Basic Real Estate Appraisal, 9e e_PowerPoint - Ch 14

advertisement

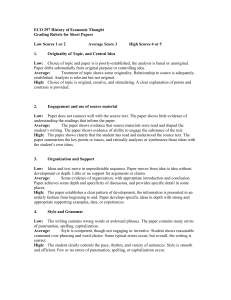

Chapter 14 Income Capitalization: Rates and Techniques Basic Real Estate Appraisal: Principles & Procedures – 9th Edition © 2015 OnCourse Learning STUDENT LEARNING OUTCOMES Page 448 • Define Income Capitalization • List the Three Key Characteristics of a Future Stream of Income • List the Two Methods used to Derive or Calculate Overall Capitalization Rates • Define and Illustrate Direct Capitalization • Define Discounted Cash Flow and Describe its Use in Appraisals 2 © 2015 OnCourse Learning 14.1 PURPOSE AND THEORY OF CAPITALIZATION Page 449 Capitalization… …the process of converting the projected future income of a property into an estimate of value, as of a specific date • Reflects the Present Worth of Future Benefits • Recognizes the Time Value of Money 3 © 2015 OnCourse Learning Page 450 CAPITALIZATION (Con’t.) Key Characteristics of Future Income Streams: • Quantity ($ Amount) • Quality (Relative Risk) • Timing (Durability & Frequency) 4 © 2015 OnCourse Learning CAPITALIZATION RATE DEFINED Page 450 • Any Rate used to Convert Income into Value • It Directly or Indirectly Provides for… • A Return on the Investment (Interest or Yield) • A Return of the Investment (Capital Recovery) 5 © 2015 OnCourse Learning TYPES OF CAPITALIZATION RATES Page 451 The type of rate is dependent on which of two Capitalization Techniques is used… • Direct Capitalization (Ratio Capitalization) • What the Market believes about future cash flows is hidden in the Capitalization Rate • Yield Capitalization • In Yield Capitalization the pattern and duration of the future income stream is explicit 6 © 2015 OnCourse Learning COMPARING INVESTMENT PROPERTY The Choice of a Capitalization Technique and Rate Considers the following Investment Criteria… • Burden of Property Taxes • Safety • Shelter from Income Taxes • Yield • Liquidity • Size or Denomination • Freedom from • Hypothecation Management (Security for a Loan) • Prospects for • Leverage Appreciation (Positive or Negative) © 2015 OnCourse Learning Page 451 7 CURRENT AND FUTURE RETURNS Page 454 • Income Stream – the initial return or profit received Monthly or Annually • Reversion – the deferred return from the Future Resale Proceeds (or Refinancing) • If a Property is encumbered by a Loan: • Income Stream or Cash Flow after loan payments is Equity Dividend or Return to Equity • Reversion will be affected by Equity Buildup due to principle reduction (loan amortization) 8 © 2015 OnCourse Learning Page 456 YIELD VERSUS RECAPTURE • Yield = Return on Investment Capital • Recapture = Return of Investment Capital • Both the Yield and the Recapture can be provided through a combination of the periodic income stream and capital recovery (reversion) • From a Lender’s perspective – principle and interest payments provide both in an amortized loan (a lender’s investment) 9 © 2015 OnCourse Learning RELATING TO ECONOMIC PRINCIPLES ECONOMIC PRINCIPLE Page 459 INCOME PROCEDURE Anticipation (Present Worth of Future Benefits) Capitalization of Future Income Agents of Production Subtracting Operating Expenses Contribution Residual Capitalization Highest and Best Use Highest Residual Land Value (Return to the Land) Consideration of these Principles can influence the choice of Capitalization Techniques and the Selection of Capitalization Rates 10 © 2015 OnCourse Learning 14.2 SELECTION OF THE CAPITALIZATION RATE Page 460 Four Types of Rates • Interest Rate • Return on Capital; Yield or Discount Rate: Internal Rate of Return; Period Rate • Overall Capitalization Rate • OAR; Ro; Cap Rate; Ratio between Income & Value • Recapture Rate • Return of Capital; typically Annually; Amortization • Composite Capitalization Rate • Composed of an Interest and a Recapture Rate © 2015 OnCourse Learning 11 RELATIONSHIP BETWEEN YIELD AND OVERALL RATES • If Income and Value remain stable over time, then Yield (Yo) = OAR (Ro) • If Value is expected to increase, then the OAR (Ro) is less than the Yield Rate (Yo) • If Value is expected to decrease, then the OAR (Ro) is greater than the Yield Rate (Yo) • The foregoing relationship reflects the expected future change in value (Δ or Delta) © 2015 OnCourse Learning Page 461 12 ESTIMATING OVERALL RATES Page 463 Direct Comparison Band of Investment 13 © 2015 OnCourse Learning ESTIMATING INTEREST RATES Page 465 14 © 2015 OnCourse Learning ESTIMATING INTEREST RATES (Con’t.) Page 466 15 © 2015 OnCourse Learning ESTIMATING INTEREST RATES (Con’t.) Page 467 Summation Method of Estimating Interest Rates 16 © 2015 OnCourse Learning Page 468 ADJUSTING OVERALL RATES The Analysis of Overall Rates Derived from Comparable Sales, and Rate Selection, should consider… • Property Location • Age, Quality and Condition of Improvements • Remaining Economic Life of the Improvements • Ratio of Building Value to the Total Value • Expenses that occur as a Percentage of Value (e.g. Property Taxes) © 2015 OnCourse Learning 17 CAPITAL RECOVERY METHODS Page 469 Straight-Line Method • Assumes equal annual recapture from net income • Used in several capitalization methods Sinking Fund Method • Assumes “safe rate” earnings • Rarely used in appraisals Annuity (Inwood) Method • Provides capital recovery in same way as loan amortization • Assumes recapture amounts earn interest • An older form of yield capitalization © 2015 OnCourse Learning 18 14.3 DIRECT AND RESIDUAL CAPITALIZATION TECHNIQUES Page 472 • Direct Capitalization technique • Equity Residual technique • Building Residual technique • Land Residual technique Detailed on slides that follow 19 © 2015 OnCourse Learning DIRECT CAPITALIZATION TECHNIQUE Page 472 • Simplest and Most Reliable 20 © 2015 OnCourse Learning EQUITY RESIDUAL TECHNIQUE Page 473 21 © 2015 OnCourse Learning BUILDING RESIDUAL TECHNIQUE Page 474 22 © 2015 OnCourse Learning Page 475 LAND RESIDUAL TECHNIQUE 23 © 2015 OnCourse Learning 14.4 ESTIMATING, MEASURING AND DISCOUNTING CASH FLOWS Page 478 • Yield Capitalization is nearly always used to value future income streams • Yield Capitalization requires estimates of: • Future Cash Flows (or their pattern) • The Time Period (projected holding period) • The Yield Rate (interest rate, discount rate, or internal rate of return) 24 © 2015 OnCourse Learning USE OF CASH FLOWS IN APPRAISALS Page 479 Estimating Cash Flows • Measuring Cash Flow from Periodic Income • Even Cash Flow (Level Income Stream) • Uneven Cash Flow (Increases or Declines) • Income Projections • Consider historical trends as well as market expectations over the projected holding period 25 © 2015 OnCourse Learning CASH FLOWS IN APPRAISALS (Con’t.) Page 482 Measuring Sale Proceeds Cash Flows • Estimating the Future Sales Price • Estimate the Net Operating Income at the end of the Holding Period, and Capitalize it using a Going-Out OAR to indicate Future Resale Price or • Project the Future Value by applying an Annual Percent value change to a Current Value 26 © 2015 OnCourse Learning Page 482 DISCOUNTING CASH FLOWS • Discounted Cash Flow (DCF) • Theory of “Discount” Math • Future $’s are Worth less than Current $’s • Discount or Present Value Factors • Six Functions of a Dollar ($) 27 © 2015 OnCourse Learning DISCOUNTING CASH FLOWS (Con’t.) Page 485 Discount Formula for a Single Future Payment Summary of Discounted Cash Flows 28 © 2015 OnCourse Learning Page 487 CHAPTER SUMMARY Income capitalization is the process of converting future income into a value estimate as of the date of value. By selecting capitalization rates that reflect the types and amounts of return sought in the real estate investment market, the appraiser completes the link between income and value. 29 © 2015 OnCourse Learning CHAPTER SUMMARY (Con’t.) The market value of amounts to be received in the future must always be reduced or discounted to their present values in some way to recognize the time value of money (i.e. Present Worth of Future Benefits). Direct Capitalization and Yield Capitalization are the basic techniques by which to convert income into an estimate of value. © 2015 OnCourse Learning Page 487 30 IMPORTANT TERMS & CONCEPTS Band of Investment Method Discounted Cash Flow (DCF) Building Residual Technique Equity Dividend Rate Capital Recovery Equity Residual Technique Capitalization Rate Equity Yield Rate Cash Flow Going-In OAR Composite Capitalization Rate Going-Out OAR Debt Service Hypothecation Delta (Value Change) Income Stream Direct Capitalization Technique Interest Rate Direct Comparison Method Internal Rate of Return Discount Rate Investment Value Page 489 31 © 2015 OnCourse Learning IMPORTANT TERMS & CONCEPTS Land Residual Technique Reversion Leverage Safe Rate Mortgage Constant Summation Method Overall Capitalization Rate (OAR) Time Value of Money Periodic Rate Yield Capitalization Ratio Capitalization Yield Rate Page 489 Recapture Rate 32 © 2015 OnCourse Learning