Chapter 13 * Financial Investments

advertisement

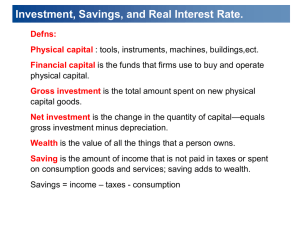

Activator Chapter 26 1. 2. What would be the disadvantage of putting your savings under your mattress? List some places that you could invest your money that might cause it to gain interest/grow. Interest Rates Interest Rates – cost of credit for borrowers, gains incurred from lending Low interest rates Good for borrowers - people buying a house, car, starting a business, etc. Interest sensitive investments Bad for savers – low interest rates amounts to low returns on investments People hoping to earn interest on saved money High interest rates Bad for borrowers – cost of credit increases, making interest saving investments less desirable Good for savers – high interest rates amount to high returns on investment Calculators http://cgi.money.cnn.com/tools/mortgagecalc/ http://www.moneychimp.com/calculator/compound_inter est_calculator.htm Chapter 26 – Saving, Investment, and the Financial System Financial System – group of institutions that turn savings into investments Financial Markets – institutions through which savers can directly provide funds to borrowers. Saving, Investment, and the Financial System Saving – the absence of spending; income not spent, or deferred consumption Bank, IRA, stocks, bonds, 401K, pension, annuity, etc. Savings – dollars that become available to borrowers/investors Loanable Funds - a hypothetical market that brings savers and borrowers together. Brings together the money available in commercial banks and lending institutions for firms and households to finance expenditures, either investments or consumption Savers supply, borrowers demand Financial Institutions in the U.S. Economy The Bond Market Bond – IOU, certificate of indebtedness that specifies the obligations of the borrower to the holder of the bond Corporate, municipal, U.S. Federal Debt finance – sale of bonds to raise money, which is a debt to the lender Principal – initial amount borrowed, $1000 Date of maturity – time at which the loan will be repaid, 10-2030 Term – length of time until the bond matures, 30 years Interest – rate at which the bond will be repaid, 6% Financial Institutions in the U.S. Economy The Bond Market Credit risk – the level of risk or loss by an investor arising from a borrower that potentially does not pay some interest or principal Junk bonds – bonds offered by shaky, high-risk corporations Default – failure to repay a borrowed loan Tax treatment – the way tax laws treat the interest earned on bonds The interest on most bonds is considered taxable income Municipal bonds – bonds offered by local or state government Federal bonds – bonds offered by the U.S. Government. U.S. treasury What is a bond video http://www.youtube.com/watch?v=svOsKnWlW-g Financial Institutions in the U.S. Economy The Stock Market Stock – partial ownership of a firm through the purchase of a share Claim to a portion of the profit the firm generates Disney, Microsoft, Toys ‘R’ Us, etc. Equity finance – sale of stocks to raise money; a right to portions of the profit of the company Financial Institutions in the U.S. Economy The Stock Market Difference between Stocks and Bonds: Owner of shares in a company are a part owner of the company Owner of bonds are a creditor of the company/institution Stockholders enjoy benefits of profits while bondholders receive interest on their bonds Bondholders are paid what they are due before stockholders if the company is in financial difficulty Stocks have a higher risk than bonds, but a potentially higher return What is a stock video http://www.youtube.com/watch?v=JrGp4ofULzQ Stock Exchanges Stock Exchanges – places where buyers and sellers meet to trade stocks Perfectly competitive market – identical products, prices are based solely on perception and speculation, supply and demand Primary Market - newly issued IPO will be considered a primary market trade when the shares are first purchased by investors directly Secondary market - also called aftermarket, is the financial market in which previously issued financial instruments such as stocks and bonds are bought and sold New York Stock Exchange (NYSE) - a stock exchange located at 11 Wall Street in lower Manhattan, New York City, USA. It is the world's largest stock exchange Stock Exchanges National Association of Securities Dealers Automated Quotation System (NASDAQ) - the largest electronic screen-based equity securities trading market in the United States Stock Index – computed average of a group of stock prices Dow Jones Industrial Average, Standard & Poor’s 500 Bidding system – brokers bid up the price of a share of stock through demand for shares Price of shares based on the following: Supply and Demand Perception of the company’s profitability Profits and losses Financial Intermediaries Financial Intermediaries – entity that channel funds from people who have extra money (savers) to those who do not have enough money to carry out a desired activity (borrowers). Banks – takes deposits from savers and loan to borrowers Mutual Funds – sell shares, pools money from investors into a portfolio of investments (stocks, bonds, commodities, etc.) Saving & Investment in National Income Accounts Gross domestic product (GDP) Total income = Total expenditure Y = C + I + G + NX Y= gross domestic product GDP C = consumption I = investment G = government NX = net exports Consumption Investment Government Net Exports Saving & Investment in National Income Accounts Closed economy – one that does not interact with other economies NX = 0 Y = C + I + G Saving & Investment in National Income Accounts National saving (saving), S – total income in the economy that remains after paying for consumption and government purchases Saving & Investment in National Income Accounts Private saving –income that households have left after paying for taxes and consumption Public saving – tax revenue that the government has left after paying for its spending Saving & Investment in National Income Accounts Budget surplus – income in excess of tax revenue over government spending; occurs when the government takes in more than it spends T–G>0 Budget deficit – shortfall of tax revenue from government spending; occurs when the government spends more than it takes in T–G<0 Crowding out - occurring when government borrowing to fund a deficit causes interest rates to rise, thereby reducing investment spending. Increase in government spending crowds out investment spending. Budget Deficit Budget Deficits and the National Debt Supply and Demand The Market for Loanable Funds Market for loanable funds – market for those who supply the funds and those who borrow to invest Loanable funds – all income people have chosen to save and lend out rather than use for consumption Assumes a closed economy and only one market for loanable funds Market for loanable funds is governed by supply and demand Source of the supply of loanable funds is savings (CIG) Source of the demand for loanable funds is spending (CIG) Price of a loan = real interest rate Borrowers pay for a loan Lenders receive a return on their saving The Market for Loanable Funds Supply and demand of loanable funds Demand curve – slopes downward As interest rate rises quantity demanded declines Supply curve - slopes upward As interest rate rises quantity supplied increases supply curve The Market for Loanable Funds Shifts in the Demand Curve (buyers demand for money) Not a result of interest rates! Spending Incentives/Disincentives: Consumption Tax credits where government gives consumers more incentive to purchase (increase demand) 2. Investment Government gives tax credits to firms (increase demand) 3. Government deficits Government lacks funds (increase demand/decrease supply) 1. The Market for Loanable Funds Supply Curve (savers supply money) Not a result of interest rates! Saving Incentives/Disincentives: 1. Consumption People become more thrifty A recession causes people to spend less and save more Laws that encourage saving Reduced taxes on financial investments (income) 2. Government deficits Government lacks the funds to pay the budget The Loanable Funds Model Real Interest Rate Supply (S) ir Demand (D) Qlf 0 Loanable Funds •The interest rate in the economy adjusts to balance the supply and demand for loanable funds. •The supply of loanable funds comes from national saving, including both private saving and public saving. •The demand for loanable funds comes from firms, households and government that want to borrow. •The equilibrium interest rate is labeled ir, and quantity of loanable funds are supplied and demanded qlf. Daily Assignment – Loanable Funds Graphing Using a properly labeled graph, illustrate each of the following scenarios: 1. Suppose the economy is in a recession and the demand for loanable funds decreases. 2. Suppose the economy is in a recession and the government injects funds into the market. 3. Suppose the government implements a tax credit for consumers in the housing market which stimulates demand. 4. Suppose the government runs a budget deficit and increases their reliance on loanable funds (closed economy). The Loanable Funds Model Interest Rate S ir1 ir2 D2 0 1. Q2 Q1 D1 Loanable Funds Suppose the economy is in a recession and the demand for loanable funds decreases. The Loanable Funds Model Interest Rate S1 S2 ir1 ir2 D1 0 2. Q1 Q2 Loanable Funds Suppose the economy is in a recession and the government injects funds into the market. The Loanable Funds Model Interest Rate S ir2 ir1 D1 0 3. Q1 Q2 D2 Loanable Funds Suppose the government implements a tax credit for consumers in the housing market which stimulates demand. The Loanable Funds Model Interest Rate S2 S1 ir2 ir1 D1 0 4. Q2 Q1 Loanable Funds Suppose the government runs a budget deficit and increases their reliance on loanable funds (closed economy). The Loanable Funds Model Interest Rate S ir2 ir1 D1 0 4. Q1 D2 Loanable Funds Suppose the government runs a budget deficit and increases their reliance on loanable funds (closed economy). Chapter 26 Homework, pgs. 586 - 593 Answer the following questions based on the reading: 1. How do American families compare to other countries when it comes to saving? 2. What principles of economics relate to Americans' saving habits. 3. How does the U.S. federal government discourage saving? 4. Describe the example provided in the book regarding a 25 year old investing in a bond. 5. What example is provided as a way to improve saving in the U.S.? 6. What curve would this policy affect; Which way would the curve shift? 7. How would this affect both the quantity of loanable funds and the interest rates? 8. What does an investment tax credit refer to? 9. Which curve would it affect; which way would it shift? 10. How would an investment tax credit affect the interest rate and the loanable funds? 11. How does a budget deficit affect the supply for loanable funds; which way does the curve shift? 12. What does crowding out refer to? 13. Why does increased borrowing by the government shift the supply curve and not the demand curve? 14. Describe what a declining debt-GDP ratio , and a rising debt-GDP ratio indicates as it relates to indebtedness. 15. How does war affect the debt to GDP ratio? 16. Describe the two reasons that debt financing is an appropriate policy. 17. How was government debt affected as a result of the Ronald Reagan administration? 18. What was a primary goal of the Clinton administration? Chapter 26 Homework, pgs. 586 - 593 Answer the following questions based on the reading: 1. How do American families compare to other countries when it comes to saving? 2. What principles of economics relate to Americans' saving habits. 3. How does the U.S. federal government discourage saving? 4. Describe the example provided in the book regarding a 25 year old investing in a bond. 5. What example is provided as a way to improve saving in the U.S.? 6. What curve would this policy affect; Which way would the curve shift? 7. How would this affect both the quantity of loanable funds and the interest rates? 8. What does an investment tax credit refer to? 9. Which curve would it affect; which way would it shift? 10. How would an investment tax credit affect the interest rate and the loanable funds? 11. How does a budget deficit affect the supply for loanable funds; which way does the curve shift? 12. What does crowding out refer to? 13. Why does increased borrowing by the government shift the supply curve and not the demand curve? 14. Describe what a declining debt-GDP ratio , and a rising debt-GDP ratio indicates as it relates to indebtedness. 15. How does war affect the debt to GDP ratio? 16. Describe the two reasons that debt financing is an appropriate policy. 17. How was government debt affected as a result of the Ronald Reagan administration? 18. What was a primary goal of the Clinton administration? 1. Am. Families save a smaller fraction of their incomes than other countries. 2. Standard of living depends on its ability to produce. People respond to incentives. 3. Taxes placed upon interest and dividends. 4. 30 year $1000 bond at 9% interest = $13268. Taxes of 33%, real interest rate = 6%. Growth of only $5,743. 5. Expand eligibility for IRAs, which shelter taxes. 6. Supply curve, shift to the right. 7. Increase the quantity of loanable funds, dropping the interest rate. 8. Tax advantage to any firm that builds a new factory or buys a new piece of equipment. 9. Demand curve, shift to the right. 10. Interest rates would increase and increase the quantity supplied of loanable funds. 11. Reduces the amount of loanable funds because the government reduces its supply of loanable funds. Shifts the supply curve to the left. 12. A decrease in investment that results from government borrowing and budget deficits. 13. Budget deficit reduces supply of loanable funds, thus affecting the supply not demand of loanable funds. 14. Declining debt-GDP ratio indicates government indebtedness is shrinking relative to its ability to raise tax revenue. Rising debtGDP ratio, government indebtedness is increasing relative to its ability to raise tax revenue. 15. Government spending increases and budget deficit increases, increasing debt to GDP ratio 16. Allows the government to keep stable tax policy. Shifts part of the burden to future generations. 17. Smaller government and lower taxes, but increased budget deficits and borrowing. 18. Clinton balanced the budget and eventually ran a budget surplus. Review Questions – Chapter 26 1. Draw a properly labeled loanable funds market model. Interest Rate Supply (Slf) ir Demand (Dlf) 0 Qlf Quantity of Loanable Funds 2. a. Supply curve represents the supply of loanable funds in the marketplace. b. Demand represents the demand for loanable funds in the marketplace. 3. Interest rates go up suppliers want to provide more loans. Interest rates go down, investors will have an incentive to borrow. Vice versa. 4. Using a correctly labeled graph of the loanable funds market, show how a decision to increase saving for retirement will affect the real market interest rate in the short run. Explain your answer in words and a graph. Word Explanation – If the supply of loanable funds increases, this will drive down the real interest rate in the market for loanable funds. 5. a. Long term, because it is more likely that you may need to sell the long-term bond at a depressed price prior to maturity. b. Yes, the credit risk has increased and lenders would demand a higher rate of return. c. Owners of shares demand a higher rate of return because it is riskier. d. It is safer to put money in an investment fund because it is diversified (not all of your eggs are in one basket). 6. a. b. c. d. (6,000 – 1,000 – 4,000) + (1,000 – 1,200) = 800 billion 6,000 – 1,000 – 4,000 = 1,000 billion 1,000 – 1,200 = –200 billion It is harming growth because public saving is negative so less is available for investment. 7. a. Equilibrium real interest rate = 4%, equilibrium S and I = 1000 billion. b. At 2 per cent interest, the quantity demanded of loanable funds exceeds the quantity supplied by 900 billion. This excess demand for loans (borrowing) will drive interest rates up to 4 per cent. 8. Equilibrium real interest rate = 5%, equilibrium S and I = 800 billion. 9. Equilibrium real interest rate = 5%, equilibrium S and I = 1200 billion. 10. An investment tax credit, because it shifts the demand for loanable funds to invest in capital to the right, raising the level of investment in capital and stimulating growth. http://articles.latimes.com/2010/sep/07/nation/la-na-obama-economy-20100907 http://marriage.about.com/od/finances/a/marriagepenalty.htm 2005 AP Macroeconomics Free-Response Questions Binder Check Due Today Chapter 25 1. Chapter 25 Mankiw Practice Review 2. North Korea Video 3. Notes 4. Terms Chapter 26 1. Free Response 2. Ch. 26 Mankiw Practice Review 3. Notes 4. Daily Tens 5. Terms Extra Credit 1. How does a high interest rate affect savers and borrowers? 2. How does a low interest rate affect savers and borrowers? 52 Rules of the game: •Monopolies occur when a player acquires all of one property color or all of the utilities 1. Once a player has declared their monopoly to the government, a monopoly can charge any price they wish for their properties (price discrimination may occur). 2. The government (Coach L) must be notified of any monopoly. 3. Other members of the market (other players) can voice complaints to the government regarding unfair price increases or inconsistent monopoly practices. 4. Responses to complaints can include fines, restrictions on ability to operate for certain amounts of time (ie: monopolies can only occur for two turns around the board), price ceilings or in extreme cases, jailings or breaking up of monopolies. •Oligopolies can form when a group of two or more players have all the properties of one color between them. 1. As an oligopoly you can charge any price you wish for your properties; you ALL must agree on the price. 2. Once you set the price, you may not change it until two rounds have passed. •Loanable Funds Market: 1. You must determine a way to incorporate the principles of the loanable funds into your market. 2. Example: 1. The center of the board acts as the loanable funds market. 2. Each round you must alternate as a saver and a borrow. 3. Government policies state that you can save 10% of your gross income; you can borrow up to 30% of your income (saved money can be collected 3 rounds after it is saved, borrowed money must be repaid + interest after 4 rounds from the time borrowed). 4. After each player has completed a round, the interest rate will be set based up on the amount of loanable funds in the market (i.e. 200 – 10%, 300 – 8%, 500 – 5%, 1000 – 2%, etc. 5. One person should keep track of the loanable funds that are borrowed and saved each round and payouts to players (this money should come from the loanable funds market or the bank).