Course Syllabus

advertisement

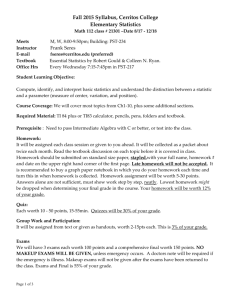

Summer Semester 2014 -2015 Course Syllabus Course Title Instructor Schedule : Advanced Accounting : Dr. Mahmoud. Aleqab : Phone # : 4948539 or 4548011 ext 8541 1.0 Credit Hours: 3 Office: A - 245 E-mail : maleqab@psu.edu.sa Vision Statement: The Accounting Program aspires to become a center of excellence and innovation in accounting education and research in the Middle East. 2.0 Mission Statement: The Accounting Program endeavors to provide quality education and pave the way for graduates to pursue professional careers and postgraduate studies. The program aims to meet the growing needs of the stakeholders through commitments to ethical standards and continuous improvement in accordance with accepted practices of international professional accounting bodies. 3.0 Course Description: This course is the capstone of financial accounting topics for most industries. This is a highly technical course on financial reporting and is solely intended for students who plan to work in accounting. This course shall revolve around (1) the CPA exam, (2) CPA ethics, and (3) personal responsibility and integrity. A significant bulk of this course’s topics requires satisfactory completion and retention of topics covered throughout previous financial accounting courses. Topics for this course include accounting for investments, taxes, foreign currency translations, hedges, partnerships, business combinations, and consolidations. Due to the international nature of Saudi Arabia’s industries, both International Financial Reporting Standards (IFRS) and United States’ Generally Accepted Accounting Principles (US GAAP) will be covered. Current Saudi Accounting Standards (SAS) require the use of US GAAP in instances that are not covered by SAS. In general, US GAAP is more narrowly defined as a rulebased standard whereas IFRS is more broadly defined as a principle-based standard. As such, a substantial number of transactions are applicable from US GAAP to IFRS but not necessarily from IFRS to US GAAP. Due to the economic downturn of the European Union, increased protectionist measures by the United States, and persuasive research showing substantial weaknesses of applying IFRS around the world, total convergence between IFRS and US GAAP is uncertain. Nevertheless, substantially all ordinary business transactions are now converged. The few exceptions are narrowly defined technical topics such as capital leases, financial instruments, and sources of funding. SOCPA announced a plan to consider the adoption of IFRS which it has adopted standards that are converged between IFRS and US GAAP. For more information, please visit the official website of FASB, IASB, and SOCPA. Copyrighted materials will be uploaded on private-access Google Drive due to apparent breach of publisher agreements on LMS. E-mail the course instructor for access. 1 4.0 program Description: The Accounting Program endeavors to provide quality education and pave the way for graduates to pursue professional careers and postgraduate studies. The program aims to meet the growing needs of the stakeholders through commitments to ethical standards and continuous improvement in accordance with accepted practices of international professional accounting bodies. The program is designed to provide the students with: Theoretical knowledge as well as practical skills in the following accounting areas such as Financial Accounting, Managerial Accounting, Information Systems, Auditing, Zakat and Taxation; Solid background in accounting and other related areas to prepare them for future careers, and pursuit of graduate studies; Intellectual, interpersonal and communication skills; and Necessary skills to be able to undertake a variety of accounting occupations, specifically in auditing, Zakat and taxation, financial analysis, financial reporting, and bookkeeping. 5.0 Course Prerequisites: ACC 202 Intermediate Accounting II Skills: English language Arithmetic Spreadsheet (e.g. Excel) Word processor (e.g. Word) Internet browser (e.g. Firefox) Dedication to pursue a career in accounting 6.0 Course Textbook and References Advanced Accounting, Pearson New International edition. Beams, Anthony, Clement, & Lowenshon, eleventh edition, ISBN: 978-1-2902-195-9. Internet References: - Saudi Organization of Certified Public Accountants Saudi Accounting Standards - International Accounting Standards Board International Financial Reporting Standards - Financial Accounting Standards Board Accounting Standards Codification - KPMG “IFRS compared to US GAAP: An overview” or equivalent - Securities Exchange Commission EDGAR Online - PSU Learning Management System 7.0 Course Contents Weeks 1 & 2 Weeks 3 & 4 Weeks 5 & 6 & 7 Weeks 8 & 9 & 10 Weeks 11 & 12 Weeks 13 & 14 Weeks 15 &16 Business Combinations Stock investments, investor accounting and reporting. Consolidated Financial Statements Consolidation techniques and procedures. Inter-company profit transactions – Inventory Inter-company profit transactions – plant assets Inter-company profit transactions – Bonds 8.0 Objectives The overall purpose of this course is to train and prepare students for a career in accountancy. This course’s primary objective is to teach financial reporting standards for a firm from inception to liquidation and other standards that do not simply fit with assets, liabilities, equity, and mezzanines. More specific topics are to help students develop useful skills and techniques as well as to gain an appreciation for accounting in general. The course will focus on IFRS and outline discrepancies with US GAAP. 2 By the end of this course, students should be able to: - Account for investments, hedges, and foreign currency translations. - Account for the life of a company from inception to liquidation of proprietorships, partnerships, and corporations. - Draft a consolidated financial report of a parent company and its subsidiaries. The objectives of ACC301 Advanced Accounting are highlighted using the NCAAA NQF Learning Domains and Course Learning Outcomes as follows: 1.1 1.2 2.1 2.2 2.3 3.1 4.1 4.2 9.0 Record for stock investments, taxes, foreign currency translations, derivatives and hedges, partnerships, business combinations, and consolidations. Write a consolidated income statement and balance sheet for users of financial information. Summarize common accounting methodologies for advanced accounting topics. Interpret financial accounting standards and annual reports. Evaluate an appropriate accounting methodology for a transaction. Write a financial report, communicate with teammates, and contribute in discussions. Operate office productivity tools to write reports and account for big data. Research accounting issues, standards and information from government, organizational, and corporate entities. Methods of Instruction The instructor will use the following teaching mediums: lectures, projects, and a wide variety of hands-on student learning activities [sic]. Lectures are intended to help the student understand the topic and learn the material. The course textbook is intended for reading before or after the intended class lecture to achieve a basic idea, with the exception of the first class lecture with no assigned readings. Note that accounting requires understanding beyond and above memorization alone. So, students are encouraged to use the textbook as a tool to prepare for lectures, review learned material, and study for exams. Projects are intended to help prepare students for practical scenarios and develop business success skills. These will require students to review and apply the topics learned throughout the course, apply both direct and indirect problem solving skills, and practice presenting in front of an audience with similar knowledge. This will help the student prepare for future projects by developing teamwork skills and work ethic. The instructor may assign students in groups of three (3) to work on a single project. Each member in the group will receive the same grade. Every group should keep its members informed of everyone’s contact information. Copying from another group is a violation of student honor codes, and thus considered as cheating. If cheating is found, both parties are presumptively guilty of the wrongdoing. Therefore, please keep your assignment confidential within your group. A wide variety of hands-on student learning activities [sic] are intended to help students prepare for projects and exams. This may include walkthroughs, problem solving, discussions, student presentations, and assistance. Much of the class will be interactive as technical subjects are best learned by doing. Students are encouraged to seek assistance about class topics outside class from the instructor through office hours, e-mail, or Google+, and the forums of LMS. The use of e-mail and LMS is recommended so the student does not have to rearrange her or his busy schedule to visit during limited office hours. The instructor may select a few questions and review them during the next class session. Note that the instructor will not answer questions about projects and exams outside of class, but will answer questions about accounting topics. 3 10.0 Attendance Preparation, promptness, participation, and professionalism are key factors of success in today’s business world. Class attendance is mandatory to the extent of University requirements. If a class is missed, it is the students’ responsibility to find out what was missed. 11.0 Grading The instructor will use the following grading mediums: exams, quizzes, and assignments. Exams are designed to reinforce and partially evaluate the result of students’ learning. All exams are used with a purpose to promote a student’s independent thinking. The final exam should be no surprise, as much of the exam topics will be seen again as questions on the final exam. There will be two midterm exams (2) and one final exam (1). Midterm exams will be problem solving 100%. Exams will only test material that was covered in class and assigned in the book up to the examination point. The final exam will be also 100% problem solving. The final grade will be computed as follows: Final Exam : 40% Midterm Exams : 40% Quizzes : 5% Attendance : 5% Assignments : 5% Participation : 5% Bonus points are available if the instructor announces an opportunity available for students during class. 12.0 Rules, Policies, and Procedures Student Conduct: Students are encouraged to read the section of the college catalog regarding student conduct, as well as other documents, policies, and the student handbook. Students should not be reminded that disruption or obstruction during teaching and learning is a high offense in any educational institution. Respect and professionalism to each other and the instructor is key. Academic Integrity: Students are expected to behave with academic honesty and integrity. It is not academically honest to plagiarize, take credit for another’s work, accept help on independent exams, obtain information on confidential test materials, or act in any way that might harm another student’s chance for academic success. Technology: Any hand-held communication device such as cell phones, Black or Red Berry, or other chip-reliant devices are not allowed as they are a distraction to learning. Please turn off all cell phones before entering class, unless you are an emergency worker. Be courteous to other students and your instructor if bringing a laptop, iPad, etc. to take notes. Dress Code: Anything covering the head during exams is prohibited (hats, hoods, masks, etc.) unless it is considered as a Saudi national address code. Please wear clothes to class that any average person in the local community would wear. Attendance: Students should be prepared with a general idea before the start of the lecture. Note that pop quizzes (counted towards your individual participation and group assignments) may be given to students at a class. There will be a seating chart for every student. A student will have to occupy that seat consistently throughout the semester. Attendance will be part of your performance on the calculation of your final grade. Cancelled Classes: Extraordinary events will result in a cancellation of class. Our schedule will be adjusted accordingly. 4