Chapter #6 - H. Zafer Yuksel

advertisement

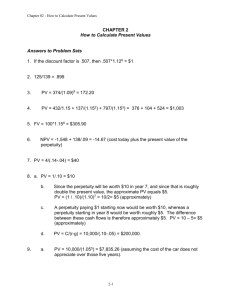

+ Discounted Cash Flow Valuation RWJ-Chapter 6 + The One-Period Case: Future Value If you were to invest $10,000 at 5-percent interest for one year, your investment would grow to $10,500 $500 would be interest ($10,000 × .05) $10,000 is the principal repayment ($10,000 × 1) $10,500 is the total due. It can be calculated as: $10,500 = $10,000×(1.05). The total amount due at the end of the investment is call the Future Value (FV). + The One-Period Case: Future Value In the one-period case, the formula for FV can be written as: FV = C0×(1 + r) Where C0 is cash flow today (time zero) and r is the appropriate interest rate (compound rate). + The One-period Case: Present Value If you were to be promised $10,000 due in one year when interest rates are at 5-percent, how much is your money worth today? $10,000 $9,523.81 1.05 The amount that a borrower would need to set aside today to able to meet the promised payment of $10,000 in one year is call the Present Value (PV) of $10,000. Note that $10,000 = $9,523.81×(1.05). + The One-Period Case: Present Value In the one-period case, the formula for PV can be written as: C1 PV 1 r Where C1 is cash flow at date 1 and r is the appropriate interest rate (discount rate). + Why is DCF important? One of the primary approach to valuation of common stock is DCF. The value of an asset is the present value of the expected cash flows on the asset 𝑉𝑎𝑙𝑢𝑒 = 𝑡=𝑛 𝐶𝐹𝑡 𝑡=1 (1+𝑟)𝑡 Information needed: N=Life of the asset CFt=Cash flows during the life of the asset r=Discount rate reflecting the riskiness of the estimated cash flows + Example Keith Vaughn is trying to sell a piece of land in Alaska. Yesterday, he was offered $10,000 for the property. He was about ready to accept the offer when another individual offered him $11,424. However, the second offer was to be paid a year from now. Both buyers are honest and financially solvent, so he has no fear that the offer he selects will fall through. His financial advisor told Keith that if he takes the first offer, he could invest the $10,000 in the bank at an insured rate of 12%. Which offer should Keith accept? + The One-Period Case: Net Present Value The Net Present Value (NPV) of an investment is the present value of the expected cash flows, less the cost of the investment. Suppose an investment that promises to pay $10,000 in one year is offered for sale for $9,500. Your interest rate is 5%. Should you buy? $10,000 NPV $9,500 1.05 NPV $9,500 $9,523.81 NPV $23.81 Yes! + Important Assumptions In the previous example, we assume that the cash flows are known with certainty. In real life, cash flows may be uncertain. If the cash flows are certain (no risk), then we can use the risk free rate to discount (or to compound). If the cash flows are uncertain, then the discount rate should reflect the risk. In other words, discount rate should be risk adjusted (in that case, discount rate will be higher than risk free rate). We will deal with risk-adjustments in later chapters. + Future and Present Value of Multiple Periods: Future Value The general formula for the future value of an investment over many periods can be written as: FV = C0×(1 + r)T Where C0 is cash flow at date 0, r is the appropriate interest rate, and T is the number of periods over which the cash is invested. + The Multi-period Case: Future Value Suppose that you have invested $1.10 of your money at a high growth fund which is expected to grow at 40-percent per year for the next five years. What will $1.10 be in five years? FV = C0×(1 + r)T $5.92 = $1.10×(1.40)5 + Future Value and Compounding Notice that the money you get in year five, $5.92, is considerably higher than the sum of the initial investment plus five increases of 40-percent on the initial $1.10 investment: $5.92 > $1.10 + 5×[$1.10×.40] = $3.30 This is due to compounding. “Money makes money and the money that money makes makes more money” Benjamin Franklin + Future Value and Compounding $1.10 (1.40) 5 $1.10 (1.40) 4 $1.10 (1.40) 3 $1.10 (1.40) 2 $1.10 (1.40) $1.10 0 $1.54 $2.16 1 2 $3.02 $4.23 3 4 $5.92 5 + Present Value and Discounting How much would an investor have to set aside today in order to have $20,000 five years from now if the current rate is 15%? PV 0 $20,000 1 2 $20,000 $9,943.53 5 (1.15) 3 4 5 + How Long is the wait? If we deposit $5,000 today in an account paying 10%, how long does it take to grow to $10,000? FV C0 (1 r ) $10,000 $5,000 (1.10) T $10,000 (1.10) 2 $5,000 T ln(1.10)T ln 2 ln 2 0.6931 T 7.27 years ln(1.10) 0.0953 T + What Rate Is Enough? Assume the total cost of a college education will be $50,000 when your child enters college in 12 years. You have $5,000 to invest today. What rate of interest must you earn on your investment to cover the cost of your child’s education? FV C0 (1 r ) $50,000 $5,000 (1 r )12 T $50,000 (1 r ) 10 $5,000 12 (1 r ) 10 r 101 12 1 1.2115 1 .2115 About 21.15%. 1 12 + Valuing Level Cash Flows: Annuities and Perpetuities Perpetuity A constant stream of cash flows that lasts forever. Growing perpetuity A stream of cash flows that grows at a constant rate forever. Annuity A stream of constant cash flows that lasts for a fixed number of periods. Growing annuity A stream of cash flows that grows at a constant rate for a fixed number of periods. + Perpetuity A constant stream of cash flows that lasts forever. C C C … 0 1 2 3 C C C PV 2 3 (1 r ) (1 r ) (1 r ) The formula for the present value of a perpetuity is: C PV r + Example What is the value of a British consol that promises to pay £15 each year, every year until the sun turns into a red giant and burns the planet to a crisp? The interest rate is 10-percent. £15 £15 £15 … 0 1 2 3 £15 PV £150 .10 + Growing Perpetuity A growing stream of cash flows that lasts forever. C C×(1+g) C ×(1+g)2 … 0 1 2 3 C C (1 g ) C (1 g ) PV 2 3 (1 r ) (1 r ) (1 r ) 2 The formula for the present value of a growing perpetuity is: C PV rg + Important Points on Growing Perpetuity Formula The numerator is the cash flow one period hence, not at time 0. The interest rate r must be greater than the growth rate g for the formula to work. The formula assumes that cash flows are received and disbursed at regular and discrete points in time. + Example The expected dividend next year is $1.30 and dividends are expected to grow at 5% forever. If the discount rate is 10%, what is the value of this promised dividend stream? $1.30 $1.30×(1.05) $1.30 ×(1.05)2 … 0 1 2 $1.30 PV $26.00 .10 .05 3 + Annuity A constant stream of cash flows with a fixed maturity. C C C C 0 1 2 3 T C C C C PV 2 3 (1 r ) (1 r ) (1 r ) (1 r )T The formula for the present value of an annuity is: 1 C 1 PV C[ 1 ] PV 1 T r r (1 r ) r (1 r )T The term in the brackets is called annuity factor + Example If you can afford a $400 monthly car payment, how much car can you afford if interest rates are 7% on 36-month loans? $400 $400 $400 $400 0 1 2 3 36 $400 1 PV 1 $12,954.59 36 .07 / 12 (1 .07 12) + How to Value Annuities with a Calculator N 36 I/Y 7/12=0.5833 PV 12,954.59 PMT –400 FV 0 Then enter what you know and solve for what you want + What is the present value of a four-year annuity of $100 per year that makes its first payment two years from today if the discount rate is 9%? 4 $100 $100 $100 $100 $100 PV1 $323.97 t 1 2 3 4 (1.09) (1.09) (1.09) (1.09) t 1 (1.09) $297.22 0 $323.97 $100 1 2 $323.97 PV $297.22 0 1.09 $100 3 $100 $100 4 5 + How to Value “Lumpy” Cash Flows First, set your calculator to 1 payment per year. Then, use the cash flow menu: CF0 0 I CF1 0 NPV CF2 100 Nj 4 9 297.22 + Growing Annuity A growing stream of cash flows with a fixed maturity C C×(1+g) C ×(1+g)2 C×(1+g)T-1 0 1 2 3 T C C (1 g ) C (1 g ) PV 2 (1 r ) (1 r ) (1 r )T The formula for the present value of a growing annuity: T 1 g C PV 1 r g (1 r ) T 1 + PV of Growing Annuity You are evaluating an income property that is providing increasing rents. The first year's rent is expected to be $8,500 and rent is expected to increase 7% each year. Each payment occurs at the end of the year. What is the present value of the estimated income stream over the first 5 years if the discount rate is 12%? $8,500 (1.07) 2 $8,500 (1.07) 4 $8,500 (1.07) $8,500 (1.07) 3 $8,500 $9,095 $9,731.65 $10,412.87 $11,141.77 0 $34,706.26 1 2 3 4 5 + PV of Growing Annuity: Cash Flow Keys CF0 0 CF1 8,500.00 CF2 9,095.00 CF3 9,731.65 CF4 10,412.87 CF5 11,141.77 I NPV 12 $34,706.26 + Growing Annuity A defined-benefit retirement plan offers to pay $20,000 per year for 40 years and increase the annual payment by three-percent each year. What is the present value at retirement if the discount rate is 10 percent? $20,000 $20,000×(1.03) $20,000×(1.03)39 0 1 2 40 40 $20,000 1.03 PV $265,121.57 1 .10 .03 1.10 + PV of a Delayed Growing Perpetuity Your firm is about to make its initial public offering of stock and your job is to estimate the correct offering price. Forecast dividends are as follows. Year: 1 2 3 4 Dividends per share $1.50 $1.65 $1.82 5% growth thereafter If investors demand a 10% return on investments of this risk level, what price will they be willing to pay? + PV of a Delayed Growing Perpetuity Year Cash flow 0 1 2 3 $1.50 $1.65 $1.82 4 … $1.82×1.05 The first step is to draw a timeline. The second step is to decide on what we know and what it is we are trying to find + PV of a Delayed Growing Perpetuity Year 0 Cash flow PV of cash flow 1 2 $1.50 $1.65 3 $1.82 dividend + P3 = $1.82 + $38.22 $32.81 1.82 1.05 P3 $38.22 .10 .05 $1.50 $1.65 $1.82 $38.22 P0 $32.81 2 3 (1.10) (1.10) (1.10) + Comparing Rates: The Effects of Compounding Compounding an investment m times a year for T years provides for future value of wealth: r FV C0 1 m mT For example, if you invest $50 for 3 years at 12% compounded semi-annually, your investment will grow to .12 FV $50 1 2 23 $50 (1.06) 6 $70.93 + Effective Annual Interest Rates A reasonable question to ask in the above example is what is the effective annual rate of interest on that investment? (12% here is the APR or stated annual interest rate) .12 23 6 FV $50 (1 ) $50 (1.06) $70.93 2 The Effective Annual Interest Rate (EAR) is the annual rate that would give us the same end-of-investment wealth after 3 years: $50 (1 EAR) 3 $70.93 + Effective Annual Interest Rates (continued) FV $50 (1 EAR) 3 $70.93 $70.93 (1 EAR) $50 3 13 $70.93 EAR 1 .1236 $50 So, investing at 12.36% compounded annually is the same as investing at 12% compounded semiannually. + Effective Annual Interest Rates (continued) Find the Effective Annual Rate (EAR) of an 18% APR loan that is compounded monthly. What we have is a loan with a monthly interest rate of 1½ percent. This is equivalent to a loan with an annual interest rate of 19.56 percent m 12 r .18 12 1 1 1 1 ( 1 . 015 ) 1 0.19561817 m 12 What will be EAR if the interest is compounded daily (365 days a year) 19.72% The higher the number of compounding periods, the higher is the EAR. + EAR on a financial Calculator Hewlett Packard 10B keys: display: 12 [gold] [P/YR] 12.00 18 [gold] [NOM%] 18.00 [gold] [EFF%] 19.56 description: Sets 12 P/YR. Sets 18 APR. Texas Instruments BAII Plus keys: description: [2nd] [ICONV] Opens interest rate conversion menu Sets 12 payments per year [↑] [C/Y=] 12 Sets 18 APR. [↓][NOM=] 18 [ENTER] [↓] [EFF=] [CPT] 19.56 + What Is a Firm Worth? We have so far focused more on present values because we are interested in valuation (of the firm, of the project) in this class. Conceptually, a firm should be worth the present value of the firm’s cash flows. The tricky part is determining the size, timing and risk of those cash flows. + What do we learn so far? OFCF1 OFCF2 OFCFn OFCF3 𝑛 𝑉𝑑+𝑒 = 𝑡=1 Operating Free Cash Flows 𝑂𝐹𝐶𝐹𝑡 (1 + 𝑊𝐴𝐶𝐶)𝑡 Total Value of Firm Weighted Average Cost of Capital 𝑉𝑒 = 𝑉𝑑+𝑒 − 𝑉𝑑 Value of the Equity Value of the Debt + Remember: 𝑂𝐹𝐶𝐹 = 𝐸𝐵𝐼𝑇 1 − 𝑇𝑎𝑥 + 𝐷𝑒𝑝𝑟𝑒𝑐𝑖𝑎𝑡𝑖𝑜𝑛 − 𝐶𝑎𝑝𝑖𝑡𝑎𝑙 𝐸𝑥𝑝𝑒𝑛𝑑𝑖𝑡𝑢𝑟𝑒 −∆𝑊𝑜𝑟𝑘𝑖𝑛𝑔 𝐶𝑎𝑝𝑖𝑡𝑎𝑙 − ∆𝑂𝑡ℎ𝑒𝑟 𝐴𝑠𝑠𝑒𝑡𝑠 Current Assets –Current Liabilities + FCF1 FCF2 FCFn FCF3 Free Cash Flows 𝑛 𝑉𝑒 = 𝑡=1 Value of the Equity 𝐹𝐶𝐹𝑡 (1 + 𝑘𝑒 )𝑡 Cost of Equity + Remember 𝐹𝐶𝐹 = 𝑁𝑒𝑡 𝐼𝑛𝑐𝑜𝑚𝑒 + 𝐷𝑒𝑝𝑟𝑒𝑐𝑖𝑎𝑡𝑖𝑜𝑛 − 𝐶𝑎𝑝𝑖𝑡𝑎𝑙 𝐸𝑥𝑝𝑒𝑛𝑑𝑖𝑡𝑢𝑟𝑒 +𝑁𝑒𝑤 𝐷𝑒𝑏𝑡 𝐼𝑠𝑠𝑢𝑒 − 𝑃𝑟𝑖𝑛𝑐𝑖𝑝𝑎𝑙 𝐷𝑒𝑏𝑡 𝑃𝑎𝑦𝑚𝑒𝑛𝑡𝑠 −∆𝑊𝑜𝑟𝑘𝑖𝑛𝑔 𝐶𝑎𝑝𝑖𝑡𝑎𝑙 − ∆𝑂𝑡ℎ𝑒𝑟 𝐴𝑠𝑠𝑒𝑡𝑠 Current Assets –Current Liabilities + Summary (1) The concept we have learned is very important. We use these ideas to value a stock or a company This is one of the most important fundamental for stock and firm valuation Let’s summarize what we know We know how to find OFCF and FCF We know how to apply DCF The remaining part is “risk” Bond Stock + Important Note on Discount and Compound Rates You need to make sure that the interest rate (compound or discount rate) and the cash flow period matches. If you have annual cash flows, you should use an annual rate. If you have monthly cash flows, you should use a monthly rate. If the compounding periods and the payment periods are different, you need to adjust the interest rate. + Summary (2) and Conclusions Two basic concepts, future value and present value are introduced in this chapter. Interest rates are commonly expressed on an annual basis, but semi-annual, quarterly, monthly and even continuously compounded interest rate arrangements exist. The formula for the net present value of an investment that pays $C for N periods is: N C C C C NPV C0 C0 2 N t (1 r ) (1 r ) (1 r ) ( 1 r ) t 1