Chapter 15: Options on stock indices and currencies

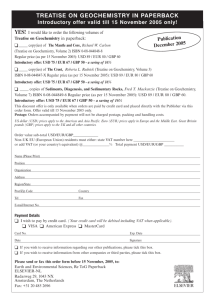

advertisement

Options on

Stock Indices and Currencies

Chapter 15

1

The cash market

Stock indexes are not traded per se.

Several mutual funds trade portfolio that

are the index portfolio, or a portfolio that

closely mimic the index.

The market values of all stock indexes are

calculated virtually continuously.

2

STOCK INDEXES (INDICES)

A STOCK INDEX IS A SINGLE NUMBER BASED ON

INFORMATION ASSOCIATED WITH A SET OF

STOCK PRICES AND QUANTITIES.

A STOCK INDEX IS SOME KIND OF AN AVERAGE OF THE

PRICES AND THE QUANTITIES OF THE STOCKS THAT ARE

INCLUDED IN A GIVE PORTFOLIO.

THE MOST USED INDEXES ARE

A SIMPLE PRICE AVERAGE

AND

A VALUE WEIGHTED AVERAGE.

3

STOCK INDEXES - THE CASH MARKET

AVERAGE PRICE INDEXES:

DJIA, MMI:

N = The number of stocks in the portfolio.

Pi = The i-th stock market price

D = Divisor

P

I=

;

i

N

i = 1,..., N.

Initially D = N and the index is set at some level.

To ensure continuity, the divisor is adjusted over

4

time.

EXAMPLES OF INDEX ADJUSMENTS

STOCK SPLITS: 2 for 1.

1.

(P1 P2 ... PN ) / D1 I1

2.

1

(P1 P2 ... PN ) / D 2 I1

2

1.

(30 + 40 + 50 + 60 + 20) /5 = 40

I = 40 and D = 5.

2.

(30 + 20 + 50 + 60 + 20)/D = 40

The new divisor is D = 4.5

5

CHANGE OF STOCKS IN THE INDEX

1.

(P1 P2 (ABC) ... PN ) / D1 I1

2.

(P1 P2 ( XYZ) ... PN ) / D 2 I1

1.

(32 + 18 + 55 + 56 + 19)/4.5 = 40

I = 40and D =4.5.

2.

(32 + 118 + 55 + 56 + 19)/D = 40

The new divisor is D = 7.00

6

STOCK #4 DISTRIBUTED 66 2/3% STOCK DIVIDEND

(22 + 103 + 44 + 58 + 25)/7.00 = 36

D = 7.00.

Next, (22 + 103 + 44 + 34.8 + 25)/D = 36

The new divisor is D = 6.355.

STOCK # 2 SPLIT 3 for 1.

(31 + 111 + 54 + 35 + 23)/6.355 = 39.9685

(31 + 37 + 54 + 35 + 23)/D = 39.9685

The new Divisor is D = 4.5035.

7

ADDITIONAL STOCKS

1.

2.

(P1 P2 ... PN ) / D1 I1

(P1P2 ,...,PN PN+1 ) / D2 I1

1. (30 + 39 + 55 + 33 + 21)/4.5035= 39.5248

2. (30 + 39 + 55 + 33 + 21 + 35)/D = 39.5248

D = 5.389

8

VALUE WEIGHTED INDEXES

S & P500, NIKKEI 225, VALUE LINE

NP

V

I

w

V

N P

ti ti

ti

t

Bi Bi

ti

Bp

B = SOME BASIS TIME PERIOD

INITIALLY t = B THUS, THE INITIAL INDEX VALUE IS SOME

ARBITRARILY CHOSEN VALUE: M.

Examples:

The S&P500 index base period was 1941-1943 and its

initial value was set at M = 10.

The NYSE index base period was Dec. 31, 1965 and its

initial value was set at M = 50.

9

The rate of return on the index:

The HPRR on a value weighted index in

any period t, is the weighted average of

the individual stock returns; the weights

are the dollar value of the stock as a

proportion of the entire portfolio value.

R It w tiR ti ;

N ti Pti

Vti

w ti

.

N tiPti VtP

10

stock

Pti

Nti

Vti

wti

Pt+1i Rti

Federal Mogul

Martin Arietta

IBM

US West

Bausch&Lomb

First Union

Walt Disney

Delta Airlines

Total

18

73

50

45

55

50

40

55

9,000

8,000

4,000

5,000

15,000

10,000

12,000

20,000

162,000

584,000

200,000

225,000

825,000

500,000

480,000

1,100,000

4,076,000

.0397

.1432

.0491

.0552

.2024

.1227

.1178

.2699

1.000

19.8

75

48

49

52

57

46

59

.1000

.0274

-.0400

.0889

-.0545

.1400

.1500

.0727

Rp = (.0397)(.1) + (.1432(.0274) + (.0491)(-.04) + (.0552)(.0889) +

(.2024)(-.0545) + (.1227)(.14) + (.1178)(.15) + (.2699)(.0727) = 0.0543

11

or 5.43%

Of course, the HPRR on the portfolio may

be calculated directly.

With the end-of-period prices – Pt+1i we

calculate the end-of-period portfolio

value: 4,297,200.

Thus, the portfolio’s HPRR is:

= [4,297,200 – 4,076,000]/4,076,000

= .0543

Or

5.43%.

12

THE RATE OF RETURN ON THE INDEX

N

I t +1 I t

R It

It

t +1i

VB

Pt +1i

N

ti

N

ti

Pti

VB

Pti

VB

N

t +1i

Pt +1i N ti Pti

N

ti

Pti

;

but, N t +1i N ti . Thus,

N (P

N

ti

t +1i

ti

Pti )

Pti

13

Pt 1i Pti

N tiPti P

ti

R It

,

N tiPti

N PR

N P

ti

ti

ti

ti

. Rewrite this as :

ti

N tiPti

[

]R ti, or

N tiPti

Vti

R ti . Finally,

VtP

R It w tiR ti . Notice, again, that :

N ti Pti Vti

w ti

.

N tiPti VtP

14

THE BETA OF A PORTFOLIO

Definitions:

COV(R i , R M )

βi

.

VAR(R M )

COV(R P , R M )

βP

.

VAR(R M )

R

COV(R P , R I )

βP

.

VAR(R I )

15

THE BETA OF A PORTFOLIO

THEOREM:

A PORTFOLIO’S BETA IS THE WEIGHTED AVERAGE OF THE

BETAS OF THE STOCKS THAT COMPRISE THE PORTFOLIO.

THE WEIGHTS ARE THE DOLLAR VALUE WEIGHTS OF THE

STOCKS IN THE PORTFOLIO.

Proof: Assume that the index is a well diversified

portfolio, I.e., the index represents the

R

market portfolio.

Let P denote any portfolio, i denote the

individual stock; i = 1, 2, …,N in the

portfolio and I denote the index.

16

By definition:

COV(R P , R I )

βP

.

VAR(R I )

Substituti ng for R P ; R P w i R i ,

βP

COV([ w i R i ], R I )

VAR(R I )

.

Recall that the covariance is

a linear operator, thus :

w iCOV(R i , R I )

βP

, or :

VAR(R I )

COV(R i , R I

βP wi

w iβi .

VAR(R I )

This concludes the proof.

17

STOCK PORTFOLIO BETA

STOCK NAME

FEDERAL MOUGUL

MARTIN ARIETTA

IBM

US WEST

BAUSCH & LOMB

FIRST UNION

WALT DISNEY

DELTA AIRLINES

PRICE

18.875

73.500

50.875

43.625

54.250

47.750

44.500

52.875

SHARES

9,000

8,000

3,500

5,400

10,500

14,400

12,500

16,600

VALUE

WEIGHT

169,875

588,000

178,063

235,575

569,625

687,600

556,250

877,725

3,862,713

BETA

.044

.152

.046

.061

.147

.178

.144

.227

1.00

.80

.50

.70

1.1

1.1

1.4

1.2

P = .044(1.00) + .152(.8) + .046(.5)

+ .061(.7) + .147(1.1) + .178(1.1)

+ .144(1.4) + .227(1.2) = 1.06

18

A STOCK PORTFOLIO BETA

STOCK NAME

BENEFICIAL CORP.

CUMMINS ENGINES

GILLETTE

KMART

BOEING

W.R.GRACE

ELI LILLY

PARKER PEN

PRICE

40.500

64.500

62.000

33.000

49.000

42.625

87.375

20.625

SHARES

11,350

10,950

12,400

5,500

4,600

6,750

11,400

7,650

VALUE

459,675

706,275

768,800

181,500

225,400

287,719

996,075

157,781

3,783,225

WEIGHT BETA

.122

.187

.203

.048

.059

.076

.263

.042

.95

1.10

.85

1.15

1.15

1.00

.85

.75

P = .122(.95) + .187(1.1) + .203(.85)

+ .048(1.15) + .059(1.15) + .076(1.0)

+ .263(.85) + .042(.75) = .95

19

Sources of calculated Betas and calculation inputs

Example: ß(GE) 6/20/00

Source

ß(GE)

Value Line Investment Survey

1.25

NYSECI

Weekly Price

5 yrs (Monthly)

Bloomberg

1.21

S&P500I

Weekly Price

2 yrs (Weekly)

Bridge Information Systems

1.13

S&P500I

Daily Price

2 yrs (daily)

Nasdaq Stock Exchange

1.14

Media General Fin. Svcs. (MGFS)

Quicken.Excite.com

1.23

MSN Money Central

1.20

DailyStock.com

1.21

Standard & Poors Compustat Svcs

S&P Personal Wealth

1.2287

S&P Company Report)

1.23

Index Data

S&P500I

Horizon

Monthly P ice

3 (5) yrs

S&P500I

Monthly Price

5 yrs (Monthly)

S&P500I

Daily Price

5 yrs (Daily)

S&P500I

Monthly Price

5 yrs (Monthly)

Charles Schwab Equity Report Card 1.20

S&P Stock Report

AArgus Company Report

1.23

1.12

Market Guide

YYahoo!Finance

1.23

Motley Fool

1.23

20

STOCK INDEX OPTIONS

1.

One contract = (I)($m)

(WSJ)

2.

ACCOUNTS ARE SETTLED BY CASH

21

EXAMPLE: Options on a stock index

MoneyGone, a financial institution, offers

its clients the following deal:

Invest $A ≥ $1,000,000 for 6 months. In 6

months you receive a guaranteed return:

The Greater of {0%, or 50% of the return

on the SP500I during these 6 months.}

For comparison purposes: The annual riskfree rate is 8%. The SP500I dividend

payout ratio is q = 3% and its annual VOL

σ= 25%.

22

MoneyGone offer:

Deposit:

$A now.

Receive:

$AMax{0, .5RI} in 6 months.

Denote the date in six month = T.

Rewrite MoneyGone offer at T:

IT I0

Retrurn ($A)Max{0, (.5)(

)}

I0

$A

Return (.5)( )Max{0, IT I0 }

I0

23

The expression:

Max{0, IT I0}

is equivalent to the at-expiration cash flow

of an at-the money European call option on

the index, if you notice that K = I0.

Calculate this options value based on:

S0 = K = I0; T – t = .5; r = .08; q = .03

and σ = .25. Using DerivaGem:

c = .08137.

Thus, MoneyGone’s promise is equivalent

24

to giving the client NOW, at time 0, a value

of:

(.5)(.08137)($A) = $.040685A.

Therefore, the investor’s initial deposit is

only 95.9315% of A.

Investing $.959315A and receiving $A in

six months, yields a guaranteed return of:

1

$A

R ln[

] .083

.5 $.959315A

= 8.3%

25

STOCK INDEX OPTIONS FOR

PORTFOLIO INSURANCE

Problems:

1. How many puts to buy?

2. Which exercise price will guarantee

a desired level of protection?

The answers are not easy because the

index underlying the puts is not the

portfolio to be protected.

26

The protective put with a single stock:

AT

STRATEGY

ICF

Hold the

stock

Buy put

-St

TOTAL

-St – p

-p

EXPIRATION

ST < K

ST

K - ST

K

ST ≥ K

ST

0

ST

27

The protective put consists of holding the

portfolio and purchasing n puts on an

index. Current t = 0; Expiration T = 1.

AT

STRATEGY

EXPIRATION (T = 1)

ICF (t = 0)

-V0

I1 < K

I1 ≥ K

V1

V1

Hold the

portfolio

Buy n puts

-nP($m)

TOTAL

-V0 –nP($m) V1+n($m)(K- I1)

n(K- I1)($m)

0

V1

28

WE USE

THE CAPITAL ASSET PRICING MODEL.

For any security i, the expected excess

return on the security and the expected

excess return on the market portfolio are

linearly related by their beta:

ER i rF βi (ER M rF )

ER p rF β p (ER M rF )

29

THE INDEX TO BE USED IN THE

STRATEGY, IS TAKEN TO BE A PROXY FOR

THE MARKET PORTFOLIO, M. FIRST,

REWRITE THE ABOVE EQUATION FOR THE

INDEX I AND ANY PORTFOLIO P :

ER p rF β p (ER I rF ).

30

Second, as an approximation, rewrite the

CAPM result, with actual returns:

R p rF β p (R I rF ).

In a more refined way, using V and I for the

portfolio and index market values,

respectively:

V1 - V0 D P

I1 - I 0 D I

rF β p [

rF ].

V0

I0

31

NEXT, use the ratio Dp/V0 as the portfolio’s

annual dividend payout ratio qP and DI/I0

the index annual dividend payout ratio, qI.

V1 - V0

I1 - I 0

q P rF β p [

q I rF ]

V0

I0

V1

I1

1 q P rF β p [ - 1 q I - rF ]

V0

I0

The ratio V1/ V0 indicates the portfolio

required protection ratio.

32

For example:

V1

.90,

V0

The manager wants V1, to be down to no

more than 90% of the initial portfolio

market value, V0:

V1 = (.9)V0.

We denote this desired level of hedging

by

(V1/ V0)*.

This is a decision variable.

33

1.

The number of puts is:

V0

n βp

.

($m)I 0

34

2. The exercise price, K, is determined by

substituting I1 = K and the required level,

(V1/ V0)* into the equation:

V1

I1

1 q P rF β p [ - 1 q I - rF ],

V0

I0

and solving for K:

V1

K

( ) * 1 q P rF β p [ - 1 q I - rF ].

V0

I0

I0 V1

K [( ) * q p - (β p )q I (1 rF )(β p -1)].

β p V0

35

EXAMPLE: A portfolio manager expects the

market to fall by 25% in the next six

months. The current portfolio value is

$25M. The manager decides on a 90%

hedge by purchasing 6-month puts on the

S&P500 index. The portfolio’s beta with the

S&P500 index is 2.4. The S&P500 index

stands at a level of 1,250 points and its

dollar multiplier is $100. The annual riskfree rate is 10%, while the portfolio and

the index annual dividend payout ratios are

5% and 6%, respectively. The data are

36

summarized below:

V1

V0 $25,000,000; ( )* .9; I0 1,250;

V0

$m $100;

The annual rates are : rF 10%; q p 5%; q I 6%.

Finally, β 2.4. Period half a year.

Solution: Purchase

V0

n βp

($m)I 0

$25,000,000

n 2.4

480 puts.

($100)(1,2 50)

37

The exercise price of the puts is:

I 0 V1

K [( ) * q p - (β p )q I (1 rF )(β p - 1)].

β p V0

1,250

K

[.9 .025 (2.4).03 (1 .05)(2.4 1)

2.4

K 1,210.

Solution: Purchase n = 480 six-months

puts with exercise price K = 1,210.

38

We rewrite the Profit/Loss table for the protective put

strategy:

AT EXPIRATION

STRATEGY

INITIAL CASH

FLOW

Hold the portfolio

-V0

I1 < K

V1

I1 ≥ K

V1

Buy n puts

-n P($m)

TOTAL

n(K - I1)($m)

-V0 - nP($m) V1+n($m)(K - I1)

0

V1

We are now ready to calculate the floor

level of the portfolio: V1+n($m)(K- I1) 39

We are now ready to calculate the floor

level of the portfolio:

Min portfolio value = V1+n($m)(K- I1)

This is the lowest level that the portfolio

value can attain. If the index falls below

the exercise price and the portfolio value

declines too, the protective puts will be

exercised and the money gained may be

invested in the portfolio and bring it to the

value of:

V1+n($m)K- n($m)I1

40

Substitute for n:

V0

n βp

.

($m)I 0

V0

Min porfolio value V1 β p

($m)K

($m)I 0

V0

βp

($m)I 1

($m)I 0

V0

V0

Min portfolio value V1 β p

K - βp

I1.

I0

I0

41

To substitute for V1 we solve the equation:

V1

I1

1 q P rF β p [ - 1 q I - rF ]

V0

I0

I1

V1 V0 (1 q P rF β p [ - 1 q I - rF ])

I0

V0

V1 β p I1

I0

V0 1 rF q p β p [q I 1 rF ]

42

3.

Substitution V1 into the equation for

the Min portfolio value

Min portfolio value

V0

βp

K V0 [β p q I q p (1 rF )(1 β p )].

I0

The desired level of protection is made at

time 0. This determines the exercise

price and management can also calculate

the minimum portfolio value.

43

Minimum

portfolio

value

V0

β p K V0 [β pq I q p (1 rF )(1 β p )].

I0

$25,000,000

2.4

1,210

1,250

$25,000,000[2.4(.03) - .025 (1 .05)(1 - 2.4)]

$22,505,000.

44

Example (p326) protection for 3 months

V1

V0 $500,000; ( )* .9; I 0 1,000; $m $100;

V0

The annual rates are : rF 12%; q p 4%; q I 4%.

Finally, β 2.0

Solution: Purchase

V0

n βp

($m)I 0

$500,000

n 2.0

10 puts.

($100)(1,0 00)

45

The exercise price of the puts is:

I 0 V1

K [( ) * q p - (β p )q I (1 rF )(β p - 1)].

β p V0

1,000

K

[.9 .01 (2.0).01 (1 .03)(2.0 1)

2.0

K 960.

Solution: Purchase n = 10 three -months

puts with exercise price K = 960.

46

Min portfolio value

V0

β p K V0 [β pq I q p (1 rF )(1 β p )].

I0

$500,000

2.0

960

1,000

$500,000[2.0(.01) - .01 (1 .03)(1 - 2.0)]

$450,000.

47

CONCLUSION:

Holding the portfolio and purchasing

10, 3-months protective puts on the

S&P500 index, with the exercise

price K = 960, guarantees that the

portfolio value, currently $500,000

will not fall below $450,000 in three

months.

48

A SPECIAL CASE: In the case that

a.

β=1

b.

qP =qI,

the portfolio is statistically similar to the

index. In this case:

V1

K I 0 ( ) * and

V0

V0

n

($m)I 0

Min portfolio value is V0 (V1/V0 ) .

*

49

Assume that in the above example:

βp = 1 and qP =qI, then:

V1

K I 0 ( ) * 1,250(.9) 1,125.

V0

V0

$25,000,000

n

200 puts and

($m)I 0

$100(1250)

Min portfolio value

V V0 (.9) $25,000,000(.9) $22,500,000.

*

1

*

50

Example: (p326-27)

βp = 1 and qP =qI, then:

V1

K I 0 ( ) * 1,000(.9) 900.

V0

V0

$500,000

n

5 puts and

($m)I 0

$100(1,000)

Min portfolio value

V V0 (.9) $500,000(.9) $450,000.

*

1

*

51

A Zero cost Collar

AT EXPIRATION

STRATEGY

ICF

I1 < KP

portfolio

Buy n puts

Sell n calls

TOTAL

-V0

-nP($m)

nC($m)

-V0

KP < I1 < KC

I1 ≥ KC

V1

n(KP-I1)($m)

0

V1

0

0

V1

0

n(I1-KC)($m)

V1+

n($m)(KP - I1)

V1

V1 –

n($m)(I1-KC)

52

A zero cost Collar

If the Collar is to be zero cost that the cost

of the puts is equal to the revenue from

the calls, given that: n(p) = n(c).

Using the same relationship between the

portfolio value and the index value, i.e.,

the CAPM the solution for the P/L profile

of the Collar is given by:

53

For I1 K P :

V0

V0 [rF q P β P (1 rF q I )] β P

KP

I0

For K P I1 K C :

V0

V0 [rF q P β P (1 rF q I )] β P

I1

I0

For I1 K C :

V0

V0 [rF q P β P (1 rF q I )] β P

KC

I0

54

FOREIGN CURRENCY (FORX)

OPTIONS(p.321)

FORX options are traded all over the world.

The main exchange in the U.S. is the

Philadelphia exchange (PHLX).

First we describe several characteristics of

the spot market for FORX.

55

FOREIGN CURRENCY: THE SPOT MARKET

EXCHANGE RATES:

The value of one

currency in one unit of another currency

is the EXCHANGE RATE between the two

currencies.There are two quote formats:

1. S(USD/FC); The number of USD in

one unit of the foreign currency.

2. S(FC/USD); The number of the

foreign currency in one USD.

www.x-rates.com

56

S(USD/GBP) = 1.6821

1

1

=

=

.5945 S(GBP/USD)

S(GBP/USD) .5945

57

CURRENCY CROSS RATES

Let FC1, FC2 AND FC3 denote 3 different

currencies. Then, in the absence of

arbitrage, the following relationship must

hold for their spot exchange rate:

S(FC1/FC3)

S(FC1/FC2) =

S(FC2/FC3)

S(FC3/FC2)

=

S(FC3/FC1)

58

CURRENCY CROSS RATES – OCT. 13, 04

USD

GBP

CAD

USD

1

1.7972

0.798212 1.2393

GBP

0.556421 1

0.444141 0.689572 0.407023

CAD

1.25279

1

1.55259

0.916425

EUR

0.806907 1.45017

.644082

1

0.590254

AUD

1.36705

1.09119

1.69418

1

2.25153

2.45686

EUR

AUD

0.731502

59

CURRENCY CROSS RATES

EXAMPLE:

FC1 = USD; FC2 = MXP; FC3 = GBP.

USD

MXP

GBP

USA

1.0000

0.0997

1.6603

MEXICO

10.0301

1.000

16.653

UK

0.6023

0.06005

1.000

S(USD/MXP) 0.0997; S(USD/GBP) 1.6603

S(MXP/USD) 10.0301; S(MXP/GBP) 16.653

S(GBP/USD) 0.6023; S(GBP/MXP) 0.06005.

60

CURRENCY CROSS RATES

Let FC1 USD;

EXAMPLE

FC2 MXP;

FC3 GBP.

S(GBP/MXP)

S(USD/GBP)

S(USD/MXP) =

=

.

S(GBP/USD)

S(MXP/GBP)

S(GBP/MXP) 0.06005

0.0997.

S(GBP/USD)

0.6023

S(USD/GBP) 1.6603

0.0997.

S(MXP/GBP) 16.653

61

AN EXAMPLE OF CROSS SPOT RATES ARBITRAGE

COUNTRY

USD

GBP

CHF

SWITZERLAND

1.7920

2.8200

1.0000

U.K

0.6394

1.0000

0.3546

U.S.A

1.0000

1.5640

0.5580

S(GBP/USD)

THEORY :

= S(CHF/USD)

S(GBP/CHF)

BUT : 0.6394 = 1.8031 1.7920

0.3546

S(USD/GBP)

SIMILARLY :

= S(CHF/GBP)

S(USD/CHF)

1.5640

BUT :

= 2.8029 < 2.8200

0.5580

62

THE CASH ARBITRAGE ACTIVITIES:

USD1,000,000

USD1,006,134.26

0.6394

0.5580

GBP639,400

CHF1,803,108

2.8200

63

Forward rates, An example:

GBP

18.5.99

SPOT

USD1.6850/GBP

30 days forward

USD1.7245/GBP

60 days forward

USD1.7455/GBP

90 days forward

USD1.7978/GBP

180 days forward

USD1.8455/GBP

The existence of forward exchange rates

implies that there is a demand and supply

64

for the GBP for future dates.

THE INTEREST RATES PARITY

Wherever financial flows are unrestricted,

the exchange rates, the forward rates and

the interest rates in any two countries must

maintain a NO- ARBITRAGE relationship:

Interest Rates Parity.

F(DC/FC) = S(DC/FC)e

1.8455 1.6850e

(rDOM - rFOR )(T - t)

180

(rUS rUK )

365

65

.

NO ARBITRAGE: CASH-AND-CARRY

TIME

CASH

FUTURES

t

(1) BORROW DC. rDOM

(4) SHORT FOREIGN CURRENCY

(2) BUY FOREIGN CURRENCY

FORWARD

DC/S(DC/FC) = DCS(FC/DC)]

(3) INVEST IN BONDS

DENOMINATED IN THE

Ft,T(DC/FC)

AMOUNT:

DCS(FC/DC)e

rFOR (T-t)

FOREIGN CURRENCY rFOR

T

(3) REDEEM THE BONDS EARN (4) DELIVER THE CURRENCY TO

rFOR (T-t)

CLOSE THE SHORT POSITION

DCS(FC/DC)e

(1) PAY BACK THE LOAN

DCe

DCe

rDOM (T -t)

RECEIVE:

F(DC/FC)DCS(FC/DC)e

IN THE ABSENCE OF ARBITRAGE:

rD (T t)

F(DC/FC)DC S(FC/DC)e

Ft,T (DC/FC) St (DC/FC)e

rFOR (T-t)

rFOR (T-t)

(rDOM - rFOR )(T-t)

66

NO ARBITRAGE: REVERSE CASH – AND - CARRY

TIME

CASH

FUTURES

t

(1) BORROW FC . rFOR

(4) LONG FOREIGN CURRENCY

(2) BUY DOLLARS

FORWARD Ft,T(DC/FC)

FCS(DC/FC)

AMOUNT IN DOLLARS:

FCS(DC/FC)e

(3) INVEST IN T-BILLS

FOR RDOM

T

REDEEM THE T-BILLS EARN

rDOM (T-t)

TAKE DELIVERY TO CLOSE

FCS(DC/FC)e

THE LONG POSITION

PAY BACK THE LOAN

RECEIVE

FCe

rFOR (T - t)

IN THE ABSENCE OF ARBITRAGE:

FCe

rFOR (T - t)

R DOM (T-t)

rDOM ( T-t)

FCS(DC/FC)e

F(DC/FC)

rDOM ( T-t)

FCS(DC/FC)e

F(DC/FC)

Ft,T (DC/FC) St (DC/FC)e

(rDOM rFOR )( T-t)

67

FROM THE CASH-AND-CARRY STRATEGY:

Ft,T (DC/FC) St (DC/FC)e (rDOM - rFOR )(T-t)

FROM THE REVERSE CASH-AND-CARRY STRATEGY:

(rDOM - rFOR )(T -t)

t

t,T

F (DC/FC) S (DC/FC)e

THE ONLY WAY THE TWO INEQUALITIES HOLD

SIMULTANEOUSLY IS BY BEING AN EQUALITY:

Ft,T (DC/FC) = St (DC/FC)e

(rDOM - rFOR )(T - t)

68

ON MAY 25 AN ARBITRAGER OBSERVES THE FOLLOWING

MARKET PRICES:

S(USD/GBP) = 1.5640 <=> S(GBP/USD) = .6393

F(USD/GBP) = 1.5328 <=> F(GBP/USD) = .6524

rUS = 7.85% ; rGB = 12%

F(USD/GBP Theoretical ) = 1.5640e

(.0785 - .12)

209

365

= 1.5273

The market forward rate 1.5328 is overvalued

relative to the theoretical, no arbitrage forward

rate 1.5273.

CASH AND CARRY

69

CASH AND CARRY

TIME

CASH

MAY 25

FUTURES

(1) BORROW USD100M AT 7. 85%

FOR 209 DAYS

SHORT DEC 20

GBP68,477,215 FORWARD.

F = USD1.5328/GBP

(2) BUY GBP63,930,000

(3) INVEST THE GBP63,930,000

IN BRITISH BONDS

DEC 20 RECEIVE GBP68,477,215

209

.12

365

63,930,000e

DELIVER GBP68,477,215

FOR USD104,961,875.2

= GBP68,477, 215

REPAY YOUR LOAN:

100Me

.0785

209

365

= USD104,59 7,484.3

70

PROFIT: USD104,961,875.2 - USD104,597,484.3 = USD364,390.90

Example 2: THE INTEREST RATES PARITY

In the real markets, buyers pay the ask

price while sellers receive the bid price.

Moreover, borrowers pay the ask interest

rate while lenders only receive the bid

interest rate.

Therefore, in the real markets, it is possible

for the forward exchange rate to fluctuate

within a band of rates without presenting

arbitrage opportunities.Only when the

market forward exchange rate diverges

71

from this band of rates arbitrage exists.

Foreign Exchange Quotes for

USD/GBP on Aug 16, 2001

Spot

Bid

1.4452

Ask

1.4456

1-month forward

1.4435

1.4440

3-month forward

1.4402

1.4407

6-month forward

1.4353

1.4359

12-month forward

1.4262

1.4268

72

FOR BID AND ASK QUOTES :

1

S(EUR/FC)

ASK S(FC/EUR)

S(EUR/FC)

BID

S(USD/NZD)

S(USD/NZD)

S(NZD/USD)

S(NZD/USD)

ASK

BID

ASK

BID

1

S(FC/EUR)

BID

ASK

USD.5NZD, buy NZD1 pay 50 cents.

USD.480/N ZD, sell NZD1 get 48 cents.

NZD2.083/USD, buy USD1 pay NZD2.083.

NZD2.000/USD, sell USD1 get NZD2.

73

Example 2: THE INTEREST RATES PARITY

We now show that in the real markets it is

possible for the forward exchange rate to

fluctuate within a band of rates without

presenting arbitrage opportunities.Only

when the market forward exchange rate

diverges from this band of rates

arbitrage exists.

Given are: Bid and Ask domestic and

foreign spot rates; forward rates

and interest rates.

74

NO ARBITRAGE: CASH - AND - CARRY

TIME

CASH

FUTURES

t

(1) BORROW DC. rD,ASK

(4) SHORT FOREIGN CURRENCY FORWARD

(2) BUY FOREIGN CURRENCY

DC/SASK(DC/FC)

(3) INVEST IN BONDS

DENOMINATED IN THE

FOREIGN CURRENCY rF,BID

T

REDEEM THE BONDS

EARN:

DC/SASK (DC/FC)e

rF,BID (T-t)

DELIVER THE CURRENCY TO CLOSE THE SHORT POSITION

r

DC/SASK (DC/FC)e F,BID

PAY BACK THE LOAN

DCe

FBID (DC/FC)

(T-t)

RECEIVE:

rD,ASK (T-t)

FBID (DC/FC)DC/ S(DC/FC)e rFOR (T-t)

IN THE ABSENCE OF ARBITRAGE:

DCe

rD,ASK (Tt)

FBID (DC/FC)A/S ASK (DC/FC)e

FBID (DC/FC) SASK (DC/FC)e

rF,BID (T-t)

(rD,ASK - rF,BID )(T-t)

75

NO ARBITRAGE:

REVERSE CASH - AND - CARRY

TIME

CASH

FUTURES

t

(1) BORROW FC .

rF,ASK

(4) LONG FOREIGN CURRENCY FORWARD FOR

FASK(DC/FC)

(2) EXCHANGE FOR

FCSBID (DC/FC)e

FCSBID (DC/FC)

(3) INVEST IN T-BILLS

rD,BID (T -t)

FOR rD,BID

T

REDEEM THE T-BILLS EARN

FCSBID (DC/FC)e

PAY BACK THE LOAN

TAKE DELIVERY TO CLOSE THE LONG POSITION

rD,BID (T -t) RECEIVE in foreign currency, the amount:

r

rF,ASK (T-t)

FCe

FCSBID (DC/FC)e D,BID

FASK (DC/FC)

IN THE ABSENCE OF ARBITRAGE:

r

D,BID

rF,ASK (T-t) FCSBID (DC/FC)e

FCe

FASK (DC/FC)

FASK (DC/FC) SBID (DC/FC)e

( T -t)

( T - t)

(rD,BID rF,ASK )( T-t)

76

From Cash and Carry:

(1)

FBID (DC/FC) SASK (DC/FC)e

(rD,ASK - rF,BID )(T-t)

From reverse cash and Carry

(2)

FASK (DC/FC) SBID (DC/FC)e

(rD,BID rF,ASK )( T-t)

(3) And FASK(DC/FC) > FBID(DC/FC)

Notice that:

RHS(1) > RHS(2)

Define: RHS(1) BU

RHS(2) BL

77

F($/D)

FASK

BU

FASK(DC/FC) > FBID(DC/FC).

BU

FBID (DC/FC) BU

FASK (DC/FC) BL

BL

BL

FBID

Arbitrage exists only if both ask and bid

futures prices are above BU,

or both are below BL.

78

A numerical example:

Given the following exchange rates:

Spot

S(USD/NZ)

Forward

F(USD/NZ)

Interest rates

r(NZ)

r(US)

ASK

0.4438

0.4480

6.000% 10.8125%

BID

0.4428

0.4450

5.875% 10.6875%

Clearly, F(ask) > F(bid).

(USD0.4480NZ > USD0.4450/NZ)

We will now check whether or not there exists an opportunity

for arbitrage profits. This will require comparing these

forward exchange rates to: BU and BL

79

Inequality (1):

FBID (USD/NZ)

SASK (USD/NZ)e

(rUS,ASK - rNZ,BID )(T - t)

0.4450 < (0.4438)e(0.108125 – 0.05875)/12 = 0.4456 = BU

Inequality (2):

FASK (USD/NZ) SBID (USD/NZ)e

(rUS,BID rNZ,ASK )( T- t)

0.4480 > (0.4428)e(0.106875 – 0.06000)/12 = 0.4445 = BL

No arbitrage.

Lets see the graph

80

F

FASK = 0.4480

0.4456

BU

FBID = 0.4450

BL

FBID (USD/NZ) 0.4456 BU

Clearly: FASK($/FC) > FBID($/FC).

0.4445

FASK (USD/NZ) 0.4445 BL

An example of arbitrage:

FASK = 0.4480

FBID = 0.4465

81

Currency options

Units

USD/AUD

50,000AUD

USD/GBP

31,250GBP

USD/CAD

50,000CAD

USD/EUR

62,500EUR

USD/JPY

6,250,000JPY

USD/CHF

62,500CHF

Exercise Style: American- or European

options available for physically settled

contracts; Long-term options are

82

European-style only.

Expiration/Last Trading Day

The PHLX offers a variety of expirations in

its physically settled currency options contracts,

including Mid-month, Month-end and Long-term

expirations. Expiration, which is also the last day

of trading, occurs on both a quarterly and

consecutive monthly cycle. That is, currency

options are available for trading with fixed

quarterly months of March, June, September and

December and two additional near-term months.

For example, after December expiration, trading

is available in options which expire in January,

February, March, June, September, and

December. Month-end option expirations are

available in the three nearest months.

83

With the Canadian dollar spot price currently

at a level of USD.6556/CAD, strike prices

Standardized

would be listed

in half-cent Options

intervals ranging

from 60 to 70. i.e., 60, 60.5, 61, …, 69, 69.5,

70. If the Canadian dollar spot rate should

move to say USD.7060/CAD, additional strikes

would be listed. E.G, 70, 70.5, 71, …, 75.

Exercise Prices

Exercise prices are expressed in terms of

U.S. cents per unit of foreign currency.

Thus, a call option on EUR with an

exercise price of 120 would give the

option buyer the right to buy Euros at 120

cents per EUR.

84

It is important that available exercise prices

relate closely to prevailing currency values.

Therefore, exercise prices are set at certain

intervals surrounding the current spot or

market price for a particular currency. When

significant price changes take place,

additional options with new exercise prices

are listed and commence trading.

Strike price intervals vary for the different

expiration time frames. They are narrower

for the near-term and wider for the longterm options.

85

Premium Quotation premiums for dollarbased options are quoted in U.S. cents

per unit of the underlying currency with

the exception of Japanese yen which are

quoted in hundredths of a cent.

Example:

A premium of 1.00 for a given EUR option

is one cent (USD.01) per EUR.

Since each option is for 62,500 EURs, the

total option premium would be

[62,500EUR][USD.01/EUR] = USD625.

86

FX Options As Insurance

Options on spot represent insurance

bought or written on the spot rate.

An individual with foreign currency to sell

can use put options on spot to establish a

floor price on the domestic currency value

of the foreign currency.

For example, a put on EUR with an exercise

price of USD1.180/EUR ensures that, if the

value of the EUR falls below

USD1.180/EUR, the EUR can be sold for

USD1.180/EUR.

87

If the put option costs USD.03/EUR, the

floor price can be roughly approximated as:

USD1.180/EUR - USD.O3/EUR =

USD1.15/EUR.

That is, if the PUT is used, the put holder

will be able to sell the EUR for the

USD1.180/EUR strike price, but in the

meantime, have paid a premium of

USD.03/EUR. Deducting the cost of the

premium leaves USD1.15/EUR as the floor

price established by the purchase of the

put. This calculation ignores fees and

88

interest rate adjustments.

Similarly, an individual who must buy

foreign currency at some point in the

future can use CALLS on spot to

establish a ceiling price on the domestic

currency amount that will have to be

paid to purchase the foreign exchange.

89

For example, a call on EUR with an exercise

price of USD1.23/EUR will ensure that, in

the event that the value of the EURO rises

above USD1.23/EUR, the call will be

exercised and the EUR bought for

USD1.23/EUR.

If the call costs USD.02/EUR, this ceiling

price can be approximated:

USD1.23/EUR + USD.02/EUR = USD1.25/EUR

or the strike price plus the premium.

90

Several real world considerations:

The calculations so far are only

approximate for essentially two reasons.

First, the exercise price and the premium

of the option on spot cannot be added

directly without an interest rate

adjustment. The premium will be paid

now, up front, but the exercise price (if

the option is eventually exercised) will

be paid later. The time difference

involved in the two payment amounts

implies that one of the two should be

adjusted by an interest rate factor.

91

Second, there may be brokerage or other

expenses associated with the purchase

of an option, and there may be an

additional fee if the option is exercised.

The following two examples illustrate

the insurance feature of FX options on

spot and show how to calculate floor and

ceiling values when some additional

transactions costs are included.

92

Example 1: An American importer will have a net

cash out flow of GBP250,000 in payment for

goods bought in Great Britain. The payment date

is not known with certainty, but should occur in

late November. On September 16 the importer

locks in a ceiling purchase for pounds by buying 8

PHLX calls [GBP250,000/GBP31,250 = 8] on the

pound, K = USD1.90/GBP and a December

expiration.

The call premium on September 16 is

USD.0220/GBP.

With a brokerage commission of USD4/call, the

total cost of the eight calls is:

8(GBP3l,250)(USD.0220/GBP) + 8(USD4)

93

= USD5,532.

Measured from today's viewpoint, the importer

has essentially assured that the purchased

exchange rate will not be greater than:

USD5,532/GBP250,000 + USD1.90/GBP

= USD.02213/GBP + USD1.90/GBP

=USD1.92213/GBP.

Notice here that the add factor USD.02213/GBP

is larger than the call premium of USD.0220/GBP

by USD.00013/GBP, which represents the dollar

brokerage cost per pound.

The number USD1.92213/GBP is the importer's

ceiling price. The importer is assured he will not

pay more than this, but he could pay less.

94

Case A. The spot rate on the November payment

date is USD1.86/GBP. The importer would not

exercise the call but would buy pounds spot at

the rate of USD1.86/GBP. The importer then

sell the eight calls for whatever market value

they had remaining. Assuming, a brokerage fee

of USD4 per contract for the sale, the options

would be sold as long as their remaining market

value was greater than USD4 per option. The

total cost will have turned out to be:

USD1.96/GBP+USD.02213/GBP

- (sale value of options- USD32)/GBP250,000.

95

If the resale value is not greater than

USD32, then the total cost per pound is

USD1.86 + USD.02213 = USD1.88213.

The USD.02213 that was the original cost

of the premium and brokerage fee turned

out in this case to be an unnecessary

expense.

96

Now, to be strictly correct, a further

adjustment to the calculation should be

made. Namely, the USD1.86 and

USD.02213 represent cash flows at two

different times. Thus, if R is the amount of

interest paid per dollar over the September

16 to November time period, the proper

calculation is the cost per pound:

USD1.86+USD.02213(l+R)

- (sale value of options-USD32)/250,000.

97

Case B. The spot rate on the November payment

date is USD1.95/GBP. The importer can either

exercise the calls or sell them for their market

value. Assume the importer sells them at a

current market value of USD.055 and pays USD32

total in brokerage commissions on the sale of

eight option contracts. The importer then buys

the pounds in the spot market for USD1.95/GBP.

The total cost is, before adding the premium and

commission costs paid in September:

(USD1.95/GBP)(GBP250,000) –

(USD.055/GBP))( GBP250,000) + 8(USD4)

= USD473,718.

This amount implies an exchange rate of:

USD473,718/GBP250,000 = USD1.89487/GBP.

98

Adding in the premium and

commission costs paid back in September,

the exchange rate is:

USD1.89487/GBP + USD.02213(l +R)/GBP.

If the importer chooses instead to exercise

the call, the calculations will be similar

except that the brokerage fee will be

replaced by an exercise fee.

This concludes Example 1.

99

Example 2

A Japanese company must

exchange USD50M into JPY and wishes to

lock in a minimum yen value. The USD50M,

is to be sold between July1 and December

31. Since the company will sell USD and

receive JPY, the company will buy a put

option on USD, with an exercise price

stated in terms of JPY.

The company buys an American put on

USD50M with a strike price of JPY130/USD

from a financial institution. The premium is

JPY4/USD. Clearly, this is an OTC

transaction.

100

The put was purchased directly from the

bank thus, there is no resale value to the

put. Assume there are no additional fees.

Then, the Japanese firm has established a

floor value for its USD, approximately at:

JPY130/USD - JPY4/USD = JPY126/USD.

Again, we can consider two scenarios, one

in which the yen falls in value to

JPY145/USD and the other in which the

yen rises in value to JPY115/USD.

101

Case A. The yen falls to JPY145/USD. In

this case the company will not exercise

the option to sell dollars for yen at

JPY13O/USD, since the company can do

better than this in the exchange market.

The company will have obtained a net

value of

JPY145/USD - JPY4/USD = JPY141/USD.

In total:

[JPY141/USD][USD50M] = JPY7.050B

102

Case B. The JPY rises to JPY115/USD. The

company will exercise the put and sell

each U.S. dollar for JPY130/USD. The

company will obtain, net,

JPY130/USD - JPY4/USD = JPY126/USD.

In total

[JPY126/USD][USD50M] = JPY6.3B

This is JPY11 better than would have

been available in the FX market and

reflects a case where the “insurance” paid

103

off. This concludes Example 2.

Writing Foreign Currency Options

General considerations. The writer of a foreign

currency option on spot or futures is in a different

position from the buyer of these options. The buyer

pays the premium up front and then can choose to

exercise the option or not. The buyer is not a source

of credit risk once the premium has been paid. The

writer is a source of credit risk, however, because the

writer has promised either to sell or to buy foreign

currency if the buyer exercises his option. The writer

could default on the promise to sell foreign currency if

the writer did not have sufficient foreign currency

available, or could default on the promise to buy

foreign currency if the writer did not have sufficient

domestic currency available.

104

If the option is written by a bank, this risk of default

may be small. But if the option is written by a

company, the bank may require the company to post

margin or other security as a hedge against default

risk. For exchange-traded options, as noted previously,

the relevant clearinghouse guarantees fulfillment of

both sides of the option contract. The clearinghouse

covers its own risk, however, by requiring- the writer of

an option to post margin. At the PHLX, for example,

the Options Clearing Corporation will allow a writer to

meet margin requirements by having the actual foreign

currency or U.S. dollars on deposit, by obtaining an

irrevocable letter of credit from a suitable bank, or by

posting cash margin.

105

If cash margin is posted, the required deposit is the

current market value of the option plus 4 percent of

the value of the underlying foreign currency. This

requirement is reduced by any amount the option is

out of the money, to a minimum requirement of the

premium plus .75 percent of the value of the

underlying foreign currency. These percentages can

be changed by the exchanges based on currency

volatility. Thus, as the market value of the option

changes, the margin requirement will change. So an

option writer faces daily cash flows associated with

changing margin requirements.

106

Other exchanges have similar requirements for

option writers. The CME allows margins to be

calculated on a net basis for accounts holding both

CME FX futures options and IMM FX futures. That

is, the amount of margin is based on one's total

futures and futures options portfolio. The risk of an

option writer at the CME is the risk of being

exercised and consequently the risk of acquiring a

short position (for call writers) or a long position (for

put writers) in IMM futures. Hence the amount of

margin the writer is required to post is related to the

amount of margin required on an IMM FX futures

contract. The exact calculation of margins at the

CME relies on the concept of an option delta.

107

From the point of view of a company or individual,

writing options is a form of risk-exposure

management of importance equal to that of buying

options. It may make perfectly good sense for a

company to sell foreign currency insurance in the

form of writing FX calls or puts. The choice of strike

price on a written option reflects a straightforward

trade-off. FX call options with a lower strike price will

be more valuable than those with a higher strike

price. Hence the premiums the option writer will

receive are correspondingly larger. However, the

probability that the written calls will be exercised by

the buyer is also higher for calls with a lower strike

price than for those with a higher strike. Hence the

larger premiums received reflect greater risk taking

on the part of the insurance seller, ie., the option 108

writer.

Writing Foreign Currency Options:

a detailed example.

The following example illustrates the

risk/return trade-off for the case of an oil

company with an exchange rate risk, that

chooses to become an option writer.

109

Example 3 Iris Oil Inc., a Houston-based

energy company, has a large foreign

currency exposure in the form of a CAD

cash flow from its Canadian operations.

The exchange rate risk to Iris is that the

CAD may depreciate against the USD. In

this

case,

Iris’

CAD

revenues,

transferred to its USD account will

diminish and its total USD revenues will

fall. Iris chooses to reduce its long

position in CAD by writing CAD calls

with a USD strike price.

110

By writing the options, Iris receives an

immediate USD cash flow representing the

premiums. This cash flow will increase Iris'

total USD return in the event the CAD

depreciates against the USD or, remains

unchanged against the USD, or appreciates

only slightly against the USD.

Clearly, the calls might expire worthless or

they might be exercised. In either case,

however, Iris walks away with the full

amount of the options premiums:

111

1. If the USD value of the CAD remains

unchanged, the option premium

received is simply an additional profit.

2. If the value of the CAD falls, the

premium received on the written option

will offset part or all of the opportunity

loss on the underlying CAD position.

3. If the value of the CAD rises sharply, Iris

will only participate in this increased

value up to a ceiling level, where the

ceiling level is a function of the exercise

price of the written option.

112

In sum, the payoff to Iris' strategy will

depend both on exchange rate movements

and on the selection of the strike price of

the written calls.

To illustrate Iris' strategy, consider an

anticipated cash flow of CAD300M over the

next 180 days.

With hedge ratio of 1:1*, Iris sells

CAD300,000,000/CAD50,000

= 6,000 PHLX calls.

*every CAD option is for CAD50,000.

113

Assume: Iris writes 6,000 PHLX calls with

a 6-month expiration; the current spot

rate is S = USD.75/CAD and the 6-month

forward rate is:

F = USD.7447/CAD.

For the current level of spot rate, logical

strike price choices for the calls might be

K = USD.74, or USD.75, or USD.76 per

CAD, of course.

For the illustration, assume that Iris’

brokerage fee is USD4 per written call and

let the hypothetical market values of the

options be as follows:

114

c(K = USD.74/CAD) = USD.01379;

c(K = USD.75/CAD) = USD.00650;

c(K = USD.76/CAD) = USD.00313.

K

Value

One call

n

.74

USD689.5

6,000

Value

Total

Total

Fees:

Premium

USD4/call

USD4,137,000 USD24,000

.75

USD325.0

6,000

USD1,950,000

USD24,000

.76

USD156.5

6,000

USD939,000

USD24,000

115

We now introduce an additional cost that is

associated with the exercise fee, which

exists in the real markets.

If the calls are exercised, an additional OCC

fee of USD35/call is assumed.

In our example then, an exercise of the

calls requires a total OCC fee of:

USD35(6,000) = USD210,000

for the 6,000 written calls.

116

In six months Iris will receive a cash flow

of CAD300M. At that time, the total value of

the long CAD position of Iris, plus the short

calls position will depend on the strike

price chosen.

Let

S = the spot exchange rate at expiration.

The next three tables show the possible

values for Iris:

117

If K = USD.74/CAD

Strategy

Write 6,000,

.74 calls

Initial

Cash Flow

S< USD.74/CAD

S>USD.74/CAD

USD4,113,000

0

-(S-.74)CAD300M

-USD210,000

(S)CAD300M

(S)CAD300M

(S)CAD300M

USD221,780,000

(S)CAD300M

+USD4.113,000

USD225,903,000

CAD

Total

P/L

USD4,113,000

Cash flow at Expiration

118

If K = USD.75/CAD

Strategy

Write 6,000,

.75 calls

Initial

Cash Flow

S< USD.75/CAD

S>USD.75/CAD

USD1,926,000

0

-(S-.75)CAD300M

-USD210,000

(S)CAD300M

(S)CAD300M

(S)CAD300M

USD224,700,000

(S)CAD300M

+USD1.926,000

USD226,716,000

CAD

Total

P/L

USD1,926,000

Cash flow at Expiration

119

If K = USD.76/CAD

Strategy

Write 6,000,

.76 calls

Initial

Cash Flow

S< USD.76/CAD

S>USD.76/CAD

USD915,000

0

-(S-.76)CAD300M

-USD210,000

(S)CAD300M

(S)CAD300M

(S)CAD300M

USD227,790,000

(S)CAD300M

+USD915,000

USD228,705,000

CAD

Total

P/L

USD915,000

Cash flow at Expiration

120

A consolidation of the three profit profile

tables:

SPOT RATE

USD/CAD

STRIKE PRICE

USD.74/CAD

USD.75/CAD

USD.76/CAD

S<.74

S(CAD300M)

+

USD4,113,000

S(CAD300M)

+

USD1,926,000

S(CAD300M)

+

USD915,000

.74<S<.75

USD225,903,000

S(CAD300M)

+

USD1,926,000

S(CAD300M)

+

USD915,000

.75<S<.76

USD225,903,000

USD226,716,000

S(CAD300M)

+

USD915,000

.76<S

USD225,903,000

USD226,716,000

USD228,705,000

121

As illustrated by the consolidated table and

the three separate profit profile tables, the

lower the strike price chosen, the better

the protection against a depreciating CAD.

On the other hand, a lower strike price

limits the corresponding profitability of the

strategy if the CAD happens to appreciate

against the USD in six months. The optimal

decision of which strategy to take is a

function of the spot exchange rate at

expiration.

122

One possible comparison of the three

results is to evaluate the options strategy

vis-à-vis the immediate forward exchange.

Recall that when Iris enters the options

strategy the forward exchange rate is

F = USD.7447/CAD.

Thus, Iris may exchange the CAD300M

Forward for USD223,410,000 a future

break-even Spot rate can be calculated for

Every corresponding exercise price chosen:

123

F =.7447.

Iris may exchange today, CAD300M

forward for:

CAD300,000,000(USD.7447/CAD)

= USD223,410,000.

IF: K =.74,

S(CAD300M) + 4,113,000 = USD223,410,000

SBE = USD.7310/CAD.

IF

K= .75,

S(CAD300M) + 1,926,000 = USD223,410,000

SBE = USD.7383/CAD.

IF

K= .76,

S(CAD300M) + 915,000 = USD223,410,000

SBE = USD.7416/CAD.

124

CONCLUSION

Writing the calls will protect Iris’ flow

in USD better than purchasing the CAD

forward if the spot rate in six months

will be above the corresponding

break- even exchange rates.

125

A second possible analysis of the optimal

decision depends on all possible values of

the spot exchange rate, given our

assumptions. Recall that the assumptions

are:

Iris maintains an open long position of

CAD300M un hedged. Alternatively, Iris

writes 6,000 PHLX calls with 180-day

expiration period. Possible strike prices

are USD.76/CAD, USD.75/CAD,

USD.74/CAD. Current spot and forward

exchange rates are USD.75/CAD and

USD.7447/CAD, respectively.

126

The terminal spot rate is the market

exchange rate when the calls expire. It

is assumed that Iris pays a brokeragefee of USD4 per option contract and an

additional fee of USD35 per option to

the Options Clearing Corporation if the

options are exercised.

127

Optimal decision as a function of the

unknown terminal spot rate

Terminal Spot rate

Optimal Decision

S >.76235

Hold long

currency only

.75267 < S< .76235

.74477 < S< .75267

S < .74477

Write options

with K = .76

Write options

with K = .75

Write options

with K = .74

128

Final comments on Example 3.

In the example, the OCC charges a USD35

per exercised call. Thus, it might be

cheaper for Iris to buy back the calls and

pay the brokerage fee of USD4 per call in

the event the options were in danger of

being exercised. In addition, it is assumed

that Iris will have the CAD300M on hand if

the options are exercised. This would not

be the case if actual Canadian dollar

revenues were less than anticipated.

129

In that event, the options would need to

be repurchased prior to expiration.

Each of the three choices of strike price

will have a different payoff, depending on

the movement in the exchange rate. But

Iris' expectation regarding the exchange

rate is not the only relevant criterion for

choosing a risk-management strategy.

The possible variation in the underlying

position should also be considered.

130

Here are the maximal and minimal

payoffs for each of the call-writing

choices, compared to the un hedged

position and a forward market hedge:

131

Strategy Max Value

Unhedged

Long

Position Unlimited

Short

Min Value

Zero.

Forward

USD223,410,000

USD223,410,000

.76 call

USD228,705,000

Unhedged min

+ USD915,000.

.75 call

USD226,716,000

Unhedged min

+ USD1,926,000.

.74 call

USD225,903,000

Unhedged min

+ USD4,113,000.

132

Futures options

A FORWARD

IS A CONTRACT IN WHICH ONE PARTY COMMITS

TO BUY AND THE OTHER PARTY COMMITS TO

SELL A PRESPECIFIED AMOUNT OF AN AGREED

UPON COMMODITY FOR A PREDETERMINED

PRICE ON A SPECIFIC DATE IN THE FUTURE.

133

Buy or sell

a forward

t

Delivery

and

payment

T

Time

BUY means OPEN A LONG POSITION

SELL means OPEN A SHORT POSITION

134

EXAMPLE:

GBP

18.5.99

SPOT

USD1,6850/GBP

30 days forward

USD1,7245/GBP

60 days forward

USD1,7455/GBP

90 days forward

USD1,7978/GBP

180 days forward

USD1,8455/GBP

The existence of forward exchange rates

implies that there is a demand and supply

for the GBP for future dates.

135

Profit from a

Long Forward Position

P/L

F

Price of Underlying

at Maturity, ST

136

Profit from a

Short Forward Position

P/L

F

Price of Underlying

at Maturity, ST

137

Futures Contracts

• Agreement to buy or sell an asset

for a certain price at a certain time

• Similar to forward contract

• Whereas a forward contract is

traded OTC, futures contracts are

traded on organized exchanges

138

A FUTURES

Is a STANDARDIZED FORWARD

traded on an organized exchange.

STANDARDIZATION

THE COMMODITY,

TYPE AND QUALITY,

THE QUANTITY ,

PRICE QUOTES,

DELIVERY DATES and PROCEDURES,

MARGIN ACCOUNTS,

The MARKING TO MARKET process.

139

NYMEX.

Light, Sweet Crude Oil

Trading Unit

Futures: 1,000 U.S. barrels (42,000 gallons).

Options: One NYMEX Division light, sweet crude oil futures contract.

Price Quotation

Futures and Options: Dollars and cents per barrel.

Trading Hours

Futures and Options: Open outcry trading is conducted from 10:00 A.M.

until 2:30 P.M.

After hours futures trading is conducted via the NYMEX ACCESS®

internet-based trading platform beginning at 3:15 P.M. on Mondays

through Thursdays and concluding at 9:30 A.M. the following day. On

Sundays, the session begins at 7:00 P.M. All times are New York time.

Trading Months

Futures: 30 consecutive months plus long-dated futures initially listed 36,

48, 60, 72, and 84 months prior to delivery.

Additionally, trading can be executed at an average differential to the

previous day's settlement prices for periods of two to 30 consecutive

months in a single transaction. These calendar strips are executed during

open outcry trading hours.

Options: 12 consecutive months, plus three long-dated options at 18, 24,

and 36 months out on a June/December cycle.

140

Minimum Price Fluctuation

Futures and Options: $0.01 (1¢) per barrel ($10.00 per contract).

Maximum Daily Price Fluctuation

Futures: Initial limits of $3.00 per barrel are in place in all but the first

two months and rise to $6.00 per barrel if the previous day's

settlement price in any back month is at the $3.00 limit. In the event of

a $7.50 per barrel move in either of the first two contract months,

limits on all months become $7.50 per barrel from the limit in place in

the direction of the move following a one-hour trading halt.

Options: No price limits.

Last Trading Day

Futures: Trading terminates at the close of business on the third

business day prior to the 25th calendar day of the month preceding the

delivery month. If the 25th calendar day of the month is a nonbusiness day, trading shall cease on the third business day prior to the

last business day preceding the 25th calendar day.

Options: Trading ends three business days before the underlying

futures contract.

141

Exercise of Options

By a clearing member to the Exchange clearinghouse not later than 5:30

P.M., or 45 minutes after the underlying futures settlement price is

posted, whichever is later, on any day up to and including the option's

expiration.

Options Strike Prices

Twenty strike prices in increments of $0.50 (50¢) per barrel above and

below the at-the-money strike price, and the next ten strike prices in

increments of $2.50 above the highest and below the lowest existing

strike prices for a total of at least 61 strike prices. The at-the-money

strike price is nearest to the previous day's close of the underlying

futures contract. Strike price boundaries are adjusted according to

the futures price movements.

Delivery

F.O.B. seller's facility, Cushing, Oklahoma, at any pipeline or storage

facility with pipeline access to TEPPCO, Cushing storage, or Equilon

Pipeline Co., by in-tank transfer, in-line transfer, book-out, or inter-facility

transfer (pumpover).

142

Delivery Period

All deliveries are rateable over the course of the month and must be

initiated on or after the first calendar day and completed by the last

calendar day of the delivery month.

Alternate Delivery Procedure (ADP)

An alternate delivery procedure is available to buyers and sellers who

have been matched by the Exchange subsequent to the termination of

trading in the spot month contract. If buyer and seller agree to

consummate delivery under terms different from those prescribed in

the contract specifications, they may proceed on that basis after

submitting a notice of their intention to the Exchange.

Exchange of Futures for, or in Connection with, Physicals (EFP)

The commercial buyer or seller may exchange a futures position for a

physical position of equal quantity by submitting a notice to the

exchange. EFPs may be used to either initiate or liquidate a futures

position.

143

Deliverable Grades

Specific domestic crudes with 0.42% sulfur by weight or less, not less

than 37° API gravity nor more than 42° API gravity. The following

domestic crude streams are deliverable: West Texas Intermediate, Low

Sweet Mix, New Mexican Sweet, North Texas Sweet, Oklahoma Sweet,

South Texas Sweet.

Specific foreign crudes of not less than 34° API nor more than 42° API.

The following foreign streams are deliverable: U.K. Brent and Forties,

and Norwegian Oseberg Blend, for which the seller shall receive a 30¢per-barrel discount below the final settlement price; Nigerian Bonny

Light and Colombian Cusiana are delivered at 15¢ premiums; and

Nigerian Qua Iboe is delivered at a 5¢ premium.

Inspection

Inspection shall be conducted in accordance with pipeline practices. A

buyer or seller may appoint an inspector to inspect the quality of oil

delivered. However, the buyer or seller who requests the inspection will

bear its costs and will notify the other party of the transaction that the

inspection will occur.

144

Position Accountability Limits

Any one month/all months: 20,000 net futures, but not to exceed

1,000 in the last three days of trading in the spot month.

Margin Requirements

Margins are required for open futures or short options positions. The

margin requirement for an options purchaser will never exceed the

premium.

Trading Symbols

Futures: CL

Options: LO

145

NYMEX Copper Futures

Trading Unit

25,000 pounds.

Price Quotation

Cents per pound. For example, 75.80¢ per pound.

Trading Hours

Open outcry trading is conducted from 8:10 A.M. until

1:00 P.M. After-hours futures trading is conducted via the

NYMEX ACCESS®

Trading Months

Trading is conducted for delivery during the current

calendar month and the next 23 consecutive calendar

months.

Minimum Price

Fluctuation

Price changes are registered in multiples of five one

hundredths of one cent ($0.0005, or 0.05¢) per pound,

equal to $12.50 per contract. A fluctuation of one cent

($0.01 or 1¢) is equal to $250.00 per contract.

146

Maximum Daily

Price Fluctuation

Initial price limit, based upon the preceding day's

settlement price is $0.20 (20¢) per pound. Two

minutes after either of the two most active months trades

at the limit, trading in all months of futures and

options will cease for a 15-minute period. Trading

will also cease if either of the two active months is bid at

the upper limit or offered at the lower limit for two

minutes without trading. Trading will not cease if the

limit is reached during the final 20 minutes of a day's

trading. If the limit is reached during the final half hour

of trading, trading will resume no later than 10 minutes

before the normal closing time. When trading resumes

after a cessation of trading, the price limits will be

expanded by increments of 100%.

Last Trading Day

Trading terminates at the close of business on the third to

last business day of the maturing delivery month.

147

Delivery

Copper may be delivered against the highgrade copper contract only from a warehouse

in the United States licensed or designated by

the Exchange. Delivery must be made upon a

domestic basis; import duties or import taxes, if

any, must be paid by the seller, and shall be

made without any allowance for freight.

Delivery Period The first delivery day is the first business day

of the delivery month; the last delivery day is

the last business day of the delivery month.

Margin Requirements Margins are required for open futures and

short options positions. The margin

requirement for an options purchaser

will never exceed the premium paid.

148

CBOT Corn Futures

Trading Unit

5,000 bushels

Tick Size

¼ cent per bushel ($12.50 per contract)

Daily Price Limit

12 cents per bushel ($600 per contract)

above or below the previous day’s

settlement price (expandable to 18

cents per bushel). No limit in the spot

month.

December, March, May, July,

September

Contract Months

Trading Hours

Last Trading Day

Deliverable Grades

9:30 a.m. to 1:15 p.m. (Chicago time),

Monday through Friday. Trading in

expiring contracts closes at noon on

the last trading day.

Seventh business day preceding the

last business day of the delivery

month.

No. 2 Yellow at par and substitution at

149

differentials established by the

exchange.

MARGIN ACCOUNTS

A MARGIN is an amount of money that

must be deposited in a margin account in

order to open any futures position, long or

short. It is a “good will” deposit. The

clearinghouse maintains a system of

margin requirements from all traders,

brokers and futures commercial merchants.

150

MARGIN ACCOUNTS.

There are two types of margins:

The initial margin: The amount that every

trader must deposit with the broker upon

opening a futures account; short or long.

The initial deposit is the investor EQUITY.

This equity changes on a daily basis

because:

all profits and losses

must be realized by the end of

every trading day.

151

MARGIN ACCOUNTS.

The maintenance (variable) margin:

This is a minimum level of the trader’s

equity in the margin account.

If the trader’s equity falls below this level,

the trader will receive a margin call

requiring the trader to deposit more funds

and bring the account to its initial level.

Otherwise, the account will be closed.

152

Most of the time, Initial margins are

between 2% to 10% of the position value.

Maintenance (variable) margin is usually

around 70 - 80% of the initial margin.

Example: a position of 10 CBT treasury

bonds futures ($100,000 face value each)

at a price of $75,000 each.

The initial margin deposit of 5% of

$750,000 is: $37,500.

If the variable margin is 75% Margin call

if the amount in the margin account falls to

153

$26,250.

Example of a Futures Trade

On JUN 5 an investor takes a long position

in 2 NYMEX DEC gold futures.

contract size is 100 oz.

futures price is USD590/oz

margin requirement is 5%.

USD2,950/contract or USD5,900 total.

Maintenance margin is 75%.

USD2,212.5/contract or USD4,425

Total.

154

Daily equity changes in the margin account:

MARKING TO MARKET

Every day, upon the market close, all

profits and losses for that day must be

realized. I.e.,

SETTLED.

The benchmark prices for this process are:

SETTLEMENT PRICES

155

A SETTLEMENT PRICE IS

the average price of trades during the last

several minutes of the trading day.

Every day, when the markets close,

SETTLEMENT PRICES

for the futures of all products and for all

months of delivery are set. They are then

compared with the previous day settlement

prices and to the trading prices on that day

and the difference must be settled

156

overnight

Open a long position in 10 JUNE crude oil futures for:

$58.50/bbl.VALUE: (10)(1,000)($58.50) = $585,000

INITIAL MARGIN

= (.03)($585,000) = $17,550;

VAR. MARGIN = 80%

SETTLE

PRICE

VALUE

DAY 0

$58.60

$586,000 + 1,000

DAY 1

$58.42

$584,200

DAY 2

$58.75

$587,500 + $3,300

DAY 3

$ 58.32

$ 58.08

$583,200

$580,800

DAY 4

MARKET-TOMARKET

MARGIN

BALANCE

$18,550

- $1,800 $16,750

$20,050

$4,300 $15,750

-$2400 $13,350

157

13,350/17,550 = .761 < .8

MARGIN CALL

SEND $4,200 TO MARGIN ACCOUNT

TO BRING IT UP TO $17,550

DAY 5

$58.27 $582,700 + $1,900

$19,450

158

Date

Settlement

price:Q

Mark-toMarket for

the long

92.23

Dollar

settlement

price = P

980,575

3

92.73

981,825

$1250

51,250

4

92.83

982,075

250

51,500

5

93.06

982,650

575

52,075

6

93.07

982,675

25

52,100

9

93.48

983,700

1025

53,125

10

93.18

982,850

-750

52,375

11

93.32

983,300

350

52,725

12

93.59

983,975

675

53,400

13

93.84

984,600

625

54,025

16

93.71

984,275

-325

53,700

93.25

983,126

-1150

52,550

93.12

982,800

June

2

17

18

Margin

Account **

50,000

-325

52,225

•$1M face value of 90-day T-bills. P = 1,000,000[1 - (1 – Q/100)(90/360)].

** Initial Margin is assumed to be 5% of contract fee.

159

Delivery

If a contract is not closed out before

maturity, it is usually settled by delivering

The assets underlying the contract. When

There are alternatives about what is

delivered, where it is delivered, and when it

is delivered, the party with the short

position chooses.

Few contracts are settled in cash.

For example, those on stock indices and

Eurodollars.

160

A futures markets statistic:

97-98% of all the futures for all delivery

months and for all underlying

commodities do not get to delivery!!

This means that:

1. Only 2-3% do reach delivery.

2. Most traders close their positions

before they get to delivery.

3. Most traders do not open futures

positions for business.

4. Most futures are traded for Risk

Management reasons,

161

Mechanics of Call Futures Options

The underlying asset is

A FUTURES.

This means that when you exercise a

futures option you become committed

to BUY or SELL the asset underlying the

futures, depending on whether you

have a call or a put.

162

Mechanics of Call Futures Options

When a call futures option is

exercised the holder acquires

1. A long position in the futures

2. A cash amount equal to the excess of

the most recent settlement futures

price, F(settle) over K.

The writer obtains short position in the

futures and the cash amount in his/her

margin account is adjusted opposite to

2. above.

163

The Payoff of a futures call exercise

If the futures position is closed out on

date j, which is immediately upon the call

exercise:

Payoff:

F(settle) – K + Fj,T – F(settle)

= Fj,T – K,

where Fj,T is futures price at time the

futures is closed.

164

Mechanics of Put Futures Option

When a put futures option is

exercised the holder acquires

1. A short position in the futures

2. A cash amount equal to the excess of

the put strike price, K, over the most

recent futures settlement price F(settle).

The put writer obtains a long futures

position and his/her margin account is

adjusted opposite to 2. above.

165

The Payoff of a futures put exercise

Payoff from put exercise:

K – F(settle) + F(settle) – Fj,T

= K – Fj,T

where Fj,T is futures price at time the

put is exercised and the futures is

closed.

166

Put-Call Parity for Futures

Options (p 329)

ct + Ke-r(T-t) = pt + Ft,Te-r(T-t)

167

Black’s Formula (P 333)

ct e

r(T -t)

pt e

d1

d2

F N(d ) KN(d )

KN(d ) F N(d )

t,T

r(T -t)

1

2

2

t,T

1

2

ln(F t,T /K) σ (T - t)/2

σ T-t

2

ln(F t,T /K) σ (T - t)/2

σ T-t

168