template presentation

advertisement

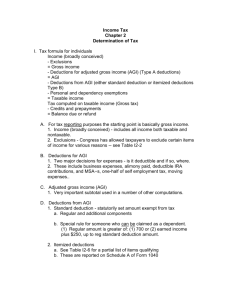

Taxes! Taxes! Taxes! Presented by: [Company Name] [Company Address] [Date] Class One: How Taxes Work [Date] Class Two: Competing Objectives [Date] Class Three: Tax Planning Your Instructor [Instructor Name] – Descriptor Points – About Instructor Instructor Photo Tonight’s Objective HOW TAXES WORK Like any game, you need to know the rules to win, let’s learn the rules! Overview Income Tax ̶ Adjustments ̶ Credits = AGI + Additional Taxes ______________ (the line) =Total Taxes Deductions ̶ Exemptions = Taxable Income ̶ Payments and Additional Credits = Refund (Due) INCOME “Everything is Income Unless Excluded” Net Portfolio Income (Interest & Dividends) Banks Bonds Stocks Mutual Funds Alimony (not child support) Net Earnings/Profits from Self Employment/Tips + Income ̶ Expenses ̶ Depreciation = Net Profit Net Capital Gain Income + What you sold it for ̶ What you paid for it = Profit (Taxable) Retirement Income Pensions IRA Distributions Etc. Net Rents & Royalties (Passive Income) + Rents ̶ Expenses ̶ Depreciation = Net Rents (same for Royalties) SS Income Unemployment Comp PFL Line 21: Other Income Jury Duty Cancellation of Debt Prizes Gambling Winnings B of D Comp Trustee Fees Rec’d Settlements Excluded Income Child Support Loan Proceeds Inheritance Gifts Property Distributions from Divorce ADJUSTMENTS Military Reservist Expense Deduction Performing Artist Expense Deduction Health Savings Account High deductible Health Insurance (can accumulate balance) Not Taxable if spent on qualified medical costs Self-employment Related Self Employment Tax Deduction Self Employed Pension Self Employed Health Insurance Deduction Early Withdrawal Penalty Close a CD (certificate of deposit) early and you pay a penalty Alimony Paid (Not Child Support) Paid as part of MSA Not Tied to kids Retirement Plan Contributions IRA (not ROTH) HRIO - KEOGH Education Related Student Loan Interest Tuition & Fees +TOTAL INCOME ̶ ADJUSTMENTS = ADJUSTED GROSS INCOME AGI is used in MANY other calculations AGI is Used to calculate: • • • • • • • • • Passive Loss Limitations Medical Deductions Employee Business Deductions Casualty Loss Deduction Student Loan Interest Deduction IRA Deductibility Child Tax Credit Taxability of Social Security Income Alternate Minimum Tax Calculation AKA: “The Line” Above the Line VS Below the Line STANDARD DEDUCTION VS ITEMIZED DEDUCTIONS Standard Deduction Or Total of Itemized Deduction (You get the Larger of) Medical Expenses + Out of pocket costs ̶ 10% of AGI = Medical Deduction Taxes Paid State & Local Income Taxes Real Estate Taxes Personal Property Taxes (DMV) Etc. (Mortgage) Interest Paid On debt <$1,100,000 on (residence & 1 vacation property) Interest Paid Investment Interest (except interest paid on purchase of tax free assets) Charity Everything given to qualified charitable organization Document what you give: Prove it or Lose it! Casualty Theft Loss + Documented loss (in excess of insurance reimbursement) ̶ 10% of AGI + $100 = C/T Loss Deduction Miscellaneous (Incl. Employee Business Deductions) + Net out of Pocket ̶ 2 % of AGI = EBE Deduction (Subject to Alternate Minimum Tax) Limitation if AGI > 150K If AGI exceeds thresholds You could lose up to ___% of your Itemized Deductions PERSONAL EXEMPTIONS Fixed Deduction for Every Dependent in your Household Number of Dependents (line 6) × $3900 = Exemption Deduction (Subject to Alternative Minimum Tax) Limited if AGI >$150K If AGI exceeds thresholds You could lose up to ___% of your Personal Exemptions TAXABLE INCOME AGI - Standard/Itemized Deductions - Personal Exemptions = Taxable Income Taxable Income to the Tax Table/ Tax Rate Schedule to Get Tax Effective Tax Rate = Rate Last Dollar is Taxed at MFJ Tax Rates Schedule: Income up to $18,150 At least $18,151 but not over $73,800 At least $73,801 but not over $148,850 Over $148,851 but not over $226,850 Over $226,851 but not over $405,100 Over $405,101 but not over $457,600 Over $457,601 x 10% (.10) × 15% (.15) × 25% (.25) × 28% (.28) × 33% (.33) × 35% (.35) × 39.6% (.396) Effective Tax Rate Tax deduction of $100 x Effective Tax Rate of 28% = Tax Savings of $28 (and vice versa) CREDITS $ For $ Reduction in Tax Tax of $100 -Credit of $100 =Net Tax of $0 Much More Valuable than Deduction In the 10% Bracket a $1 Credit = $10 Deduction In the 25% Bracket a $1 Credit = $4 Deduction In the 33% Bracket a $1 Credit = $3 Deduction Child Care Credit Credit for expenses paid to care for your <13 year old child while you work. $3000 in expense per child / 2 children maximum Credit = 20%-35% of expense depending on AGI (higher the income lower the %) Education Credit Maximum credit American Opportunity Credit Up to $2,500 per eligible student Lifetime Learning Credit Up to $2,000 per return Modified Adjusted Gross Income (MAGI) Refundable or nonrefundable $180,000 if MFJ; $90,000 if Single, HOH, or QW 40% of credit may be refundable $127,000 if MFJ; $63,000 if Single, HOH, or QW Credit limited to tax owed Number of years Limited to first 4 years of post HS Available for all years of post HS education and all courses Number of tax years credit available Available ONLY for 4 tax years Unlimited number of years Type of program required Student must be pursuing degree or other education credential Any program Qualified expenses Only certain expenses apply – tuition, required enrollment fees, etc. Payments for academic periods Payments made in 2013 for academic periods beginning in 2013 or beginning in the first 3 months of 2014 Child Tax Credit $1000 refundable credit for every dependent child under the age of 17. Credit reduces when income exceeds $75K Single / $110K MFJ If reduces tax to $0 could create a refund Residential Energy Credits Solar Energy Property – credit equal to 30% of cost of purchase and installation! Energy efficiency expenses – 10% of cost of purchase up to $500 (not active at this time) Electric Car/Alternative Fuels Credit $7500 non-refundable credit to buy (not lease) a plug-in automobile (not income or AMT restricted) Lesser credits available for hybrids and alternative fuel autos (income and AMT restricted) Non-Refundable vs Refundable Non-refundable = you need to owe tax to use any portion of this credit and it ends when tax reaches $0 Portion or all of the credit is paid to you over and above any tax due ADDITIONAL TAXES Taxes Due to Certain Actions that “Add-on” to your Income Tax There are certain other taxes – not “income” taxes that are added to your income tax. Your annual income tax return is the reporting and collection mechanism for these taxes. Alternate Minimum Tax “AMT” introduced into the law in 1972 by Congress under Nixon to make sure everyone paid taxes Unintentionally now applies to many working Americans by way of “tax preferences” like State tax deductions and Employment related expense deductions Self Employment Tax The way that self-employed people pay into Social Security and Medicare system Pay both halves (employer and employee) Deduct ½ of this tax as Adjustment to Income Social Security Tax on Tip Income Equivalent to SE tax on people who receive tips Large employers now required to report and withhold on tip income Early Withdrawal from Retirement Account 10% Federal penalty if you take money out of retirement account before 59.5 Also applies to non-qualified HSA or 529 plan withdrawal Accompanying State penalties *NEW* Additional Medicare Tax (8959) *NEW* Tax on Net Investment Income (8960) PAYMENTS AND REFUNDABLE CREDITS Money Paid-in Against Potential Taxes Withholding Taxes withheld from paycheck Taxes withheld from retirement Taxes withheld Social Security Taxes withheld on 1099s Estimated Tax Payments Quarterly tax payments Paid in with Extension Last Year’s Refund left on deposit Earned Income Credit Credit to subsidize low income working taxpayers. Dependent children increases credit. Higher income reduces / eliminates credit. Excess FICA Paid Overpayment of FICA tax is refundable Requires multiple employers withheld FICA taxes from wages No limit on Medicare taxes REFUND / TAX DUE [Date] Class Two: Competing Objectives [Date] Class Three: Tax Planning