Business Case 2

advertisement

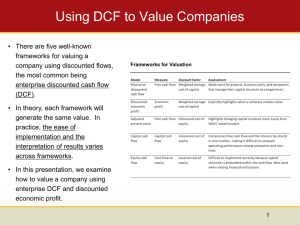

THE MERGERS AND ACQUISITION MARKET. AN OVERVIEW. INTRODUCTION TO COMPANY’S VALUE AND VALUATION TECHNIQUES. DCF AND COMPARABLES Lesson 12 Corporate Finance 24th Castellanza, November, 2010 2 Business valuation: definition of value Market value: is a general estimate of what a business would sell for in the open market. It is independent of a particular investor Investment value: is the value of the business to a specific investor. It would reflect synergies, a tax rate specific to the investor, and policies the investor is likely to implement Fair value: is used in certain legal cases and the method is defined by statute 3 How to realize an acquisition Analysis and definition of the industry and the target co. General screening of the co.s Specific analysis of the most interesting co.s Priority in contacts Way of contacting First approach 4 Methods Assets Revenues Comparables Market approach Discounted Cash Flow (DCF) Analytical approach Each approach has advantages and disadvantages Generally there is no right answer to a valuation problem. More an art than a science! 5 Comparables (Multiples) Multiple = Enterprise value / most important element to value (EBIT, EBITDA, Sales) Compute the average of the multiple of the companies of the sample Multiply the average multiple obtained for EBIT, EBITDA or Sales of your company 6 Discounted Cash Flow (DCF) DCF capitalizes the cash flows the firm is expected to generate Strenght: reflects actual benefits that investors care about better than other methods Weakness: relies heavily on projections. Valuations are only as good as these projections 7 Discounted Cash Flow (DCF) (cont’d) n Wf = t=1 Ft (1 + k)t W company’s value Ft Cash Flows k discount rate n number of periods considered TV terminal value of the company + TV 8 Cash Flows Cash Flows to Firm Cash Flows Cash Flows to Equity 9 Cash Flows to Firm The FCF are the expected cashflows to the firm, i.e., the residual cashflows after meeting all operating expenses and taxes, but prior to debt payments, discounted at the WACC. EBIT -/+ Change in Net Working Capital + Depreciation, amortization - Investments + Divestments - Taxes Free Cash Flow to Firm 10 Cash Flows to Equity The CF to Equity are the expected cashflows, i.e., the residual cashflows after meeting operating expenses, tax obligations and interest and principal debt payments and reinvestments needs, at the cost of equity (ke), i.e., the rate of return required by equity investors in the firm. EBIT +/- Change in Net Working Capital + Depreciation, amortization - Investments + Divestments - Interests Expenses - Principal payments - Taxes Free Cash Flows to Equity 11 Terminal value TV = Fn / (k-g) (1 + k)n+1 Because businesses are typically long-lived assets and detailed cashflows forecasts beyond 5 yrs tend to be more fiction than fact, most analysts project cashflows for a finite period and then assume some normal terminal value at the end of that period g = sustainable growth rate (usually: long-term expected rate of inflation) 12 Business Case 1 - Valuations How time can be critical Overview 1° case – original business plan 2° case – revised business plan Conclusion 13 Business Case 1 Alpha company operates in the Italian real estate sector. The following tables shows the flows deriving from the company business plan, as follow: 1 2 original business plan before the market drop (2007) revised business plan to show the expected flows after the crisis (2008) To suit the new scenario, the revised business plan postpones the expected in-flows until 6 months 14 Business Case 1 1° case – original business plan Projections € million Project 1 Project 2 Project 3 Project 4 Project 5 Project 6 Other revenues In - flows Project 1 Project 2 Project 3 Project 4 Project 5 Project 6 Marketing costs Other costs Out - flows FCFO untill 2006 2007 2008 2009 2010 2011 2012 2013 Totale 27,0 15,2 0,6 42,8 (58,6) (52,0) (1,8) (14,4) (5,4) (15,2) (0,3) (147,7) (104,9) 25,0 7,1 32,1 (0,1) (0,7) (1,2) (0,8) (0,3) (3,1) 29,0 24,3 4,5 7,6 36,4 (12,7) (3,5) (0,5) (16,7) 19,7 104,1 0,3 5,3 6,0 1,5 117,3 (55,5) (0,6) (8,9) (0,9) (0,2) (66,2) 51,1 109,9 3,8 33,9 3,5 151,0 (57,6) (2,8) (23,6) (0,2) (84,1) 66,9 60,3 4,3 23,5 88,1 (38,1) (1,6) (10,2) (0,1) (50,0) 38,1 12,8 0,6 1,3 14,6 (16,4) (0,6) (2,6) (19,6) (5,0) (7,1) (0,3) (2,5) (10,0) (10,0) 311,3 52,0 9,0 64,0 14,0 15,2 16,8 482,3 (246,0) (52,0) (7,8) (62,8) (11,1) (15,2) (1,8) (0,6) (397,4) 84,9 15 Business Case 1 2° case – revised business plan Projections 6 month postponed € million Project 1 Project 2 Project 3 Project 4 Project 5 Project 6 Other revenues In - flows Project 1 Project 2 Project 3 Project 4 Project 5 Project 6 Marketing costs Other costs Out - flows FCFO untill 2006 2007 2008 2009 2010 2011 2012 2013 Totale 27,0 15,2 0,6 42,8 (58,6) (52,0) (1,8) (14,4) (5,4) (15,2) (0,3) (147,7) (104,9) 25,0 7,1 32,1 (0,1) (0,7) (1,2) (0,8) (0,3) (3,1) 29,0 24,3 4,5 7,6 36,4 (12,7) (3,5) (0,5) (16,7) 19,7 43,3 0,6 3,0 1,5 48,5 (55,5) (0,6) (8,9) (0,9) (0,2) (66,2) (17,7) 117,0 1,6 6,5 17,8 142,9 (57,6) (2,8) (23,6) (0,2) (84,1) 58,8 88,1 5,5 36,7 130,3 (38,1) (1,6) (10,2) (0,1) (50,0) 80,3 35,0 2,0 8,8 45,7 (16,4) (0,6) (2,6) (19,6) 26,1 3,7 3,7 (7,1) (0,3) (2,5) (10,0) (6,3) 311,3 61,0 6,5 0,6 7,5 78,6 16,8 482,3 (246,0) (52,0) (7,8) (62,8) (11,1) (15,2) (1,8) (0,6) (397,4) 84,9 16 Business Case 1 Conclusion 1° case – original business plan € million In - flow Out - flow Margin Tax Unlevered FCF Years Discount factor Disconted cash flow # 2009 117,3 (66,2) 51,1 (16,1) 35,1 1 0,94 33,0 2010 151,0 (84,1) 66,9 (21,0) 45,9 2 0,88 40,6 2011 88,1 (50,0) 38,1 (12,0) 26,1 3 0,83 21,7 2012 14,6 (19,6) (5,0) (5,0) 4 0,78 (3,9) 2013 (10,0) (10,0) (10,0) 5 0,74 (7,3) 2011 130,3 (50,0) 80,3 (25,2) 55,1 3 0,83 45,8 2012 45,7 (19,6) 26,1 (8,2) 17,9 4 0,78 14,0 2013 3,7 (10,0) (6,3) (6,3) 5 0,74 (4,6) Valuation Enterprise Value 84,1 NFP (giu-08) (59,5) Equity value 24,6 2° case – revised business plan € million In - flow Out - flow Margin Tax Unlevered FCF Years Discount factor Disconted cash flow # 2009 48,5 (66,2) (17,7) (17,7) 1 0,94 (16,6) 2010 142,9 (84,1) 58,8 (18,5) 40,3 2 0,88 35,7 The equity value drops by 41% Valuation Enterprise Value 74,2 NFP (giu-08) (59,5) Equity value 14,7 17 Business Case 2 - Valuations Exchange ratios in a merger Overview The project Conclusion 18 Business Case 2 Overwiev Both the Companies operates in the same sector Company A Company B Capital stock 37.000 32.000.000 (€/000) Shares 37.000 32.000 Face share value 1 (€/000) 1 (€/000) Revenues 249.592 (€/000) 162.340 (€/000) (€/000) We are going to analyse a project of merger between Company A and Company B. 19 Business Case 2 The Project The merger process is supposed to be structured on a valuation process based on general criteria of rationality, demonstrability, objectivity and stability. Method’s choice: on the basis of the business’ nature and investment plans the Unlevered Discounted Cash Flow method has been adopted. Value’s determination: according to UDCF method, the consultant has considered it right to identify, instead of a precise value, a range of values of the share conversion ratio. 20 Business Case 2 A sensitivity analisys has been made on the basis of different assumptions, i.e.: -the potential companies’ prospecitve capacity to generate benefits in terms of NOPLAT (Net Operating Profit Less Adjusted Taxes); -different debt ratios related to WACC (Weighted Average Cost of Capital). Company A (€/000) NOPLAT 7.8 7.8 5.9 5.9 6.1% 5.7% 6.1% 5.7% Firm Market Value 82 91 59 66 Number of shares 37 37 37 37 Value of shares 2,2 2,4 1,6 1,7 5.1 5.1 4.1 4.1 6.7% 5.7% 6.7% 5.7% Firm Market Value 73 86 62 73 Number of shares 32 32 32 32 Number of shares 2,2 2,7 1,9 2,2 WACC Company B (€/000) NOPLAT WACC 21 Business Case 2 Conclusion On the basis of the valuation process with the UDCF method the share conversion ratio was supposed to be in the sequent range: Conversion ratio 0.98 0.91 0.82 0.78 A market approach method (market multiples method) has furthermore been adopted to validate the share conversion ratio: Conversion ratio 0.80 0.78 0.77 0.76 22 Business Case 2 Pursuant to the camparison between the different methods of valuation the board of directors suggested to consider a share conversion ratio between a minimum of 0.80 and a maximum of 0.85. 0.98 0.91 0.82 0.78 0.77 0.78 0.76 Flow approach: Unlevered Discounted Cash Flow Market approach: Multiples 0.80