OPTIONS

GRAHAM O’BRIEN

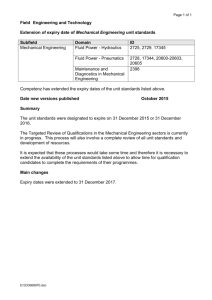

1

Disclaimer

This material contains information only. ASX does not represent or warrant that it is complete or

accurate. The information is for education purposes only and any advice should be sought from a

professional adviser. If you are seeking advice (including a recommendation or opinion) about a

financial product you should consult an Australian financial services licensee. To the extent permitted by

law, no responsibility for any loss arising in any way (including by way of negligence) suffered by anyone

acting or refraining from acting as a result of this material is accepted by ASX. This disclaimer extends

to any private discussions or correspondence with the presenter of this information.

©Copyright ASX Operations Pty Limited ABN 42 004 523 782 (‘ASXO’). All rights reserved. This

publication should not be reproduced, stored in a retrieval system or transmitted in any form, whether in

whole or in part, without the prior written consent of ASXO.

2

What are options?

Exchange Traded Options

Calls v Puts

Options pricing

Three common strategies

3

What are options?

Exchange Traded Options create unique payoffs

Prior to the creation of options, only three choices existed:

B

S

Long a position

Short a position

Options give you options!

Cash

Pay-off diagram

Profit

Long stock

Share price

Current

share price

Loss

6

Pay-off diagram

Profit

Short stock

Share price

Current

share price

Loss

7

Pay-off diagram

Profit

Cash

Share price

Loss

8

Pay-off diagram

Profit

Earn income (Premium)

Share price

Protect losses

Current

share price

Loss

9

What are Exchange Traded Options?

B

S

A contract between two parties

conveying a right, but not an obligation,

to buy (call) or sell (put) an underlying

security at a specified price within a

specified time for an agreed premium

Components of an Option

Every option contract has:

Profit

An underlying security

ANZ, BHP, RIO, TLS, XJO

An expiration date

December, January 2015 etc.

Type

Put or Call

Premium or Price

Strike price

Loss

Pay-off diagram for a call

75 stocks and 1 index

AGL

BSL

GMG

NCM

SGM

WES

AIO

BXB

GPT

NWS

SGP

WFD

AMC

CBA

HVN

ORG

SHL

WOR

AMP

CCL

IAG

ORI

STO

WOW

ANN

CIM

IFL

OSH

SUN

WPL

ANZ

CPU

ILU

OZL

SYD

XJO

ARI

CSL

IPL

QAN

TAH

ASX

CSR

JHX

QBE

TCL

AWC

CTX

LLC

RIO

TEN

AZJ

CWN

MPL

RMD

TLS

BEN

EGP

MQG

RRL

TOL

BHP

FLT

MTS

S32

TTS

BLD

FMG

MYR

SCG

TWE

BOQ

FXJ

NAB

SEK

WBC

Calls v puts

13

Calls vs Puts (rights vs obligations)

B

Call

Put

The right

(but not the

obligation)

to buy

The right

(but not the

obligation)

to sell

The option buyer (holder of a long position) has the right

to purchase or sell the underlying instrument at a:

Specific price

(the strike price)

Specified time

(until the

expiration date)

The option buyer

pays a premium

for this right

Calls vs Puts (rights vs obligations)

B

Call

Put

The right

(but not the

obligation)

to buy

The right

(but not the

obligation)

to sell

Once you have purchased an option

(established a long position) you can:

Sell it

Exercise your right

Let it expire

Calls vs Puts (rights vs obligations)

S

Call

Put

The potential

obligation

to sell

The potential

obligation

to buy

The option seller (creator of a short position) is obligated

to sell or purchase the underlying instrument at a:

Specific price

(the strike price)

Specified time

The option seller

(until the

receives a premium

expiration date)

for assuming this

obligation

Calls vs Puts (rights vs obligations)

S

Call

Put

The potential

obligation

to sell

The potential

obligation

to buy

Once you have sold an option

(established a short position) you can:

Buy it back

Let it expire

Be assigned to fulfill your obligation

Calls vs Puts (rights vs obligations)

B

S

Call

Put

The right

(but not the

obligation)

to buy

The right

(but not the

obligation)

to sell

Call

Put

The potential

obligation

to sell

The potential

obligation

to buy

18

Call options – Recap

Profit

Long call

Share price

Premium

Strike price

Loss

Call options – Recap

Profit

Short call

Strike price

Premium

Share price

Loss

Call options – Recap

Gives the buyer the right, but not the

obligation, to buy a standard quantity

of shares at the exercise price, on or

before the expiry date

Seller obligated to deliver

Put options – Recap

Profit

Long put

Share price

Premium

Strike price

Loss

Put options – Recap

Profit

Short put

Strike price

Premium

Share price

Loss

Put options – Recap

Gives the buyer the right, but not the

obligation, to sell a standard quantity

of shares for the exercise price on,

or before, the expiry date

Seller obligated to buy

ASX options – key points

Equity options

Index options

Contract size: 100 shares

Contract value: $10 per point

Expiry day: Last Thursday

of the month

Expiry day: Third Thursday

of the month

American style

(some Euro style)

European style

Physically settled

Cash settled

Options pricing

What are Options?

Exchange Traded Options (ETOs)

Calls v Puts

Options Pricing?

Top 3 Strategies

Major pricing factors

$4.00

Share price

$3.50

Exercise price

27

Major pricing factors

$4.00

50c

Share price

$3.50

Exercise price

Intrinsic

value

Share price

Exercise price

28

Major pricing factors

$4.00

Share price

$3.50

50c

22c

Exercise price

Intrinsic

value

Time

value

Time to expiry

Dividends

Interest rates

Volatility

Supply and demand

29

Major pricing factors

$4.00

Share price

$3.50

Exercise price

50c

72c

22c

Premium

30

In, at or out of the money – calls

$5.00

$4.50

$4.00

Out of the money

At the money

$3.50

In the money

$3.00

Series

The Greeks

Theta

Delta

32

Theta

The change in an option’s price given

a change in the time to expiration:

Is not constant

Accelerates as

expiry approaches

Theta – time decay

Lose 1/3

time value

Lose 2/3

time value

Option life

First half

Second half

The Greeks

Theta

Delta

35

Delta

The change in an option’s price given a change

in the price of the underlying stock or index:

For a $1 change

in the price of the

underlying stock

Expressed as

50 delta = .50 delta

Is highest for

“In-the-money”

options

Is not constant

Calls have

positive deltas

Puts have

negative deltas

Delta – Call options

0.8

0.5

0.1

Out

of the money

Option moves 1/5

as much as share

Delta – Call options

0.8

0.5

0.1

At

the money

Option moves 1/2

as much as share

Delta – Call options

0.8

0.5

0.1

In

the money

Option moves

1 for 1 with share

Option terminology

Taker/writer

Premium

Exchange

traded options

Intrinsic value

Call/put options

Exercise price

Expiry month

Time value

In-the-money

At-the-money

Out-of-the-money

Expiry date

52

Three common strategies

What are Options?

Exchange Traded Options (ETOs)

Calls v Puts

Options Pricing?

Top 3 Strategies

Three common strategies

Buying Calls

Buying Puts

Selling Calls

Leverage or low-risk?

Protecting shares

Buy-write

Generating income

54

Three common strategies

1. Bought Call

Market view:

Bullish

Buying Calls

Is buying calls risky?

Buying Calls

Buying Calls ensures you only buy stock

after the market confirms your decision

1

Buys leverage up(calls)

2

So you only buy stocks when the

market confirms your decisions

3

Go long with limited risk

4

You don’t get closed out before expiry!

57

Example – AML MAR/400/CALL

Call Option

B

S

Buyer has the right to buy a

standard quantity of shares

Shares

AML

Exercise price $4.00

Expiry date

June

Contracts

10

If the buyer/taker exercises the

option, on or before the September

expiry date, the writer/seller

must sell those shares at $4.00

The writer receives the premium

58

The life cycle of a call option

Share price ($)

Option price ($)

1.00

5.00

Options

4.80

0.80

Shares

4.60

0.60

Intrinsic value

4.40

0.40

Time value

0.20

4.20

Exercise price

4.00

Months 1

3.80

3.60

3.40

3.20

3.00

2

3

4

0

5

6

7

8

9

First rule of call buying

B

You would not

consider buying call

options

as a sole strategy

unless

you are bullish about

the underlying stock

Payoff example

AML shares

$4.00

Exercise price

AML/Jun/350 calls

AML/Jun/400 calls

AML/Jun/450 calls

$3.50

$4.00

$4.50

Premium

72c

38c

16c

Payoff example

AML shares on expiry

$4.00

$5.00

Exercise price

AML/Jun/350 calls

AML/Jun/400 calls

AML/Jun/450 calls

$3.50

$4.00

$4.50

Expiry value

$1.50

$1.00

50c

Profit

% Return

$780

108

$620

163

$340

213

Breakeven points – Bought Call

AML shares

$4.00

$5.00

Exercise price

AML/Jun/350 calls

AML/Jun/400 calls

AML/Jun/450 calls

$3.50

$4.00

$4.50

Premium

$1.50

72c

38c

$1.00

50c

16c

Breakeven points – Bought Call

AML shares

$4.00

Breakeven price

AML/Jun/350 calls

$4.22 P.S.

AML/Jun/400 calls

$4.38 P.S.

AML/Jun/450 calls

$4.66 P.S.

Breakeven points – Bought Call

AML shares

$4.00

Increase over current

AML/Jun/350 calls

22c

AML/Jun/400 calls

38c

AML/Jun/450 calls

66c

Second rule of call buying

The more bullish you are

the more you will consider

out-of-the money series

Leverage

$4,500

$4,000

$670

$380

Bought

October

Sold

December

Leverage

76.3%*

$500

$290

12.5%*

Shares

Options

Return on investment

*Not Including Transaction Charges

*Not Annualised

68

Leverage

$4,000

$3,500

$380

$0

Bought

October

Sold

December

Leverage

-100%*

-$500

-12.5%*

-$380

Shares

Options

Return on Investment

*Not Including Transaction Charges

*Not Annualised

70

Bought call

Profit

$4.00

C

-0.38

A

Loss

$4.38

B

Call at

expiry

Share price

Bought call – summary

Position

Risk/reward

Break even

Market view

Pay premium

in full

Limited risk

Unlimited reward

Exercise price

plus premium

Bullish

Three common strategies

2. Portfolio protection

Market view:

Bearish

Put Options/Protective Puts

Assume bullish

on the market

S&P/ASX 200 index

worth $59,500

at 5,950 points

Share

Put Options/Protective Puts

Nervous about another

market correction

S&P/ASX 200 index

worth $59,500

at 5,950 points

Share

Put Options can hedge

the portfolio against

market hiccups

Put Options/Protective Puts

Consider buying

S&P/ASX 200 index

worth $59,500

at 5,950 points

Share

1 S&P/ASX 200 September 5950 Puts

Assume price is 160 points each or

$1,600 per contract

Protective Put Purchase

5950 put

Own

shares

$59,500

$1,600

Share

Position

investment (b/e)

$61,100

Protective Put Purchase

Raise break-even level

from $59,500 to $61,100

$61,100

$59,500

Incur cost to

purchase puts

$1,600

Limit downside

risk to $1,600

$1,600

Position

investment (b/e)

$61,100

Protective Put Purchase

Profit

Puts expire worthless

Lose $1,600 (may be

offset by stock gain)

5,950

XJO at expiration

Receive cash ($10) for

every point below 5,950

Loss

Loss is limited to $1,600

(premium paid for put)

Protective Put Purchase

Profit

4,950

XJO at expiration

$10,000

Loss

Stock

($10,000)

Option

($8,400)

Total P&L ($1,600)

Protective Put Purchase

Profit

5,450

XJO at expiration

$5,000

Loss

Stock

($5,000)

Option

($3,400)

Total P&L ($1,600)

Protective Put Purchase

Profit

5,950

$0

XJO at expiration

Stock

($0)

Option

($1,600)

Total P&L ($1,600)

Loss

Protective Put Purchase

Profit

Stock

($5,000)

Option

($1,600)

Total P&L ($3,400)

$5,000

6,450

Loss

XJO at expiration

Protective Put Purchase

Profit

$10,000

Stock

($10,000)

Option

($1,600)

Total P&L ($8,400)

6,950

Loss

XJO at expiration

The Protective Put Strategy

Acts like

insurance

Maximum risk/loss in

this example is the

“cost of insurance”

$1,600 or 3%

Insurance expires in

September

Benefits – Protective Put Purchase

Benefits

Risks

Simplicity

Expensive when

volatility is high

Limit risk to a predetermined amount

Premium paid for

flexibility can result in

under-performance

Implement protection

only if you need it

Three common strategies

3. Buy-write

covered call

Market view:

Neutral

Buy-Write or Covered Calls

Profit

Call seller agrees to sell

shares at an agreed upon

price (the strike price)

Share price

Receives

premium

By a certain date

(the expiration date)

Loss

A call is covered if the investor

owns the underlying shares

Selling Calls

Reasons for selling calls against

shares currently owned:

Enhance returns from investment

When to use:

Neutral to moderately

bullish on the shares

Pre-set sale price for shares

Provide limited downside protection

89

Buy-Write

Selecting the

opportunity

Selling Calls

Buy-Write

Placing

the trade

Selling Calls

Outlook is neutral

to moderately

bullish on XYZ

Buy 2,000 XYZ shares

trading at $39.81/share

Share

Selling Calls

Want to increase

stock return if

market is level

Buy 2,000 XYZ shares

trading at $39.81/share

Share

Selling Calls

Sell 20 XYZ December

$41.00 Calls at $1.00 each

S

Share

B

Selling Calls

Long 2,000 shares

in XYZ at $39.81

Short 20 XYZ

December $41.00 Call

at $1.00

Selling Calls

Profit

Maximum profit $4,380 ($2.19 per share)

Own 2,000 shares

at $39.81

Sell 20 December

$41.00 call at $1.00

37.81

39.81

41.00

Overall Position

investment (break-even)

$38.81

Loss

Share price

Selling Calls

Called away return

$2.19 or 4.5%

in 90 days

Break-even lowered

from $39.81 to $38.81

Limited downside protection

Maximum gain = Premium + Gain on stock

($2.19 = $1.00 + $1.19)

There is no further profit

participation above $41.00

At expiry

Profit

$41.00

Option is assigned

Investor must sell

shares at $41.00

Seller keeps call

premium $1.00

XYZ at expiration

Loss

At expiry

Profit

$41.00

XYZ at expiration

Call expires worthless

Seller keeps shares

and call premium $1.00

Loss

At expiry

Profit

$37.81

XYZ at expiration

Loss

Option premium provides

limited downside protection

Losses will occur below

break-even point of $38.81

Selling Covered Calls

Benefits

Risks

Income from

selling call

Caps upside

Partial hedge

Downside risk

if stock falls

Exchange Traded Options

OPTIONS

……………………………………

Thank you

……………………………………

Graham O’Brien

February 2014

1