Chapter Eight Complex Derivatives - Delmar

advertisement

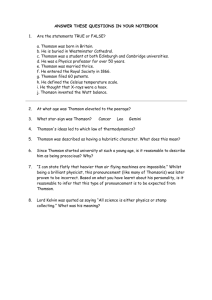

Chapter 8 Complex Derivatives © 2007 Thomson Delmar Learning, a part of the Thomson Corporation Introduction to Derivatives Complex derivatives became popular in the 1990s. – Computer advancements led to more detailed financial analysis. Powerful risk management tools – must be fully understood to be used properly. – can be as equally harmful as helpful. California energy crisis and the collapse of Enron fueled public fears. © 2007 Thomson Delmar Learning, a part of the Thomson Corporation The Role of Multiple Risks Businesses often have more than one risk or risks embedded within another. Single risks are risks that are fairly easy to separate. Embedded or cloistered risks are risks that are embedded within another risk and therefore not easy to separate or keep separated. © 2007 Thomson Delmar Learning, a part of the Thomson Corporation Multiple Single Risk Farming Example: Midwest corn farmers are generally soybean farmers as well. – This creates multiple risks from corn and soybean price movements. Referring back to the first step of the Risk and Mitigation Profile of Chapter 2 is to list the financial risks. The risk for the typical Midwest farmer is dropping corn and soybean prices. (See Figure 8-1.) These two risks are easy to separate and manage. © 2007 Thomson Delmar Learning, a part of the Thomson Corporation A Farm with Cloistered Risks Consider the same Midwest corn and soybean farmer with the two price risks. This farmer will likely have an operating loan and land loan. – Assuming the loans are at a fixed rates, they are both tied directly to the production of the crops. – This embeds the risk of price change into the loans. – Figure 8-2 exhibits the partial RMP for cloistered risks. (continued) © 2007 Thomson Delmar Learning, a part of the Thomson Corporation A Farm with Cloistered Risks (continued) The loans have price objectives to obtain repayment; these objectives may or may not be attainable with options or futures. The farmer has more than one option and must decide upon the consequences of each. – Figure 8-3 shows the full RMP for the farmer. © 2007 Thomson Delmar Learning, a part of the Thomson Corporation Financial Engineering Financial Engineering – The term engineering means to plan and execute an operation. – More financial information and risk management tools allow this to be possible. The more appropriate term however is financial management, as risk management is not always an exact process. (continued) © 2007 Thomson Delmar Learning, a part of the Thomson Corporation Financial Engineering (continued) Engineering of a derivative (designing and constructing) is important, but managing the risk is paramount. Complex derivatives have two parts: – designing and construction – management © 2007 Thomson Delmar Learning, a part of the Thomson Corporation Designing and Constructing Complex Derivatives Proper design and construction of a complex derivative must begin with a purpose—to meet a specific risk. Find the proper derivative for the specific risk to be mitigated. If the derivatives selected are inappropriate, they could increase the risk. Start with the RMP to define and outline the risk; do not begin with the derivative. © 2007 Thomson Delmar Learning, a part of the Thomson Corporation Abuse of Derivatives Zero cost or synthetic hedges (see Chapters 5 and 6) Synthetic forward—almost unlimited combinations of strike prices Stacked derivative—several risks are bundled together and risk management tools applied to mitigate risks – This term is used for multiple single risks. Cloistered derivative—embedded or cloistered risks © 2007 Thomson Delmar Learning, a part of the Thomson Corporation Stacked Derivatives See Figure 8-4. The Midwest corn and soybean farmer wants to manage the price risk in the early stages of the crops growth. Figure 8-5 shows the cost and benefits section of the RMP and adds standard risk analysis. The farmer looks more closely at the factors that have the most variation on the estimated futures target price—the estimated ending basis. The farmer could opt to stack with a forward/futures stack or a futures/futures stack. © 2007 Thomson Delmar Learning, a part of the Thomson Corporation Cloistered Derivatives A cattle feeder is a good example of a cloistered derivative as he has the drop of cattle prices and the rise of feed prices to contend with. Figure 8-6 shows the RMP of a cattle feeder. The feeder’s risks are: fed cattle, corn, and soybean meal. The feeder needs to determine the breakeven price on the cattle, corn, and soybean meal; the feeder then can look at his choices. The feeder must select a combination of futures and options to create a cloistered hedge. Price forecasting plays a large role in the feeder’s decision. © 2007 Thomson Delmar Learning, a part of the Thomson Corporation The Power of the Risk and Mitigation Profile A good RMP must be developed for a particular situation. – The user can add or subtract levels of sophistication. The RMP format provides the structure to look at the tools in conjunction with the identified risks. This keeps the problem—price risks—in line with the risk management tools. © 2007 Thomson Delmar Learning, a part of the Thomson Corporation Unwinding Once a risk management package is developed, the user must determine whether it mitigates his risks. This can be done by unwinding the risk management package. For example, take the cattle feeder from Figures 8-6 and 8-7. Determine whether it meets the minimum price requirements for the cattle feeder. – The put mitigates the feeder cattle price risk, but does not meet the minimum price requirement. – It makes more sense to hedge with an option that covers the minimum price requirement. – The option hedge in this case is better for the cattle feeder if the price forecast is bullish. © 2007 Thomson Delmar Learning, a part of the Thomson Corporation The Treasury as a Profit Center The treasury or finance department of a business must manage the accounts payable, receivable, and so on. Many companies try to operate their treasuries as profit centers as well. Doing this takes on risk. One way a finance department could earn a profit is through decreasing the rate on loans through swaps. The problem in the example case in the text was moving interest rates on a variable rate operation loan, which were mitigated through a swap. © 2007 Thomson Delmar Learning, a part of the Thomson Corporation A Final Note on Complex Derivatives The popularity of complex derivatives peaked in the 1980s and 1990s and unfolded in the twenty-first century as corrupt accounting practices and bankruptcies occurred. Most complex derivatives have vanished from the marketplace. The mitigation of a price risk is the most important issue to be concerned with managing risk. If a complex derivative is the best tool, then it should be used. A large problem with complex derivatives is hedging and speculative strategies bound together. © 2007 Thomson Delmar Learning, a part of the Thomson Corporation