Do Now:

● Considering the closing entries made last

class, what do you think we have to do now?

● Think about the cycle we have gone through when

recording transactions thus far in this course

● Hint: What two components of any spreadsheet

always need to balance and where have we done

this before?

© 2014 Cengage Learning. All Rights Reserved.

SLIDE 1

Class Activity:

● Five cups labeled either Sales, Expenses,

Income Summary, Drawing, and Capital

● Pieces of paper have titles and amounts of Sales,

$12,000…Expenses, $9,800…Income Summary,

blank…Drawing, $200…Capital, $2,390

● Transfer strips of paper to appropriate cup to exemplify

four types of closing entries

● Others evaluate/assess decision by classmate

© 2014 Cengage Learning. All Rights Reserved.

SLIDE 2

Lesson 8-1

Lesson 8-1 Audit Your Understanding

1. What do the ending balances of permanent

accounts for one fiscal period represent at

the beginning of the next fiscal period?

ANSWER

Beginning balances

© 2014 Cengage Learning. All Rights Reserved.

SLIDE 3

Lesson 8-1

Lesson 8-1 Audit Your Understanding

2. What do the balances of temporary accounts

show?

ANSWER

Changes in the owner’s capital account for

a single fiscal period

© 2014 Cengage Learning. All Rights Reserved.

SLIDE 4

Lesson 8-1

Lesson 8-1 Audit Your Understanding

3. List the four closing entries.

ANSWER

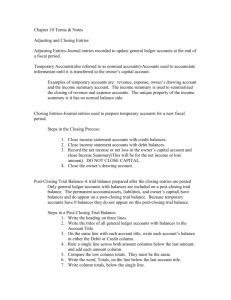

1. An entry to close income statement accounts with

credit balances.

2. An entry to close income statement accounts with

debit balances.

3. An entry to record net income or net loss and close

the Income Summary account.

4. An entry to close the owner’s drawing account.

● 8-1 Work Together on Front Board

© 2014 Cengage Learning. All Rights Reserved.

SLIDE 5

Lesson 8-2

General Ledger Accounts after Closing Entries

Are Posted

LO2

When an account has a zero balance,

lines are drawn in both the Balance Debit

and Balance credit columns

© 2014 Cengage Learning. All Rights Reserved.

SLIDE 6

Lesson 8-2

General Ledger Accounts after Closing Entries

Are Posted

© 2014 Cengage Learning. All Rights Reserved.

LO2

SLIDE 7

Lesson 8-2

Post-Closing Trial Balance

LO2

● A trial balance prepared after the closing

entries are posted is called a post-closing trial

balance.

● Only general ledger accounts with balances are

included on a post-closing trial balance

● Permanent accounts (assets, liabilities, owner’s capital)

● Temporary accounts (INCOME SUMMARY, revenue,

expenses, and drawing) are closed and have zero

balances, so they don’t appear on a post-closing trial

balance

© 2014 Cengage Learning. All Rights Reserved.

SLIDE 8

Lesson 8-2

Post-Closing Trial Balance

Heading

LO2

1

Account

Balances

Account

Titles

3

2

4 Single

Totals

Rule

6

Compare Totals

5

Double Rule 8

© 2014 Cengage Learning. All Rights Reserved.

7

Record Totals

SLIDE 9

Lesson 8-2

Accounting Cycle for a Service Business

LO2

● The series of accounting activities included in

recording financial information for a fiscal

period is called an accounting cycle.

● Concept “Accounting Period Cycle”

● Class Activity: 8-2 WT

● Complete as class by explaining answers to

different parts of problem (answer and where you

found it specifically)

© 2014 Cengage Learning. All Rights Reserved.

SLIDE 10

Group Activity:

● In groups of 2, create a poem/song about the process we have

undergone in this class from the time a transaction was identified

to the point at which we reached today.

● **Hint: remember to include ALL types of journal entries**

● **Hint: you have used five different spreadsheets to do all of the

accounting work thus far, with the exception of the checking account

chapter work…one spreadsheet is used twice**

● You will also create an illustration to accompany your poem/song

while you present so that we can visualize the process you are

explaining

● Presentations to follow

● Once each presentation ends, we will have a class evaluation of

groups’ accuracy using a scale of 1-5 on white boards

● Class Discussion about which items were correct/incorrect in each cycle

© 2014 Cengage Learning. All Rights Reserved.

SLIDE 11

Lesson 8-2

Accounting Cycle for a Service Business

1.

2.

3.

4.

5.

1

2

8

3

7

6

4

5

LO2

Analyze transactions

Journalize

Post

Prepare work sheet

Journalize and post

adjusting entries

6. Prepare financial

statements

7. Journalize and post

closing entries

8. Prepare post-closing trial

balance

© 2014 Cengage Learning. All Rights Reserved.

SLIDE 12

Lesson 8-2

Lesson 8-2 Audit Your Understanding

1. Why are lines drawn in both the Balance

Debit and Balance Credit columns when an

account has a zero balance?

ANSWER

To assure a reader that a balance has not

been omitted

© 2014 Cengage Learning. All Rights Reserved.

SLIDE 13

Lesson 8-2

Lesson 8-2 Audit Your Understanding

2. Which accounts go on the post-closing trial

balance?

ANSWER

Only those with balances (permanent

accounts)

© 2014 Cengage Learning. All Rights Reserved.

SLIDE 14

Lesson 8-2

Lesson 8-2 Audit Your Understanding

3. Why are temporary accounts omitted from a

post-closing trial balance?

ANSWER

Because they are closed and have zero

balances

© 2014 Cengage Learning. All Rights Reserved.

SLIDE 15

Lesson 8-2

Lesson 8-2 Audit Your Understanding

4. What are the steps in the accounting cycle?

ANSWER

1. Analyze transactions.

2. Journalize.

3. Post.

4. Prepare work sheet.

5. Journalize and post adjusting entries.

6. Prepare financial statements.

7. Journalize and post closing entries.

8. Prepare post-closing trial balance.

© 2014 Cengage Learning. All Rights Reserved.

SLIDE 16

Question then CLOSE

● Create questions regarding chapter 8 that you

feel are essential to answer in order to be able to

complete closing entries and the post-closing trial

balance

● Others will ring bell if they know the answer

● Create an alternate method of the accounting

cycle that you believe would be more

efficient/effective when taking a transaction and

working toward a post-closing trial balance – be

innovative!

© 2014 Cengage Learning. All Rights Reserved.

SLIDE 17