File

advertisement

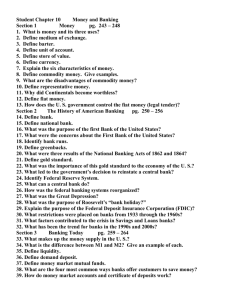

UNIT IV Caution: This PPT will not replace reviewing the textbook. Both need to be studied in preparation for the test. CHAPTERS 10-11: MONEY, BANKING, AND FINANCE PAGE 30 – WHAT IS MONEY? Directions: Define each of the following terms. Use pages 288-290. Functions of Money 1. Medium of Exchange - A means through which products can be exchanged 2. Store of Value - Holds value over time; can be saved for later use 3. Unit of Account - Serves as standard by which economic value can be measured or Standard of Value Characteristics of Money 4. Divisible - Change can be made; $1 = 4 quarters or 10 dimes 5. Portable - Small, light and easy to carry 6. Acceptable - Users must agree it’s a valid medium of exchange 7. Scarce - Limited quantity; absolutely necessary for value 8. Durable - Sturdy enough to last through many transactions 9. Stable - Purchasing power remains about the same over time MATCHING ACTIVITY At the grocery store last week, you purchased $93.25 worth of groceries. You paid for the groceries in cash. You gave the cashier four $20 bills, a $10 bill, three $1 bills, and a quarter. What is the primary function of money exhibited here? Medium of Exchange MATCHING ACTIVITY During the American Civil War, the U.S. government printed fractional currency notes to get around the fact that there were not enough coins in circulation. Between 1862 and 1875, the U.S. government printed fractional notes in dominations of 3, 5, 10, 15, 25, and 50 cents. The fractional notes were meant to restore what primary characteristic of good money? Divisible MATCHING ACTIVITY At the grocery store last week, you had to decide whether to buy the 14.5 oz. can of diced tomatoes for $1.75 or the 28 oz. can of diced tomatoes for $2.55. What is the primary function of money exhibited here? Unit of Account MATCHING ACTIVITY Last year, you sold your game system to your friend Jimmy for $125 in cash. You’ve been saving that money in a shoebox under your bed. You are saving the money to buy a new computer next year. What is the primary function of money exhibited here? Store of Value MATCHING ACTIVITY In the 17th century, Virginia, Maryland, and North Carolina began to use tobacco as currency. But, since tobacco could easily be grown in the southern colonies, tobacco did not always function well as money. What primary characteristic of good money was violated when tobacco was used as money? Scarce MATCHING ACTIVITY Inflation in Zimbabwe in 1998 was 32 percent. In August 2008, inflation was estimated at 11,200,000 percent. Also in 2008, Zimbabwe issued a new 100 billion dollar note. What primary characteristic of good money was violated by the Zimbabwean dollar during this period? Stable PAGE 31 – STOCKS AND DIVIDENDS Most pay a return of 1% or less per year! If you put $100 into a savings account, a year later you would have $101. PAGE 31 – STOCKS AND DIVIDENDS Savings Account • Low interest rates (0.8 and 1.5%) • Penalty paid for too many withdraws Checking Account • Very low interest rates (usually less than 0.1%) • Tied to a debit card; same as cash • Monthly fee Certificate of Deposit • Higher interest rates (anywhere from 2-5%) • Specified lengths of investment (6 months – 5 years) • Penalty if withdrawn early PAGE 31 – STOCKS AND DIVIDENDS Why Buy Stock? • Earn more interest than you would in a savings account or a CD (certificate of deposit). • Dividends are a share of company profits. • Capital gains are profits from resale of stock. PAGE 31 – STOCKS AND DIVIDENDS U.S. Indexes: • Dow Jones (DJIA) • NASDAQ Composite • S&P 500 Global Indexes: • Nikkei 225 (Japan) • FTSE 100 (UK) • TSE 300 (Canada) PAGE 31 – STOCKS AND DIVIDENDS Tracking the Dow • Bull market - Prices rise steadily over a relatively long period • Bear market - Prices decline steadily over a relatively long period Stock Market Video PAGE 32 – ANALYZING THE STOCK MARKET 1. Define the following: A. B. C. D. Use your Stocks app (iPhone) or download MSN Money on Android. stock volume - # of shares traded per day price-to-earnings ratio (P/E) - ratio for valuing a company market capitalization - total market value of the shares outstanding stock yield - annual dividends divided by the share price 2. What’s the difference between a stock exchange and a stock index? 3. Pick a stock and identify the following: 4. - Stock exchange is where stocks are bought and sold. A stock index is a measurement of the value of a section of the stock market. A. Open G. Market Cap B. High H. 52 Week High C. Low I. 52 Week Low D. Volume J. Average Volume E. P/E K. Yield F. Stock Exchange Which three factors do you would believe would be most useful for determining to invest? Why? DOW JONES INDUSTRIAL AVERAGE EXIT TICKET – (POINT BANK) 1. Which of the following companies is a better investment? 2. Explain how you came to this conclusion (use at least two factors). Under Armour (UA) - $88.47 Nike (NKE) – $121.96 Open 87.41 87.44 Open 121.80 Volume (Avg.) 1.63m Day’s (3.18m) Range 86.4289.59 Volume (Avg.) 1.49m Day’s (4.52m) Range 121.34122.93 52w Range 63.77105.89 Market Cap. 18.87b 52w Range 90.69133.52 Market Cap. 103.85b P/E Ratio (EPS) 90.09 (0.97) Dividend (Yield) 1.12 (.92%) P/E Ratio 30.77 (EPS) (3.96) Total Shares 674.74 m Dividend (Yield) Total Shares -180.12 m Previous Close Previous Close 121.88 PAGE 33 – TYPES OF MONEY Directions: Use pages 291 – 293. Include a explanation and a picture of an example for each. Directions: Divide page 33 of your notebook into six sections. Each box should contain one of the following: • • • Commodity Money $ that derives it’s value from the material it’s made Representative Money $ that’s backed by something tangible Fiat Money $ that gets its value from a gov’t promise Used in United States: • • • Currency Paper money and coins Demand Deposits Deposits that are easily converted to cash Near Money Not quite as easily converted as demand deposits What is Money Video PAGE 34 – BANKING TIMELINE 1791 - First Bank of the United States • • • issued national currency controlled money supply loaned money to federal government, state banks, businesses 1811 – End of First Bank of the U.S. charter • • • government had difficulty financing War of 1812 state banks again issued currency not linked to gold, silver reserves increased money supply led to inflation during the war PAGE 34 – BANKING TIMELINE 1816 - Second Bank of the United States • • more resources than First Bank; made money supply more stable Opponents thought bank too powerful, too close to wealthy 1832 - President Andrew Jackson vetoed renewal of charter • • Grew up in a modest farming family in the Carolinas Bank’s charter ends in 1836 PAGE 34 – BANKING TIMELINE Wildcat Banking • All banks become state banks; • Each bank issued it’s own paper currency • States passed free banking laws = bank runs, instability, panic PAGE 34 – BANKING TIMELINE 1863 - National Banking Act • • • created national currency backed by U.S. Treasury bonds required minimum amount of capital for national banks, to back currency taxed state bank notes issued after 1865, taking them out of circulation 1900 – Gold Standard adopted • Dollars were = to a set amount of gold PAGE 34 – BANKING TIMELINE 1913 – Federal Reserve System created • • • • consists of 12 regional banks, one decision-making board provides financial services to federal government and regulates money supply makes loans to banks that serve the public issues Federal Reserve notes as national currency PAGE 34 – BANKING TIMELINE 1929 – Great Depression and New Deal • • many banks failed due to bank runs Banking Act of 1933 • regulated interest rates banks paid; prohibited sale of stocks by banks • Federal Deposit Insurance Corporation (FDIC) insured people’s savings PAGE 35 – THE FEDERAL RESERVE Directions: You should be able to do the following after watching the video. Record the questions at the top of page 35. • Describe the structure of the Federal Reserve. • Identify the primary goal of the Federal Reserve. • What does the Federal Reserve do on a day-to-day basis? PAGE 36 – SIMPLE AND COMPOUND INTEREST Interest: Money paid for money borrowed APR: Annual percentage rate; amount of interest paid over the course of one year Calculating simple interest: I = Prt I - Interest P - Principal (starting balance) r - Rate (written as decimal) t - Time (written in years) PAGE 36 – SIMPLE AND COMPOUND INTEREST PAGE 36 – SIMPLE AND COMPOUND INTEREST 550 154 .07 4 870 .037 80.48 2.5 *To find the account balance, simply add the principal to the interest earned. A=I+P PAGE 36 – SIMPLE AND COMPOUND INTEREST 3. Michael borrowed $9,000 to purchase a 2011 Honda Civic. He will pay the money back in 48 months with simple interest of 11%. How much money will Michael pay back in total? I = (9000)(.11)(4) = $3,960 A = 9000 + 3,960 = $12,960 4. Samantha was given $7,500 from her grandparents. She deposited the money into a certificate of deposit (CD) that pays 4.7% simple annual interest. After 10 years, what was her account balance? I = (7500)(.047)(10) = $3,525 A = 7500 + 3525 = $11,025 PAGE 36 – SIMPLE AND COMPOUND INTEREST Compound Interest – interest earned on both the principal and any interest that has been previously earned. Compound Interest Formula: A=P(1 + r)^t A - Account Balance P - Principal (starting balance) r - Rate (written as decimal) t - Time (written in years) PAGE 36 – SIMPLE AND COMPOUND INTEREST Use the compound interest formula. Don’t forget PEMDAS! 1. Add #s in parenthesis first. 2. Multiply by exponent (use ^ or xy key). 3. Then, multiply by principal. 4. Watch the money pile up! PAGE 36 – SIMPLE AND COMPOUND INTEREST 6 285 319.07 .019 2 1200 1417.88 .087 PAGE 36 – SIMPLE AND COMPOUND INTEREST Who can live more comfortably at a retirement age of 60? Prove it by showing your work. A) Lacey is 18 years old and she has saved money throughout high school. She currently has $7,800 in a savings account. She decides to invest in the stock market. Her broker guarantees an average rate or return of 12% compounded annually. She will cash out at age 60. A = 7800(1 + .12)^42 = $910,440.47 Or B) Mark waits until he is 38 to start investing because he wanted to first buy a house and raise his kids. At 38 he places his life savings, which is $7,800, into a stock brokerage account earning 12% interest compounded annually. He will cash out at age 60. A = 7800(1 + .12)^22 = $94,382.42