Investment Evaluation - Kellogg School of Management

advertisement

INVESTMENT EVALUATION

Professor Tim Thompson

Kellogg School of Management

Investment Evaluation

1

The Finance Function

Operations

(Plant,

Equipment,

Projects,

etc.)

Financial

Manager

(2) Investment

(1a) Raise

Funds

Financial

Markets

(Investors)

(1b) Obligations

(Stocks, Debt, IOUs)

(4) Reinvest

(3) Cash from

Operations

(5) Dividends or

Interest Payments

The finance function manages the cash flow

Investment Evaluation

2

The Finance Function

Finance focuses on these two decisions

Operations Investment Financial Financing

Decision Manager Decision

How much to

invest and in

what assets?

Capital Budgeting

Financial

Markets

Where is the $

going to come

from?

Investment Evaluation

3

Interaction between Financing &

Investment Decisions

The interplay of the decisions determines the cost of capital

Characteristics

of the

Investment

Operations

Investment Financial

Decision

Manager

Financing

Decision

Financial

Markets

Cost of Capital

Investment Evaluation

4

The Finance Function

By making investing and financing decisions, the financial

manager is attempting to achieve the following objective:

The objective of the financial manager

and the corporation is to MAXIMIZE

THE CURRENT VALUE OF

SHAREHOLDERS' WEALTH.

(Taken literally, this means that a firm should pursue policies that

maximize its today's quotation in the Wall Street Journal.)

Investment Evaluation

5

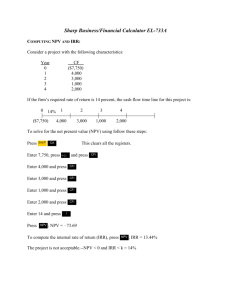

Investment Evaluation in 3 Basic Steps

1)

Forecast all relevant after tax expected cash flows generated

by the project

2)

Estimate the opportunity cost of capital--r (reflects the time

value of money and the risk)

3)

Evaluation

DCF (discounted cash flows)

NPV (net present value)

Accept project if NPV is positive

Reject project if NPV is negative

IRR (internal rate of return

Accept project if IRR > r

Payback, Profitability Index

ROA, ROFE, ROI, ROCE

ROE

EVA

Investment Evaluation

6

Forecasting Cash Flows

First, forecast all relevant after-tax expected cash flows

Sample Corporation VALUATION

Actual

1998

1999

2000

2001

ProForma

2002

2003

2004

1,356.1

1,535.0

1,660.0

1,759.6

1,865.2

1,958.4

2,056.4

(1,143.2)

(67.5)

(1,304.8)

(77.0)

(1,402.7)

(83.0)

(1,478.1)

(80.0)

(1,566.7)

(75.0)

(1,645.1)

(70.0)

(1,727.3)

(65.0)

4 EBIT

5 Taxes

145.4

(50.6)

153.3

(61.3)

174.3

(69.7)

201.5

(80.6)

223.4

(89.4)

243.3

(97.3)

264.0

(105.6)

6 EBIAT

94.8

92.0

104.6

120.9

134.1

146.0

158.4

B. Operating Income

1 Sales

2 Operating Costs

3 Depreciation

C. Cash Flows from Operations

Actual

1998

1999

2000

2001

ProForma

2002

2003

2004

7 EBIAT

94.8

92.0

104.6

120.9

134.1

146.0

158.4

8 Depreciation

67.5

77.0

83.0

80.0

75.0

70.0

65.0

(87.7)

(30.3)

(75.0)

(19.9)

(21.1)

(18.7)

(19.6)

(59.7)

(46.2)

(48.4)

(50.0)

(50.0)

(50.0)

(50.0)

14.9

92.4

64.2

131.0

137.9

147.4

153.8

9 Changes in WC

10 Capital Investment

11 Free Cash Flows

Key is that cash flows must be (a) relevant, costs and income directly

affected by the project, and (b) after-tax, cash into the owner’s pocket

Investment Evaluation

7

Forecasting Cash Flows

This is done by estimating operational parameters

Sample Corporation VALUATION

A. Operating Parameters

S

P

T

D

C

W

Sales Growth (%)

Operating Profit Margin (%)

Tax Rate (%)

Depreciation ($)

Capital Expenditure ($)

Working Capital as % of Sales (%)

Excess Cash

Market Value of Debt

# of Outstanding Shares

Perpetual Growth Rate

Actual

1998

49.6%

15.7%

39.9%

67.5

59.7

19.5%

1999

13%

15.0%

40.0%

77.0

46.2

16.9%

2000

8%

15.5%

40.0%

83.0

48.4

60.0%

2001

6%

16.0%

40.0%

80.0

50.0

20.0%

217.3

22.9

5.0%

These are based on

actual reported

performance

ProForma

2002

2003

6%

16.0%

40.0%

75.0

50.0

20.0%

5%

16.0%

40.0%

70.0

50.0

20.0%

2004

5%

16.0%

40.0%

65.0

50.0

20.0%

2005

Terminal

5%

16.0%

40.0%

65.0

50.0

20.0%

This represents a “best

guess” about the

company’s future

performance

Obviously, there is an uncertainty problem but history is used as a guide for

what to expect in the future

Investment Evaluation

8

Investment Evaluation

Evaluating investments involves the following:

1)

Forecast all relevant after tax expected cash flows generated

by the project

2)

Estimate the opportunity cost of capital--r (reflects the time

value of money and the risk)

3)

Evaluation

DCF (discounted cash flows)

NPV (net present value)

Accept project if NPV is positive

Reject project if NPV is negative

IRR (internal rate of return

Accept project if IRR > r

Payback , Profitability Index

ROA, ROFE, ROI, ROCE

ROE

EVA

Investment Evaluation

9

Forecasting Cash Flows: The Ten Commandments

1)

Depreciation is not a cash flow, but it affects taxation

2)

Do not ignore investment in fixed assets (Capital Expenditures)

3)

Do not ignore investment in net working capital

4)

Separate investment and financing decisions: Evaluate as if entirely

equity financed

5)

Estimate flows on a incremental basis

•

•

•

6)

Include only changes in operating working capital. Short-term debt,

excess cash and marketable securities should not be accounted for.

Forget sunk costs: cost incurred in the past and irreversible

Include all externalities - the effects of the project on the rest of the firm e.g., cannibalization or erosion, enhancement

Opportunity costs cannot be ignored

Investment Evaluation

10

Forecasting Cash Flows: The Ten Commandments

7)

Do not forget continuing value (residual or terminal value)

•Liquidation value: Estimate the proceeds from the sale of assets after the

explicit forecast period. (Recover investment in working capital, tax-shield or

fixed assets but missing the intangibles and value of on-going business)

•Perpetual growth: Assume cash flows are expected to grow at a constant rate

perpetually.

8)

c t1

Continuing Value

(r - g)

Be consistent in your treatment of inflation

•Nominal cash flows (including inflation) -- use a nominal cost of capital R

•Real cash flows (without inflation) -- use a real cost of capital r

9)

Overhead costs

10)

Include excess cash, excess real estate, unfunded (over-funded)

pension fund, large stock option obligations, and other relevant off

balance sheet items.

Investment Evaluation

11

Forecasting Cash Flows

Cash Flows from Operations

-

Revenue

Cost of Goods Sold

Depreciation (may be in CGS)

Selling, General & Admin.

= Operating Profit

- Cash Taxes on Operating Profit

=

+

-

Net Operating Profit After Tax

Depreciation

Capital Expenditures

Increase in Working Capital

= Cash Flow from Operations

Investment Evaluation

12

Forecasting Cash Flows

1) Depreciation is not a cash flow, but it affects taxation

-

Revenue

Cost of Goods Sold

Depreciation

Selling, General & Admin.

= Operating Profit

- Cash Taxes on Operating Profit

=

+

-

Net Operating Profit After Tax

Depreciation

Capital Expenditures

Increase in Working Capital

= Cash Flow from Operations

Investment Evaluation

13

Forecasting Cash Flows

2) Do not ignore investment in fixed assets.

-

Revenue

Cost of Goods Sold

Depreciation

Selling, General & Admin.

= Operating Profit

- Cash Taxes on Operating Profit

=

+

-

Net Operating Profit After Tax

Depreciation

Capital Expenditures

Increase in Working Capital

= Cash Flow from Operations

Investment Evaluation

14

Forecasting Cash Flows

3) Do not ignore investment in net working capital.

-

Revenue

Cost of Goods Sold

Depreciation

Selling, General & Admin.

= Operating Profit

- Cash Taxes on Operating Profit

=

+

-

Net Operating Profit After Tax

Depreciation

Capital Expenditures

Increase in Working Capital

= Cash Flow from Operations

Investment Evaluation

15

Forecasting Cash Flows

There is an important distinction between

the accounting definition of working

capital and the economic/finance

definition relevant to cash flows forecast.

The distinction is a direct result of the 4th

commandment above: We need the operating

working capital, not the operating and

financial working capital.

Investment Evaluation

16

Accounting Definition of Working

Capital

Working Capital = Current Assets - Current Liabilities

Accounts receivable

Inventory

Cash (required for operations)

Excess Cash & marketable securities

Accounts payable

Accrued taxes

Accrued wages

short-term debt

• Current assets include operating assets (above dotted line). However,

excess cash and marketable securities not required for operations (below

dotted line) are not operating working capital and accounted separately for

value (see 10th commandment).

• Current liabilities include both operating liabilities (above the dotted line)

and non-operating short-term debt (below the dotted line).

Investment Evaluation

17

Forecasting Cash Flows

4) Separate investment and financing decisions

-

Revenue

Cost of Goods Sold

Depreciation

Selling, General & Admin.

= Operating Profit

- Cash Taxes on Operating Profit

=

+

-

Net Operating Profit After Tax

Depreciation

Capital Expenditures

Increase in Working Capital

Evaluate as if

entirely equity

financed

Ignore

financing/

no interest line

item

= Cash Flow from Operations

Investment Evaluation

18

Forecasting Cash Flows

5) Estimate flows on an incremental basis

Incremental = total firm cash flow - total firm cash flow

Cash Flow

WITH the project

WITHOUT the project

•Forget Sunk Costs –

costs incurred in the past and irreversible

•Include all effects of the project on the rest of the firm

(e.g., cannibalization, erosion, enhancement, etc.)

Investment Evaluation

19

Forecasting Cash Flows

6) Opportunity costs cannot be ignored

What other

uses could

resources be

put to?

The cost of any resource is the foregone opportunity of

employing this resources in the next best alternative use.

Investment Evaluation

20

Forecasting Cash Flows

7) Do not forget continuing value (residual or terminal)

Two approaches are available:

•Liquidation value: Estimate the proceeds from the sale of

assets after the explicit forecast period. (Include the recovery

of investment in working capital, tax-shield on the

undepreciated fixed assets and any revenue from assets sale).

•This approach results in under-valuation since it misses the

value of on-going business. It ignores the value of

intangibles.

Investment Evaluation

21

Forecasting Cash Flows

•Perpetual growth: Assumes that after time n cash

flows are expected to grow at a constant rate

perpetually.

Terminal Value

Year 1

CF1

Year 2 . . . Year n

CF2

Year n+1 & on

CFn

Investment Evaluation

CFn+1/(r-g)

22

Forecasting Cash Flows

8) Be consistent in the treatment of inflation

Discount nominal cash flows with nominal cost of capital

Discount real cash flows with real cost of capital

Common Mistake: Nominal (inflation adjusted) discount

rate used to discount real cash flows

Bias towards short-term investment

7%

{

4% Inflation

Nominal

3% Real

Nominal Rate Real Rate + Inflation

Investment Evaluation

23

Forecasting Cash Flows

Nominal vs. Real Cash Flows

Nominal

Real

1

2.00

2.00

2

2.08

2.00

3

2.16

2.00

Inflation @ 4%

Note: Depreciation is based on historical costs and therefore is not

adjusted for inflation

Investment Evaluation

24

Forecasting Cash Flows

9) Overhead costs

-

Do not forget

overheads and

other indirect

costs that

increase due

to the project

Revenue

Cost of Goods Sold

Depreciation

Selling, General & Admin.

= Operating Profit

- Cash Taxes on Operating Profit

=

+

-

Net Operating Profit After Tax

Depreciation

Capital Expenditures

Increase in Working Capital

= Cash Flow from Operations

Investment Evaluation

25

Forecasting Cash Flows

10) Include excess cash, excess real estate, unfunded (overfunded) pension funds, large stock option obligations

Year 1 Year 2 Year 3 Year 4 Year 5 . . . Terminal

CF1

CFn+1/(r-g)

CF2

CF4

CF5

CF3

+

+

+

-

PV(Operating Cash Flows)

Excess cash balance

Excess marketable securities

Excess real estate

Under-funded pension

Assets/Liabilities

not required to

support operations

=Value of the FIRM

Investment Evaluation

26

Value of Equity

Value of the Firm

-Value of Debt

=Value of Equity

To calculate share price-divide by the

number of shares outstanding

Investment Evaluation

27

Investment Evaluation

Evaluating investments involves the following:

1)

Forecast all relevant after tax expected cash flows generated by

the project

2)

Estimate the opportunity cost of capital--r (reflects the time

value of money and the risk)

3)

Evaluation

DCF (discounted cash flows)

NPV (net present value)

Accept project if NPV is positive

Reject project if NPV is negative

IRR (internal rate of return

Accept project if IRR > r

Payback , Profitability Index

ROA, ROFE, ROI, ROCE

ROE

EVA

Investment Evaluation

28

Evaluation Methods: NPV

Net Present Value (NPV) is the sum of all cash flows adjusted

by the discount rate

Example:

Time Period

0

1

2

Buy Hot Dog Cart

Sell Hot Dogs

Sell Hot Dogs

Cash Flows

-187

110

121

Discount Rate

10%

NPV 187

110

121

(1 0.10) (1 0.10) 2

Activity

NPV 187 100 100 13

Future cash flows are discounted “penalized” for time and risk

Investment Evaluation

29

Evaluation Methods: NPV

Net Present Value (NPV) is the sum of all cash flows adjusted

by the discount rate

Example:

Time Period

0

1

2

Buy Hot Dog Cart

Sell Hot Dogs

Sell Hot Dogs

Cash Flows

-200

110

121

Discount Rate

10%

NPV 200

110

121

(1 0.10) (1 0.10) 2

Activity

NPV 200 100 100 0

Investment Evaluation

30

Evaluation Methods: IRR

As the discount rate increases, the PV of future cash flows is

lower and the NPV is reduced

Example:

Hot Dog Cart Valuation

50

40

IRR: Discount rate at

which the project has a

NPV of zero

20

10

24

%

22

%

20

%

18

%

16

%

14

%

12

%

10

%

8%

6%

0%

-10

4%

0

2%

NPV ($)

30

-20

-30

Discount Rate (%)

Internal rate of return (IRR) is the discount rate that sets the

NPV to zero

Investment Evaluation

31

Calculation of IRR

The IRR is the r that solves

Cn

C1

C2

0 C0

....

2

1 r (1 r )

(1 r ) n

Decision Rule: Accept the project if

IRR > Opportunity Cost of Capital

Investment Evaluation

32

Evaluation Methods:

NPV vs. IRR

NPV is a measure of absolute performance, whereas IRR

measures relative performance:

1) Independent Projects

Accept if NPV > 0

Accept if IRR > Opportunity Cost of Capital

Investment Evaluation

33

Evaluation Methods:

NPV vs. IRR

2) Mutually Exclusive Projects (Ranking)

Problems with IRR:

A) Scale

Time Period:

Project A

Project B

0

-1

-100

Highest (NPVa, NPVb, NPVc)

Highest (IRRa, IRRb, IRRc)

1

5

120

IRR

400%

20%

Obviously, the return in absolute

dollars must be considered

B) Timing of Cash Flows: Bias against long-term

investments

Time Period:

Project A

Project B

0

-100

-100

1

20

100

2

120

31.25

IRR

20%

25%

NPV@0% NPV@10% NPV@20%

Preference for CF early!

40

17.3

0.0

But, it depends.

31.25

16.7

5.0

Investment Evaluation

34

Evaluation Methods:

NPV vs. IRR

The ranking of the projects depends on the discount rate

Time Period:

Project A

Project B

0

-100

-100

1

20

100

2

120

31.25

IRR

20%

25%

NPV@0%

40

31.25

NPV@10%

17.3

16.7

A is a LT project and when discount rate PV

B is a ST project and when discount rate PV drops less

Investment Evaluation

35

Other Evaluation Methods

Profitability Index: PV/I. Problem: Biases against large-scale projects.

Payback: How long does it take for the project to payback?

Time Period:

Project A

Project B

0

-100

-10

1

2

20

2

3

30

2

4

50

2

5

10

Corporate Rule: Project must payback in at most 3 years!

ROA (return on assets)

ROI (return on investment)

ROFE (return on funds employed)

ROCE (return on capital employed)

ROE =

}

Net Income

Shareholders’ Equity

Pass

5B Fail

Problems:

•No discounting the first

3 years

•Infinite discounting of

later years

Biases against longterm projects.

Earnings

= Investment

Problems:

•Investment not valued at market

•Earnings vs. cash flows

Book Value

Investment Evaluation

36