B.Com. Sem 2 - Grace College

advertisement

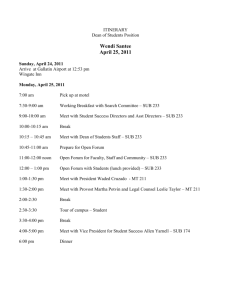

GRACE COLLEGE OF COMMERCE MANAGED BY : SHRI N. P. VEKARIYA EDUCATIONAL & CHARITABLE TRUST FYBCOM SEM – 2 SUB. : ENGLISH Q.1 Q.2 Q.3 Write a detailed note on prepositions. The character sketch of mini. The three friends in the meeting pool. SUB. : COMPANY LAW Attempt any two from the following: Q.1 Q.2 Q.3 Explain the various principles/elements of Corporate Governance. Describe the duties and powers of company Directors. Define the Company Secretary. Explain qualifications for a successful company secretary. SUB. : BUSINESS ADMINISTRATION Attempt any two from the following: Q.1 Q.2 Q.3 Explain the Maslow’s hierarchy and Herzberg’s theory. Define the communication and types of communication. Define group. Types of group and difference between team and group. SUB. : FINANCIAL ACCOUNT Answer any two of the following: Q.1 ABC furniture mart, Ahmadabad sent 100 steel cupboards costing Rs. 4000 each on consignment to XYZ. of Bombay the consignees were to be allow a commission of 5 per cent on sales. They accepted a bill of Rs. 180000 at 3 months, as an advance. The consignor discounted the bill immediately at 12% p.a. ABC furniture mart paid Rs. 15000 for freight and Rs. 8000 for wages on sending the goods. XYZ. paid Rs. 20000 for custom duties, wages etc. XYZ. sent account sales after 2 months, stating that 70 cupboards were sold at Rs 6000 each. In another account sales sent after a month, it was stated that the remaining 5 cupboards were sold at Rs. 5’500 each. The consignees sent a bank draft for the balance after deducting their commission. Give journal entries and prepare necessary accounts in the books of both the parties. Q.2 On 1-7-2015 A and B of RAJKOT entered into a joint venture to send goods on consignment to Gopal and Dinesh. They decided to share profits and losses in the proportion of 3:2 respectively. For the purpose of sale ram sent to Gopal the goods worth Rs.40’000 for his own stock and goods of Rs.20000 purchases at 10% trade discount from the market. He paid Rs.2’000 for freight and other expenses, while sending the goods. The following information was available from the account sales received from Gopal on 31-122010: (1) He sold whole of the goods for Rs. 1’20’000. (2) He paid Rs. 1’000 for expenses. (3) He sent a bill of exchange for Rs. 70’000 duly accepted by him to ram. The bill was discounted at a discount of Rs.1’500. (4) He sent remaining amount by a bank draft to A, after deducting the amount of expenses incurred by him and his commission at the rate of 5% on sales, in full settlement of his account. On 31-12-2015 ram and A closed the business of joint venture they settled their accounts relating and to joint venture with each other. Prepare (1) joint venture account (2)A’s account (3) gopals account in the books of ram. Q.3: A and B are partners sharing profits or losses equally. Their balance sheet as on 31-3-2015 is as under: Liabilities Rs. Assets Rs. Capital a/cs: A 105000 B 70000 General reserve Worker accident fund A’ loan Bank loan Creditors Work men saving a/c Provident fund Total (1) (2) (3) (4) 175000 38500 10500 10500 87500 61250 10500 24500 Land and building machinery Debtors Less: B.D.R. stock investment Cash and bank goodwill Bills receivable 157500 43750 61,000 5,000 56000 61250 24500 42000 14000 29750 428750 Total 428750 On 1.4.2015 partnership firm was converted into Abahy vachan limited. the term are as under: The p.c. Is to be paid in 1750 fully paid equity shares of us.100 each at 110 market prices, 5250 preference shares of rs.10each and remaining amount in cash. The company took over all the liabilities and assets except cash or Rs. 14000 and A’s loan. The assets were revalued as follows: Goodwill to be valued at Rs.18375, fixed assets at 20% more than book value and stock at 20% less than book value and BDR 10% on debtors. The partner distributed equity and preference shares in the proportion of their balance sheet capital. Prepare realization account, cash account and capital account also. SUB. : BUSINESS ECONOMICS Attempt any two from the following: Q.1 Q.2 Q.3 Explain Short Run Equilibrium of Firm and Industry under Perfect Competition. What is the meaning of Interest? Explain the factor affecting the Rate of Interest. Explain the theory of Kinked Demand Curve under Oligopoly. SUB. : SALESMANSHIP AND PUBLICITY Answer any two of the following: Q.1 Q.2 Q.3 What is Management? State Luther Gullick’s classification of Management. Discuss the Salesmen’s Selection Procedure. What is Training? Describe various types of training techniques. SUB. : FUNDAMENTALS OF entrepreneurship Attempt any two from the following: Q.1 Q.2 Q.3 Explain various factors affecting selection of plant location for enterprise. Give information about institutes that arrange entrepreneurship development programme in India. Analyse Technological Environment related to Business Industry. OR SUB. : com. Fund. And it Attempt any two from the following: Q.1 Q.2 Q.3 Write a detailed note on 1. Key board 2. Scanner 3. Printer Explain various types of Memory. Explain internet connection methods. SUB. : ACCOUNTING AND FINANCE – 2 Answer any two of the following: Q.1 Brahma, Vishnu and Mahesh are partners sharing profit and loss in the ratio of 4:4:2 in a solicitor firm. Their balances as at 31/3/11 were as under: Debit balances Rs. Credit balances Rs. Accounts of clients 1,05,000 Total Capital of Partners 8,40,000 Salaries 60,000 Total fees 6,15,000 Books 52,500 Accounts of clients 15,000 Debtors 1,69,500 Creditors 1,05,000 Stationery 11,250 Sundry expenses – Ledger of clients 11,250 Bank 67,500 Electricity charges 3,000 Office Building 7,50,000 Motor car 1,50,000 Office expenses 27,000 Magazine subscription Postage 4,500 Furniture 1,80,000 15,86,250 15,86,250 Capital of Mahesh is 50% of Vishnu and capital of Vishnu is 50% of Brahma. Additional Information: (a) Rs. 1500 paid for clients are included in office expenses. (b) Rs. 7500 received from a client for sundry expenses are credited in advance account of client. (c) Provide 10% depreciation on building, motor car, furniture and books. (d) Fees to be received Rs. 45,000 (e) Allow 10% interest on capital. (f) Incomplete work Rs. 22,500 at the end of the year. Prepare annual accounts on cash basis for the year eSnding on 31/3/2011. Q.2 A factory building is replaced at the cost of Rs. 23,12,000. Original cost of which was Rs. 8,00,000. Proportion of materials, labour and other expenses in the cost was 5:3:2 respectively. In comparison to original cost, materials, labour and other expenses increased by 20%, 10% and 5% respectively. Used old material in new building worth Rs. 60,000 and is not included in the above cost of Rs. 23,12,000. Scrap material was sold for Rs. 17,000. Show calculations of revenue and capital expenditure and write journal entries. Q.3 Write short note on weighted average cost of capital. OR SUB. : BUSINESS MANAGEMENT – 2 Answer any two of the following: Q.1 Q.2 Q.3 What is meant by production management? Give its definitions. What is plant location? Explain importance of plant location. Discuss the meaning and objectives of plant layout. ASSIGNMENT SUBMISSION /MCQ TEST/ SEMINAR BCOM STD CLASS DATE DAY TIME BCOM – 6 CLASS – A 02/03/2016 WEDNESDAY AT 9.30AM BCOM – 6 CLASS – B 03/03/2016 THURSDAY AT 9.30AM BCOM – 4 CLASS – A 04/03/2016 FRIDAY AT 9.30AM BCOM – 4 CLASS – B 05/03/2016 SATURDAY AT 9.30AM BCOM – 2 CLASS – A 08/03/2016 TUESDAY AT 9.30AM BCOM – 2 CLASS – B 09/03/2016 WEDNESDAY AT 9.30AM