OF_Ch04

advertisement

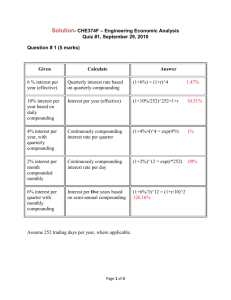

Interest Rates Chapter 4 4.1 Goals of Chapter 4 Introduce three types of interest rates – Treasury rates (國庫券利率), LIBOR (倫敦銀行 間拆款利率), and repo rates (附買回利率) Compounding frequency and continuous compounding (連續複利) Zero rates (零息利率) and bond prices Forward rates (遠期利率) and the term structure of interest rates (利率期間結構) Forward rate agreement (遠期利率協定) – A derivative whose underlying variable is the forward rate 4.2 4.1 Three Types of Interest Rates 4.3 Three Types of Interest Rates Why to study the interest rates? – Due to the classical discount cash flow (DCF) pricing model, the interest rate is a factor in the valuation of virtually all assets (or derivatives) – The theoretical futures and forward prices (will be introduced in Ch. 5) depend on the interest rate during the contract life – The interest rates can be underlying variables of derivatives (Ch.6 introduces interest rate futures) Treasury rates (國庫券利率) – The rate of return an investor earns on Treasury bills or Treasury bonds, which are government debts issued in its own currency 4.4 Three Types of Interest Rates – Treasury rates are theoretically risk-free since the government is always able to pay the promised interest and principal payments in domestic currency LIBOR and LIBID – The shorts for London Interbank Offered Rate and London Interbank Bid Rate (倫敦銀行間拆款利率) – A LIBOR (LIBID) quote is the interest rate at which an AA-rated bank is prepared to make (accept) a wholesale lending (deposit) with other AA-rated banks LIBOR is higher than LIBID – Large banks quote LIBOR and LIBID for maturities up to 12 months in all major currencies every day 4.5 Three Types of Interest Rates Prices of Eurodollar futures (introduced in Ch.6) and swap rates (introduced in Ch. 7) can be used to imply the LIBOR rates beyond 12 months – LIBOR and LIBID trade in the Eurocurrency market, which is outside the control of any government Eurocurrencies indicate the currencies that are traded outside their home markets, e.g., trade US$ with a British bank in London market Eurosterling, Euroyen, or Eurodollar – Credit risk issue: The credit risk of a AA-rated financial institution is small for short-term loans Thus, LIBOR rates are close to risk-free 4.6 Three Types of Interest Rates Derivatives traders regard LIBOR rates as a better approximation of the “true” risk-free rate than Treasury rates – LIBOR rates reflect the opportunity cost of funds for AA-rated bank traders – It is believed that Treasury rates are artificially low due to some tax advantage and regulatory issues for financial institutions In the U.S., Treasury instruments are not taxed at the state level Treasury instruments must be purchased by financial institutions to fulfill a variety of regulatory requirements Minimal capital requirements for Treasury instruments is lower than those for other fixed-income securities ※ All the above reasons stimulate the demand of Treasury instruments and thus bid up their prices The rates of return of investing in Treasury instruments are driven down The overnight indexed swap rate is increasingly being used instead of LIBOR as the risk-free rate (introduced in Ch. 7) 4.7 Three Types of Interest Rates Repo rates (附買回利率) – Repurchase agreement (repo) (附買回合約): a contract where a trader who owns securities agrees to sell them to a financial institutions now and buy them back at a slightly higher price Equivalent to borrow funds with securities as collaterals Thus, the repo loan involves very little credit risk – Price margins reflect the interest earned by the financial institutions, which is known as the repo rate – Overnight repos are the most common, but there are also longer-term arrangements, known as term repos 4.8 4.2 Compounding Frequency and Continuous Compounding 4.9 Compounding Frequency There are different compounding frequencies used for an interest rate, for example, quarterly or annually compounding The terminal value of the investment amount 𝐴 after 𝑛 years is 𝑅 𝑚𝑛 𝐴 1+ 𝑚 𝑚 = number of compounding frequency per year 𝑛 = investment horizon in terms of years 𝑅 = annual interest rate ※ Note that it is a market convention that the interest rate is always quoted on an annual basis 4.10 Compounding Frequency For 𝐴 = $1, 𝑛 = 1 year, and 𝑅 = 10%, analyze the effect of different compounding frequencies Compounding frequency Terminal value of $1 at the end of 1 year 𝑚=1 1.10000000 𝑚=2 1.10250000 𝑚=4 1.10381289 𝑚 = 12 1.10471307 𝑚 = 52 1.10506479 𝑚 = 365 1.10515578 𝑚=∞ 1.10517092 ※ Due to the compounding effect, the terminal value increases with the compounding frequency, 𝑚, although the interest rate for each period is 𝑅/𝑚 ※ In the limit as we compound more and more frequently, we obtain continuously compounded interest rates, i.e., 𝑚 = ∞ 4.11 Compounding Frequency With continuous compounding, i.e., 𝑚 = ∞, the terminal value for the amount 𝐴 approches 𝑅 𝑚𝑛 lim 𝐴 1 + = 𝐴𝑒 𝑅𝑛 𝑚→∞ 𝑚 where 𝑒 is a constant of 2.718281828 – The exponential function enjoys some advantages of simplifying algebraic calculation, e.g., 1/𝑒 𝑥 = 𝑒 −𝑥 – Thus, it is convenient to employ the continuous compounding to compute PVs and FVs $100 grows to $100𝑒 𝑅𝑇 when invested at a continuously compounded rate 𝑅 for time 𝑇 $100 received at time 𝑇 discounts to $100𝑒 −𝑅𝑇 at time 0 when the continuously compounded discount rate is 𝑅 4.12 Compounding Frequency Comparing to daily compounding frequency, the continuous compounding can provide accurate approximation (see Slide 4.11) – In financial markets, it is common to compound interest rates daily, e.g., for deposit accounts or loans In derivatives markets, almost all formulae are expressed with continuous compounding For a given interest rate that is compounded at a lower frequency: – A conversion to find the equivalent continuous compounding rate is needed before using formulae 4.13 Compounding Frequency Conversion formula to derive the equivalent continuous compounding rate 𝑅𝑚 : interest rate compounded 𝑚 times per year 𝑅𝑐 : equivalent continuous compounding rate 𝑅𝑚 𝑚𝑛 =𝐴 1+ 𝑚 𝑅𝑚 𝑚𝑛 𝑅𝑐 𝑛 ⇒𝑒 = 1+ 𝑚 𝑅 ⇒ 𝑅𝑐 𝑛 = 𝑚𝑛 ln 1 + 𝑚 𝑚 𝑅𝑚 ⇒ 𝑅𝑐 = 𝑚 ln 1 + 𝑚 (or 𝑅𝑚 = 𝑚 𝑒 𝑅𝑐/𝑚 − 1 ) 𝐴𝑒 𝑅𝑐 𝑛 4.14 4.3 Zero Rates and Bond Prices 4.15 Zero Rates (零息利率) A zero rate (also known as a spot rate) for maturity 𝑇 is the rate of interest earned on an investment that provides a payoff only at time 𝑇 An example of zero rates with different times to maturity Maturity (years) Zero rate (continuous compounding) Current value of the corresponding zero coupon bond (零息債券) (face value = $1 paid at maturity) 0.5 5.0% $1 ∙ 𝑒 −5.0%∙0.5 = $0.9753 1.0 5.8% $1 ∙ 𝑒 −5.8%∙1.0 = $0.9436 1.5 6.4% $1 ∙ 𝑒 −6.4%∙1.5 = $0.9085 2.0 6.8% $1 ∙ 𝑒 −6.8%∙2.0 = $0.8728 4.16 Bond Pricing The pricing of coupon-bearing bonds (附息債 券) – Each cash payment is discounted at the appropriate zero rate More specifically, to discount a cash payment matured at 𝑡, a zero rate with the time to maturity 𝑡 should be employed – Based on the table of zero rates on the previous slide, the theoretical price of a two-year bond providing a 6% coupon paid semiannually is 3𝑒 −0.05∙0.5 + 3𝑒 −0.058∙1.0 + 3𝑒 −0.064∙1.5 + 103𝑒 −0.068∙2.0 = 98.39 4.17 Bond Yield (or Yield to Maturity) The bond yield (or yield to maturity) is a constant discount rate that makes the present value of the cash flows on the bond equal to the market price of the bond – Given the market price of the bond equals $98.39, the bond yield satisfies the following equation 3𝑒 −𝑦∙0.5 + 3𝑒 −𝑦∙1.0 + 3𝑒 −𝑦∙1.5 + 103𝑒 −𝑦∙2.0 = 98.39 – Solve the above equation by the bisection method (二分逼近法) to obtain 𝑦 = 0.0676 or 6.76% ※Financial calculators cannot solve the bond yield correctly given continuous-compounding formulae 4.18 Par Yield The par yield for a certain maturity is the coupon rate that causes the bond price to equal its face value – For the same example, we solve 𝑐 −0.05∙0.5 𝑒 2 𝑐 100 + 2 𝑐 −0.058∙1.0 𝑐 −0.064∙1.5 + 𝑒 + 𝑒 2 2 𝑒 −0.068∙2.0 = 100 + to get 𝑐 = 6.87 4.19 Par Yield In general if 𝑚 is the number of coupon payments per year, 𝑑 is the present value of $1 received at maturity and 𝐴 is the present value of an annuity of $1 on each coupon date 𝑐 100 − 100𝑑 𝑚 𝐴 + 100𝑑 = 100 ⇒ 𝑐 = 𝑚 𝐴 ※In the above example, 𝑚 = 2, 𝑑 = 𝑒 −0.068∙2.0 , and 𝐴 = 𝑒 −0.05∙0.5 + 𝑒 −0.058∙1.0 + 𝑒 −0.064∙1.5 + 𝑒 −0.068∙2.0 4.20 The Bootstrap Method Bootstrap method (拔靴法): to determine treasury zero rates sequentially from the shortest maturity to the longest maturity based on market prices of Treasury bills and bonds – The sequence must be followed because the information of zero rates with shorter maturities is needed to solve the zero rate with a longer maturity (shown in the following numerical example) – The name of “bootstrap”: In order to take off your shoes by unfastening the shoelace, make sure you first loosen the upper part of the shoelace and then loosen the lower part 4.21 The Bootstrap Method Hypothetic data for Treasury bills (the first three quotes) and bonds (the last two quotes) Bond Principal Time to ($) Maturity (years) Annual Coupon ($) Bond Price ($) 100 0.25 0 97.5 100 0.50 0 94.9 100 1.00 0 90.0 100 1.50 8 96.0 100 2.00 12 101.6 Find the zero rates corresponding to the time to maturities of 0.25, 0.5, 1, 1.5, and 2 years 4.22 The Bootstrap Method Step 1 (for 𝑅(0.25)): – For this zero coupon bond, an amount of $2.5 can be earned on the investment of $97.5 in 3 months – The 3-month rate is 4 times $2.5/$97.5 or 10.2564% with quarterly compounding – This is equivalent 10.1271% with continuous compounding Method 1: Exploit the conversion formula on Slide 4.14 to solve 𝑅𝑐 with 𝑚 and 𝑅𝑚 to be 4 and 10.2564% Method 2: Solve 𝑅(0.25) from $97.5𝑒 𝑅(0.25)∙0.25 = $100 Step 2 (for 𝑅(0.5) and 𝑅(1)): – Similarly, the 6-month and 1-year continuous compounding zero rates are 10.4693% and 10.5361% 4.23 The Bootstrap Method Step 3 (for 𝑅(1.5)): – Solve the following equation for 𝑅(1.5) 4𝑒 −0.104693∙0.5 + 4𝑒 −0.105361∙1 + 104𝑒 −𝑅(1.5)∙1.5 = 96 ⇒ 𝑅 1.5 = 10.6810% Step 4 (for 𝑅(2)): – Solve the following equation for 𝑅(2) 6𝑒 −0.104693∙0.5 + 6𝑒 −0.105361∙1 + 6𝑒 −0.106810∙1.5 + 106𝑒 −𝑅(2)∙2 = 101.6 ⇒ 𝑅 2 = 10.8082% 4.24 Zero Curve Calculated From the Hypothetic Data Zero Rate (%) 12 11 10.4693 10 10.5316 10.6810 10.8082 10.1271 Maturity (yrs) 9 0 0.5 1 1.5 2 2.5 ※ The zero curve (零息利率曲線) is also known as the term structure (期間結 構) of interest rates, i.e., the interest rate is a function of the time to maturity ※ Bond prices are determined with the demand and supply Bond prices are stochastic interest rates are stochastic 4.25 4.4 Forward Rates and Term Structure of Interest Rates 4.26 Forward Rates (遠期利率) The forward rate is the future zero rate implied by the term structure of interest rates today Formula to calculate forward rates: – Suppose that the zero rates for time periods 𝑇1 and 𝑇2 are 𝑅1 and 𝑅2 , respectively, with both rates continuously compounded – Formula for the forward rate between 𝑇1 and 𝑇2 is 𝑅𝐹 = 𝑅2 𝑇2 −𝑅1 𝑇1 , 𝑇2 −𝑇1 which is the future zero rate at 𝑇1 with the time to maturity (𝑇2 −𝑇1 ) implied from the current term structure 4.27 Calculation of Forward Rates – The intuition for the formula is the equality of 1. Cumulative return compounding at 𝑅2 until 𝑇2 2. Cumulative return compounding at 𝑅1 until 𝑇1 and next compounding at 𝑅𝐹 between 𝑇1 and 𝑇2 𝑒 𝑅2 𝑇2 = 𝑒 𝑅1 𝑇1 𝑒 𝑅𝐹 (𝑇2−𝑇1 ) – An example of calculation of forward rates Years (T) Zero rate for an T-year investment Forward rate for the T-th year 1 3.0% 2 4.0% 5.0% 3 4.6% 5.8% 4 5.0% 6.2% 5 5.3% 6.5% 4.28 Upward vs. Downward Sloping Yield Curve Rewrite the formula for the forward rate as 𝑇1 𝑅𝐹 = 𝑅2 + (𝑅2 − 𝑅1 ) 𝑇2 − 𝑇1 – For an upward sloping zero curve, i.e., 𝑅2 > 𝑅1 : forward rate 𝑅𝐹 (applicable for the interval [𝑇1 , 𝑇2 ]) > zero rate 𝑅2 (matured at 𝑇2 ) (see the table on the previous slide) – For a downward sloping zero curve, i.e., 𝑅2 < 𝑅1 : forward rate 𝑅𝐹 (applicable for the interval [𝑇1 , 𝑇2 ]) < zero rate 𝑅2 (matured at 𝑇2 ) 4.29 Theories of the Term Structure Expectations Theory: 𝑇2 𝑅𝐹 = 𝑅1 + (𝑅2 − 𝑅1 ) 𝑇2 − 𝑇1 – 𝑅2 > 𝑅1 (𝑅2 < 𝑅1 ) if and only if 𝑅𝐹 > 𝑅1 (𝑅𝐹 < 𝑅1 ) – Upward (downward) sloping zero curves indicate that the market is expecting higher (lower) forward rates Liquidity Preference Theory: – Explain upward sloping zero curves according to the liquidity preference of lenders and borrowers – Lenders prefer to preserve their liquidity and invest funds for short periods of time Lenders demand 4.30 lower (higher) rates for short- (long-) term loans Theories of the Term Structure – To avoid the re-borrowing interest rate risk, borrowers prefer to borrow at fixed rates for long periods of time Borrowers would like to pay lower (higher) rates for short- (long-) term loans – The above two forces lead to a convergent result which is an upward sloping zero curve The mixture of the above two theories can explain the occurrence of hump-shaped zero curves in markets – The hump-shaped zero curve is first rising and then falling along the maturity dimension 4.31 4.5 Forward Rate Agreement 4.32 Forward Rate Agreement A forward rate agreement (FRA) (遠期利率協 定) is an agreement made today that a fixed borrowing or lending rate 𝑅𝐾 will apply to a certain principal during a future time period – Illustration of a FRA from the viewpoint of the lender L fixed lending rate RK t 0 T1 lend L T2 4.33 Forward Rate Agreement Some details of FRAs – Traded in OTC markets – Commonly associated with LIBOR, e.g., at 𝑇1 , to fix the 6-month lending or borrowing rate, which should be the prevailing 6-month LIBOR at 𝑇1 without the FRA – Market conventions for compounding frequency The compounding period for interest rates reflects the length of the FRA period, i.e., the compounding period is 𝑇2 − 𝑇1 for the reference interest rate and thus it is compounded once during the FRA period More specifically, for any interest rate 𝑅 which is applied to (𝑇1 , 𝑇2 ], the corresponding interest payment at 𝑇2 is 𝑅 𝑇2 − 𝑇1 if the principal is $1 4.34 Forward Rate Agreement – Payoff of the FRA at 𝑇2 for the lender is 𝑃𝐹𝑅𝐴 = 𝐿(𝑅𝐾 − 𝑅𝑀 ) 𝑇2 − 𝑇1 where 𝑅𝑀 is the actual LIBOR rate in (𝑇1 , 𝑇2 ] Payoff for the lender if he lends 𝐿 to earn the actual LIBOR rate for (𝑇1 , 𝑇2 ] is 𝐿𝑅𝑀 𝑇2 − 𝑇1 The net effect for the lender who enters into the FRA is to fixed the earned interest rate at 𝑅𝐾 𝐿𝑅𝑀 𝑇2 − 𝑇1 + 𝐿 𝑅𝐾 − 𝑅𝑀 𝑇2 − 𝑇1 = 𝐿𝑅𝐾 (𝑇2 − 𝑇1 ) In practice, FRAs can be settled at 𝑇1 and the settlement price equals the present value of the payoff at 𝑇2 𝐿(𝑅𝐾 −𝑅𝑀 ) 𝑇2 −𝑇1 1+𝑅𝑀 𝑇2 −𝑇1 4.35 Forward Rate Agreement – There is no cost to lock the forward rate for the period between 𝑇1 and 𝑇2 Zero-cost strategy to earn 𝑅𝐹 in [𝑇1 , 𝑇2 ]: Borrow 𝐿 at 𝑅1 for 𝑇1 years and invest this amount of 𝐿 at 𝑅2 for 𝑇2 years Cash outflow of 𝐿𝑒 𝑅1 𝑇1 at 𝑇1 (considered as the initial investment) and cash inflow of 𝐿𝑒 𝑅2 𝑇2 at 𝑇2 (considered as the final payoff) Earn the forward rate 𝑅𝐹 for the period between 𝑇1 and 𝑇2 (due to the definition of 𝑅𝐹 which can satisfy 𝐿𝑒 𝑅2 𝑇2 = 𝐿𝑒 𝑅1 𝑇1 𝑒 𝑅𝐹(𝑇2 −𝑇1 ) ) So, if 𝑅𝐾 is set as 𝑅𝐹 (with compounding period to be 𝑇2 − 𝑇1 ), the value of a FRA should be zero, i.e., the value for the following payoff is zero 𝐿(𝑅𝐹 − 𝑅𝑀 ) 𝑇2 − 𝑇1 4.36 Forward Rate Agreement – If 𝑅𝐾 is set to be different from 𝑅𝐹 , the excess payoff (could be negative) of a FRA contributes to its value 𝐿 𝑅𝐾 − 𝑅𝑀 𝑇2 − 𝑇1 − 𝐿(𝑅𝐹 − 𝑅𝑀 ) 𝑇2 − 𝑇1 = 𝐿 𝑅𝐾 − 𝑅𝐹 𝑇2 − 𝑇1 – Thus, the present value of the excess payoff is the value of the FRA today 𝑉𝐹𝑅𝐴 = 𝑒 −𝑅2 𝑇2 𝐿(𝑅𝐾 − 𝑅𝐹 ) 𝑇2 − 𝑇1 ※ Note that 𝑅2 , which is the continuous compounding LIBOR zero rate for 𝑇2 , can be employed as the risk-free rate to discount the expected payoff (see Slide 4.7) 4.37 Forward Rate Agreement – Another way to derive the formula for the value of the FRA Note that 𝑅𝐹 can be viewed as the expectation of the most likely value for 𝑅𝑀 based on today’s term structure, i.e., 𝐸 𝑅𝑀 = 𝑅𝐹 The general rule to price a FRA is the present value (discounted at the continuous compounding risk-free rate) of its expected payoff 𝑉𝐹𝑅𝐴 = 𝑒 −𝑅2 𝑇2 𝐸 𝐿 𝑅𝐾 − 𝑅𝑀 𝑇2 − 𝑇1 = 𝑒 −𝑅2𝑇2 𝐿(𝑅𝐾 − 𝑅𝐹 ) 𝑇2 − 𝑇1 – It is common in practice to set 𝑅𝐾 as 𝑅𝐹 and thus the FRA is worth zero initially 𝑅𝐹 changes according to the demand and supply of funds in Eurocurrency markets values of FRAs change randomly 4.38 Forward Rate Agreement For the trading counterparty, i.e., the borrower of a FRA, – Payoff at 𝑇2 −𝐿 𝑅𝐾 − 𝑅𝑀 𝑇2 − 𝑇1 = 𝐿(𝑅𝑀 − 𝑅𝐾 ) 𝑇2 − 𝑇1 – Settlement price at 𝑇1 𝐿 𝑅𝐾 − 𝑅𝑀 𝑇2 − 𝑇1 𝐿(𝑅𝑀 − 𝑅𝐾 ) 𝑇2 − 𝑇1 − = 1 + 𝑅𝑀 𝑇2 − 𝑇1 1 + 𝑅𝑀 𝑇2 − 𝑇1 – Position value today −𝑒 −𝑅2𝑇2 𝐿 𝑅𝐾 − 𝑅𝐹 𝑇2 − 𝑇1 = 𝑒 −𝑅2 𝑇2 𝐿(𝑅𝐹 − 𝑅𝐾 ) 𝑇2 − 𝑇1 4.39 Forward Rate Agreement A pricing example of the FRA – A company has agreed that it will receive 4% (= 𝑅𝐾 ) on $100 million (= 𝐿) for 3 months (= 𝑇2 − 𝑇1 ) starting after 3 years (= 𝑇1 ) – The 3-year zero rate is 3% (= 𝑅1 ), the 3.25-year zero rate is 3.1% (= 𝑅2 ), and the forward rate for the period between 3 and 3.25 years is 4.3% (= 𝑅𝐹 ) (All of them are expressed with continuous compounding) – According to Slide 4.14, the quarterly compounding 𝑅𝐹 is 𝑅𝐹 = 4 𝑒 4.3%/4 − 1 = 4.3232% 4.40 Forward Rate Agreement – The current value of this FRA is 𝑉𝐹𝑅𝐴 = 𝑒 −𝑅2 𝑇2 𝐿 𝑅𝐾 − 𝑅𝐹 𝑇2 − 𝑇1 = 𝑒 −3.1%∙3.25 $100,000,000 4% − 4.3232% 3.25 − 3 = −$73,056.05 – Suppose 3-month LIBOR proves to be 4.5% (= 𝑅𝑀 ) with quarterly compounding after 3 year At the 3.25-year point (i.e., at 𝑇2 ), the payoff is 𝑃𝐹𝑅𝐴 = $100,000,000 4% − 4.5% 3.25 − 3 = −$125,000, which is equivalent to a payoff of 𝑃𝐹𝑅𝐴 = −$123,609 1 + 4.5% 3.25 − 3 at the 3-year point (i.e., at 𝑇1 ) 4.41