Things to Ponder *Strategically*

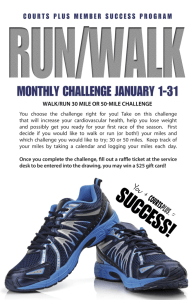

advertisement

G&T Update – Western Farmers Electric Cooperative OAEC MR/PR Fall Meeting (2015) 2 360 MW of Capacity via PPA 3 Regional Transmission Development Aggregate Study process being streamlined. Integrated Marketplace (IM) SPP since March 1, 2014 functionally controls the entire transmission footprint. SPP consolidated from 15 balancing authorities to one SPP balancing authority. Administers tools for efficient / open use of transmission and generation resources. WFEC receives an allocation of Auction Revenue Rights (ARR) based on its load and resources. ARR’s can be converted to Transmission Congestion Rights (TCRs) which provide a financial hedge for transmission congestion. March 1, 2014 the IM opened WFEC bids in sufficient capacity and energy to meet the next day load. SPP selects most efficient generation to meet the next day load + reserves for the entire region. SPP tells WFEC which of its units will generate for the next day and will pay WFEC for this energy. WFEC purchases from the IM all of its energy needs for the next day. SPP establishes an unsecured credit limit for each market participant. WFEC provides a letter of credit to participate in the ARR process. In coordination with WFEC staff and Board policies, ACES, acting as WFEC’s agent, interfaces with SPP and performs the daily activities to meet WFEC energy needs. 4 Current Footprint 370,000 square miles of territory More than 15 million people 627 generating plants 4,103 substations 48,537 miles transmission: ⁻ 69 kV – 12,569 miles ⁻115 kV – 10,239 miles ⁻138 kV – 9,691 miles ⁻161 kV – 5,049 miles ⁻230 kV – 3,889 miles ⁻345 kV – 7,401 miles ⁻500 kV – 93 miles 5 FERC 1000 The Clean Power Plan Capital Credits XYZ Committee Month, Day, Year 6 Impacts rates Unbundling Impacts retail rates Impacts LM Programs Billing Determinates C&I Consumers Drives renewables Creates new competitors 7 Bundled Demand Unbundled - proposed $8.20/kW Generation Energy winter $5.85/kW based on 3yr 3cp avg. $0.00336 shoulder $0.00486 Transmission $3.30/kW Distribution $1.55/kW summer $0.00636 based on 12 month CP avg. Fuel $0.034 Energy $0.00541 Surcharge $0.0018 Fuel $0.03053 Proposed implementation – January 2017 8 2014 (MW) So Far 2015 (MW) August 22 1511 August 7 1599 July 26 1500 August 8 1573 August 23 1495 July 24 Our dilemma … Winter Peak of 2015 1684 MW 1531 Summer Peak of 2015 1599 MW (with 100 MW LM) On the horizon … SPP has expressed their desire for our cost to be driven off of our CP with SPP peak rather than our own peak. 9 Transition continues Large portion have contract expiration Dec. 2016 ~200MW of ~325MW - ~60% All will be transitioned by the end of 2017 Average increase to the C&I consumer … 7.5% 10 Adding 20+ MW of Community Solar to the WFEC Portfolio 5 multiple MW stations totaling 18 MW 13 co-op participants in approximately 5 MW Why? To learn the ropes To deal with the “Clean Power Plan” Adds diversity to our portfolio & some capacity To deal with new competitors that pose a threat! 11 WFEC increasing their incentives for GEO in 2016 Why – Everybody Wins WFEC increasing Tier II rebate $200/T for Q4 2015 WFEC $650/T + Co-op $225 = $875/T New approach to Energy Efficiency Strategic Relationships providing measured results Geo Energy Services Energy Pioneer Solutions LED USA 12 XYZ Committee Month, Day, Year 13