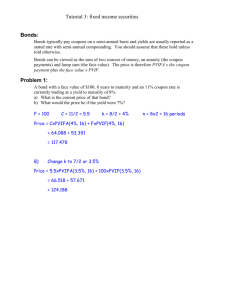

Bonds

advertisement

Chapter 6 The Risk and Term Structure of Interest Rates © 2008 Pearson 6.1 Objective We have calculated the Rate of Returns on Bonds. Now, use the Term Structure of YTM of various-term Bonds for forecast of the economy over the long-run. 2 The idea is that • The long term bond’s YTM reflects the market player’s expectations of many things, including the macroeconomic changes. • Thus YTMs of bonds with varying terms, such as YTM of one year bond, YTM of 2 yr bond, and YTM of 10 yr bond, have different time perspectives. • The differences between these YTMs reveal the market player’s expectation of some changes in macroeconomic variables. 3 1. Recall: Returns on Bonds: YTM 1) Definition • Effective Annual Rate of Returns = Yield to Maturity (YTM) = Nominal annual Interest Rate + Annual Capital Gains as percentage of Average Price of Bonds 4 2) Approximation Formula for Yield to Maturity Coupon Payment Annual Changes in Price Average Price where Average Price = (Purchase Price + 100)/2; And Annual Changes in Prices = (Face Value – Purchase Price) / Maturity Period 5 *Example • suppose that newspaper on March 1, 2004 Issue ABC Co. Coupon Rate 10% Maturity Date Bid/Ask 1 March 08/09 92 Yield ? Yield to Maturity = (10 + 8/4) / 96 x 100 = 11.46% * ‘/09’ means that the bonds are extendable for a year. 6 2. Different Rates of Returns on Different Bonds YTM = Core/basis YTM + Various Risk Premiums 7 1) The Core Part of YTMs Competition in the financial market leads to the equalization of YTM of various bonds and other financial assets as long as have the same risk characteristics. 8 2) Different Risk Premiums Differences in YTM for Different Bonds = Compensations for differences in Risk = Differences in Risk Premium 9 3) What risks?(recall) a) Default/Credit Risk –The lower the Bond Rating, the higher the risk of default = The higher the risk premium = The higher the YTM should be in order to induce the people to hold the bonds of more risk -> Bond Rating show the level of this risk b) Liquidity Risk c) Inflation/Macroeconomic Risk d) (Financial) Market Risk (1) Mean Variance Theorem – The higher the SD (=variance) of the price and returns over time, the higher the rate of return should be ; (2) Capital Asset Pricing Model – The higher the Correlation of the rate of return of a bond with the overall Market Index, the higher the rate of return should be. e) Idiosyncratic Risk: specific to one particular bond; there is no risk premium for this part. 10 3. Credit Risk and Bond Rating: Bond Rating Services in the world Moody’s Standard & Poor’s Aaa (“best quality”) Aa (“high quality”) A (“uppper-mediumgrade”) Baa (“medium grade”) _____________ Ba (“Speculative”) B Caa Ca C AAA (“extremely strong”) AA (“very strong”) A (“strong”) BBB (“adequate” or “fair”) _________ BB(“uncertain” or “speculative”) B CC (“extremely vulnerable”) Canadian Bond Rating Services – Combined with S & P’s 11 **Junk Bonds? • Bonds are generally classified into two groups "investment grade" bonds and "junk" bonds. Investment grade bonds include either Standard & Poor's (AAA, AA, A, BBB) or Moody's (Aaa, Aa, A, Baa). • The term "junk" is reserved for all bonds with Standard & Poor's ratings below BBB and/or Moody's ratings below Baa. • Investment grade bonds are generally legal for purchase by banks; junk bonds are not. 12 ***Some Canadian Examples: Source: http://www.standardandpoors.com/RatingsActions/RatingsLists/CanadianIssuers/index.ht ml • • • • • • • • • • • • • Ontario Government AA Quebec Government A York Municipality AAA Rogers Cable systems BB Xerox Canada BBB New Foundland A Nova Scotia A New Brunswick AA Nortel Network A Pacific Northern Gas BB Air Canada BB Alberta Government AAA or AA Canadian Government AAA 13 5. Bonds issued i)by the same borrower ii) for a Variety of Terms to Maturity have different YTM: Term Structure of Interest Rates Thus, default risk is controlled (held constant), but the macroeconomic risk varies from one year to another: Eg) Same Government Bonds with Different Maturity Dates Ontario Government Bonds which will mature and be repaid in six months; Ontario Government Bonds which will mature and be repaid in one year; Ontario Government Bonds which will mature and be repaid in two years; 14 4. Inflation Risk, and Term Structure and Yield Curve Go back to previous example. 1) Liquidity Risk Premium Theory -> Simply, the longer the term, the higher the liquidity risk and thus the higher the risk premium and the YTM 2) Inflation Expectation Theory -> (Future) Monetary/ Economic Conditions change. 15 1) Liquidity Risk Premium Theory Definition of liquidity: the speed at which you can turn one asset into another asset, mainly bonds into cash The longer the term to maturity, the longer the commitment and thus the higher the risk premium should be.Otherwise, no one will hold the longterm bonds. In general but not always, long-term bond’s YTM should be always higher than Short-bond’s YTM 16 *Some argues against the Liquidity Premium Theory = Preferred Habitat Theory (Market Segmentation) -> Risk Premium is not necessarily larger for long-term maturity -> The risk premium depends on what you consider to be risky For instance, the pension fund manager prefer the long-term investment to short-term investment. Unless the short-term investment carries a higher YTM, he would not invest on it. But the PHT is not necessarily true at the Aggregate Level, on Average or In General. 17 2) Expectations Theory The long-run interest rate is the average of the current actual interest rate and the expected future short-run interest rates, which reflect the contemporary monetary conditions, which are related to the most important macroeconomic conditions, National Income(Business Cycles) and Price Level(inflation). 18 So, by comparing the YTMs of different terms, some being short and others being long, we can extract the market player’s expectations about the monetary conditions. • We can compare one-year bond’s YTM and 10-yr-bond’s YTM • Long-term bond’s YTM could be either higher or lower than Short-term bond’s YTM 19 Expectations Theory of Term Structure a) L.T. YMT reflects the present and future S.T. YTMs. b) Formula Rn: YTM of bond with n years to maturity date; R1: current YTM of bond with 1 year to maturity date; E n-1 1: expected YTM on a 1-year bond for one year starting n-1 years from today. Rn R1 E 1 1 E 2 1 ...... E n 1 1 n 20 *Example I: Expectations Hypothesis **Simplifying Assumptions: no credit risk difference; no liquidity risk premium difference • We assume the same risk for the short-term and the long-term bonds- Ignore liquidity risk. • Suppose that the current and the expected yields on a 1-year short-term bonds are as follows. R1 E11 E21 E31 E41 14% 13% 12.5% 12% 11.5% •What would be the actual rate of returns on the long-term bonds?: R2 = ? R3 = ? R4 = ? R5 = ? 21 The Answer to Example I • R1= 14%; R2 = 13.5%; R3 = 13.2%; R4 = 12.9%; R5 = 12.6% “Term Structure” • Note: As E goes down, R goes down too. • Yield Curve is a graphic representation of the Term Structure % 0 1 2 3 ……………… yrs : Terms to Maturity 22 *Example II: Expectations Hypothesis • The current annualized short-term interest rate or YTM is 10% for a one-year bond this year. • The YTM for a two-year bond is 12%. • What is the short-term annual interest rate which the financial market expected for the next year? 23 Answer to Example II Bonds YTM R2 12 % Competition in the financial market will ensure the equality between Options I and II. 1. Option I: Investing on a 2 yr bond 12% R1 10% E11 x% 12% = 24 % 2. Option II: Rolling over investment on 1 yr bonds 10% + X% 3. Returns on Option I = Returns Option II Thus, X 14% 24 3) Monetarists’ view of Expectations Theory of Term Structure expectations of interest rate =expectation of nominal interest rate (R = r + pe ) = expectations of inflation rate (= pe; because r is constant) = expectations of the rate of growth of money (supply) 25 • Fisher Equation: R = r + pe • Quantity Equation of Exchange: - MV = P y D% M + D% V D% P+ D% y , where D% P p • Combining the two: we get RA = rA + pe A and R B = rB + pe B RA - R B = (rA - rB ) + (pe A - pe B ) A lower interest rate means a strict monetary policy - Either a lower inflation - Or a slower business 26 * Yield Curve: Graph of Term Structure Steep(er) Typical(Normal) • YTM(%) Flat(tened) Inverted 0 1 2 3 4 5 6 (Maturity Term: Years) 27 **When we combine Expectations Theory and Liquidity Premium Theory: • Let’s suppose that the one-year interest rate over the next five years is expected to be 5%, 6%, 7%, 8% and 9%. Investors’ preferences are such that the liquidity premiums for one-year to five-year bonds are 0%, 0.25%, 0.5%, 0.75%, and 1% respectively. What is the actual interest rate on a two-year bond and a five-year bond? • Answer: 5.75% and 8%. 28 *Historical Examples of Yield Curves in the U.S. economy • Living Yield Curve • http://fixedincome.fidelity.com/fi/FIHistoric alYield • http//www.smartmoney.com/onebond/index .cfm?story=yieldcurve&nav=LeftNav • http://www.smartmoney.com/Investing/Bon ds/The-Living-Yield-Curve-7923/ 29 Advanced Topics 30 1) Use of Term Structure of YTM for Business Forecast 1) Term Structure tells strongly about the Future of Economy: The difference between L.T. YTM(10 year bond) and S.T. YTM(one year bond, or shorter) is is the most certain leading indicator of business cycles. - when L.T YTM minus S.T. YTM is negative (L.T. YTM < S.T. YTM), we would soon see Recession: “Inverted Yield Curve is observed just prior to Recession” - When the difference between L.T. YTM and S.T. YTM grows (L.T. YTM >> S.T. YTM), then the business gets better, and the growth rate of Y rises. 31 2) Empirical Evidence • J. Haubrich and A. M. Dombrosky tested the predictive power of the spread between the long-term and short-term bond yields. - Regression Model: DY = a b (R10-year – R3-month T-Bill) - Data: 1961:1Q to 1995:IIIQ of U.S. - Results: D Y = 1.83 0.97 (R10-year – R3-month T-Bill) b hat is 0.97 with its t-value=4.50, being very significant. The spread has a substantial predictive power. The yield curve emerges as the most accurate predictor of real economic growth (better than more sophisticated leading index of business cycles). 32 3)Two Explanations for Harvey Campbell’s Inverted Yield Curve 1) Economics Theory Inflation Expectation Theory : A lower long-term interest rate means that compared to the current interest rate, either a lower rate of inflation, a slower growth rate of money supply, or a slowing down of the economy is expected for the future. 2) Finance Theory Portfolio Substitution Theory: • When people expect a recession (not permanent), people would like to shift their investment into a safe haven; from short-term investment(bonds) to long-term investment (bonds) • Demand for, and Price of Long-term bonds go up 33 • Yield of Long-term bonds falls – “Inverted Yield Curve” 4) New Empirical Evidence by Campbell Harvey(1989): - Use the term-structure interest rate spread (=long-term interest rate – short-term interest rate) and other known leading indicator for the regression forecasting the economic growth - Compared two predictors of the spreads and other Leading indicators by their R2 - Two Regression Results DY = a b (R10-year – R3-month T-Bill) R2 = 0.30 to 0.45 versus DY = a b (Stock Price Index as The Leading Indicator) R2 = -0.004 to 0.045 (Interpretation) The first is better than the second: bond market reveals more information about future economic growth than stock market. 34