000; General Reserve Rs.10,000; Sales Rs.2,00,000; Opening Stock Rs.12,000; Purchases Rs.1,20,000;Wages Rs.8,000; Closing Stock Rs.18,000;Selling and distribution expenses Rs.2,000. Other current Assets Rs.50,000 and Current Liabilities Rs.30,000. (Operating Ratio 62%; Quick Ratio 1.67:1) Q55. Current Liabilities of a Company are Rs.2, 80,000.Current Ratio is 4:3 and Quick ratio is 1:1. Find the value of stock. (Value of stock 93,333) Q56. From the following information: Particulars Opening Stock Cost of Goods Sold Operating Expenses Current liabilities Closing Stock Rs. 5,00,000 18,00,000 4,80,000 6,00,000 7,00,000 Particulars Fixed Assets Net Sales Interest Charge Current assets Rs. 5,25,000 30,00,000 1,80,000 9,75,000 Calculate: (i) Opening Ratio (ii) Stock Turnover ratio. (Operating Ratio 76%; Stock Turnover Ratio 3 times) Q57. Compute the Gross profit ratio from the following information: Sales = Rs.4,20,000 and Gross profit 20%on Cost. (Gross Profit ratio 16.67%) By: Subhash Thakur. Cell.99101-90005 Page 8 Unique UNIQUE Pvt. TUTORIALS ® B-4/164 Sector-8 Rohini New Delhi 110085 Ph: 98101-90005, 99101-90005,011-4357-3657,011-6574-8080 Q58. Calculate current Assets of a Company from the following information: (i) Stock Turnover 4 times (ii) Stock in the end is Rs.20,000 more than Stock in beginning (iii) Sales Rs.3,00,000 (iv) Gross profit ratio 20%of Sales (v) Current liabilities Rs.40,000 (vi) Quick ratio 0.75. (Current Assets 1, 00,000) Q59. Current Liabilities of a Company are Rs.5, 60,000, Current ratio is 5:2 and Quick ratio is 2:1.Find the value of stock. (Value of stock 2, 80,000) Q60. X Ltd has a Liquid ratio 7:3. If its Stock is Rs.25,000 and its Current liabilities are Rs.75,000.Find the current ratio. (Current Ratio 2.67:1) Q61. From the data given below, calculate the current ratio and debt equity ratio. 12% debentures Rs.6, 00,000; Total current liabilities Rs.3, 60,000 ;equity share capital Rs.20,00,000; Preferences share capital Rs.8,00,000; General Reserve Rs.2,00,000; Cost of goods sold Rs.4,48,000;Total current assets Rs.6,00,000; debtors Rs.2,80,000; Net profit Rs.1,80,000. (Current Ratio 1.67:1; Debt Equity Ratio-0.2:1) Q62. The following information is given about a Company: Particulars Sales Cost of Goods Sold Closing Stock Net profit Rs. 1,50,000 1,20,000 29,000 14,000 Particulars Gross profit Opening Stock Debtors Net Fixed Assets Rs. 30,000 28,000 18,000 1,10,000 Calculate the gross profit ratio and Stock turnover ratio. (GPR 20%; STR 4.14 times) Q63. Gross profit ratio of a Company was 25%. It s cash sales Rs.2, 00,000 and its credit sales was 80% of the total sales. If the indirect expenses of the Company were Rs.20, 000, calculate its Net profit ratio. (Net profit ratio 24%) Q64. From the information given below calculate the following ratio: (i) Current Ratio (ii) Debt equity ratio Information: Net profit of the year Rs.80,000; Fixed assets Rs.2,00,000;Closing Stock Rs.10,000; Other current assets Rs.1,00,000; Current liabilities Rs.30,000; Equity share capital Rs.1,00,000; 10% Preferences share capital Rs.70,000; 12% debentures Rs.60,000 and sales during the year Rs.5,00,000. (Current Ratio 3.67:1; Debt Equity Ratio-0.35:1) Q65. Calculate Current ratio, quick ratio and debt equity ratio from the figures given below: Particulars Stock Other Current Assets 12% debentures Equity Share Capital Rs. 30,000 50,000 30,000 1,00,000 Particulars Prepaid expenses Current liabilities Accumulated Profit Long term investment Rs. 2,000 40,000 10,000 18,000 (Current Ratio 2.05:1; Quick ratio 1,25:1; Debt Equity Ratio-0.27:1) By: Subhash Thakur. Cell.99101-90005 Page 9 Unique UNIQUE Pvt. TUTORIALS ® B-4/164 Sector-8 Rohini New Delhi 110085 Ph: 98101-90005, 99101-90005,011-4357-3657,011-6574-8080 Q66. A Company had a liquid ratio of 1.5 and current ratio of 2 and inventory turnover ratio 6 times . If has total current assets of Rs.8,00,000 in the year 2003.Find out annual sales if goods are sold at 25%rofit on cost. (Sales = Rs.15,00,000;Cost of goods Sold Rs.12,00,000) Q67. Calculate following ratios from the given information : (i) Operating ratio (ii) Stock turnover ratio (iii) Proprietary ratio Information: Net Sales Rs.3,75,000; Cost of Goods Sold Rs.1,08,500; Administrative expenses Rs.42,000;Selling expenses Rs.47,500; Share capital Rs.8,00,000; Reserves Rs.3,50,000;Long term loans Rs.8,20,000; Fixed assets (net) Rs.4,62,000;Investment Rs.2,42,000; Debtors Rs.72,000; Opening Stock Rs.2,00,000; Closing stock Rs.2,20,000 and bank balance Rs.3,15,000. (Operating Ratio 52.80%; Stock Turnover Ratio 0.516 times; Proprietary ratio 87.69%) Q68. Rs.2,00,000 is the cost of goods sold, inventory turnover 8 times ; Stock at the beginning is 1.5 times more than the stock at the end . Calculate the values of opening & Closing stocks. (Closing Stock 14,286; Opening Stock 35,715) Q69. The ratio of current assets (Rs.6,00,000) to current liabilities (Rs.4,00,000) is 1.5:1. The accountant of the firm is interested in maintaining a current ratio of 2:1, by paying off a art of the current liabilities. Compute the amount of current liabilities that should be paid , so that the current ratio at the level of 2:1 may be maintained. (Current liabilities to be paid off is 2, 00,000) Q70. On the basis of information given below, calculate of the following ratio: (i) Gross profit ratio (ii) Debt profit ratio (iii) Working Capital turnover ratio Information: Particulars Net Sales Cost of Goods Sold Current Liabilities Loan Rs. 3,75,000 2,50,000 1,20,000 60,000 Particulars Current Assets Equity Share Capital Debentures Rs. 4,25,000 1,90,000 75,000 (Gross Profit ratio 33.3%; Debt Equity Ratio-0.7:1; Working Capital turnover ratio 1.23 times) Q71. Current Liabilities of a Company are Rs.1, 20,000. Its current ratio is 3.00 and liquid ratio is 0.90. Calculate the amount of current assets: Liquid assets and inventory. (Current Assets 3, 60,000; Liquid Assets 1, 08,000; Inventory 2, 52,000) Q72. Current Liabilities of a Company are Rs.4, 50,000. Its current ratio is 3 and liquid ratio is 1.60. Calculate the amount of current assets: Liquid assets and inventory. (Current Assets 13, 50,000; Liquid Assets 7, 20,000; Inventory 6, 30,000) By: Subhash Thakur. Cell.99101-90005 Page 10