word file - six

advertisement

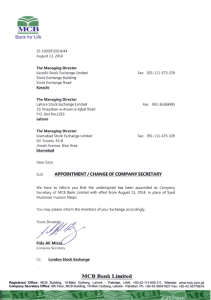

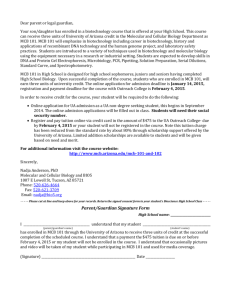

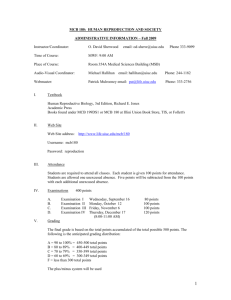

MCB BANK LTD Letter of Transmittal To, Prof. Abdul Jabar Lecturer Hailey College Of Commerce University of the Punjab, Lahore, Subject Transmittal Letter Dear sir, It is a great honor for me to present you the internship report as required for the completion of b.com (HONS) degree programmed. The staff of the MCB has been very Cooperative with me in providing information regarding the procedures and processes in practice. Due to certain constraints and legal formalities, I have not been able to gather all the facts and figures about the organization. Yet, the report is a comprehensive one, containing a lot of information of the MCB township branch. The practical work during the internship period has been a reworking and enlightening experience. I work in general banking (clearing, remittances and account opening departments). Yours sincerely. Shumaila Iqbal Puri Roll # 105 (A) Hailey college of commerce shumaila iqbal puri Page 1 MCB BANK LTD ACKNOWLEDGEMENT All thanks are due only to ALLAH ALMIGHTY, the most gracious and most merciful who enabled me to complete this internship report. I also show my gratitude to my loving parents and my humble teachers who make me able to be at thus position. I would like to express my sincere gratitude to my respected principal dr. liaquat Ali for giving me the opportunity to do internship in MCB. This report is based on the experience of my internship in a most respectable bank MCB karim block branch Lahore. I also very thankful to the staff of MCB township branch especially miss raheel, Sir furqan, sir zaheer, sir arman sir aftab chaduhry, sir amir who gave me the constant encouragement, sincere advice and suggestions which they rendered throughout the study, towards accomplish of this internship report. and provided us with such a wealth led ideas, to peruse and power of writing this report. It could not have been possible to accomplish this report without his thoughtful guidance and expertise. Finally, for any all too fallible errors, omissions and shortcomings in the writing of the report only we are responsible for which we hope that all concerning regards of this report will forgive us. Hailey college of commerce shumaila iqbal puri Page 2 MCB BANK LTD Table of contents Executive summary 5 Historical overview 6 Vision statement 8 Mission statement 8 Out values 8 Organizational structure 10 Branch profile 11 Corporate structure of MCB 11 Learning during internship 13 Cash department 16 Sales department 20 Account opening 20 Types of account 23 Issuance of cheque book 28 Closing of account 28 Products and services 30 Clearing department Hailey college of commerce 35 shumaila iqbal puri Page 3 MCB BANK LTD Outward clearing 37 Inward clearing 38 Remittance department 40 Advances department 46 Financial ratios 50 Swot analysis Conclusion Recommendations Skills required during internship appendix bibliography Hailey college of commerce shumaila iqbal puri Page 4 MCB BANK LTD EXECUTIVE SUMMARY MCB bank limited (formerly muslim commercial bank limited) has a solid foundation of over 63 years in pakistan with a network of above 1000 branches, over 850 of which are automated branches, over 600 ATM nationwide MCB’s operations continued to be streamlined with focus on rationalization of expenses, re – alignment of back end processing to increase productivity, enhancement of customer service standards, process efficiency and controls. The bank has taken the lead in introducing the innovative concepts of centralizing trade services in the country by providing centralized foreign trade services to branches with a view to improve efficiency, expertise and reduce delivery cost. During my internship in MCB township branch I worked in sales department, remittance department, advances department, cash department, customer service department. I successfully completed all the task/duties that were assigned to me. I also learned bank’s correspondence with their customers and within branches. I learned about documentation requirements and record keeping for different activities and processes, especially the requirement for different kinds of account opening. Hailey college of commerce shumaila iqbal puri Page 5 MCB BANK LTD HISTORICAL OVERVIEW MCB formally known as Muslim Commercial Bank Limited was incorporated by the AJMEE Group on July 9, 1947 in Kolkata Bengal under the Indian companies Act VII of 1913 as a limited company. But due to the changing scenario of the region, the certificate of incorporation was issued on 17 August, 1948 with a delay of almost 1 year and certificate of issued at Chittagong. The first office of the company established at Dacca and Mr. G.M Admee was appointed its first chairman. It was incorporated with an authorized capital of 15 million, the bank transferred its registered head office from Dhaka to Karachi on august 23, 1956 through a special resolution. The bank was established with a view to provide banking facilities to the business community of south Asia. The bank was nationalized in 1974 during the period of Zulfiqar Ali Bhutto by the recommendation o world bank and IMF . On April 8th. 1991, the management control was handed over to national group ( the highest bidders) . initially only 26% of shares were sold to private sector at RS. 56 per share. This was the first bank that privatized in 1991 and the bank was purchased by a consortium of Pakistanis Groups led by Nishat Group. In 2008 the head office of MCB was shifted from Karachi to Lahore in a newly constructed building namely MCB house located at sharea Ghous ul Azam commonly known as Jail Road. MCB has over 1,150 branches (as of 31st December, 2010) including local branches, and business establishments in SriLanka and Bahrain including Hailey college of commerce shumaila iqbal puri Page 6 MCB BANK LTD newly established Rep. Office in Dubai, UAE. The Bank has also formed a private company in Hong Kong (fully owned subsidiary of MCB) in partnership with Standard Chartered Bank, handling trade transactions of select countries in the Asia-Pacific region. To further strengthen its financial services base, MCB has also incorporated an Asset Management Company in the year 2005 known as MCB Asset Management Company. MCB has also incorporated a leasing company in Azerbaijan in 2009. MCB is Pakistan’s largest bank by market share 18% its assets are of PKR 605 bln (apprx.)(US$ 7.02 billion)in 2011, and the largest by market capitalization having a market capitalization of US$ 1.8 billion. The bank is versed as one of the oldest and most responsible banks in Pakistan and has played pivotal role in representing the country on global platforms while being one of the few institutions that are recognized and traded in the international market. The Bank has a customer base of approximately 4.5 million and a nationwide distribution network of 1,130 branches, including 8 Islamic banking branches, and over 600 ATMs, in a market with a population of over 160 million.(July 2011 record). The bank has also been acknowledged though prestigious recognition and awards by Euromoney, MMT, Asia Money, SAFA (SAARC), The Asset and The Asian Banker. Hailey college of commerce shumaila iqbal puri Page 7 MCB BANK LTD VISSION STATEMENT To be the leading financial services provider, partnering with our customers for a more prosperous and secure future. MISSION STATEMENT We are a team of committed professionals, providing innovative and efficient financial solutions to create and nurture long-term relationships with our customers. In doing so, we ensure that our shareholders can invest with confidence in us. OUR VALUES Integrity: We are the trustees of public funds and serve our community with integrity. We believe in being the best at always doing the right thing. We deliver on our responsibilities and commitments to our customers as well as our colleagues. Respect: We respect our customer’s values, beliefs, culture and history. We value the equality of gender and diversity of experience and education that our employees bring with them. We create an environment where each individual is enabled to succeed. Excellence: We take personal responsibility for our role as leaders in the pursuit of excellence. We are a performance driven, result oriented organization where merit is the only criterion for reward. Customer Centricity: Our customers are at the heart of everything we do. We thrive on the challenge of understanding their needs and aspirations, both realized and unrealized. We make every effort to exceed customer expectations through superior services and solutions. Hailey college of commerce shumaila iqbal puri Page 8 MCB BANK LTD Innovation: We encourage and reward people who challenge the status quo and think beyond the boundaries of the conventional. Our teams work together for the smooth and efficient implementation of ideas and initiatives. Hailey college of commerce shumaila iqbal puri Page 9 MCB BANK LTD ORGANIZATIONAL STRUCTURE Board of Directors chairman president Audit & RAR Corporate affairs Whole sale banking Special asset management Information technology Hailey college of commerce Consumer banking Risk management Islamic Commercia banking l banking Complianc e & control Human resource management shumaila iqbal puri Strategic planning & investment banking Treasury and forex Financial control operations Page 10 MCB BANK LTD Branch Profile I did my internship in MCB township branch Lahore. MANAGEMENT OF THE BRANCH Branch manager Mr. kashif baig Operations manager Mr. Arman aftab Supervisor Miss Raheel Ishtiaq Clearance officer Mr. Zaheer Personal banking advisor Mr. Furqan ul haq mahravi Personal banking advisor Mr. Bilal ahmed Remitance officer Mr. Usman wariach Remitance officer Mr. amir Relation ship manager Mr. shahzad Credit manager Mr. Aftab chaduhry Cashier Muhammad yousaf Chief cashier Mr. Ahsan Customer service officer Miss Riffat Customer service officer Miss anam Corporate Information of MCB Board of Directors Mian Mohammad Mansha Chairman Hailey college of commerce (Non-Executive Director) shumaila iqbal puri Page 11 MCB BANK LTD S.M. Muneer Vice Chairman (Non-Executive Director) Tariq Rafi (Non-Executive Director) Shahzad Saleem (Non-Executive Director) Sarmad Amin (Non-Executive Director) Dr. Muhammad Yaqub (Non-Executive Director) Dato’ Mohammed Hussein (Non-Executive Director) Mian Raza Mansha (Non-Executive Director) Aftab Ahmad Khan (Non-Executive Director) Mian Umer Mansha (Non-Executive Director) Muhammad Ali Zeb (Non-Executive Director) Dato’ Seri Ismail Shahudin (Non-Executive Director) M.U.A. Usmani President & Chief Executive Officer (Executive Director) Audit Committee Tariq Rafi – Chairman (Non-Executive Director) Dr. Muhammad Yaqub (Non-Executive Director) Dato’ Mohammed Hussein (Non-Executive Director) Aftab Ahmad Khan (Non-Executive Director) Muhammad Ali Zeb (Non-Executive Director) Hailey college of commerce shumaila iqbal puri Page 12 MCB BANK LTD Learning during internship During my internship in MCB Township branch I worked in Remittances, Advances, Foreign Exchange and Customer Service Office department , sales, cash department and I successfully completed all the task/duties that were assigned to me. The duties that I performed and the thing I learned each day are given as follows: 1st weak: Functions which are performed in MCB township branch Learn about the types of account Learn about the requirements of account opening Fill out the account opening form and KYC Learn how to fill deposit slip for cheques and cash Observe the working of CSO Learn how to attend phone call 2nd weak: Receive cheque book requisition Issuance of cheque book Entries of new cheque book Issue foreign currency cheque book Issue manual cheque book Learn about the cheque stop payment Deletion of cheque book Help out the customers in filling the cheque Prepare debit vouchers for new cheque book charges Hailey college of commerce shumaila iqbal puri Page 13 MCB BANK LTD 3rd weak: Learn to prepare CDR Record the lockers rent and prepare debit voucher Make calls to customers for the collection of rent of lockers. Prepare credit vouchers for cheques received in DAK Make clearance cheque entries in register Basic operations of clearing department Learn about inward clearance and outward clearance Stamping on cheques and deposit slip 4th weak: Learn how tofill fund transfer application for Demand draft Pay order Internal transfer ATM claims and their entries Receive ATM forms Issuance of ATM card Learn to prepare the debit voucher and credit voucher for utility bills 5th weak: Learning about the online money transfer application for the request of issuance of bank statement Hailey college of commerce shumaila iqbal puri Page 14 MCB BANK LTD wrote application for the new cheque book request in case of lost of “cheque book requisition” by customer observe the foreign remittance operations stamping on the invoice of foreign remittance learn about car leasing and its requirements take the concept of online banking 6th weak: learn about open ended and close ended investment types of LC document of LC learn about running finance basic types of advances facilities receive the applications for the account closing fill the form for the request of change in residence address Hailey college of commerce shumaila iqbal puri Page 15 MCB BANK LTD DEPARTMENTS Cash department Sales department Clearing department Remittance department Advances department Cash department In cash department both deposits and withdrawals go side by side. This department works under the accounts department and deals with cash deposits and payments. This department maintains the following sheets, books, ledger of account: Cash book: At the end of the working day cashier is responsible to maintain the cash balance book. The cash book contain the date, opening balance, detail of cash payment and received in figures, closing balance, denomination of government notes (Currency). It s checked by manager. The figure of receipt and payment of cash is entered in the cash book and the closing balance of cash is drawn from that i.e. Opening Balance Of Cash + Receipts - Payments = Balance Hailey college of commerce shumaila iqbal puri Page 16 MCB BANK LTD The closing balance of today will be the opening balance of tomorrow. This department is one of the most important departments of the bank. Five day average book: Dailey basis flow of cash is recorded. Cash position register: Recording of sorted, unsorted and sailted cash is maintained. Day book: End day summary is prepared in day book. Cash ratio: Record of total voucher and the summary of cash receipt, cash payment, cash in hand are maintained. Cash carry: Request for the needed cash in the branch to cash house which is in Lala gumbat. ATM check list: All the recording relevant to the ATM like camera, cash , roll etc. Call deposit register: Register of CDR entries. CDR number , receiving, account number etc are recorded. Hailey college of commerce shumaila iqbal puri Page 17 MCB BANK LTD Fixed deposit ledger: all the records of STDR are maintained , their interest rate, time period for which amount is fixed, name, address, and all other relevant information of the customer. Inter branch signatory (IBS) : IBS book contains the signatures of all the authorizes persons. Voucher register: The summary of vouchers of clearing , cash, transfer are Maintained TDR ledger: Certain amount of the saving account is fixed for specific time period for one month, six months, two year or more. The interest rate provided on that fixed amount is more than the saving account interest rate. Cash Payment: The only instrument that can be used to withdraw an amount from an account is the Cheque book. No payments are made by another instrument. Cheques can be of two types, they may be presented at the counter and encashed and the others are clearing or transfer cheques. Cashier manually inspects the Cheque for following: Ø Signature & date Ø Cross cutting Hailey college of commerce shumaila iqbal puri Page 18 MCB BANK LTD Ø Drawer’s a/c title Ø Amounts in words & figures Ø Two signatures at the back The cheques should not be stated as post dated. If in the Cheque there may discrepancy regarding any of the aspects described above the cheque is returned to the customer for rectification. On other hand if the cheque is valid in all respects, the cashier enters the necessary inputs in the computer and post the entry so that account balance is updated. When cashier posts these entries, computer automatically display the balance before posting the transaction amount, balance after posting. The cashier easily and quickly see whether the amount being withdrawn so exceed the balance or within the balance. If the amount does exceed the balance then Cheque is returned to customer. Cash Received: For depositing the cash into customer’s accounts, there is need to fill in the deposit slip giving the related details of the transaction. The deposit slip serves as a voucher to update to computerized transaction ledger. The cashier responsible to receive both the deposit slip and cash from the depositor, and give back the carbon copy to customer as receiving. The cashier check the necessary details provided In the deposit slip and accounts the cash and tallies with the amount declared in the slip. If the amount does not tally with the cash given, the deposit is not entertained until the customer remove the discrepancy. Hailey college of commerce shumaila iqbal puri Page 19 MCB BANK LTD Sales department Account opening This department performs various functions among them the first and most important function is Account opening. The bank reserves the right to open any account, which in its opinion is suitable as a customer. The process of opening an account is very simple and anybody that would like to open his account could do it easily without any difficulty. Nature of account: Current Khushali bachat account Basic banking account( BBA) PLS saving Smart saving account Saving 365 gold Current account: MCB Bank offers a variety of current accounts to cater to the everyday transactional needs of various customers. Low minimum balance requirements. Unlimited cash deposit and withdrawal facility at hundreds of branches nationwide. Khushali Bachat Account: Khushali Bachat Account, a Rupee savings account is one of MCB Bank’s most popular products. Due to the low initial deposit, the account can be opened by people from all walks of life and still Hailey college of commerce shumaila iqbal puri Page 20 MCB BANK LTD avail the facility of daily product profit calculation. Profit provided on khushali bachat account is 5%. Basic banking account: There is no any service charges of basic banking account. Two withdrawals and two deposit are allowed in one month. If more than two withdrawals and deposits than there are service charges. Profit provides on the BBA is 5%. PLS saving: MCB Savings Account offers you one of the most suitable ways to manage your hard-earned money. MCB Bank offers a wide array of savings products that suit short term growth & transactional needs. MCB savings accounts offer attractive profit rates as well as flexibility to transact. PLS savings has a lower minimum balance requirement. PLS saving Rates Below 5 M 5% Rs 5M to less than 10M 6.50% Rs 10M to less than 15M 7.00% Rs 15M to less than 20M 7.50% Rs 20M to less than 25M 7.75% Rs 25M & above 8.50% Saving 365 Gold This account is newly developed of MCB and it provides flexibility of saving account to business people. Profit on deposits will be payable on daily product basis on balance of RS. 500,000/- and above.. There will be no restriction on withdrawal from the account. Zakat and withholding Tax is also applicable on the account opened under this scheme. Hailey college of commerce shumaila iqbal puri Page 21 MCB BANK LTD a- Minimum balance is Rs.500,000/= b- Below minimum balance, profit calculation ignored c- Profit calculated on daily basis d- Profit paid on annually basis e- Zakat deducted on @ 2.5% f- The higher the balance, higher the rate is offered. g- Profit calculated on daily basis. h- Profit paid into your account every month smart saving account: MCB Smart Savings Account gives you the optimum value you deserve. A Savings Account where not only do you get a competitive return, enjoy the unlimited number of fringe benefits but also stay connected all the time. Following are some of the benefits you get when you are Smart enough! ◊Smart Profit • MCB Smart Savings Account gives you up to 7% return per annum. Calculated on a monthly basis, based on the minimum monthly balance maintained during that month. ∞3.0%p.a. - If minimum Balance is Rs. 10,000 Rs. 100,000 ∞5.0%p.a. - If minimum Balance is Rs. 100,000 Rs. 200,000 ∞7.0%p.a. - If minimum Balance is Rs. 200,000 Rs. 300,000 ∞Profit will not be paid on any amount above Rs. 300,000 ◊Smart Network • MCB Smart Savings Account is available through our vast network of about 600 online branches all over the country. Hailey college of commerce shumaila iqbal puri Page 22 MCB BANK LTD ◊Smart Card • Absolutely no issuance fee will be charged on issuance of the MCB Smart Card not only for you but also for your spouse. ◊Smart Lockers • The MCB Smart Account holders will receive a preference over anyone else to use the facility of our Lockers. ◊Smart Discounts • If you decide to avail any of our Consumer Loans facility you receive a 50% discount on the processing fee. Types of account: Individual Single joint Business sole proprietorship joint stock company ( public/ private) partnership (registered/ unregistered) societies association/ club/ trust autonomous bodies Govt institutions (federal/provincial) Foreign Missions/diplomats Other Common Requirements of account opening: Hailey college of commerce shumaila iqbal puri Page 23 MCB BANK LTD o Valid CNIC copy o Source of income o Evidence of address o Account opening application, SSC and other documents. Requirements for individual account: a) Attested photocopy of computerized national identity card/passport of individual. b) In case of salaried person, attested copy of his/her service card or any other acceptable evidence of service, including but not limited to a certificate from the employer. c) In case of illiterate person, two recent passport size photographs of the new account holder besides taking his right and left thumb impression on the specimen signature card. d) Salary slip of next to kin. Joint account: · In case of joint A/c, applicant mentions that how much person will operate the A/c. Instruction are given for joint A/c such that the account shall be operated by Any one of us or survivor In first case if one of the a/c holders died then the other can operate the a/c individually. Any two/All of us jointly In second case if one of the a/c holders died then the other partner can’t operate this a/c individually without having permission from the court. Hailey college of commerce shumaila iqbal puri Page 24 MCB BANK LTD ·Requirements a- Sign of both customers on back of AOF b- Sign on joint A/C # mandate c- Name and A/C # of introducer d- NIC copies of both members. e- Mode of operation. Account opened in the name of Minor In case of account being operated in the name of minor (age below 18) the word MINOR to be added to the tile of account. The particulars of guardian (if not one of the applicant of same account with the minor) to provided as required under particulars of account in the account application form. Also copy of CNIC of the guardian along with Form “B” for minor to be provided. Requirements for joint stock companies: a) Resolution of board of directors for opening of account specifying the person (s) authorized to operate the company account. b) Memorandum and article of association c) Certificate of incorporation d) Certificate of commencement of business e) Attested photocopies of computerized national identity card of all directors f) List of directors in form -29 issued for the registrar oing stock companies Requirements for trust account: a) Attested copy of certificate of registration Hailey college of commerce shumaila iqbal puri Page 25 MCB BANK LTD b) Attested copies of CNIC of all the trustees c) Certified copies of instrument of trust. Requirements for sole proprietorship: In addition to documentary requirements for individuals, following documents are required. a) Application to open an account on the official letter head of the sole proprietorship. b) National tax number /sales tax registration certificate c) Evidence of membership of trade organization /chamber of commerce etc. (whenever applicable) d) List of official authorized to operate the account and their specimen signatures. Requirements for partnership account: a) Attested photocopies of computerized national identity card of all partners b) Attested copy of “partnership deed” or “letter of partnership” duly signed by all partners of the firm. c) Authorized letter in original, in favor of the persons, other than the partners authorized to operate on account of the firm. Requirements for clubs, societies and associations: a) Certified copy of : I. Certificate of registration II. By laws/rules and regulations Hailey college of commerce shumaila iqbal puri Page 26 MCB BANK LTD b) Resolution of the governing body/ executive committee for open ing of account authorizing the person to operate the account and attested copies of CNIC of the authorized persons. c) An undertaking by authorized persons on behalf of the institutions mentioning that when any change takes place in the persons authorized to operate on the account the bank will be informed immediately. Procedure for Account Opening The customer would like to open his account is required to meet with the manager or personal banking officer, who gives him an Application Form specially used for account opening. Application Forms are available for each type of account. Along with the form, a Card for specimen signature is also provided to the customer which is scanned and loaded to computer. Manager has every right not to accept this contract if he is not satisfied by the details provided by the customer. If both accept the contract, then the next step is official Account opening. After opening a saving or current account every applicant’s data is entered into the computer to maintain a safe record and the application form is properly filled so that it can be available when necessary. Checking officer is responsible to match the manual application form with the computerized Account opening file. The “Signature Specimen Card” as mentioned above, contains two signatures of an applicant. The banker uses this card at the time when he receives the cheque for payment or authentication of Hailey college of commerce shumaila iqbal puri Page 27 MCB BANK LTD different transactions. Then he compares customer’s signature with the signature on the cheque for avoiding fraud. Issuance of Cheque Book The cheque book is issued against the valid requisition slip signed by the account holder Customer can receive cheque book after 4 to 5 days. Current account cheque book contains 50 leafs and charges are 6 per leaf Saving account cheque book contains 25 leafs and charges are 6 per leaf. Customer have to collect their new cheque book with in 6 months other wise cheque book will be deleted. The account holder can draw sums from his account by means of cheque provided to him by the bank for that particular account. Closing of an Account There are number of reasons of closing an account. Some are listed below: If customer desires to close his account due to any reason In case of death of one account holder Hailey college of commerce shumaila iqbal puri Page 28 MCB BANK LTD Bankruptcy of the account holder If an account contains nil balance or not up to the requirement of rules. Any other reason for which the banks thinks to terminate the relation ship Bank adopts the practice while closing an account that the accounts Holder personally come to the Bank premises or any official of the bank meets the account holder and satisfies him that the desire of the customer is genuine. Bank charges Rs.250/- for closing the account and hands over the whole balance to the account holder through cash payment or by preparing Pay a order. Hailey college of commerce shumaila iqbal puri Page 29 MCB BANK LTD Products and services of MCB Products and services of MCB township BRANCH Hailey college of commerce shumaila iqbal puri Page 30 MCB BANK LTD MCB car 4 u: MCB Car4U not only gets you a car of your own choice but is also affordable with competitive mark-up, flexible conditions, easy processing and above all, no hidden costs. Mark up is less than other banks and car is with out tracker which reduce tha cost of car.markup is 1% more on used and imported car. 2nd hand car should not b 2 year old and imported car should not b 5 year old. Criteria: CNIC copy Last 6 weaks bank statement which should contains continous transactions Business prove Salary should b minumum 25 to 30 thousand which should transferred in salary account. Age limit for salaried person is 21 to 60 years and for business man 22 to 70 years. 3 Vouchers are prepared Debit voucher to debit the customer account Credit voucher to credit the head office account Debit voucher to debit the MCB auto loan by head office. Hailey college of commerce shumaila iqbal puri Page 31 MCB BANK LTD MCB Investment Services: Make the most of your wealth with investment opportunities that match your unique financial aspirations. MCB Investment Services offer distribution of mutual funds managed by the leading fund managers of Pakistan. We can suggest the products most suited for customers needs, or work with customer to create a personalized solution completely focused on customer expectations of the capital markets. MCB Agri Products MCB is committed to the farming community to support their national objectives of self sufficiency & food security to the people of Pakistan. The bank’s extensive branch network in all the provinces and diversified product range extends our reach of agri credit facilities to farmers engaged in any type of activity, encompassing both crop & non crop sectors. Online banking: MCB SMS Banking With MCB SMS Banking, you can bank on your fingertips. Once you’re registered onto the service you can SMS anytime to get account information. MCB Full-Day Banking Enjoy the convenience of extended banking hours from 9am to 5pm, including Saturdays at MCB Full-Day Banking branches across the country. MCB Mobile Hailey college of commerce shumaila iqbal puri Page 32 MCB BANK LTD MCB Mobile is a quick easy and secure way to recharge mobile phones, transfer money, pay bills and do much more. Visit the nearest MCB ATM or call 111-000-622 to register and logon to www.mcbmobile.com using your mobile phone to start transacting. MCB Virtual Banking MCB Virtual Banking Service is a convenient way to access your account. It is secure, free of cost and lets you do your banking whenever and wherever. This service allows you to transfer funds, pay utility/mobile bills, set up standing order instruction, download account statement and much more. MCB Call Centre The simplest way to bank is with the new enhanced MCB Call Centre, which blends innovation and convenience to provide banking services that go beyond expectations. MCB Call Centre enables you to manage your VISA Credit & ATM/Debit Cards, confirm account balances & view last 5 transactions, pay utility/mobile phone & MCB Visa Credit Card bills, topup your mobile, transfer money within MCB network accounts and register complaints. Most importantly it provides you with our very own banking consultant to discuss your financial needs and requirements. Simply call at 111-000-622 and we’ll do the rest. MCB Rupee Travelers Cheque MCB Rupee Travelers Cheque is the best and safest alternate way of carrying cash. It can be used by travelers, businessmen or by the general public in meeting their day to day cash requirements while they travel. It is a safe and secure way to make payments because it gives the purchaser security that even if the cheque is lost it can be refunded. Unlike other modes of fund/remittance transfer which can only be drawn at a particular Hailey college of commerce shumaila iqbal puri Page 33 MCB BANK LTD branch and can be encashed only at that branch, MCB Rupee Travelers Cheque can be encashed at any of our branches across the nation. MCB ATMs MCB has one of the nation’s largest ATM networks with 500 ATMs covering 110 cities across the country and still growing. MCB ATMs give you a 24-hours convenience of cash withdrawal, mini-statement, utility bill payments, mobile top-ups, funds transfer services and much more. MCB Mobile ATM Through our MCB Mobile ATM we allow for convenient world class banking services. Our innovative MCB Mobile ATM van ensures that we offer our services wherever you are, be it concerts, fairs or any other occasion/special event MCB Smart Card MCB Smart Card opens the opportunity to have access to your funds via multiple banking channels. It enables you to withdraw cash from ATMs across Pakistan and around the world, transfer funds, pay utility and mobile bills and register for mobile and virtual banking services. MCB Visa Credit Card MCB offers a complete suite of Classic, Gold and Platinum Visa Credit Cards focusing on providing, superior services, travel privileges & shopping pleasure. It also offers comprehensive insurance & installment plans, reward points and SMS alerts that give a different feel to the world of credit cards.variable mark-up rate available to customers allowing them to repay at affordable rates. Hailey college of commerce shumaila iqbal puri Page 34 MCB BANK LTD CLEARING DEPARTMENT Every banker acts both as a paying as well as a collecting banker. It is however an important function of crossed cheques. A large part of this work is carried out through the banker clearing house. A clearing house is a place where representative of all banks of the city get together on settle the receipt and payment of cheques drawn on each other. As the collecting banker runs certain risk receipt of their ownership the law has provided certain protections to the banks. Types of cheques collected Transfer cheques Transfer cheques are those cheques, which are collected and paid by the same branch of bank. Transfer delivery cheques Transfer delivery cheques are those cheques, which are collected and paid by two different branches of the same bank situated in the same city. Clearing cheques Clearing cheques are those cheques, which are drawn on the branches of some other bank of the same city or of the same area, which is covered by a particular clearing house. Cheque Collection Collection cheques are those cheques, which are drawn on the branches of either the same bank or of another bank, but those Hailey college of commerce shumaila iqbal puri Page 35 MCB BANK LTD branches, are not in the same city or they are not the members of clearing house. Functions of clearing department : To accept transfer, transfer delivery, clearing and collection cheques from the customer of the branch and to arrange for their collection To arrange the payments of cheques drawn on the branch and given for collection to any other branch on MCB or any other member or sub member of the local clearing house. To collect the amount of cheques drawn on member, sub members of local clearing house, sent for collection by MCB branches, not represented at the local clearing house. Common procedure for all cheques: o Receiving an secutinizing the cheques and other deposit instruments, and the pay in slip at the counter. o Instrument should not b post dated o Instrument should not b mutilated. If the instrument is tore by the negligence of the banker than a stamp of “ mutilated confirm” is posted on the cheque. o The amount in words and figures should be same o Cheque the activation of account o For CMD ( cash mendatory division) the posting is made before sending for clearance. o On the face of the cheque and deposit slip “ transfer” stamp and on the back of cheque ‘ payee’s account credited” Hailey college of commerce shumaila iqbal puri Page 36 MCB BANK LTD o Account balance should b sufficient o Seprating the cheques into transfer , transfer delivery, and clearing cheques. o Returning the counter file to the depositor. Types of clearance Out ward clearance: Cheques deposited in the bank for credit to their accounts, drawn on a bank other than that of the collecting bank,i.e., not a transfer cheque. Cheques are bound outward to the payee/ drawee bank (the bank that is making the payment/ on whom the cheque is drawn). 1- Same day clearance: All branches are not the member of same day clearance. MCB township branch is a member of same day clearance. When the cheques presented in the morning than the rider of NIFT collects and sends them for clearance and in the evening these cheques are received after clearance. The service charges dare 232 (200 + 16% FED). The amount limit for same day clearance as per 01 July 2011 is 100,000 2- Normal clearance: All the cheques received before 1:30 pm are for local clearance. On the stamp of “ transfer “ one day forward date is mention because thy will receive the cheques tomorrow. After clearance cheques will receive on next day evening or if not than on 3rd day morning. Posting cannot b done before clearance. Hailey college of commerce shumaila iqbal puri Page 37 MCB BANK LTD 3- Inter city clearance: .Use when both banks are in different cities. .Standard time by SBP Is 72 Hours or 3 days but can delya up to 4 days. .Rider of NIFT collects cheques for clearance from branch .When other bank receives the cheques for clearance than they send receival letter. .After clearance advice is received with cheques. .Along with advices there is a NILL letter which indicates about the final clearance. .Before the receival of NILL letter banker can’t credit or debit the amount. 4- CC (cheque collection): Also called out door bill collection CC is used when there is no lift service to the banks like villeges, tirbal areas. Contact with our own branch in that area and then follows the instructions which are given by them for clearance. Cheques are dispatched to our own bank branch than they sent it to the relevant branch. Before dispatching entries of CC in the register are done. Inward clearance: Inward clearing means the cheques received by the bank from other banks. These - Inward clearing - cheques are the cheques drawn by the Hailey college of commerce shumaila iqbal puri Page 38 MCB BANK LTD bank/branch customers on their account in favour of other parties. On receipt of the inward clearing, the cheques are posted to the various accounts on which they are drawn -meaning the accounts of the cheque issuer or drawer with the bank is debited to the account and the payment is made to the bank presenting the cheque. So if in your bank statement there is a debit as inward clearing, it means that your account has been debited with the amount of cheque you have issued to someone for that amount. Since you will be having details as to the issue of cheques, you can find out . The debit indicates that the cheque has been paid. If the balance was insufficient to pay the inward cheque, the bank will have returned the same to the presenting bank and would have debited your account with cheque return charges. 1- Same day clearance: MCB receives cheques for clearance which are presented by our customer to other. After verification of signature and balance the cheuqes are dispatched on the same day. 2- Normal clearance: CPD (centralized processing discrepancy) is used for clearance of local cheques. It is a central system which is used for clearance of local cheques by MCB. Is some problem in verification occurs then contract with relevant branch. 3- Inter city clearance: Hailey college of commerce shumaila iqbal puri Page 39 MCB BANK LTD Cheques presented to us for clearance from other cities. After verification the clearance advice is prepared and dispatch cheques along with advice and NILL letter to the bank. REMITANCE DEPARTMENT Transfer of money or equivalent to money from one branch to another branch of the same bank is called remittance. Home remittance MCB brings FAST and FREE Home Remittance service to beneficiaries in Pakistan. With our large network of over 1100 branches, MCB can deliver your remittances to every part of Pakistan. MCB Fast Transfer & MCB Pak Cash enables you, the Non Resident Pakistanis, to send money to your loved ones in Pakistan quickly, easily and conveniently. MCB Home Remittance Service is FREE and available at all MCB. MCB Remittance Service offers you two ways of sending money to your loved ones : 1- MCB Fast Transfer :(Account to Account Transfer): ◊Same day credit to MCB Account holders ◊ Fast, prompt and free funds transfer ◊ Free of charge ◊ SMS alert for beneficiary Hailey college of commerce shumaila iqbal puri Page 40 MCB BANK LTD ◊ For Non MCB Account holders, funds are transferred online or via bank draft to any other bank 2- MCB Pak Cash Features : ◊Receiver's account in MCB is not required ◊Instant cash payment of up to Rs. 500,000/- over the counter can be made to the beneficiary at any MCB branch ◊Fast, dependable and hassle-free funds transfer ◊SMS alert for beneficiary (subject to provision of mobile number) Mode of Payment MCB uses following types of Mode of Payment: Demand Draft (DD) Pay order (PO) Mail Transfer (MT) Telegraphic Transfer (TT) Requirements: Remittance Reference Number and original CNIC provided by the receiver/ beneficiary. For SMS alert valid mobile number of beneficiary. Now it has become easier and safer method both for the client and banker to transfer their money from one branch to another within the city and outside the city through the instruments. Hailey college of commerce shumaila iqbal puri Page 41 MCB BANK LTD Originating Branch It is the branch, which issues advice of remittance to other branch. Responding Branch It is the branch which receives instrument for remittance. When customer requires a facility of remittance, he should be asked to complete the prescribed fund transfer application Same prescribed application form is used for MT, TT, DD, and PO. This application form states the amount of the remittance, the name and address of the payee, the name of originating and responding branch. The applicant and the bank officer who have been duly authorized to act on his behalf should sign this application form. Demand Draft (DD) A draft is an instrument drawn by a bank in favor of any person on a branch of its own bank or any other bank to pay a certain amount of money, which is demanded, to the person named on it. It is negotiable instrument Thump impressions is not acceptable on DD. Legal provisions are same as that of cheque. It is not necessary for the demand draft that the applicant or recipient’s account should be open in originating and responding branches. Hailey college of commerce shumaila iqbal puri Page 42 MCB BANK LTD For demand draft, bank charges excise duty and commission which is bank’s income. It is one of the cheapest methods to transfer money within the country or outside the country. The following are the parties: ◊ Purchaser ◊ Issuing bank ◊ Drawer branch ◊ Issuing bank Procedure for Demand Draft Applicant has to fill in the fund transfer application form for availing the facility of demand draft. After depositing the amount of draft, remittance officer prepares the cheque/leaf of demand draft. When banker issues the draft to the customer, he also records customer particulars in a demand draft register where record is maintain branch wise. Responding branch and originating branch debit/credit the head office account and send the daily statement of transaction to head office. Pay Order (PO) Pay order is called “Banker’s Cheque”. Pay order is written order, which is issued and received by the same bank or drawn and payable on same branch. In this case originating and responding Hailey college of commerce shumaila iqbal puri Page 43 MCB BANK LTD branches will be same for Pay Order it is not necessary that applicant should be account holder. It is used for local transference of money from one person to another within the city. The procedure of preparing of PO Is same as that of DD. For account holder the charges are RS 100+16 and if the pay order is prepared by cash than Rs. 200 +32. The bank charges excise duty and flat rate of 16%. All records of issued and paid must be maintained. Credit voucher should be prepared. Parties in pay order: ◊ Purchaser ◊ Issuing bank ◊ drawer branch ◊ Payee Mail Transfer (MT) The transfer of money from one branch to another branch of the same bank with in or out of the city through mail or courier service is called mail transfer. Mail transfer is not a negotiable instrument. The procedure of the preparation of MT is same as that of DD. Hailey college of commerce shumaila iqbal puri Page 44 MCB BANK LTD In mail transfer it is obligatory that the Beneficiary must have the account in responding Branch. However, the applicant may or may not be the account holder of the issuing branch. Fund transfer application form is used for MT. After receiving the money to be remitted, Branch prepares MT advice in duplicate and sends one copy to responding branch and other becomes voucher of the bank. Telegraphic transfer: Transfer of funds from one branch to another branch of the same bank or upon other bank under special arrangement. Telegraphic transfer is not negotiable The funds are not payable to bearer Minor can not avail this facility. Full name of the beneficiary or account number should be mention in the application form Instructions regarding mode of payment should be obtained. A record in the maintance outward register should be maintained All the remittance must be controlled through number. Parties: ◊ Applicant ◊ Drawing branch ◊ Drawer branch ◊ Beneficiary Hailey college of commerce shumaila iqbal puri Page 45 MCB BANK LTD ADVANCES DEPARTMENT Advances are the major revenue generating activity carried out by the banks. This activity demands adequate expertise and attention for the efficient and effective operation of the procedures underlying the system of Advances. . The credit portfolio of this institution is in a very much better shape than other financial institutions of Pakistan and the credit goes to the management and the staff who are concerned about the quantity and quality as well. MODES OF CREDIT FACILITIES Various Corporate and Commercial advances facilities provided by the Bank are divided into the following categories. There are two types of facilities Funded Facilities; Non-funded Facilities 1- FUNDED FACILITIES A funded Facility Fund based facility are financial accommodation extended by bank where bank use its funds that generate revenue in shape of Mark up.MCB is offering following kind of Fund Based facilities to its clients. Running finance Cash finance. Demand finance/ term finance Hailey college of commerce shumaila iqbal puri Page 46 MCB BANK LTD Running Finance Running finance facility is provided to a customer by way of allowing withdrawals from current account in excess of the credit balance, maintained by the customer with the bank. The account is allowed to be operated freely by way of multi transactions. Account is strictly operated with in approved terms and conditions. Running finance facility should not b use for long term needs Clean up period is provided for 3 days Charging of mark up on markup is prohibited Security structure 1- primary security: Hypothecation over Assets Pledge of shares or near cash security 2- secondary security Mortgage of fixed assets Hypothecation of plant and machinery Hailey college of commerce shumaila iqbal puri Page 47 MCB BANK LTD Cash Finance In this, the borrower gives a specific reason for the need of cash. MCB gives the facility of cash credit to business. Cash finance is a facility where an amount is disbursed against pledge of local/ locally produced goods or merchandize. The amount after retaining the prescribed percentage of margin on stocks is transferred in a separate cash finance account of the customer. Delivery of pledge stock is allowed on repayment of finance along with mark up. Possible security structure: Pledge of local / locally produced goods or merchandize. Demand Finance This is a type of secured loan and demand loan never allowed without security. It is a type of long term financing. Primary purpose is to finance fixed assets such as plant and machinery, land, building etc. Under this type of facility is allowed to borrower for a fixed period usually exceeding one year, repayable either in period installment or in lump sum, at a future date Purpose of obtaining loan: New fresh project: green field project with no existing operations. Hailey college of commerce shumaila iqbal puri Page 48 MCB BANK LTD Expansion: increase in existing business. Financing financial mismatches: long term needs being financed through short term sources. NON FUNDED FACILITIES Non Fund based facility are financial accommodations extended by bank where bank does not use its funds but add guarantee for execution of some contract. MCB is offering following kind of Non Fund Based facilities to its clients. Letter of credit Letter of guarantees Letter of credit: A letter from a bank guaranteeing that a buyer's payment to a seller will be received on time and for the correct amount. In the event that the buyer is unable to make payment on the purchase, the bank will be required to cover the full or remaining amount of the purchase. Letter of guarantee: A contract of grantee is a contract to perform the promise, or discharge the liability of a third person in case of his default. A person who gives grantee is called grantor A person in respect of whose default grantee is given is called principle debtor. Hailey college of commerce shumaila iqbal puri Page 49 MCB BANK LTD RATIO ANALYSIS Ratio analysis enables the analyst to compare items on a single financial statement or to examine the relationships between items on two financial statements. After calculating ratios for each year's financial data, the analyst can then examine trends for the company across years. Since ratios adjust for size, using this analytical tool facilitates intercompany as well as intercompany comparisons. Ratios are often classified using the following terms: profitability ratios (also known as operating ratios), liquidity ratios, and solvency ratios. Profitability ratios are gauges of the company's operating success for a given period of time. Liquidity ratios are measures of the short-term ability of the company to pay its debts when they come due and to meet unexpected needs for cash. Solvency ratios indicate the ability of the company to meet its long-term obligations on a continuing basis and thus to survive over a long period of time. CATEGORIES OF RATIO ANALYSIS: Liquidity ratios Activity ratios Debt ratios Profitability ratios Market ratios LIQUIDITY RATIOS The liquidity of a firm is measured by its ability to satisfy its short-term obligations as they come due. Liquidity refers to the solvency of the firm’s overall financial Hailey college of commerce shumaila iqbal puri Page 50 MCB BANK LTD position i.e. the ease with which it pays its bills. Due to low or declining liquidity firm moves towards financial distress and bankruptcy. Liquidity Measures are Current ratio Quick (acid-test) ratio CURRENT RATIO: The current ratio, one of the most commonly cited financial ratios, measure the firm’s ability to meet its short-term obligations. It is expressed as follows: Current assets Current ratio = Current liability Years 2010 2009 2008 Current ratio 1.42 1.02 1.31 RESULT: From the above ratios it is clear that the firm’s investment in current assets has increased. In 2010, it is in better position to pay its obligations as they come due. But in three years we can see that the firm has the ability to pay its current liabilities efficiently. The standard for this ratio is 2:1 it is calculated by the current assets by total of the current liabilities. This ratio is below the standard. The management should take steps to improve the short- term financial position of the firm. Hailey college of commerce shumaila iqbal puri Page 51 MCB BANK LTD DEBT RATIO The debt position of a firm indicates the amount of other people’s money being used to generate profits. In general, the financial analyst is most concerned with long term debts, because these commit the firm to a stream of payment s over the long run. The debt ratio measures the proportion of total assets financed by the firm’s creditors. The higher this ratio the greater the amount of other people money being used to generate profit. The ratio is calculated by following formula Debt ratio = Total liabilities Total assets Years Debt ratios 2010 2009 2008 0.864958 0.860627 0.877075 RESULT: The ratio indicates the more than half of the assets financed by the debt. This ratio is almost showing the same trend throughout the previous three years. Debt ratio indicates the greater the risk and more financial leverage it has. It also shows that firm has paid some portion of the debt during the year 2010. MARKET RATIOS Return on total assets Return on equity Hailey college of commerce shumaila iqbal puri Page 52 MCB BANK LTD Earnings per share RETURN ON TOTAL ASSETS: It measures the overall effectiveness of management in generating profits with its available assets. The higher the Return on total assets better will be the performance. Earning available for common stockholders Return on total assets = Total assets Year 2010 2009 2008 ROA 5.030% 5.505% 5.219% RESULT: The return on investment of the firm is 5.03 % in 2010. It is less than the previous year. It shows that firm generates Rs.5.03 for each Rs.100 of the investment which is very poor for the company progress. RETURN ON EQUITY: Earning available for common stockholders Return on total assets = Total Equity Hailey college of commerce shumaila iqbal puri Page 53 MCB BANK LTD Year 2010 2009 2008 ROE (%) 28.313 34.73238 34.448881 RESULT: The return on equity of the firm is 28.313% in 2010. It is less than the previous year. It shows that firm generates Rs.28.313 for each Rs.100 of the investment made by the partners or shareholders of the company (which are privately owned by four brothers). EARNING PER SHARE: Year 2010 2009 2008 EPS 24.38929 26.16947 22.95 RESULT: This ratio indicates the amount of income earned by the common stockholders. Above figures clearly show the progress of the company and it maintains this ratio more than Rs.20 which is good for the investors. Hailey college of commerce shumaila iqbal puri Page 54 MCB BANK LTD SWOT Analysis STRENGTH MCB is the first Pakistani privatized bank and because of its quality management, marketing, innovation in products and services. Owing to all such factors they have established a good reputation in the banking market. The name of MCB makes you recall the highly cooperative and professional individuals ready to serve you with maximum zeal and zest. MCB township branch have faster banking services that are making it more prominent in the banking industry especially in operations and Foreign exchange. The customer prefers this bank not only because of its faster speedy service rather due to reasonable service charges. MCB town ship branch is the also in the list of highly automated banks like Emirates because of its modern style of banking through fully computerized control and twenty four hour banking. The joining of experienced people, advanced management, advance setup and facilities gave MCB township branch an edge over its competitors. 24 hours cash access through ATM. Extension and improvement in services to domestic as well as foreign customers. Hailey college of commerce shumaila iqbal puri Page 55 MCB BANK LTD MCB has long term vision which plays a very important role in organization’s success. FLAWS IN MCB township branch (WEAKNESSES) Although MCB is a well performing bank and its deposits are growing day-by-day and so its profitability, but as we know that nothing is perfect, there is always a room for improvement. Some of the flaws that I have observed during my training period are as under: There is a criticism on the banking management that the salaries of the employees are decreasing in every succeeding year. I think this will shake the confidence and working habit of the employees. Another pitfall I observed is that there is no proper timing of the bank and there is made unnecessary delays in the banking transactions, which might not be a good sign for the bank from future prosperity point of view. There is a lack of incentives for employees, which causes most of the employees to work with heavy heart, and as a result of which conflicts arise between lower and higher officers. Working environment, equipments, furniture in MCB township branches not according to the modern banking style. Although the bank is in process of computerizing its records, which is, a good sign but it is going on with small progress. The majority of people are not well aware about the products Hailey college of commerce shumaila iqbal puri Page 56 MCB BANK LTD of MCB township branch .Therefore it should advertise extensively especially RTC and Master Cards A behavior has been noted that bank tries to feel at ease with good looking, rich and educated people and the poor looking customers feel some bit strange in the environment of the bank. The bank employees should try to accommodate behaviorally all type of customers. In MCB township branch there is lack of specialized skill because of job rotation policy of human resource department. The bank should concentrate upon increasing its abilities on individual service basis. Mismanagement of time is another big mistake in MCB township branch, the bank official time of closing is 5:30pm but due mismanagent of time allocation and work the staff is normally on their seats till 7:00 or 8:00 clock. No market for advances No training for advances in charge. Number of branches are decreasing due to low profitability. Opportunities Due to largest ATM network, MCB can expand its 24 hours cash facilities to the far off cities of the growing market demand. They can capture a large portion of the market, if they expand its ATM and branch network to other countries of the as well. Growing policies of government on business and commerce sector provides MCB township branch opportunity to efficiently Hailey college of commerce shumaila iqbal puri Page 57 MCB BANK LTD meet with the business people’s requirement of instant cash and financing facilities To open overseas branches throughout the world like National Bank of Pakistan and Habib Bank Limited or merger with other foreign banks outside Pakistan Benefits from incoming expertise and competition. THREATS Changes in government policies have affected the banking business. Still banks have to wait to get permission of state bank. The Competition has become severe by the entrants of so many banks, So to exist one will have to prove himself in its services through excellent management and will have to satisfy its shareholders. Otherwise he will be out the market. The decrease purchasing power of consumer in the current economic situation of the country affecting the business activity speed too much and the result is the low investment from the investors in new projects can create problem for the bank because it is working a lot in trade. Increasing foreign banks in the country. Privatization of other domestic banks has also increased their services. Highly specialized and attractive services provide by the foreign banks to their customers. Hailey college of commerce shumaila iqbal puri Page 58 MCB BANK LTD Growing global technological advances. High inflation rate. CONCLUSION It is evident from this report the financial statement of the branch of is making decreasing trend as compared to last year 2009. The profits of MCB has grown considerably during the last few years and this trend is expected to continue for the coming future. Therefore I conclude that the MCB township branch has very prosperous present and future, which assures the shareholders of wealth maximization. Side by side of it I think that if bank would be able to cover and control on the given mentioned recommendations then it would be in such a situation that will really lead it towards the road of prosperity, development and integrity . And with the above mentioned sentences I think that there is too fault of the customers and in order to make the proper working of the bank. The customers should also behave in a good and nice manner, and also keep in mind the timings of the bank especially in RAMAZAN which ultimately gain the corporation on bank side. And then in this case the bank would be able to compete with the competitors, at national level as well as at international level. Hailey college of commerce shumaila iqbal puri Page 59 MCB BANK LTD RECOMMENDATIONS OR SUGGESTIONS From the quantum of the profit and its financial data it can be easily judged that after privatization, MCB is performing well. Its deposits are growing day by day and so its profitability. The following suggestions can be recommended to overcome flaws in MCB township branch and to improve the efficiency for the development of the bank. Employees Training Programs must be introduced on continuous basis so that the employees will have understanding with the latest developments especially with the customers. Bank should introduce incentive plans for employees on regular basis so that if employees will work whole-heartedly for the welfare of their organization. Incentives should be given on the basis of qualification, hard work, and experience etc. Salaries of the employees should be increased MCB township branch should follow the proper timings as scheduled. MCB township branch working environment, equipment and furniture should be according to modern banking style. Proper attention should be paid to upgrade customer services. Bank should adopt the global organizational banking structure to meet the international standards of banking sector. Proper attention should be paid to upgrade customer service. Every year some of the employees should be sent for training to other countries Hailey college of commerce shumaila iqbal puri Page 60 MCB BANK LTD A big portion of home remittance is sent by Pakistan working capital through MCB limited. As we know a big portion of this amount is wasted purchasing of luxuries. The people motivated to save money by offering the deposit through various investment schemes Skills required during internship Communication skills Development of professional attitude. Learning the art of self management. Punctuality. Practical approach towards problem solving and creative thinking. APPENDIX Following document have been attached with this internship Report. 1) Training Completion Certificate 2) Letter Of Authorization 3) Balance Sheet 4) Profit And Loss Account Hailey college of commerce shumaila iqbal puri Page 61 MCB BANK LTD 5) Statement Of Comprehensive Income 6) Statement Of Changes in Equity 7) Cash Flow Statement 8) vertical/ horizontal analysis of balance sheet Bibliography http://www.mcb.com.pk/mcb/corporate_information.asp http://www.mcb.com.pk/uploads/FCG/docs/Annual%20Report%202010_1. pdf www.investopedia.com Hailey college of commerce shumaila iqbal puri Page 62