Presentation

advertisement

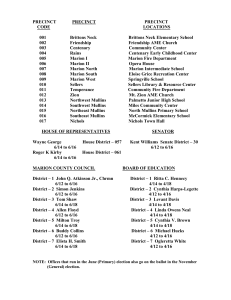

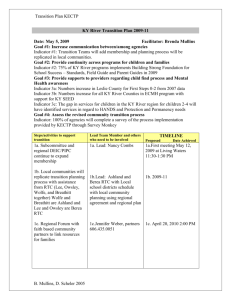

Who Needs Investors? @John_W_Mullins London Business School © John Mullins 2015 1 Bill Sahlman Puts it Simply “The best money comes from customers… not investors.” © John Mullins 2015 2 Is Sahlman Right? © John Mullins 2015 3 And What About Start-Ups or Your New Ideas? • Fred Wilson: Union Square Ventures – “The amount of money that start-ups raise in their Seed and Series A rounds is inversely correlated with success.” © John Mullins 2015 4 Why Might This Be So? – Talk with your neighbor • 2 minutes • 3 top reasons, please © John Mullins 2015 5 Why Might This Be So? • My take on it: – Too much money makes entrepreneurs sloppy, stupid – Plan A for any new idea rarely works. But the investor wants the entrepreneur to (flawlessly) implement it anyway! • Question: Might it be wiser to follow Sahlman’s advice? But how? © John Mullins 2015 6 Here’s How Not to Do It © John Mullins 2015 7 © John Mullins 2015 8 So, Would You Invest in Ali G? • Fact: the vast majority of fast-growing businesses never raise venture capital (nor write business plans, either) • Nor should they, I argue: why? • Raising capital (especially too early) – whether from angels or VCs – is a dangerous practice, on both sides of the table © John Mullins 2015 9 The Killer Drawbacks of Raising Venture Capital • Distraction: takes the entrepreneur’s eye off the ball, now, and later, too • Higher risk = lower stake for the founder • And the baggage that comes with it in the shareholders’ agreement • Is this good news for the investor in such a deal? © John Mullins 2015 10 Let’s Consider Some Evidence: US Venture Fund Returns Returns from inception to 12/31/11. Source: Josh Lerner analysis of Thomson/Reuters data. 11 © John Mullins 2015 So, Is There an Alternative? The Customer-Funded Business Matchmaker Models Service-to-Product Models Pay-in-Advance Models Your Customer Scarcity-Based Models © John Mullins 2015 Subscription Models 12 Is Anything New Here? – Talk with your neighbor • Identify examples of companies that have actually put one of these models to work – maybe even yours! • Two minutes – go! © John Mullins 2015 13 Is Anything New Here? • Pay-in-advance models: Consultants, architects, Dell. Nearly all services, too. • Matchmaker models: eBay, Expedia • Subscription models: Periodicals, Netflix • Scarcity models: Zara • Service-to-product models: Microsoft • But let’s look at some savvy 21st century entrepreneurs putting them to use © John Mullins 2015 14 Vinay Gupta 2006: A Pay-in-Advance Model © John Mullins 2015 15 Brian Chesky & Joe Gebbia 2007: A Matchmaker Model © John Mullins 2015 16 Krishnan Ganesh 2005: A Subscription Model © John Mullins 2015 17 Krishnan Ganesh 2005: A Subscription Model © John Mullins 2015 18 Jacques-Antoine Granjon 2001: A Scarcity Model © John Mullins 2015 19 Balder Olrik, Claus Moseholm 2003: A Service-to-Product Model © John Mullins 2015 20 These Examples Share Three Attributes in Common • Negative working capital – love thy float! • They required essentially no external capital to get started • When they did raise capital to grow once the concept was proven, there was an eager queue of angels or VCs lined up at their doors © John Mullins 2015 21 So, What About You? • Which of the five models might be put to work in your business – tomorrow? – Pay-in-advance model – Matchmaker model – Subscription model – Scarcity model – Service-to-product model Talk with your team: which might work? • 5 minutes © John Mullins 2015 22 So, Which Did You Choose? Matchmaker Models Service-to-Product Models Pay-in-Advance Models Your Customer Scarcity-Based Models © John Mullins 2015 Subscription Models 23 Have I Said This is Easy to Do? • No! But it’s what many of you already intuitively know • Now there’s a set of tools – five models – you can use • Can you do this for every business? • But note: Have we seen here both goods and services, both B2B and B2C? © John Mullins 2015 24 So, Is Venture Capital Bad for Growing Your Business? • Not necessarily. It’s the timing that concerns me. • And it concerns Fred Wilson, too! • If you’ve found a venture that’s clearly firing on all cylinders, that’s when to add fuel! © John Mullins 2015 25 A Final Observation on Business Plans “We believe that… © John Mullins 2015 26 For the “When-to”, the “How-to” and the Pitfalls to Watch out for… One of 5 “not-to-bemissed” books, 2014 Number 1 in venture capital, Amazon.com, November 2014 © John Mullins 2015 27 In a Nutshell… “The customer is not just king. He can be your VC, too!” Bernie Auyang Angel Investor and Entrepreneur Shanghai © John Mullins 2015 28 Questions? jmullins@london.edu www.TheCustomerFundedBusiness.com @John_W_Mullins © John Mullins 2015 29